India Mehndi Cone Market (2022-2028) | Outlook, Forecast, Size, Trends, Value, Revenue, Analysis, Growth, Industry, Share, Segmentation & COVID-19 IMPACT

Market Forecast By Types (Natural, Synthetic), By Organized and Unorganized (Organized, Unorganized), By Seasons (Spring, Summer, Monsoon, Winter, Autumn), By Regions (Northern Region, Southern Region, Eastern Region, Western Region) and Competitive landscape

| Product Code: ETC4377988 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 66 | No. of Figures: 12 | No. of Tables: 5 |

India Mehndi Cone Market Synopsis

The India Mehndi Cone Market is primarily driven by rising demand from wedding industry which is expected to reach up to INR 38 lakh crore over the next 10 years. Furthermore, the increasing per capita GDP and disposable income have enabled people to spend lavishly on weddings thereby increasing consumer expenditure on quality herbal mehndi cones which is expected to augment the growth of India mehndi market during the forecast period. However, the market was affected in 2020 by the pandemic, which resulted in lockdown and government restrictions on mass gathering during wedding and festive season thereby declining the sales of mehndi cones. Additionally, the limitations put forward by the government restricting the number of people that could attend a wedding during pandemic negatively impacted the sales of mehndi cones.

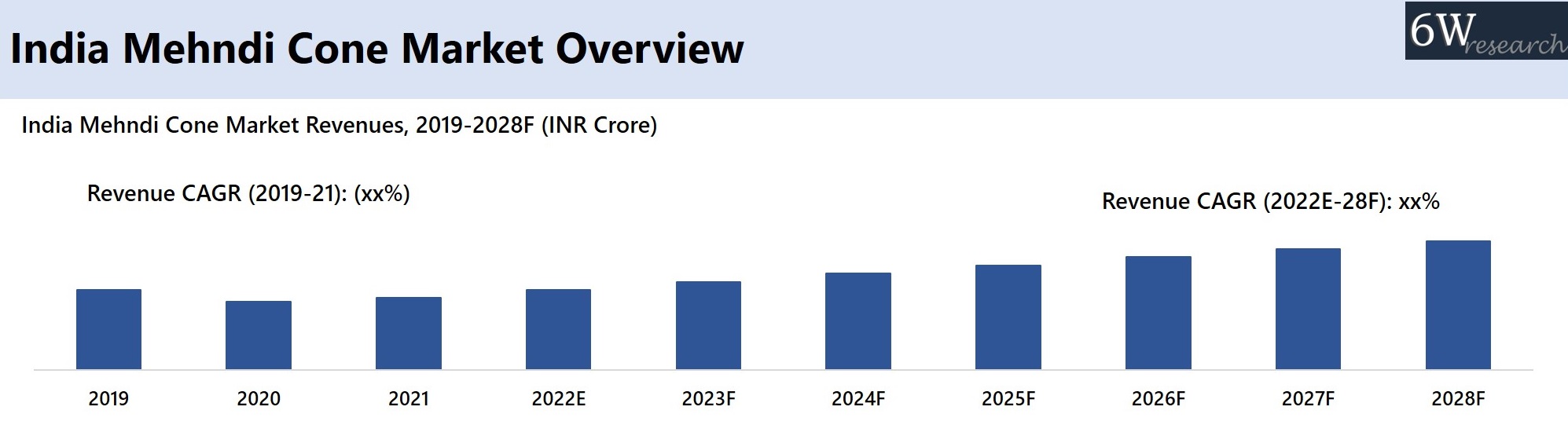

According to 6Wresearch, India Mehndi Cone Market revenue is projected to grow at a CAGR of 8.1% during 2022-2028. This sector is a significant part of the Asia Pacific Mehndi Cone Market. India mehndi cone market revenues recorded significant growth in the previous years owing to growth in wedding industry and increased consumer festive spending post-covid and the same trend is expected in the coming years on account of rapidly growing wedding industry which is expected to reach up to INR 38 lakh crore in next 10 years coupled with increasing festive spending by people. Additionally, the wedding events made a robust comeback in 2021 with cities like Mumbai, Bengaluru and Hyderabad hosting the highest number of marriages which surged the demand for mehndi cones. The Mehndi Cone Market in India will remain one of the most prominent markets.

The Indian wedding industry has always existed as a key driver of the nation’s economy owing to its rapidly growing large wedding industry which never witnessed a slowdown until Covid-18 pandemic. The India wedding industry is estimated to have a worth over INR 6 lakh crore with an annual growth rate of between 25-30% and around 1 crore weddings per year.

Market by Types

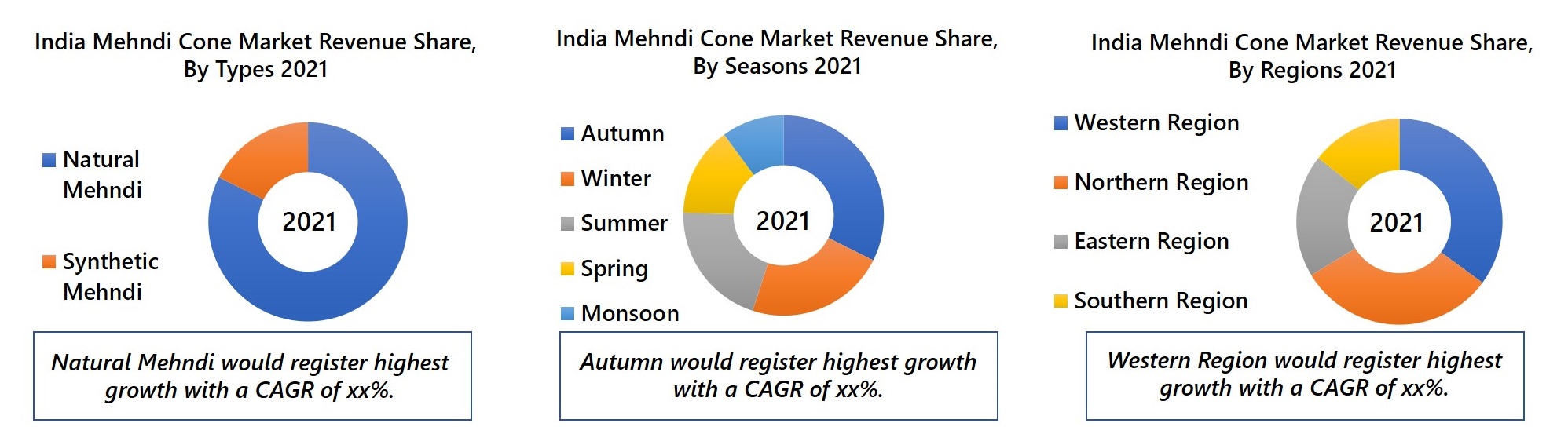

Natural mehndi garnered the maximum revenue share in India mehndi cone market in 2021 on account of increased consumer preference for herbal and natural products coupled with penetration of key market players like Velnik India Pvt. Ltd. and Prem Green Pvt. Ltd. in this segment. This segment will continue to retain its dominance in the future.

Market by Organized and Unorganized

Unorganized accounted for the highest revenue share in 2021 in mehndi cone market of India owing to presence of large number of scattered small market players in this sector across all Indian states coupled with wide variety of mehndi cones offered by unorganized sector at different price range. The segment is expected to witness growth in the future years on account of it being preferred by a large number of people as the consumers primarily focusses on which mehndi cone would give the darkest colour rather than on brand name.

Market by Seasons

Autumn acquired the majority revenue share in India mehndi cone market in 2021 and would continue to dominate the market during the forecast period owing to it being the season which witnesses largest number of weddings annually among all seasons.

Market by Regions

The western region was the largest revenue shareholder in India’s mehndi cone market in the year 2021. The same segment will continue to evolve in the India Mehndi Cone Market.

Key Attractiveness of the Report

- COVID-18 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2022

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Mehndi Cone Market Overview

- India Mehndi Cone Market Outlook

- India Mehndi Cone Market Forecast

- Historical Data and Forecast of India Mehndi Cone Market Revenues for the Period 2018-2028F

- Historical Data and Forecast of India Mehndi Cone Market Revenues, By Types for the Period 2018-2028F

- Historical Data and Forecast of India Mehndi Cone Market Revenues, By Organized Vs Unorganized for the Period 2018-2028F

- Historical Data and Forecast of India Mehndi Cone Market Revenues, By Seasons for the Period 2018-2028F

- Historical Data and Forecast of India Mehndi Cone Market Revenues, By Regions for the Period 2018-2028F

- India Mehndi Cone Market Drivers and Restraints

- India Mehndi Cone Market Trends

- India Mehndi Cone Key Performance Indicators

- India Mehndi Cone Market Opportunity Assessment

- India Mehndi Cone Market Revenue Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Natural

- Synthetic

By Organized Vs Unorganized

- Organized

- Unorganized

By Seasons

- Spring

- Summer

- Monsoon

- Winter

- Autumn

By Regions

- Northern Region

- Southern Region

- Eastern Region

- Western Region

India Mehndi Cone Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope and Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Mehndi Cone Market Overview |

| 3.1 India Mehndi Cone Market Revenues, 2019-2028F |

| 4. India Mehndi Cone Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Cultural significance of mehndi in Indian traditions and festivals |

| 4.2.2 Growing popularity of mehndi art as a fashion trend, especially in weddings and celebrations |

| 4.2.3 Increasing disposable income leading to higher spending on beauty and grooming products |

| 4.3 Market Restraints |

| 4.3.1 Availability of counterfeit or low-quality mehndi cones in the market affecting consumer trust |

| 4.3.2 Seasonal demand fluctuations impacting sales and production |

| 4.3.3 Price sensitivity among consumers leading to price wars and margin pressures |

| 5. India Mehndi Cone Market Trends |

| 6. India Mehndi Cone Market Overview, By Types |

| 6.1 India Mehndi Cone Market Revenue Share and Revenues, By Natural Mehndi, 2019-2028F |

| 6.2 India Mehndi Cone Market Revenue Share and Revenues, By Synthetic Mehndi, 2019-2028F |

| 7. India Mehndi Cone Market Overview, By Organized Vs Unorganized |

| 7.1. India Mehndi Cone Market Revenue Share and Revenues, By Organized, 2019-2028F |

| 7.2. India Mehndi Cone Market Revenue Share and Revenues, By Unorganized, 2019-2028F |

| 8. India Mehndi Cone Market Overview, By Seasons |

| 8.1. India Mehndi Cone Market Revenue Share and Revenues, By Spring, 2019-2028F |

| 8.2. India Mehndi Cone Market Revenue Share and Revenues, By Summer, 2019-2028F |

| 8.3. India Mehndi Cone Market Revenue Share and Revenues, By Monsoon, 2019-2028F |

| 8.4. India Mehndi Cone Market Revenue Share and Revenues, By Winter, 2019-2028F |

| 8.5. India Mehndi Cone Market Revenue Share and Revenues, By Autumn, 2019-2028F |

| 9. India Mehndi Cone Market Overview, By Regions |

| 9.1. India Mehndi Cone Market Revenue Share and Revenues, By Northern Region, 2019-2028F |

| 9.2. India Mehndi Cone Market Revenue Share and Revenues, By Western Region, 2019-2028F |

| 9.3. India Mehndi Cone Market Revenue Share and Revenues, By Southern Region, 2019-2028F |

| 9.4. India Mehndi Cone Market Revenue Share and Revenues, By Eastern Region, 2019-2028F |

| 10. India Mehndi Cone Market - Key Performance Indicators |

| 10.1 Number of mehndi artists using cones for intricate designs |

| 10.2 Social media engagement and mentions related to mehndi cone brands |

| 10.3 Growth in online searches for mehndi cone designs and tutorials |

| 11. India Mehndi Cone Market - Opportunity Assessment |

| 11.1 India Mehndi Cone Market Opportunity Assessment, By Types, 2028F |

| 11.2 India Mehndi Cone Market Opportunity Assessment, By Organized Vs Unorganized, 2028F |

| 11.3 India Mehndi Cone Market Opportunity Assessment, By Seasons, 2028F |

| 11.4 India Mehndi Cone Market Opportunity Assessment, By Regions, 2028F |

| 12. India Mehndi Cone Market - Competitive Landscape |

| 12.1 India Mehndi Cone Market Revenue Ranking, By Companies, 2021 |

| 12.2 India Mehndi Cone Market Competitive Benchmarking, By Technical Parameters |

| 12.3 India Mehndi Cone Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Neha Herbals Pvt. Ltd. |

| 13.2 Velnik India Private Limited |

| 13.3 Prem Green Private Limited |

| 13.4 Singh Satrang |

| 13.5 Yutika Natural Pvt. Ltd. |

| 13.6 Hindkush Henna Herbal |

| 13.7 Pankhudi Henna |

| 13.8 Swell Henna Pvt. Ltd. |

| 13.9 Golecha Naturals Pvt. Ltd. |

| 13.10 Kajal Dulhan Mehndi Center |

| 14. Disclaimer |

| List of Figures |

| 1. India Mehndi Cone Market Revenues, 2019-2028F (INR Crore) |

| 2. India Wedding Industry Estimated Growth in the next 10 years (INR Lakh Crore) |

| 3. India destination Wedding Growing Size (INR Thousand Crore) |

| 4. India Mehndi Cone Market Revenue Share, By Types, 2021 & 2028F |

| 5. India Mehndi Cone Market Revenue Share, By Organized Vs Unorganized, 2021 & 2028F |

| 6. India Mehndi Cone Market Revenue Share, By Seasons, 2021 & 2028F |

| 7. India Mehndi Cone Market Revenue Share, By Regions, 2021 & 2028F |

| 8. India Mehndi Cone Market Opportunity Assessment, By Types (INR Crore) |

| 9. India Mehndi Cone Market Opportunity Assessment, By Organized Vs Unorganized (INR Crore) |

| 10. India Mehndi Cone Market Opportunity Assessment, By Seasons (INR Crore) |

| 11. India Mehndi Cone Market Opportunity Assessment, By Regions (INR Crore) |

| 12. India Mehndi Cone Market Revenue Ranking, By Companies, 2021 |

| List of Tables |

| 1. India Wedding Industry Approximate Projected Growth and Industry |

| 2. India Mehndi Cone Market Revenues, By Types, 2019-2028F (INR Crore) |

| 3. India Mehndi Cone Market Revenues, By Organized Vs Unorganized, 2019-2028F (INR Crore) |

| 4. India Mehndi Cone Market Revenues, By Seasons, 2019-2028F (INR Crore) |

| 5. India Mehndi Cone Market Revenues, By Regions, 2019-2028F (INR Crore) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero