India Power & Distribution Transformer Market (2024-2030) | Outlook, Growth, Industry, Companies, Size, Forecast, Analysis, Value, Revenue, Share & Trends

Market Forecast By Type (Power Transformer, Distribution Transformer), By Power Rating (Power Transformer (5.1 MVA – 50 MVA, 50.1 MVA – 160 MVA, 160.1 MVA – 350 MVA, Above 350 MVA), Distribution Transformer (Up To 100 KVA, 100.1 – 315 KVA, 315.1 – 5 MVA), By Colling System (Dry Type, Liquid Type), By Applications (Power Utilities, Industrial), By Region (Northern, Western, Southern, Eastern, North Eastern) And Competitive Landscape

| Product Code: ETC001498 | Publication Date: Dec 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 88 | No. of Figures: 31 | No. of Tables: 12 |

Topics Covered in India Power & Distribution Transformer Market Report

India Power & Distribution Transformer Market Report thoroughly covers the market by Type, Power Rating, Cooling System, Applications and Regions. India Power & Distribution Transformer Market Outlook report provides an unbiased and detailed analysis of the ongoing India Power & Distribution Transformer Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

India Power & Distribution Transformer Market Synopsis

India's Power and Distribution Transformer market has seen substantial growth in recent years, driven by the rapid expansion of the power and energy sector and a sharp rise in electricity demand. Peak energy demand rose from 193 GW in January 2024 to 250 GW in May 2024, propelled by rapid urbanization and increased consumption. Government initiatives such as "Power for All" and the electrification of over 18,000 villages under the Saubhagya scheme have further fueled electricity demand. These developments have highlighted the critical need for high-capacity, efficient, and reliable Power and Distribution Transformers to support India's growing energy requirements and ensure effective power distribution.

According to 6Wresearch, India Power & Distribution Transformer market Volume is projected to grow at a CAGR of 6.7% respectively during 2024-30F. India's industrial sector, consuming 40% of electricity, is driving demand for advanced transformers, supported by the National Electricity Plan’s (NEP) ₹2.6 lakh crore ($32 billion) transmission investment target by 2027 and the Production-Linked Incentive (PLI) scheme fostering manufacturing growth. Annual exports of ₹10,000 crore ($1.2 billion) reinforce India’s global leadership. Urbanization, with 500 million people expected to migrate to cities by 2030, necessitates extensive power infrastructure upgrades. Meanwhile, renewable energy is advancing rapidly, comprising 42.26% of total capacity as of October 2024. The Ministry of New and Renewable Energy (MNRE) has increased its budget from ₹128.5 billion in 2023-24 to ₹191 billion in 2024-25, including ₹10 billion for the Solar Power Grid Scheme, a 110% rise from the previous year.

Market Segmentation By Type

The distribution transformer is expected to witness the highest growth in India’s power and distribution transformer market due to factors such as rural electrification, rising electricity demand, smart grid developments, and the integration of renewable energy.

Market Segmentation By Power Rating

The 160.1–350 MVA power transformers are expected to experience the highest growth in India’s Power Transformer Market due to rising electricity demand driven by industrialization, urbanization, and renewable energy expansion. In the coming years, the up to 100 kVA distribution transformer segment in India is expected to experience significant growth due to factors like rural electrification, increased residential and small commercial consumption, and government initiatives such as the Saubhagya Scheme.

Market Segmentation By Cooling System

Liquid transformers are expected to see the highest growth in India’s Power & Distribution Transformer Market due to increasing energy demand, technological advancements in cooling and insulation, and government initiatives like the Smart Cities Mission and rural electrification.

Market Segmentation By Application

The industrial segment of the India Power & Distribution Transformer Market is expected to see the highest growth due to rapid industrialization, infrastructure development, and government initiatives like "Make in India.

Market Segmentation By Region

South region of India is expected to see the highest growth in the Power & Distribution Transformer Market due to strong industrial expansion, rapid urbanization, and significant investments in infrastructure development. The region’s growing renewable energy capacity, government initiatives like rural electrification, and increasing demand for reliable power supply in both urban and rural areas further drive the need for advanced transformer solutions.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Power & Distribution Transformer Market Overview

- India Power & Distribution Transformer Market Outlook

- India Power & Distribution Transformer Market Forecast

- Historical Data and Forecast of India Power & Distribution Transformer Market Volume and Volume Share, for the Period 2020-2030F

- Industry Life Cycle

- Porter’s Five Force Analysis

- India Power & Distribution Transformer Market Drivers and Restraints

- India Power & Distribution Transformer Market Trends and Evolution

- Market Opportunity Assessment, By Type

- Market Opportunity Assessment, By Power Rating

- Market Opportunity Assessment, By Cooling System

- Market Opportunity Assessment, By Application

- Market Opportunity Assessment, By Region

- Key Performance Indicators

- Opportunity Assessment, By Type

- Opportunity Assessment, By Power Rating

- Opportunity Assessment, By Cooling System

- Opportunity Assessment, By Application

- Opportunity Assessment, By Region

- Revenue Ranking, By Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Type

- Power Transformer

- Distribution Transformer

ByPower Rating

- Power Transformer

- 5.1 MVA – 50 MVA

- 50.1 MVA – 160 MVA

- 160.1 MVA – 350 MVA

- Above 350 MVA

- Distribution Transformer

- Up to 100 kVA

- 100.1 – 315 kVA

- 315.1 – 5 MVA

ByCooling System

- Dry Type

- Liquid Type

By Application

- Power Utilities

- Industrial

By Region

- West

- North

- South

- East

India Power & Distribution Transformer Market (2024-2030): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Power & Distribution Transformer Market Overview |

| 3.1. India Power & Distribution Transformer Market Revenues and Volume (2020-2030F) |

| 3.2. India Power & Distribution Transformer Market Industry Life Cycle |

| 3.3. India Power & Distribution Transformer Market Porter’s Five Forces Model |

| 4. India Power & Distribution Transformer Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Government initiatives promoting renewable energy sources |

| 4.2.2 Increasing urbanization and industrialization leading to higher electricity demand |

| 4.2.3 Upgradation and modernization of existing power infrastructure |

| 4.3. Market Restraints |

| 4.3.1 Fluctuating prices of raw materials like copper and steel |

| 4.3.2 Technological advancements leading to the adoption of alternative power sources |

| 4.3.3 Regulatory challenges and policy changes impacting the transformer market |

| 5. India Power & Distribution Transformer Market Evolution & Trends |

| 6. India Power & Distribution Transformer Market Overview, By Type |

| 6.1. India Power & Distribution Transformer Market Revenue Share and Revenues, By Type (2020 & 2030F) |

| 6.1.1. India Power & Distribution Transformer Market Revenues, By Power Transformer (2020-2030F) |

| 6.1.2. India Power & Distribution Transformer Market Revenues, By Distribution Transformer (2020-2030F) |

| 6.2. India Power & Distribution Transformer Market Volume Share and Volume, By Type (2020 & 2030F) |

| 6.2.1. India Power & Distribution Transformer Market Volume, By Power Transformer (2020-2030F) |

| 6.2.2. India Power & Distribution Transformer Market Volume, By Distribution Transformer (2020-2030F) |

| 7. India Power & Distribution Transformer Market Overview, By Power Rating |

| 7.1. India Power Transformer Market Revenue Share and Revenues, By Power Rating (2020 & 2030F) |

| 7.1.1. India Power Transformer Market Revenues, By 5.1 MVA – 50 MVA (2020-2030F) |

| 7.1.2. India Power Transformer Market Revenues, By 50.1 MVA – 160 MVA (2020-2030F) |

| 7.1.3. India Power Transformer Market Revenues, By 5.1 MVA – 50 MVA (2020-2030F) |

| 7.1.4. India Power Transformer Market Revenues, By Above 350 MVA (2020-2030F) |

| 7.2. India Power Transformer Market Volume Share and Volume, By Power Rating (2020 & 2030F) |

| 7.2.1. India Power Transformer Market Volume, By 5.1 MVA – 50 MVA (2020-2030F) |

| 7.2.2. India Power Transformer Market Volume, By 50.1 MVA – 160 MVA (2020-2030F) |

| 7.2.3. India Power Transformer Market Volume, By 5.1 MVA – 50 MVA (2020-2030F) |

| 7.2.4. India Power Transformer Market Volume, By Above 350 MVA (2020-2030F) |

| 7.3. India Distribution Transformer Market Revenue Share and Revenues, By Power Rating (2020 & 2030F) |

| 7.3.1. India Distribution Transformer Market Revenues, By Up to 100 kVA (2020-2030F) |

| 7.3.2. India Distribution Transformer Market Revenues, By 100.1 – 315 kVA (2020-2030F) |

| 7.3.3. India Distribution Transformer Market Revenues, By 315.1 – 5 MVA (2020-2030F) |

| 7.4. India Distribution Transformer Market Volume Share and Volume, By Power Rating (2020 & 2030F) |

| 7.4.1. India Distribution Transformer Market Volume, By Up to 100 kVA (2020-2030F) |

| 7.4.2. India Distribution Transformer Market Volume, By 100.1 – 315 kVA (2020-2030F) |

| 7.4.3. India Distribution Transformer Market Volume, By 315.1 – 5 MVA (2020-2030F) |

| 8. India Power & Distribution Transformer Market Overview, By Cooling System |

| 8.1. India Power & Distribution Transformer Market Revenue Share and Revenues, By Cooling System (2020 & 2030F) |

| 8.1.1. India Power & Distribution Transformer Market Revenues, By Dry Type (2020-2030F) |

| 8.1.2. India Power & Distribution Transformer Market Revenues, By Liquid Type (2020-2030F) |

| 9. India Power & Distribution Transformer Market Overview, By Application |

| 9.1. India Power & Distribution Transformer Market Revenue Share and Revenues, By Application (2020 & 2030F) |

| 9.1.1. India Power & Distribution Transformer Market Revenues, By Power Utilities (2020-2030F) |

| 9.1.2. India Power & Distribution Transformer Market Revenues, By Industrial (2020-2030F) |

| 10. India Power & Distribution Transformer Market Overview, By Region |

| 10.1. India Power & Distribution Transformer Market Revenue Share and Revenues, By Region (2020 & 2030F) |

| 10.1.1. India Power & Distribution Transformer Market Revenues, By North (2020-2030F) |

| 10.1.2. India Power & Distribution Transformer Market Revenues, By South (2020-2030F) |

| 10.1.3. India Power & Distribution Transformer Market Revenues, By East (2020-2030F) |

| 10.1.4. India Power & Distribution Transformer Market Revenues, By West (2020-2030F) |

| 11. India Power & Distribution Transformer Market Key Performance Indicators |

| 11.1 Average capacity utilization rate of power transformers |

| 11.2 Investment in grid modernization projects |

| 11.3 Adoption rate of smart transformers |

| 11.4 Percentage of electricity generated from renewable sources |

| 11.5 Number of new power projects announced or initiated |

| 12. India Power & Distribution Transformer Market EXIM Analysis |

| 13. India Power & Distribution Transformer Market Opportunity Assessment |

| 13.1. India Power & Distribution Transformer Market Opportunity Assessment, By Type (2030F) |

| 13.2. India Power Transformer Market Opportunity Assessment, By Power Rating (2030F) |

| 13.3. India Distribution Transformer Market Opportunity Assessment, By Power Rating (2030F) |

| 13.4. India Power & Distribution Transformer Market Opportunity Assessment, By Cooling System (2030F) |

| 13.5. India Power & Distribution Transformer Market Opportunity Assessment, By Application (2030F) |

| 13.6. India Power & Distribution Transformer Market Opportunity Assessment, By Region (2030F) |

| 14. India Power & Distribution Transformer Market Competitive Landscape |

| 14.1. India Power & Distribution Transformer Market Revenue Share, By Top-3 Companies (2023) |

| 14.2. India Power & Distribution Transformer Market Competitive Benchmarking, By Technical and Operating Parameters |

| 15. Company Profiles |

| 15.1 ABB India Ltd. |

| 15.2 Bharat Bijlee Ltd. |

| 15.3 Bharat Heavy Electricals Ltd |

| 15.4 CG Power and Industrial Solutions Limited |

| 15.5 GE T&D Ltd Company |

| 15.6 IMP Power Ltd. |

| 15.7 Kirloskar Electric Company Ltd. |

| 15.8 Schneider Electric SE |

| 15.9 Siemens AG |

| 15.10 Toshiba Transmission & Distribution Systems (India) Pvt. Ltd. |

| 15.11 TBEA Energy India Pvt Ltd. |

| 15.12 Transformers & Rectifiers (India) Ltd |

| 15.13 Voltamp Transformers Ltd |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| LIST OF Figures |

| 1. India Power & Distribution Transformer Market Revenue and Volume, 2020-2030F (₹ Crore and Units) |

| 2. India Month-Wise Peak Energy Demand Met in 2021 versus 2024, (GW) |

| 3. India Year-Wise Peak Energy Demand Met (FY20-FY24), (GW) |

| 4. Breakdown of India's Installed Power Capacity by Source, 2024 |

| 5. India Power & Distribution Transformer Market Revenues Share, By Type, 2020 & 2030F |

| 6. India Power & Distribution Transformer Market Volume Share, By Type, 2020 & 2030F |

| 7. India Power Transformer Market Revenue Share, By Power Rating, 2020 & 2030F |

| 8. India Power Transformer Market Volume Share, By Power Rating, 2020 & 2030F |

| 9. India Distribution Transformer Market Revenue Share, By Power Rating, 2020 & 2030F |

| 10. India Distribution Transformer Market Volume Share, By Power Rating, 2020 & 2030F |

| 11. India Power & Distribution Transformer Market Revenue Share, By Cooling System, 2020 & 2030F |

| 12. India Power & Distribution Transformer Market Revenue Share, By Application, 2020 & 2030F |

| 13. India Power & Distribution Transformer Market Revenue Share, By Region, 2020 & 2030F |

| 14. Total Power Generation in India (including renewable sources), 2011-2021E (Billion Units) |

| 15. Installed capacity In RES as on Oct 2024 (in GW) |

| 16. India Installed Renewable Energy Capacity (GW), 2020-2030F |

| 17. India Electricity Demand (TWh) (Million Tonnes), 2007-2027F |

| 18. India Imports Of Electrical Transformers From World, 2021-2021, (In Million) |

| 19. India Imports Of Electrical Transformers From World, 2021-2021, (In Billion) |

| 20. India Imports Of Electrical Transformers From World, By Countries 2021 |

| 21. India Exports Of Electrical Transformers To World, 2021-2021, (In Million) |

| 22. India Exports Of Electrical Transformers To World, 2021-2021, (In Billion) |

| 23. India Exports of Electrical transformers To world, by Countries 2024 |

| 24. India Power & Distribution Transformer Market Opportunity Assessment, By Type, 2030F (₹ Crore) |

| 25. India Power Transformer Market Opportunity Assessment, By Power Rating, 2030F (₹ Crore) |

| 26. India Distribution Transformer Market Opportunity Assessment, By Power Rating, 2030F (₹ Crore) |

| 27. India Power & Distribution Transformer Market Opportunity Assessment, By Cooling System, 2030F (₹ Crore) |

| 28. India Power & Distribution Transformer Market Opportunity Assessment, By Application, 2030F (₹ Crore) |

| 29. India Power & Distribution Transformer Market Opportunity Assessment, By Region, 2030F (₹ Crore) |

| 30. India Power & Distribution Transformer Market Revenue Ranking, By Companies, 2024 |

| 31. Top Renewable Energy Producing States in India |

| LIST OF table |

| 1. India's Active Policies/Initiatives Supporting Power Generation |

| 2. India Power & Distribution Transformer Market Revenue, By Type, 2020-2030F (₹ Crore) |

| 3. India Power & Distribution Transformer Market Volume, By Type, 2020-2030F (Units) |

| 4. India Power Transformer Market Revenues, By Power Rating, 2020-2030F (₹ Crore) |

| 5. India Power Transformer Market Volume, By Power Rating, 2020-2030F (Units) |

| 6. India Distribution Transformer Market Revenues, By Power Rating, 2020-2030F (₹ Crore) |

| 7. India Distribution Transformer Market Volume, By Power Rating, 2020-2030F (Units) |

| 8. India Power & Distribution Transformer Market Revenues, By Cooling System, 2020-2030F (₹ Crore) |

| 9. India Power & Distribution Transformer Market Revenue, By Application, 2020-2030F (₹ Crore) |

| 10. India Power & Distribution Transformer Market Revenues, By Region, 2020-2030F (₹ Crore) |

Market Forecast By Type (Power Transformer, Distribution Transformer), By Rating (Power Transformer (5.1 MVA – 50 MVA, 50.1 MVA – 160 MVA, 160.1 MVA – 350 MVA, Above 350 MVA), Distribution Transformer (Up To 100 KVA, 100.1 – 315 KVA, 315.1 – 5 MVA), By Colling System (Dry Type, Liquid Type), By Applications (Power Utilities, Industrial), By Region (Northern, Western, Southern, Eastern, North Eastern) And Competitive Landscape

| Product Code: ETC001498 | Publication Date: Jan 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 130 | No. of Figures: 60 | No. of Tables: 14 |

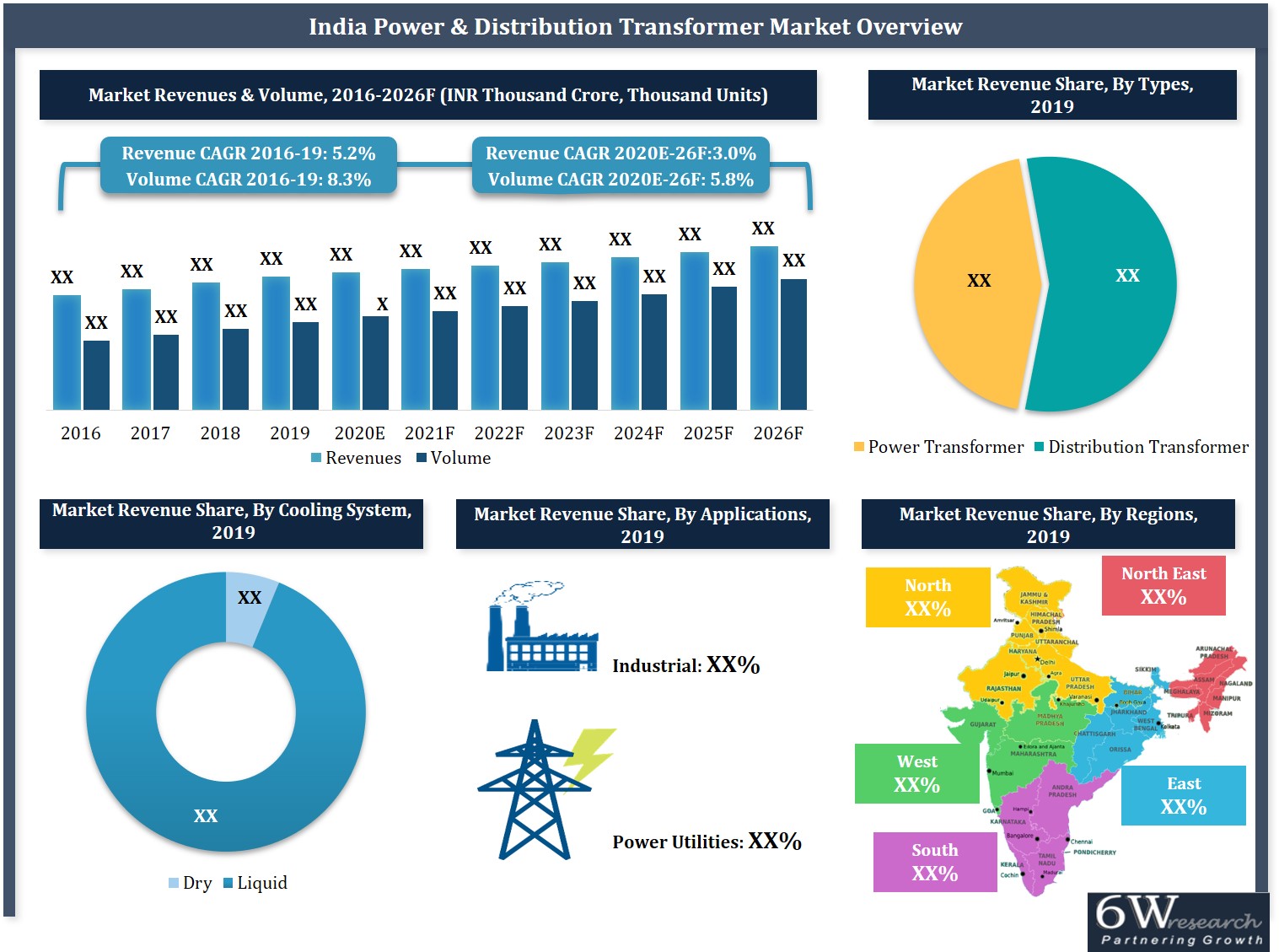

India Power and Distribution Transformer Market report thoroughly covers the market by product types, demographics, and distribution channels. The India Power and Distribution Transformer market outlook report provide an unbiased and detailed analysis of the India Power and Distribution Transformer market trends, opportunities high growth areas, market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

India Power and Distribution Transformer Market Synopsis

India Power and Distribution transformer market has witnessed substantial growth on account of steps taken by the Government of India such as enhancement of electrification rate and improvement of operational efficiency of the country. Further, the country has witnessed an increase in the demand for power which has been fostered by an increase in capacity utilization, industrialization, urbanization, and population. Currently, India has the fifth largest installed capacity in the power sector worldwide. Further, reforms such as “Power for all” and plans to add 175 GW of capacity by 2022 would surge the demand for power transmission and distribution equipment. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in the overall market growth.

According to 6Wresearch, India Power and Distribution Transformer Market size is projected to grow at a CAGR of 7.3% during 2021-2027. The Indian government has introduced certain key initiatives such as strengthening the power transmission & distribution network and efforts such as UDAY for financial turnaround of power distribution companies. Further, the Indian Government envisages the addition of about Rs 1 lakh ckm of transmission lines and Rs 2.9 lakh MVA of transformation capacity between 2017-2022 to strengthen the transmission network thus increasing the demand for power transformers.

Market Analysis By Verticals

In terms of verticals, the power utility segment has dominated the overall Power and Distribution transformer market in 2020. This growth is primarily driven by the rising rate of electrification as well as increasing power generation capacity, especially in the area of renewable power segment. Additionally, as India continues to reduce its dependence on traditional sources of energy, the country has witnessed a constant rise in the number of solar parks and wind farms which has opened up new avenues for the application of power and distribution transformation.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Historical data of Global Power & Distribution Transformer Market Revenues for the Period 2017-2020

- Market Size & Forecast of Global Power & Distribution Transformer Market Revenues until 2027

- Historical data of India Power & Distribution Transformer Market Revenues & Volume for the Period 2017-2020

- Market Size & Forecast of India Power & Distribution Transformer Market Revenues & Volume Market until 2027

- Historical data of India Distribution Transformer Market Revenues & Volume for the Period 2017-2020

- Market Size & Forecast of India Distribution Transformer Market Revenues & Volume until 2027

- Historical data of India Power Transformer Market Revenues & Volume for the Period 2020-2020

- Market Size & Forecast of India Power Transformer Market Revenues & Volume until 2027

- Historical data of India Dry Type Power & Distribution Transformer Market Revenues for the Period 2017-2020

- Market Size & Forecast of India Dry Type Power & Distribution Transformer Market Revenues until 2027

- Historical data of India Liquid Type Power & Distribution Transformer Market Revenues for the Period 2017-2020

- Market Size & Forecast of India Liquid Type Power & Distribution Transformer Market Revenues until 2027

- Historical data of India Power & Distribution Transformer Application Market Revenues for the Period 2017-2020

- Market Size & Forecast of India Power & Distribution Transformer Application Market Revenues until 2027

- Historical data of India Power & Distribution Transformer Regional Market Revenues for the Period 2017-2020

- Market Size & Forecast of India Power & Distribution Transformer Regional Market Revenues until 2027

- Market Drivers and Restraints

- Market Trends and Developments

- Players Market Share and Competitive Landscape

- Company Profile

- Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

-

By Type

- Power Transformer

- Distribution Transformer

- By Rating

-

Power Transformer

- 1 MVA – 50 MVA

- 50.1 MVA – 160 MVA

- 160.1 MVA – 350 MVA

- Above 350 MVA

-

Distribution Transformer

- Up to 100 kVA

- 100.1 – 315 kVA

- 315.1 – 5 MVA

-

By Colling System

- Dry Type

- Liquid Type

o By Application

- Power Utilities

- Industrial

-

By Regions

- Northern

- Western

- Southern

- Eastern

- North Eastern

Market Forecast By Type (Power Transformer, Distribution Transformer), By Rating (Power Transformer (5.1 MVA – 50 MVA, 50.1 MVA – 160 MVA, 160.1 MVA – 350 MVA, Above 350 MVA), Distribution Transformer (Up to 100 kVA, 100.1 – 315 kVA, 315.1 – 5 MVA), By Colling System (Dry Type, Liquid Type), By Application (Power Utilities, Industrial), By Region (Northern, Western, Southern, Eastern, North Eastern) And Competitive Landscape

| Product Code: ETC001498 | Publication Date: Jan 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 129 | No. of Figures: 59 | No. of Tables: 14 |

India power and distribution transformer market is anticipated to witness continues growth during the forecast period owing to government initiatives to boost the electrification rate and uplift the operational efficiency of discom in the nation. There has been a surge in demand for power in India which has been fostered by an increase in capacity utilization, industrialization, urbanization and population. Currently, India has the fifth largest installed capacity in the power sector worldwide. Further, reforms such as “Power for all” and plans to add 175 GW of capacity by 2022, would surge the demand for power transmission and distribution equipment.

According to 6Wresearch, India Power & Distribution Transformer Market size is projected to grow at a CAGR of 3.0% during 2019-25. Government is taking major steps to strengthen the power transmission & distribution network and has undertaken initiatives such as UDAY for financial turnaround of power distribution companies. Further, the Indian Government envisages an addition of about INR 1 lakh ckm of transmission lines and Rs 2.9 lakh MVA of transformation capacity between 2017-2022, to strengthen the transmission network. This initiative will furtherincreasing the demand for power transformers over the coming years

By regions, Western India accounted for the largest revenue share in the country in 2019. However, major investment in transmission sector is expected in Southern India, followed by Northern and Western India. In the distribution sector, the Western region is expected to receive highest investment followed by the Southern and Northern region.

The report thoroughly covers the market by transformer types, power rating, cooling system, applications and by regions. The report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Key Highlights of the Report

- Historical data of Global Power & Distribution Transformer Market Revenues for the Period 2016-2019

- Market Size & Forecast of Global Power & Distribution Transformer Market Revenues until 2026

- Historical data of India Power & Distribution Transformer Market Revenues & Volume for the Period 2016-2019

- Market Size & Forecast of India Power & Distribution Transformer Market Revenues & Volume Market until 2026

- Historical data of India Distribution Transformer Market Revenues & Volume for the Period 2016-2019

- Market Size & Forecast of India Distribution Transformer Market Revenues & Volume until 2026

- Historical data of India Power Transformer Market Revenues & Volume for the Period 2019-2019

- Market Size & Forecast of India Power Transformer Market Revenues & Volume until 2026

- Historical data of India Dry Type Power & Distribution Transformer Market Revenues for the Period 2016-2019

- Market Size & Forecast of India Dry Type Power & Distribution Transformer Market Revenues until 2026

- Historical data of India Liquid Type Power & Distribution Transformer Market Revenues for the Period 2016-2019

- Market Size & Forecast of India Liquid Type Power & Distribution Transformer Market Revenues until 2026

- Historical data of India Power & Distribution Transformer Application Market Revenues for the Period 2016-2019

- Market Size & Forecast of India Power & Distribution Transformer Application Market Revenues until 2026

- Historical data of India Power & Distribution Transformer Regional Market Revenues for the Period 2016-2019

- Market Size & Forecast of India Power & Distribution Transformer Regional Market Revenues until 2026

- Market Drivers and Restraints

- Market Trends and Developments

- Players Market Share and Competitive Landscape

- Company Profile

- Strategic Pointers

India Power and Distribution Transformer Market Covered:

The report provides the detailed analysis of the following market segments:

By Type

- Power Transformer

- Distribution Transformer

By Rating

- Power Transformer

- 5.1 MVA – 50 MVA

- 50.1 MVA – 160 MVA

- 160.1 MVA – 350 MVA

- Above 350 MVA

- Distribution Transformer

- Up to 100 kVA

- 100.1 – 315 kVA

- 315.1 – 5 MVA

- By Colling System

- Dry Type

- Liquid Type

- By Applications

- Power Utilities

- Industrial

By Regions

- Northern

- WesternEastern

- North Eastern

- Southern

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero