India PC Monitor Market Tracker (2025-2031) | Companies, Share, Industry, Size, Trends, Revenue, Value, Analysis, Outlook, Growth & Forecast

India PC Monitor Market Tracker, CY Q4'2013

| Product Code: ETC000155 | Publication Date: Aug 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 01 | No. of Figures: 01 | No. of Tables: 01 |

India Pc Monitor Market Competition 2023

India Pc Monitor market currently, in 2023, has witnessed an HHI of 5643, Which has decreased slightly as compared to the HHI of 8166 in 2017. The market is moving towards concentrated. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For PC Monitor Market (Values in USD Thousand)

India PC Monitor Market Shipment Analysis

India PC Monitor Market registered a growth of 37.08% in value shipments in 2022 as compared to 2025 and an increase of 8.14% CAGR in 2022 over a period of 2017. In PC Monitor Market India is becoming more competitive as the HHI index in 2022 was 5643 while in 2017 it was 8166. Herfindahl Index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means less numbers of players or countries exporting in the market. India has reportedly relied more on imports to meet its growing demand in PC Monitor Market.

![India PC Monitor Market Shipment Analysis]() India PC Monitor Market Competition 2025

India PC Monitor Market Competition 2025

India PC Monitor market currently, in 2025, has witnessed an HHI of 5643, Which has decreased substantially as compared to the HHI of 8166 in 2017. The market is moving towards concentrated. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For PC Monitor Market (USD Values in Thousand)

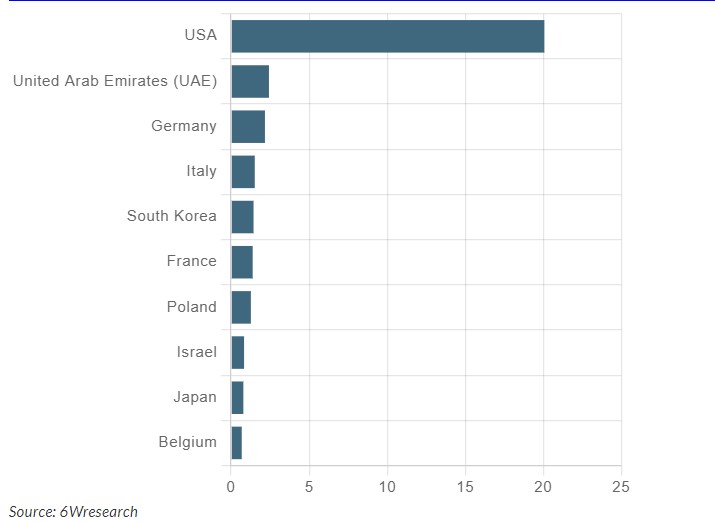

For India Exporters of PC Monitor, USA seems to be the most attractive market (in 2031) in terms of export potential followed by United Arab Emirates (UAE), Germany, Italy and South Korea. However, in terms of total import demand across all countries, Thailand occupies the top position. Hence considering overall import demand, Thailand leads the importing demand but considering India as a partner, USA provides high unmet demand potential as Compared to others for 2031.

With growing enterprise and SMB segments, the demand for PC monitor is increasing in Indian market. Though, Indian market is not growing as per the expectation of the vendors, but is still out performing several developed economies. According to 6Wresearch, India PC Monitor Market shipments reached 0.85 million units in CY Q4 2013. Amongst all players, Acer led the market followed by HP and Samsung. The dominance of Acer was on account of its growing 18.5 inch PC monitor market. In CY Q4 2013, PC monitors with 18.5 inch display captured major share of pie, contributing for 39% of the total shipments.

India PC Monitor Market Overview

The India PC monitor market has observed prominent growth in recent years, driven by the growing demand for computing devices in a number of sectors. With the proliferation of virtual technology, there has been a rise in the adoption of PC monitors in the country for diverse applications, ranging from business as well as education to entertainment.

Drivers of the Market

Numerous factors are there that have to key role to play in the significant growth of the India PC monitor industry. The growing adoption of remote work and online education has propelled the demand for high-quality displays, driving sales in the consumer and enterprise segments. In addition, the gaming industry's robust development has also led to a growth in demand for gaming monitors, characterised by high refresh rates as well as improved visual capabilities.

Challenges of the Market

There are many challenges that the market has been experiencing. One of the major drivers behind the growth of this industry is the competition among manufacturers which has been leading to pricing pressures, and also impacting profit margins. Furthermore, economic fluctuations as well as uncertainties may affect consumer spending patterns which influences the overall market success. Rapid changes in the preferences of consumers and advancements in technology pose limitations for manufacturers.

Significant Government Policies

The policies of the Indian government play an essential role in shaping the PC Monitor Market in India. Initiatives promoting digital literacy as well as technology adoption have indirectly contributed to the rise in demand for PC monitors. Policies supporting domestic manufacturing and electronics sector growth also help in influencing the market landscape, inspiring both local production as well as foreign investments.

Leading Players of the Market

Numerous players dominate the India PC monitor industry. Well-established global brands, like Dell, HP, and Lenovo, preserve a significant presence, leveraging their reputation in the market for quality and innovation. Local companies, like Acer and ViewSonic, have attained significant growth in the market as they offer competitive products tailored to the Indian market. The market is dynamic, with continuous product launches, partnerships, as well as strategic alliances influencing the competitive landscape.

Key Highlights of the India PC Monitor Market

- India PC Monitor Market Overview

- India PC Monitor Market Outlook

- Market Size of India PC Monitor Market, 2024

- Forecast of India PC Monitor Market, 2031

- Historical Data and Forecast of India PC Monitor Revenues & Volume for the Period 2025-2031

- India PC Monitor Market Trend Evolution

- India PC Monitor Market Drivers and Challenges

- India PC Monitor Price Trends

- India PC Monitor Porter's Five Forces

- India PC Monitor Industry Life Cycle

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By Resolution for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By 1366x768 for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By 1920x1080 for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By 1536x864 for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By 1440x900 for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By 1280x720 for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By Application for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By Consumer for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By Commercial for the Period 2025-2031

- Historical Data and Forecast of India PC Monitor Market Revenues & Volume By Gaming for the Period 2025-2031

- India PC Monitor Import Export Trade Statistics

- Market Opportunity Assessment By Resolution

- Market Opportunity Assessment By Application

- India PC Monitor Top Companies Market Share

- India PC Monitor Competitive Benchmarking By Technical and Operational Parameters

- India PC Monitor Company Profiles

- India PC Monitor Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India PC Monitor Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India PC Monitor Market Revenues & Volume, 2021 & 2031F |

| 3.3 India PC Monitor Market - Industry Life Cycle |

| 3.4 India PC Monitor Market - Porter's Five Forces |

| 3.5 India PC Monitor Market Revenues & Volume Share, By Resolution, 2024- 2031F |

| 3.6 India PC Monitor Market Revenues & Volume Share, By Application, 2024- 2031F |

| 4 India PC Monitor Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for high-resolution displays for gaming and multimedia purposes |

| 4.2.2 Growing trend of remote work and online education, leading to higher demand for PC monitors |

| 4.2.3 Technological advancements such as curved displays and ultrawide screens attracting consumers |

| 4.3 Market Restraints |

| 4.3.1 Price sensitivity among consumers, especially in the price-conscious Indian market |

| 4.3.2 Competition from alternative devices like laptops and tablets impacting PC monitor sales |

| 4.3.3 Economic uncertainty and fluctuations affecting consumer spending on non-essential items |

| 5 India PC Monitor Market Trends |

| 6 India PC Monitor Market, Segmentations |

| 6.1 India PC Monitor Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 India PC Monitor Market Revenues & Volume, By 1366x768, 2024- 2031F |

| 6.1.3 India PC Monitor Market Revenues & Volume, By 1920x1080, 2024- 2031F |

| 6.1.4 India PC Monitor Market Revenues & Volume, By 1536x864, 2024- 2031F |

| 6.1.5 India PC Monitor Market Revenues & Volume, By 1440x900, 2024- 2031F |

| 6.1.6 India PC Monitor Market Revenues & Volume, By 1280x720, 2024- 2031F |

| 6.2 India PC Monitor Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 India PC Monitor Market Revenues & Volume, By Consumer, 2024- 2031F |

| 6.2.3 India PC Monitor Market Revenues & Volume, By Commercial, 2024- 2031F |

| 6.2.4 India PC Monitor Market Revenues & Volume, By Gaming, 2024- 2031F |

| 7 India PC Monitor Market Import-Export Trade Statistics |

| 7.1 India PC Monitor Market Export to Major Countries |

| 7.2 India PC Monitor Market Imports from Major Countries |

| 8 India PC Monitor Market Key Performance Indicators |

| 8.1 Average selling price (ASP) of PC monitors |

| 8.2 Adoption rate of new display technologies in the market |

| 8.3 Percentage of households with multiple PC monitors |

| 8.4 Average time spent on PCs for work or leisure activities |

| 8.5 Percentage of PC monitor sales through online channels |

| 9 India PC Monitor Market - Opportunity Assessment |

| 9.1 India PC Monitor Market Opportunity Assessment, By Resolution, 2024- 2031F |

| 9.2 India PC Monitor Market Opportunity Assessment, By Application, 2024- 2031F |

| 10 India PC Monitor Market - Competitive Landscape |

| 10.1 India PC Monitor Market Revenue Share, By Companies, 2024 |

| 10.2 India PC Monitor Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

6Wresearch publishes monthly/quarterly/annual shipments data of PC monitor market in India. The publication would enable the player to enter or devise strategies to expand its presence in India PC monitor market by monitoring the shipments data by various types and specifications on a regular basis. This would also allow Companies to track their competitors' performance on a periodical basis.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero

India PC Monitor Market Competition 2025

India PC Monitor Market Competition 2025