India Smart TV Market (2023-2029) | Trends, Share, Companies, Revenue, Forecast, Size, Industry, Value, Growth, Outlook, COVID-19 IMPACT & Analysis

Market Forecast By Screen Type (28 to 40 inch, 41 to 59 inch, 60 inches & above), By Pannel Type (LED, OLED, QLED, Others), By Resolution Type (HD TV, Full HD TV, 4K UHD TV, 8K TV), By Distribution Channel (Direct, Indirect), By End Use (Commercial, Residential, Others) And Competitive Landscape

| Product Code: ETC012224 | Publication Date: Aug 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

India Smart Tv Market Import Shipment Trend (2020-2024)

The India smart TV market import shipment experienced a significant decline with a CAGR of -36.0% from 2020-2024. However, there was a notable rebound in growth between 2023 and 2024, with an impressive growth rate of 78.9%. Despite the overall deceleration, signs of recovery and momentum are evident in the latter period.

India Smart TV Market | Country-Wise Share and Competition Analysis

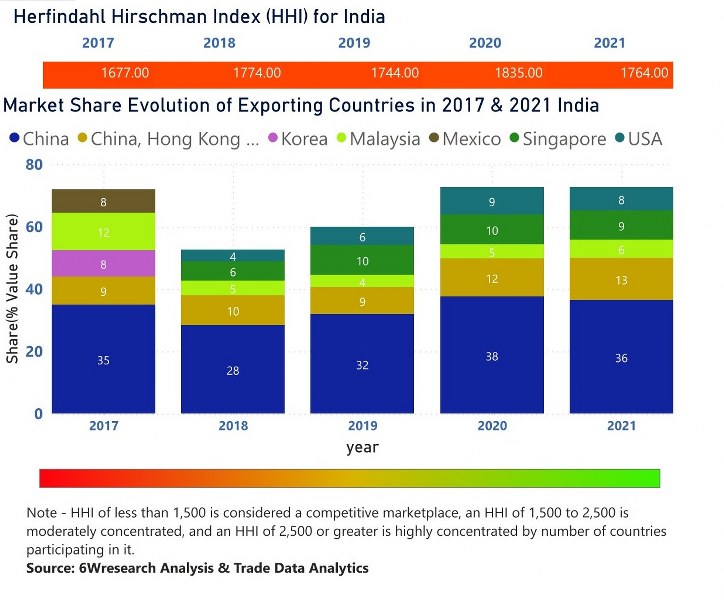

In the year 2021, China was the largest exporter in terms of value, followed by China, and Hong Kong SAR. It has registered a growth of 2.16% over the previous year. In China, Hong Kong SAR registered a growth of 16.15% as compared to the previous year. In the year 2017, China was the largest exporter followed by Malaysia. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, India has a Herfindahl index of 1677 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1764 which signifies moderately concentrated in the market.

India Smart TV Market - Export Market Opportunities![]()

Topics Covered in the India Smart TV Market

India Smart TV Market report thoroughly covers the market by screen types, screen size, resolution, technology, distribution channels, and regions. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Smart TV Market Synopsis

India Smart TV Market is anticipated to register a sound growth in the coming years owing to the rising urbanization, disposable income, and internet penetration. The rising income level of the population enables them to invest in the purchase of smart TVs to achieve premium entertainment experiences, as smart TVs are integrated with advanced features and connectivity options, which drives product demand. Digitalization and Internet Penetration have increased the adoption of smart TVs, as they provide access to online content to watch on a large screen. Urbanization is also a significant driver for the India Smart TV industry, with the rising shift of the population from rural to urban areas willing to adopt standard lifestyles, including the installation of smart TVs.

According to 6Wresearch, the India Smart TV Market size is estimated to grow at a compound annual growth rate of 16.9% during the forecast period 2023-2029. The market is estimated to grow considerably in the country due to increased e-commerce setups such as Amazon and Flipkart, which have made it easier for customers to purchase from the comfort of their homes, price comparisons, and deep product details are some benefits offered by these portals. Additionally, the rising popularity of OTT platforms such as Netflix, Amazon Prime, and others is increasingly generating demand for smart TVs to easily access content. These are some major growth proliferating factors driving the India Smart TV Market growth. Moreover, the continuous technological upgradation into smart TVs such as faster processors, better image quality, and enhanced user interface has resulted in an increased smart TV adoption at a tremendous rate. Smart Home Integration is another prominent factor driving the market growth as this offers connectivity access to the consumers, which is extremely convenient to use.

COVID-19 Influence on the India Smart TV Market

COVID-19 had a significant influence on the India Smart TV Market which is a part of the Asia Pacific Smart TV market. with the initial lockdown, people were staying at home watching online content, as a result, smart TVs experienced a slight demand during the pandemic, nevertheless, with a delay in the smart TV manufacturing process due to disruption in the raw materials. This has led to a decline in the availability of the product in the Indian market.

Key Players of the India Smart TV Market

- India Smart TV Market is highly competitive as various companies are dealing in the same products. Some of them are mentioned below in the given list:

- Samsung is a well-known player in the country, that offers a spectrum range of electronic products including smart TVs.

- LG Electronics is another well-renowned company with a strong existence. They offer innovative and top-notch quality electronics to their customers.

- Sony Corporation is a well-established player in the country, offering top-notch quality smart TVs at competitive prices with advanced features.

- Xiaomi (Mi TV) has a strong presence in the country, they provide a wide range of smart TVs integrated with advanced features.

Some Ongoing Trends & Opportunities India Smart TV Market

The India Smart TV Market is estimated to witness tremendous growth over the coming years underpinned by several trends and opportunities. One of the significant opportunities estimated to fuel the product demand is smart TV adoption in rural areas, which can be a great opportunity for the manufacturers to tap into the market by providing an affordable range of TVs. Moreover, environmentally conscious consumers are spending to buy energy-efficient and eco-friendly TVs, so manufacturers can focus on developing greener smart TVs. With the availability of high-quality content in 4K and 8K resolution, consumers are willing spending to purchase Smart TVs that can deliver better picture quality. This is one of the ongoing market trends estimated to leave a positive impact on the Smart TV Market in India.

Market Analysis by Resolution

According to Shivankar, Research Manager, 6Wresearch, full HD resolution based smart TVs are in high demand, as the availability of high-quality content seeks HD resolution TVs integrated with advanced features, such as fast processors and improved user interface.

Market Analysis by Distribution Channel

Based on distribution channels, both offline and online segments are dominating the India Smart TV Market share, however, the online segment is gaining traction in the country with an increased population presence over online portals for shopping purposes.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Smart TV Market Outlook

- Market Size of India Smart TV Market, 2022

- Forecast of India Smart TV Market, 2029

- Historical Data and Forecast of India Smart TV Revenues & Volume for the Period 2019 - 2029

- India Smart TV Market Trend Evolution

- India Smart TV Market Drivers and Challenges

- India Smart TV Price Trends

- India Smart TV Porter's Five Forces

- India Smart TV Industry Life Cycle

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Screen Type for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 28 to 40 inch for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 41 to 59 inch for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 60 inch & above for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Pannel Type for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By LED for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By OLED for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By QLED for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Others for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Resolution Type for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By HD TV for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Full HD TV for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 4K UHD TV for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 8K TV for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Distribution Channel for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Direct for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Indirect for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By End Use for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Commercial for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Residential for the Period 2019 - 2029

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Others for the Period 2019 - 2029

- India Smart TV Import Export Trade Statistics

- Market Opportunity Assessment By Screen Type

- Market Opportunity Assessment By Panel Type

- Market Opportunity Assessment By Resolution Type

- Market Opportunity Assessment By Distribution Channel

- Market Opportunity Assessment By End Use

- India Smart TV Top Companies Market Share

- India Smart TV Competitive Benchmarking By Technical and Operational Parameters

- India Smart TV Company Profiles

- India Smart TV Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Screen Type

- 28 To 40 Inch

- 41 to 59-inch

- 60 Inch & Above

By Panel Type

- LED

- OLED

- QLED

- Others

By Resolution Type

- HD TV

- Full HD TV

- 4K UHD TV

- 8K TV

By Distribution Channel

- Direct

- Indirect

By End Use

- Commercial

- Residential

- Others

India Smart TV Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Smart TV Market Overview |

| 3.1 India Smart TV Market Revenues & Volume, 2019 - 2029F |

| 3.2 India Smart TV Market - Industry Life Cycle |

| 3.3 India Smart TV Market - Porter's Five Forces |

| 3.4 India Smart TV Market Revenues & Volume Share, By Screen Type, 2022 & 2029F |

| 3.5 India Smart TV Market Revenues & Volume Share, By Pannel Type, 2022 & 2029F |

| 3.6 India Smart TV Market Revenues & Volume Share, By Resolution Type, 2022 & 2029F |

| 3.7 India Smart TV Market Revenues & Volume Share, By Distribution Channel, 2022 & 2029F |

| 3.8 India Smart TV Market Revenues & Volume Share, By End Use, 2022 & 2029F |

| 4 India Smart TV Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing disposable income of consumers in India, leading to higher spending on consumer electronics like smart TVs. |

| 4.2.2 Growth in digitalization and internet penetration in India, driving demand for smart TVs with internet connectivity and streaming capabilities. |

| 4.2.3 Technological advancements in smart TV features and functionalities, attracting consumers to upgrade their existing TVs. |

| 4.3 Market Restraints |

| 4.3.1 Price sensitivity among Indian consumers, hindering adoption of high-priced smart TVs. |

| 4.3.2 Lack of awareness and understanding of smart TV functionalities and benefits, slowing down market growth. |

| 4.3.3 Infrastructure challenges in certain regions of India, affecting the seamless usage of smart TV features like streaming services. |

| 5 India Smart TV Market Trends |

| 6 India Smart TV Market Segmentation |

| 6.1 India Smart TV Market, By Screen Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Smart TV Market Revenues & Volume, By Screen Type, 2019 - 2029F |

| 6.1.3 India Smart TV Market Revenues & Volume, By 28 to 40 inch, 2019 - 2029F |

| 6.1.4 India Smart TV Market Revenues & Volume, By 41 to 59 inch, 2019 - 2029F |

| 6.1.5 India Smart TV Market Revenues & Volume, By 60 inch & above, 2019 - 2029F |

| 6.2 India Smart TV Market, By Pannel Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Smart TV Market Revenues & Volume, By LED, 2019 - 2029F |

| 6.2.3 India Smart TV Market Revenues & Volume, By OLED, 2019 - 2029F |

| 6.2.4 India Smart TV Market Revenues & Volume, By QLED, 2019 - 2029F |

| 6.2.5 India Smart TV Market Revenues & Volume, By Others, 2019 - 2029F |

| 6.3 India Smart TV Market, By Resolution Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 India Smart TV Market Revenues & Volume, By HD TV, 2019 - 2029F |

| 6.3.3 India Smart TV Market Revenues & Volume, By Full HD TV, 2019 - 2029F |

| 6.3.4 India Smart TV Market Revenues & Volume, By 4K UHD TV, 2019 - 2029F |

| 6.3.5 India Smart TV Market Revenues & Volume, By 8K TV, 2019 - 2029F |

| 6.4 India Smart TV Market, By Distribution Channel |

| 6.4.1 Overview and Analysis |

| 6.4.2 India Smart TV Market Revenues & Volume, By Direct, 2019 - 2029F |

| 6.4.3 India Smart TV Market Revenues & Volume, By Indirect, 2019 - 2029F |

| 6.5 India Smart TV Market, By End Use |

| 6.5.1 Overview and Analysis |

| 6.5.2 India Smart TV Market Revenues & Volume, By Commercial, 2019 - 2029F |

| 6.5.3 India Smart TV Market Revenues & Volume, By Residential, 2019 - 2029F |

| 6.5.4 India Smart TV Market Revenues & Volume, By Others, 2019 - 2029F |

| 7 India Smart TV Market Import-Export Trade Statistics |

| 7.1 India Smart TV Market Export to Major Countries |

| 7.2 India Smart TV Market Imports from Major Countries |

| 8 India Smart TV Market Key Performance Indicators |

| 8.1 Average time spent on smart TV apps per user. |

| 8.2 Percentage of households with smart TV penetration. |

| 8.3 Number of new smart TV models and features launched in the market. |

| 8.4 Customer satisfaction ratings for smart TV brands. |

| 8.5 Percentage of households upgrading from traditional TVs to smart TVs. |

| 9 India Smart TV Market - Opportunity Assessment |

| 9.1 India Smart TV Market Opportunity Assessment, By Screen Type, 2022 & 2029F |

| 9.2 India Smart TV Market Opportunity Assessment, By Pannel Type, 2022 & 2029F |

| 9.3 India Smart TV Market Opportunity Assessment, By Resolution Type, 2022 & 2029F |

| 9.4 India Smart TV Market Opportunity Assessment, By Distribution Channel, 2022 & 2029F |

| 9.5 India Smart TV Market Opportunity Assessment, By End Use, 2022 & 2029F |

| 10 India Smart TV Market - Competitive Landscape |

| 10.1 India Smart TV Market Revenue Share, By Companies, 2022 |

| 10.2 India Smart TV Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Screen Type (28 to 40 inch, 41 to 59 inch, 60 inches & above), By Pannel Type (LED, OLED, QLED, Others), By Resolution Type (HD TV, Full HD TV, 4K UHD TV, 8K TV), By Distribution Channel (Direct, Indirect), By End Use (Commercial, Residential, Others) And Competitive Landscape

| Product Code: ETC012224 | Publication Date: Aug 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Latest 2023 Developments of the India Smart TV Market

India Smart TV Market is flourishing as the country has witnessed prominent growth in recent years, driven by rising consumer preferences, availability of cost-effective smart TV alternatives, and rising disposable incomes, and these trends are anticipated to continue in the years to come. The nation has seen a faster rise in internet penetration, especially with the emergence of cost-effective data plans and the availability of higher-speed internet connections. This factor has led to a rise in the adoption of smart TVs since they need an internet connection in order to access online content as well as streaming services. Price sensitivity is also a central factor in the Indian market. In the country, manufacturers have been focusing on offering people cost-effective smart TV options. These factors are stimulating the India Smart TV Market Growth.

Topics Covered in the India Smart TV Market

India Smart TV Market report thoroughly covers the market by screen type, by panel type, by resolution, by distribution channel, and by end-use. The Smart TV Market outlook report provides an unbiased and detailed analysis of the ongoing Smart TV Market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Smart TV Market Synopsis

India Smart TV Market is progressing faster and smoother and will progress more during the forecast period. The market is propelling on account of the factors such as the shift towards larger screen sizes, cost-effective smart TV options, language support and localized content, and improved use experience and advanced features.

According to 6Wresearch, the India Smart TV Market size is expected to propel more during 2020–2026. Consumers in India are opting for TVs with larger screens, driven by the urge for a more immersive viewing experience. Price sensitivity is also a major factor stimulating market progression. Manufacturers in India have been focusing on coming up with smart TVs that are affordable in order to cater to a wide consumer base and this has led to smart TVs that are budget-friendly. The nation is very diverse with many languages and regional preferences. Manufacturers focus on working on offering localized content as well as language support in order to cater to the diverse requirements of Indian consumers. Players also focus on enhancing user experience by introducing features like AI-powered recommendations, voice control, as well as smart home integration.

Impacts of the COVID-19 Pandemic on the Market

The demand for smart TVs in India expanded more when the pandemic hit the country and one of the key reasons behind this growth was the large population of the country and the urge of people to keep themselves and their families entertained during the uncertain time. Smart TVs have the potential to be linked with streaming platforms such as Netflix, YouTube, and Amazon Prime Video, which also expanded the demand for this market in the country. The market is also a major part of the Asia Pacific Smart TV Market and the demand for smart TVs rose across the region.

Key Players of the India Smart TV Industry

Some crucial players playing a crucial role in the market are:

- Samsung

- LG Electronics

- Sony

- Xiaomi

- TCL

- Panasonic

- Vu

- OnePlus

- Micromax

The Future of the Smart TV Market in India

The future of the market is progressing and the India Smart Market size will expand more owing to the different and significant factors driving its growth. The nation has seen a faster rise in internet penetration, especially with the emergence of cost-effective data plans and the availability of higher-speed internet connections. Smart TVs have gained significance in the country since people in the country prefer spending quality time with their family and friends watching the TV shows and movies they like.

Market by Resolution Type

According to Shivankar, Research Manager, 6wresearch, it is the 4K segment that will progress the most in the market in the upcoming years owing to its higher demand.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Smart TV Market Outlook

- Market Size of India Smart TV Market, 2019

- Forecast of India Smart TV Market, 2026

- Historical Data and Forecast of India Smart TV Revenues & Volume for the Period 2016 - 2026

- India Smart TV Market Trend Evolution

- India Smart TV Market Drivers and Challenges

- India Smart TV Price Trends

- India Smart TV Porter's Five Forces

- India Smart TV Industry Life Cycle

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Screen Type for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 28 to 40 inch for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 41 to 59 inch for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 60 inch & above for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Pannel Type for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By LED for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By OLED for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By QLED for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Others for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Resolution Type for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By HD TV for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Full HD TV for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 4K UHD TV for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By 8K TV for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Distribution Channel for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Direct for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Indirect for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By End Use for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Commercial for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Residential for the Period 2016 - 2026

- Historical Data and Forecast of India Smart TV Market Revenues & Volume By Others for the Period 2016 - 2026

- India Smart TV Import Export Trade Statistics

- Market Opportunity Assessment By Screen Type

- Market Opportunity Assessment By Pannel Type

- Market Opportunity Assessment By Resolution Type

- Market Opportunity Assessment By Distribution Channel

- Market Opportunity Assessment By End Use

- India Smart TV Top Companies Market Share

- India Smart TV Competitive Benchmarking By Technical and Operational Parameters

- India Smart TV Company Profiles

- India Smart TV Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Screen Type

- 28 To 40 Inch

- 41 To 59 Inch

- 60 Inch & Above

By Panel Type

- LED

- OLED

- QLED

- Others

By Resolution Type

- HD TV

- Full HD TV

- 4K UHD TV

- 8K TV

By Distribution Channel

- Direct

- Indirect

By End Use

- Commercial

- Residential

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero