India Professional Lighting Market (2024-2030) | Share, Revenue, Trends, Companies, Forecast, Growth, Analysis, Outlook, Size, Industry & Value

Market Forecast By Products (Recessed Light,Surface Light,Spot Light,Down Light,Facade Light (Fasad Light),Landscape Light,Panel Light,Flood Light,Street Light,Tube Light,Sports Light), By Usages (Indoor, Outdoor), By Sales Channel (B2B, B2C), By Technology (Smart, Non-Smart), By Sectors (Organised, Unorganised), By End Users (Hospital, Hospitality, Office, Warehouse and Industry, Street, Retail, Sports Industry), By Region (Northern, Western, Southern, Eastern) And Competitive Landscape

| Product Code: ETC005504 | Publication Date: Jun 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 96 | No. of Figures: 21 | No. of Tables: 12 |

India Professional Lighting Market Synopsis

The professional lighting market in India has seen notable growth in recent years, driven by a combination of government initiatives and increasing technological awareness among individuals. Key initiatives such as the UJALA (Unnat Jyoti by Affordable LEDs for All) program, the Production Linked Incentive (PLI) scheme, and the Street Lighting National Programme have played significant roles in stimulating demand for professional lighting solutions across various sectors. Moreover, the Smart Cities Mission aims to transform 100 existing cities across India into smart cities, leveraging technology and innovation to address urban challenges efficiently. The integration of advanced lighting solutions into smart city projects aligns with the mission's objectives of promoting sustainable urban development and enhancing citizen well-being.

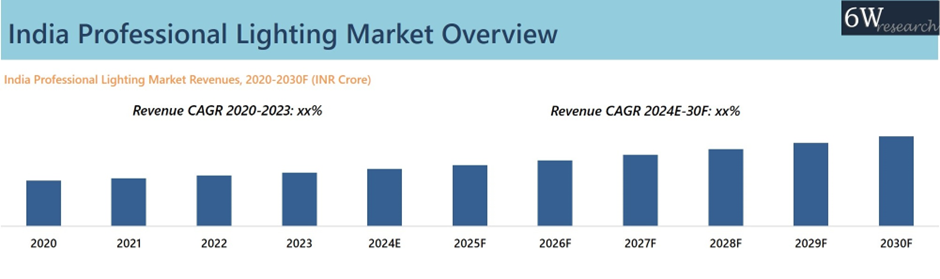

According to 6Wresearch, the India Professional Lighting Market is projected to grow at a CAGR of 7.8% from 2024-2030F. In the forthcoming years, the India professional lighting market is projected to witness additional growth, propelled by the burgeoning real estate sector. Remarkably, country's real estate is forecasted to reach a value of INR 83.3 Lakh Crores by 2030, marking a substantial rise from INR 16.67 Lakh Crores in 2021.

Additionally, the office sector in India is experiencing swift evolution. Elements such as the urbanization of Indian cities, the rise of sizable structures, and the introduction of new policies favoring the development of strong commercial real estate are substantially bolstering the sector's expansion and would consequently drive the need for professional lighting in the coming years. For instance, India is experiencing a sharp increase in urbanization, with approximately 600 million people expected to reside in cities by 2030. This substantial shift towards urban living would create a significant market opportunity for professional lighting in the Indian market.

Market Segmentation by Products

The anticipated growth of facade lighting in the upcoming years is attributed to the swift urbanization and modernization occurring throughout the nation, resulting in a notable increase in construction endeavours encompassing commercial buildings, hotels, malls, and public infrastructure.

Market Segmentation by Usages

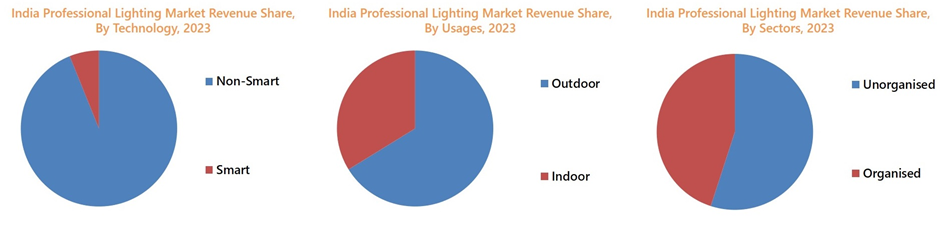

Outdoor lighting has acquired the largest revenue share in the professional lighting market of India as the demand for well-lit outdoor environments, both for functional and aesthetic purposes, has consequently surged. The outdoor lighting segment has been further boosted by urban construction, which accelerates the construction of outdoor spaces such as parks, stadiums, streets, and highways.

Market Segmentation by Sales Channel

In the landscape of India's professional lighting market, the B2C sales channel has the major revenue share owing to the expansion of urban areas and the development of smart cities, which have spurred the demand for innovative lighting solutions for both indoor and outdoor spaces, thus driving sales through the B2C sales channel.

Market Segmentation by Technology

By technology, non-smart lighting has the largest revenue share in India professional lighting market due to its lower upfront costs and the requirement for less complex installation and maintenance, making it more accessible to a wider range of end users. Moreover, smart lighting technology is gaining traction, especially in urban areas and high-end commercial projects, thus this trend will propel its market share by 2030.

Market Segmentation by Sectors

The unorganized sector has the maximum revenue share in the landscape of India's professional lighting market, mainly due to the presence of large number of small-scale manufacturers, suppliers, and distributors operating within the unorganized sector that offer a diverse range of lighting products at competitive prices. These entities often cater to specific regional markets, niche segments, or customized requirements, thereby meeting the diverse needs of customers across India.

Market Segmentation by End Users

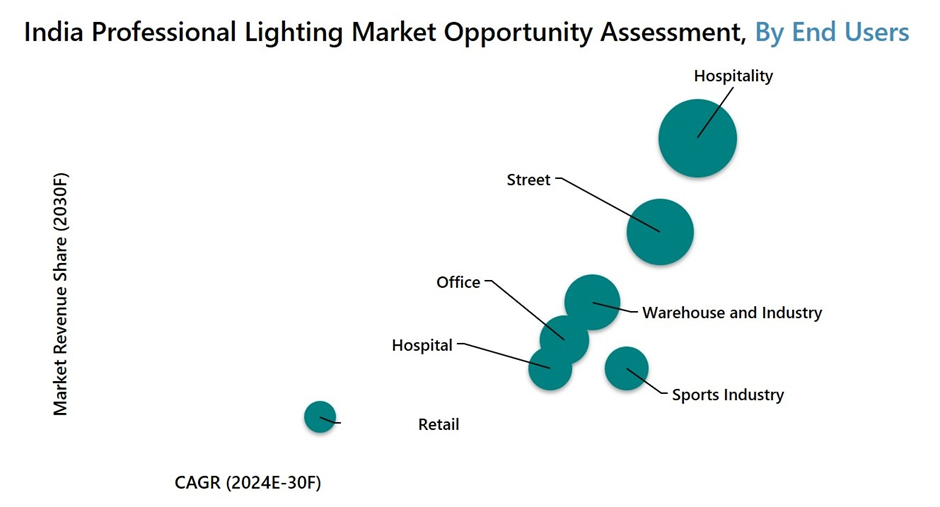

The hospitality sector is expected to maintain its higher growth rate in the coming years due to government initiatives aimed at promoting tourism and infrastructure development, coupled with increasing investments in hospitality projects across the country. These factors would contribute to the sustained growth of the hospitality sector within India's professional lighting market.

Market Segmentation by Region

The Northern region has garnered a major revenue share and is anticipated to further dominate in India’s professional lighting market owing to the development of expressways such as Dwarka and Jewar. Additionally, the boosting tourism sector in cities like Varanasi and Ayodhya is contributing to the rapid development of the hospitality sector in the region along with the enhancement of other public places such as parks and streetlights.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Professional Lighting Market Overview

- India Professional Lighting Market Outlook

- India Professional Lighting Market Forecast

- Industry Life Cycle

- Porter’s Five Forces Analysis

- SWOT Analysis

- Historical Data and Forecast of India Professional Lighting Market Revenues for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Products, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Usages, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Sales Channel, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Technology, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Sectors, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By End Users, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Region, for the Period 2020-2030F

- Market Drivers and Restraints

- India Professional Lighting Market Evolution & Trends

- India Professional Lighting Market Region-wise Analysis

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Products

- Recessed Light

- Surface Light

- Spot Light

- Down Light

- Facade Light (Fasad Light)

- Landscape Light

- Panel Light

- Flood Light

- Street Light

- Tube Light

- Sports Light

By Usages

- Indoor

- Outdoor

By Sales Channel

- B2B

- B2C

By Technology

- Smart

- Non-Smart

- By Sectors

- Organised

- Unorganised

By End Users

- Hospital

- Hospitality

- Office

- Warehouse and Industry

- Street

- Retail

- Sports Industry

By Region

- Northern

- Western

- Southern

- Eastern

India Professional Lighting Market (2025-2031):FAQ

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Professional Lighting Market Overview |

| 3.1 India Professional Lighting Market Revenues, 2020-2030F |

| 3.2 India Professional Lighting Market Industry Life Cycle |

| 3.3 India Professional Lighting Market Porter's Five Forces |

| 3.4 India Professional Lighting Market SWOT Analysis |

| 4. India Professional Lighting Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing urbanization and infrastructure development in India leading to higher demand for professional lighting solutions. |

| 4.2.2 Government initiatives promoting energy-efficient lighting solutions. |

| 4.2.3 Technological advancements in LED lighting driving the market growth. |

| 4.3. Market Restraints |

| 4.3.1 Cost constraints for consumers and businesses in adopting professional lighting solutions. |

| 4.3.2 Lack of awareness about the benefits of energy-efficient lighting solutions. |

| 4.3.3 Intense competition among lighting manufacturers impacting pricing and profitability. |

| 5. India Professional Lighting Market Trends |

| 6. India Professional Lighting Market Overview, By Products |

| 6.1 India Professional Lighting Market Revenue Share, By Products, 2023 & 2030F |

| 6.2 India Professional Lighting Market Revenues, By Products, 2020-2030F |

| 6.2.1 India Professional Lighting Market Revenues, Recessed Light, 2020-2030F |

| 6.2.2 India Professional Lighting Market Revenues, Surface Light , 2020-2030F |

| 6.2.3 India Professional Lighting Market Revenues, Spot Light, 2020-2030F |

| 6.2.4 India Professional Lighting Market Revenues, Down Light, 2020-2030F |

| 6.2.5 India Professional Lighting Market Revenues, Panel Light, 2020-2030F |

| 6.2.6 India Professional Lighting Market Revenues, Flood Light, 2020-2030F |

| 6.2.7 India Professional Lighting Market Revenues, Street Light, 2020-2030F |

| 6.2.8 India Professional Lighting Market Revenues, Tube Light, 2020-2030F |

| 6.2.9 India Professional Lighting Market Revenues, Facade Light, 2020-2030F |

| 6.2.10 India Professional Lighting Market Revenues, Landscape Light, 2020-2030F |

| 6.2.11 India Professional Lighting Market Revenues, Sports Light, 2020-2030F |

| 7. India Professional Lighting Market Overview, By Usages |

| 7.1 India Professional Lighting Market Revenue Share and Revenues, By Usages |

| 7.1.1 India Professional Lighting Market Revenues, By Indoor, 2020-2030F |

| 7.1.2 India Professional Lighting Market Revenues, By Outdoor, 2020-2030F |

| 8. India Professional Lighting Market Overview, By Sales Channel |

| 8.1 India Professional Lighting Market Revenue Share and Revenues, By Sales Channel |

| 8.1.1 India Professional Lighting Market Revenues, By B2B, 2020-2030F |

| 8.1.2 India Professional Lighting Market Revenues, By B2C, 2020-2030F |

| 9. India Professional Lighting Market Overview, By B2C Sales Channel |

| 9.1 India Professional Lighting Market Revenue Share and Revenues, By B2C Sales Channel |

| 9.1.1 India Professional Lighting Market Revenues, By Speciality, 2020-2030F |

| 9.1.2 India Professional Lighting Market Revenues, By Supermarkets and Hypermarkets, 2020-2030F |

| 9.1.3 India Professional Lighting Market Revenues, By Convenience Stores, 2020-2030F |

| 10. India Professional Lighting Market Overview, By Technology |

| 10.1 India Professional Lighting Market Revenue Share and Revenues, By Technology |

| 10.1.1 India Professional Lighting Market Revenues, By Smart, 2020-2030F |

| 10.1.2 India Professional Lighting Market Revenues, By Non-Smart, 2020-2030F |

| 11. India Professional Lighting Market Overview, By Sectors |

| 11.1 India Professional Lighting Market Revenue Share and Revenues, By Sectors |

| 11.1.1 India Professional Lighting Market Revenues, By Organised, 2020-2030F |

| 11.1.2 India Professional Lighting Market Revenues, By Unorganised, 2020-2030F |

| 12. India Professional Lighting Market Overview, By End Users |

| 12.1 India Professional Lighting Market Revenue Share, By End Users, 2023 & 2030F |

| 12.2 India Professional Lighting Market Revenues, By End Users, 2020-2030F |

| 12.2.1 India Professional Lighting Market Revenues, By Hospital, 2020-2030F |

| 12.2.2 India Professional Lighting Market Revenues, By Hospitality, 2020-2030F |

| 12.2.3 India Professional Lighting Market Revenues, By Office, 2020-2030F |

| 12.2.4 India Professional Lighting Market Revenues, By Warehouse and Industry, 2020-2030F |

| 12.2.5 India Professional Lighting Market Revenues, By Street, 2020-2030F |

| 12.2.6 India Professional Lighting Market Revenues, By Retail, 2020-2030F |

| 12.2.7 India Professional Lighting Market Revenues, By Sports Industry, 2020-2030F |

| 13. India Professional Lighting Market Overview, By Region |

| 13.1 India Professional Lighting Market Revenue Share and Revenues, By Region |

| 13.1.1 India Professional Lighting Market Revenues, By Northern, 2020-2030F |

| 13.1.2 India Professional Lighting Market Revenues, By Western, 2020-2030F |

| 13.1.3 India Professional Lighting Market Revenues, By Southern, 2020-2030F |

| 13.1.4 India Professional Lighting Market Revenues, By Eastern, 2020-2030F |

| 14. India Professional Lighting Market Region Wise Analysis |

| 15. India Professional Lighting Market Key Performance Indicators |

| 15.1 Energy savings achieved through the adoption of professional lighting solutions. |

| 15.2 Number of government projects integrating energy-efficient lighting. |

| 15.3 Percentage of commercial buildings using LED lighting solutions. |

| 15.4 Rate of adoption of smart lighting technologies in urban areas. |

| 15.5 Number of new product launches and innovations in the professional lighting market. |

| 16. India Professional Lighting Market Opportunity Assessment |

| 16.1 India Professional Lighting Market Opportunity Assessment, By Products, 2030F |

| 16.2 India Professional Lighting Market Opportunity Assessment, By Usages, 2030F |

| 16.3 India Professional Lighting Market Opportunity Assessment, By Sales Channel, 2030F |

| 16.4 India Professional Lighting Market Opportunity Assessment, By End Users, 2030F |

| 16.5 India Professional Lighting Market Opportunity Assessment, By Region, 2030F |

| 17. India Professional Lighting Market Competitive Landscape |

| 17.1 India Professional Lighting Market Revenue Share, By Top 3 Companies |

| 17.2 India Professional Lighting Market Competitive Benchmarking, By Technical Parameters |

| 17.3 India Professional Lighting Market Competitive Benchmarking, By Operating Parameters |

| 18. Company Profiles |

| 18.1 Signify Innovations India Limited |

| 18.2 Wipro Lighting |

| 18.3 Bajaj Electricals Ltd |

| 18.4 Orient Electric Ltd. |

| 18.5 Havells India Ltd. |

| 18.6 Eveready Industries India Limited |

| 18.7 Surya Roshni Ltd. |

| 18.8 Crompton Greaves Consumer Electricals Ltd. |

| 18.9 RR Kabel Ltd |

| 18.10 Panasonic Life Solutions India Pvt. Ltd |

| 18.11 Halonix Technologies Private Limited |

| 19. Key Strategic Recommendations |

| 20. Disclaimer |

| List of Figures |

| 1. India Professional Lighting Market Revenues, 2020-2030F (INR Crore) |

| 2. India Construction Sector Contribution In GDP, 2020-2025F |

| 3. India Real Estate Market Size, 2017-2030F, in $ Billion |

| 4. India Professional Lighting Market Revenue Share, By Products, 2023 & 2030F |

| 5. India Professional Lighting Market Revenue Share, By Usages, 2023 & 2030F |

| 6. India Professional Lighting Market Revenue Share, By Sales Channel, 2023 & 2030F |

| 7. India Professional Lighting Market Revenue Share, By B2C Sales Channel, 2023 & 2030F |

| 8. India Professional Lighting Market Revenue Share, By Technology, 2023 & 2030F |

| 9. India Professional Lighting Market Revenue Share, By Sectors, 2023 & 2030F |

| 10. India Professional Lighting Market Revenue Share, By End Users, 2023 & 2030F |

| 11. India Professional Lighting Market Revenue Share, By Region, 2023 & 2030F |

| 12. India Office Demand, 2020-2025F (Million sq. ft) |

| 13. India Expected Office Area Completion, By Cities, 2024-2025 |

| 14. India Luxury and First-Class Hotel Projects, 2022-2025F |

| 15. India Shopping Mall Stock as of H1 2023 |

| 16. India Professional Lighting Market Opportunity Assessment, By Products, 2030F |

| 17. India Professional Lighting Market Opportunity Assessment, By Usages, 2030F |

| 18. India Professional Lighting Market Opportunity Assessment, By Sales Channel, 2030F |

| 19. India Professional Lighting Market Opportunity Assessment, By End Users, 2030F |

| 20. India Professional Lighting Market Opportunity Assessment, By Region, 2030F |

| 21. India Professional Lighting Market Revenue Share, By Companies, 2023 |

| List of Tables |

| 1. Smart City Mission Outlook, 2023 |

| 2. India Professional Lighting Market Revenues, By Products, 2020-2030F (INR Crore) |

| 3. India Professional Lighting Market Revenues, By Usages, 2020-2030F (INR Crore) |

| 4. India Professional Lighting Market Revenues, By Sales Channel, 2020-2030F (INR Crore) |

| 5. India Professional Lighting Market Revenues, By B2C Sales Channel, 2020-2030F (INR Crore) |

| 6. India Professional Lighting Market Revenues, By Technology, 2020-2030F (INR Crore) |

| 7. India Professional Lighting Market Revenues, By Sectors, 2020-2030F (INR Crore) |

| 8. India Professional Lighting Market Revenues, By End Users, 2020-2030F (INR Crore) |

| 9. India Professional Lighting Market Revenues, By Region, 2020-2030F (INR Crore) |

| 10. List of Upcoming Hotels In India |

| 11. India Retail Supply In Malls, 2027F |

| 12. Smart Light Features and Potential Power Savings |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Iraq Insulation and Waterproofing Market (2026-2032) | Outlook, Drivers, Growth, Size, Share, Industry, Revenue, Trends, Demand, Competitive, Strategic Insights, Opportunities, Segments, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Value, Segmentation, Forecast, Restraints

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero