India Precious Metal Market (2025-2031) | Revenue, Forecast, Companies, Value, Outlook, Analysis, Industry, Growth, Share, Trends & Size

| Product Code: ETC038645 | Publication Date: Aug 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

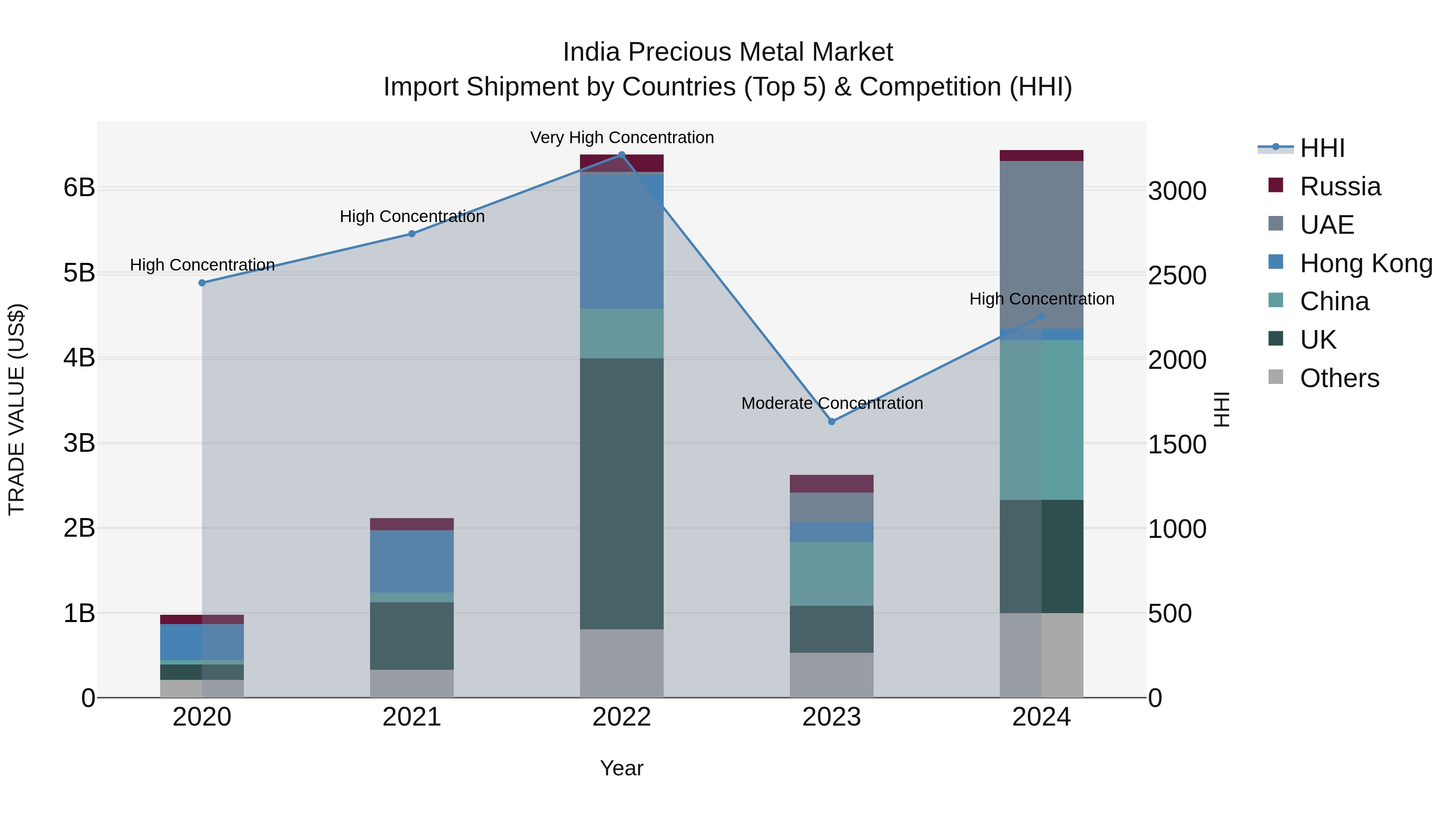

India Precious Metal Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s precious metal import shipments in 2024 saw a significant spike in concentration, with top exporters being UAE, China, UK, Switzerland, and Germany. The Herfindahl-Hirschman Index (HHI) indicated a shift from moderate to high concentration within a year. The impressive compound annual growth rate (CAGR) of 60.32% from 2020 to 2024 highlights the robust demand for precious metals in India. Additionally, the exceptional growth rate of 145.49% from 2023 to 2024 underscores the accelerating pace of imports, signaling a thriving market for precious metals in the country.

India Precious Metal Market Synopsis

The India precious metal market is expected to reach a value of USD 69.5 billion by 2031, growing at a CAGR of 10.2% between 2025 and 2031. Precious metals play an important role in the economic development of India as they are considered safe investments due to their low correlation with other asset classes, such as equities or bonds. The demand for gold jewelry in India has increased significantly over the years and is likely to continue its growth trajectory due to rising disposable incomes and changing lifestyles. Other factors driving demand include increasing investment from foreign investors, positive macroeconomic indicators, and growth in e-commerce platforms that provide easy access to these metals without any geographical restrictions.

Drivers of the Market:

? Rising Disposable Incomes: Increasing disposable income levels have resulted in increased spending on luxury goods such as gold jewelry which has contributed significantly towards the growth of the Indian precious metal market over recent years.

? Positive Macroeconomic Indicators: The improving economic conditions across major regions like North America and Europe have boosted investor confidence towards emerging markets like India which has led to more investments into this space resulting in an increase in precious metal prices over recent times.

Challenges of the Market:

High Import Duty on Gold & Silver Imports : A high import duty rate on gold & silver imports into India makes it difficult for local importers/traders who do not possess adequate funds or resources required for operating large businesses successfully within this industry . This could lead them into losses if there were sharp fluctuations within the global price of these commodities during trading hours .

Trends of the Market:

Growing E-commerce Platforms : With advancements made in technology , e-commerce platforms are becoming increasingly popular amongst consumers . These platforms provide customers with convenient access to buy different types of valuable metals from anywhere around the world without having to go through long tedious processes involved when making physical transactions at traditional stores . This trend will help boost sales volumes across various verticals within this sector due mainly because it provides buyers with competitive pricing options that may not be available elsewhere thereby allowing them greater savings opportunities while simultaneously promoting accessibility convenience factor associated with purchasing products online.

The COVID - 19 Impact on the Market:

Due to mandated lockdowns imposed across many countries , physical store outlets had been shut down temporarily while movement restrictions further curtailed customer visits leading up till now . As a result , sales figures witnessed significant drops during 2025 year end however there was some recovery witnessed post lockdowns.

Key Highlights of the Report:

- India Precious Metal Market Outlook

- Market Size of India Precious Metal Market, 2024

- Forecast of India Precious Metal Market, 2031

- Historical Data and Forecast of India Precious Metal Revenues & Volume for the Period 2021-2031

- India Precious Metal Market Trend Evolution

- India Precious Metal Market Drivers and Challenges

- India Precious Metal Price Trends

- India Precious Metal Porter's Five Forces

- India Precious Metal Industry Life Cycle

- Historical Data and Forecast of India Precious Metal Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of India Precious Metal Market Revenues & Volume By Gold for the Period 2021-2031

- Historical Data and Forecast of India Precious Metal Market Revenues & Volume By Silver for the Period 2021-2031

- Historical Data and Forecast of India Precious Metal Market Revenues & Volume By Platinum Group Metals (PGM) for the Period 2021-2031

- Historical Data and Forecast of India Precious Metal Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of India Precious Metal Market Revenues & Volume By Jewelry for the Period 2021-2031

- Historical Data and Forecast of India Precious Metal Market Revenues & Volume By Industrial for the Period 2021-2031

- Historical Data and Forecast of India Precious Metal Market Revenues & Volume By Investment for the Period 2021-2031

- India Precious Metal Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Applications

- India Precious Metal Top Companies Market Share

- India Precious Metal Competitive Benchmarking By Technical and Operational Parameters

- India Precious Metal Company Profiles

- India Precious Metal Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Precious Metal Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Precious Metal Market Revenues & Volume, 2021 & 2031F |

3.3 India Precious Metal Market - Industry Life Cycle |

3.4 India Precious Metal Market - Porter's Five Forces |

3.5 India Precious Metal Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 India Precious Metal Market Revenues & Volume Share, By Applications, 2021 & 2031F |

4 India Precious Metal Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for precious metals as safe-haven investments |

4.2.2 Growth in jewelry consumption due to cultural significance and rising disposable income |

4.2.3 Expansion of industrial applications for precious metals in sectors like electronics and healthcare |

4.3 Market Restraints |

4.3.1 Volatility in global prices of precious metals impacting local market prices |

4.3.2 Government regulations and policies affecting import/export of precious metals |

4.3.3 Competition from alternative investment options such as cryptocurrencies |

5 India Precious Metal Market Trends |

6 India Precious Metal Market, By Types |

6.1 India Precious Metal Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 India Precious Metal Market Revenues & Volume, By Product, 2021-2031F |

6.1.3 India Precious Metal Market Revenues & Volume, By Gold, 2021-2031F |

6.1.4 India Precious Metal Market Revenues & Volume, By Silver, 2021-2031F |

6.1.5 India Precious Metal Market Revenues & Volume, By Platinum Group Metals (PGM), 2021-2031F |

6.2 India Precious Metal Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 India Precious Metal Market Revenues & Volume, By Jewelry, 2021-2031F |

6.2.3 India Precious Metal Market Revenues & Volume, By Industrial, 2021-2031F |

6.2.4 India Precious Metal Market Revenues & Volume, By Investment, 2021-2031F |

7 India Precious Metal Market Import-Export Trade Statistics |

7.1 India Precious Metal Market Export to Major Countries |

7.2 India Precious Metal Market Imports from Major Countries |

8 India Precious Metal Market Key Performance Indicators |

8.1 Average daily trading volume of precious metals in India |

8.2 Number of new jewelry stores opening in key cities |

8.3 Percentage of industrial companies using precious metals in their manufacturing processes |

8.4 Price index of precious metals in the Indian market |

8.5 Consumer sentiment index towards investing in precious metals |

9 India Precious Metal Market - Opportunity Assessment |

9.1 India Precious Metal Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 India Precious Metal Market Opportunity Assessment, By Applications, 2021 & 2031F |

10 India Precious Metal Market - Competitive Landscape |

10.1 India Precious Metal Market Revenue Share, By Companies, 2024 |

10.2 India Precious Metal Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero