India Video Surveillance Market (2026-2032) | Size, industry, Share, Trends, Revenue, Analysis, Forecast, Growth, Value, Outlook

Market ForecastBy Offering (Hardware, Software, Service), By System (Analog Video Surveillance Systems, IP Video Surveillance Systems, Hybrid Video Surveillance Systems), By Vertical (Commercial, Infrastructure, Military & Defense, Residential, Public Facility, Industrial)

| Product Code: ETC081272 | Publication Date: Oct 2024 | Updated Date: Feb 2026 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 106 | No. of Figures: 37 | No. of Tables: 18 |

India Video Surveillance Market Growth Rate

According to 6Wresearch internal database and industry insights

India Video Surveillance Market Highlights

| Report Name | India Video Surveillance Market |

| Forecast Period | 2026-2032 |

| CAGR | 12.5% |

| Growing Sector | Commercial |

Topics Covered in the India Video Surveillance Market Report

India Video Surveillance Market report thoroughly covers the market by offering, system and vertical. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Video Surveillance Market Synopsis

India video surveillance market has witnessed exponential growth in the last few years. The growth is driven by a mix of drivers like increasing security needs in different industries, including residential, commercial, and government. Due to technological advancements, the market has grown in terms of coverage as well as solution sophistication.

Evaluation of Growth Drivers in the India Video Surveillance Market

Below mentioned are some prominent drivers and their influence to the market dynamics:

| Driver | Primary Segments Affected | Why it matters (evidence) |

| Smart City Development | Centralized Surveillance; Transportation & Infrastructure | Government-backed smart city projects demand large-scale video monitoring for traffic control, law enforcement, and city safety. |

| Rising Crime Rates & Security Concerns | Ductless & Centralized Surveillance; Residential & Commercial | Increasing incidents of theft, vandalism, and cybercrimes push adoption of surveillance cameras in homes, offices, and retail chains. |

| Technological Advancements (AI & IoT) | Room & Ductless Surveillance; Healthcare & Retail | AI-powered analytics and IoT integration enable predictive monitoring, facial recognition, and smart alerts. |

| Infrastructure Growth | Centralized & Ducted Surveillance; Transportation, Hospitality | Rapid metro expansions, airports, and hospitality projects require large-scale monitoring systems. |

| E-Governance & Digital India | Centralized Surveillance; Public Infrastructure | National programs such as Digital India encourage integration of smart monitoring solutions in government offices and public spaces. |

India Video Surveillance Market is expected to reach a significant CAGR of 12.5% during the forecast period 2026-2032. Various drivers are helping to drive the video surveillance market in India. Urbanization and infrastructure development have raised the demand for security solutions. The rising demand for overall surveillance systems, with the constant introduction of government schemes, such as smart city projects, is boosting the market. Moreover, technological advancements in AI and machine learning have provided opportunities for smart video analytics, improving the effectiveness and efficiency of video surveillance and driving the India Video Surveillance Market growth.

Evaluation of Restraints in the India Video Surveillance Market

Below mentioned are some major restraints and their influence to the market dynamics:

| Restraint | Primary Segments Affected | What this means (evidence) |

| High Installation & Maintenance Costs | All Types; Commercial & Healthcare | Advanced surveillance systems with AI and cloud support increase upfront and recurring expenses. |

| Data Privacy Concerns | Centralized Surveillance; Residential & Retail | Rising concerns regarding misuse of video footage and lack of strict data protection laws may affect adoption. |

| Lack of Skilled Workforce | AI-Integrated Surveillance; Healthcare & Infrastructure | Deployment of advanced surveillance systems requires trained technicians and system integrators. |

| Connectivity Issues in Rural Areas | Cloud-Based & Centralized Surveillance; Residential | Limited broadband penetration in remote areas hampers cloud adoption and real-time monitoring. |

| Cybersecurity Threats | All Segments | Increasing hacking and data breaches pose risks to surveillance networks. |

India Video Surveillance Market Challenges

As much as it has growth potential, the India video surveillance industry also has several key challenges that need to be addressed. Another key problem is the cost of advanced surveillance systems, which can be unaffordable for small institutions or single consumers. There are also privacy rules and ethical use of surveillance data to address. Infrastructure limitations in certain regions, such as the absence of broadband connections, can also hinder the use of advanced video surveillance applications.

India Video Surveillance Market Trends

Several prominent trends reshaping the market growth are:

- Cloud-Based Storage Expansion: The cloud storage technology has continued to be in high demand because of its flexibility and low cost, enabling businesses to store huge amounts of video data without having to make extensive on-premises installations.

- Integration with Access Control: Usage of facial detection and biometric technology has become increasingly popular, and, therefore, increasing accuracy-based monitoring features are becoming the reality.

- Body-Worn Cameras: Growing adoption by police, law enforcement, and private security firms to enhance transparency and accountability.

- IP- based surveillance systems: Movement toward IP-based surveillance systems offering enhanced picture quality and distant observation than traditional analogue systems.

Investment Opportunities in the India Video Surveillance Industry

Some prominent investment opportunities in the market are:

- AI & IoT-Based Solutions – Demand for software products involving AI and machine learning for advanced video analytics is another lucrative possibility.

- Video Surveillance-as-a-Service (VSaaS) – Investors can contemplate creating and manufacturing low-cost surveillance devices especially targeting small and medium enterprises, who are not targeted at present due to cost concerns

- Rural Market Expansion – Affordable, solar-powered surveillance solutions for rural safety and public monitoring.

- Cloud Infrastructure Development – Investment in cloud-based infrastructure that provides safe and reliable video data management will be highly likely to be most rewarding since corporations and governments continue to transition into such systems.

Top 5 Leading Players in the India Video Surveillance Market

Some leading players operating in the market are:

1. Hikvision India Pvt. Ltd.

| Company Name | Hikvision India Pvt. Ltd. |

| Establishment Year | 2001 |

| Headquarter | Mumbai, India |

| Official Website | Click here |

Hikvision offers advanced video surveillance products, including AI-powered cameras and cloud-based solutions catering to commercial, residential, and government projects.

2. CP PLUS (Aditya Infotech Ltd.)

| Company Name | CP PLUS (Aditya Infotech Ltd.) |

| Establishment Year | 2007 |

| Headquarter | New Delhi, India |

| Official Website | Click here |

CP PLUS specializes in IP cameras, recorders, and access control systems with strong distribution across India’s retail and residential sectors.

3. Dahua Technology India

| Company Name | Dahua Technology India |

| Establishment Year | 2001 |

| Headquarter | Gurgaon, India |

| Official Website | Click here |

Dahua provides AI-enabled video surveillance systems with strong adoption in transportation and public infrastructure projects.

4. Godrej Security Solutions

| Company Name | Godrej Security Solutions |

| Establishment Year | 1897 |

| Headquarter | Mumbai, India |

| Official Website | Click here |

Godrej offers integrated security solutions including video surveillance, access control, and fire detection systems for corporate and public infrastructure.

5. Panasonic India Pvt. Ltd.

| Company Name | Panasonic India Pvt. Ltd. |

| Establishment Year | 1972 |

| Headquarter | Gurugram, India |

| Official Website | Click here |

Panasonic delivers surveillance solutions with AI-driven analytics, primarily focusing on healthcare, retail, and transportation sectors.

Rising Security Concerns Fuelling Growth in India Video Surveillance Market

The India video surveillance industry has witnessed significant growth over the past years, owing to increasing security needs in both public and private spaces. There is an enormous need for sophisticated surveillance with the rising demand for urbanization, shifting crime patterns, and safeguarding key infrastructure.

Expenditures in intelligent security equipment such as AI cameras, face recognition, and analysis have been made by private sector and government players to enhance supervision and incident reactions.

The emergence of smart cities is also shaping the sector so that video monitoring is one of the core devices of urban area public security. The transformation reiterates the technological advancements' implication in resolving present security challenges.

India Smart Surveillance Revolution: How AI & IoT Are Transforming Security

With the rapid fusion of technologies in India, including AI and IoT, the surveillance landscape in cities and industrial zones is evolving, bringing a smart surveillance revolution. AI-fuelled surveillance solutions are bolstering real-time monitoring, identifying anomalies, and supporting predictive insights as fears over crime, infrastructure safety, and traffic control are growing. Seamless data sharing through IoT-enabled cameras and sensors enhances situational awareness. Facial recognition and automated threat detection powered by AI are being designed into smart cities for increased public safety.

Expanding Urban Infrastructure Driving Demand in India CCTV Market

With the growth and growth of cities, India high-speed urban infrastructure expansion is propelling the demand for CCTV. Robust surveillance systems will be needed for infrastructural developments such as smart cities, metro, and industrial corridors to ensure efficiency as well as security.

As urbanization increases, 24-hour security systems for the surveillance of public areas, transport, and critical infrastructure are in demand. Projects are increasingly using AI- and IoT-powered smart CCTV technology, which provides real-time monitoring, analysis, and prevention solutions. Residential and commercial development drives the demand for security solutions, further evolving CCTV technology. This symbiotic relationship between surveillance and urbanisation marks the central role played by expanding infrastructure in transforming innovation and investment for the India CCTV sector.

Rise of Cloud-Based Surveillance in India: Market Growth & Adoption

Cloud monitoring is becoming a game-changer for the India CCTV industry with scalability, flexibility, and affordability. Enterprises and governments increasingly depend on cloud technology for storage, management, and processing surveillance data, lessening the dependency on conventional on-premise infrastructures. It is propelled by the requirement for centralized management, remote access, and real-time sharing of data from multiple locations.

Further, developments in AI and machine learning interface have pushed the capabilities of cloud surveillance systems for predictive insights and incident identification. With the widespread availability of cheap internet services and advanced data protection mechanisms, cloud-based technology is becoming increasingly mainstream, even among SMEs. Increased adoption signifies the shift towards a more efficient and smarter surveillance infrastructure in India.

Government Regulations Introduced in the India Video Surveillance Market

According to Indian Government Data, there are several regulations being enforced to boost the security and privacy levels of the video surveillance industry. The regulations require rigorous adherence to data protection legislation to protect personal data collected by surveillance systems.

There is also a strong focus on all surveillance devices conforming to India Standards (IS) to attain quality and reliability. Certain industries, including public facilities and sensitive governmental regions, impose strict regulations calling for the establishment of surveillance systems to promote public safety. These codes demonstrate the government's dedication to promoting a safe and privacy-focused society.

Future Insights of the India Video Surveillance Market

The future of the India Video Surveillance market is bright with technological advancements and increasing demand for security solutions. As artificial intelligence and machine learning become increasingly integrated, future surveillance systems will integrate advanced analytics, enabling real-time detection of threats and prevention responses.

Urban expansion in smart cities and infrastructure development will fuel demand further. Second, with more commercial and government users of cloud computing-based surveillance tools, there will be a call for more pliable and easier-to-access security measures.

The Impact of the 5G Rollout on India Video Surveillance Market

Implementation of 5G technology in India is poised to make a revolutionary difference to the video surveillance sector. With greater data rates, lower latency, and higher connectivity, the live streaming of high-definition video will be accompanied by real-time analysis. All these developments will bring intelligent surveillance solutions to the field of traffic management, city surveillance, and area-wide surveillance, thus making the overall functioning of surveillance systems considerably better.

Low-Cost CCTV Solutions for Indian SMEs: Emerging Opportunities

Indian Small and Medium Enterprises (SMEs) are now increasingly opting for low-cost CCTV solutions to enhance security features. The trend is being capitalized upon by manufacturers and service providers by offering cost-effective, simple-to-install systems that are particularly designed to meet the needs of SMEs. Cloud storage and remote monitoring solutions as part of bundled packages are gaining popularity, thus allowing SMEs to experience enhanced security features without facing humongous financial expenses.

How AI Video Analytics is Revolutionizing Surveillance in India

AI in the video surveillance market is integrating intelligent systems that can identify abnormalities, perform facial recognition, and conduct behavior analysis. These systems provide real-time alerts, reduce the need for human monitoring, and enhance efficiency in general. AI surveillance is being increasingly embraced in crowded public areas, industrial sites, and business hubs, where quick decision-making is imperative for risk mitigation.

Smart Cities and Surveillance: How Urbanization is Shaping Security Demand in India

India's transition to smart cities is strongly pushing the demand for sophisticated video surveillance systems. The needs of smart cities call for intelligent surveillance solutions with the capability of efficiently monitoring critical infrastructure, traffic, and city safety.

Intelligent surveillance solutions contain artificial intelligence, the Internet of Things, and intelligent sensors to ensure seamless operation. The urbanization process and the growing need to keep the public safe and to eliminate crimes once again boost the demand nationwide.

Privacy Issues and Legislation on Video Surveillance in India

The increasing deployment of surveillance technology in India has brought privacy and regulatory concerns to the forefront. A lack of robust data protection regime has raised data abuse and unauthorized access concerns. Policymakers are making efforts to bring into force elaborate regulations that will balance security needs and privacy rights, and ensure ethical and lawful uses of surveillance technology throughout the country.

Why the Commercial Sector is Propelling Maximum Growth in the India Video Surveillance Market

India's corporate sector is powering the India Video Surveillance Market Growth due to rising investments in corporate, banking, and retail environments. The sector is investing heavily in sophisticated security solutions to protect its assets, prevent theft, and improve the security of employees. The use of video analytics, access control systems, and converged surveillance solutions is particularly high in this sector, indicative of its pivotal position in industry growth.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Hardware to Dominate the Market - By Offering

According to Sumon, Research Manager, 6wresearch, the hardware segment leads the market size and share. This category includes monitors, cameras, storage devices, and accessories, representing the largest market share collectively, fueled by the growing use of advanced surveillance systems.

Commercial to dominate the market - By Vertical

In the Market, the commercial vertical is dominating. This segment mainly consists of retail premises, corporate offices, and hospitality industries, generating high demand for video surveillance solutions. The commercial vertical accounts for about 25% of the market. The demand for improved security measures, along with the development of smart building technologies, continues to drive this segment.

Key Attractiveness of the Report:

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2032.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Video Surveillance Market Outlook

- Market Size of India Video Surveillance Market, 2024

- Forecast of India Video Surveillance Market, 2032

- Historical Data and Forecast of India Video Surveillance Revenues & Volume for the Period 2022-2032

- India Video Surveillance Market Trend Evolution

- India Video Surveillance Market Drivers and Challenges

- India Video Surveillance Price Trends

- India Video Surveillance Porter's Five Forces

- India Video Surveillance Industry Life Cycle

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Offering for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Hardware for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Software for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Service for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By System for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Analog Video Surveillance Systems for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By IP Video Surveillance Systems for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Hybrid Video Surveillance Systems for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Vertical for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Commercial for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Infrastructure for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Military & Defense for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Residential for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Public Facility for the Period 2022-2032

- Historical Data and Forecast of India Video Surveillance Market Revenues & Volume By Industry for the Period 2022-2032

- India Video Surveillance Import Export Trade Statistics

- Market Opportunity Assessment By Offering

- Market Opportunity Assessment By System

- Market Opportunity Assessment By Vertical

- India Video Surveillance Top Companies Market Share

- India Video Surveillance Competitive Benchmarking By Technical and Operational Parameters

- India Video Surveillance Company Profiles

- India Video Surveillance Key Strategic Recommendations

Market Covered

The market report provides a detailed analysis of the following market segments:

By Offering

- Hardware

- Software

- Service

By System

- Analog Video Surveillance Systems

- IP Video Surveillance Systems

- Hybrid Video Surveillance Systems

By Vertical

- Commercial

- Infrastructure

- Military & Defense

- Residential

- Public Facility

- Industrial

India Video Surveillance Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Video Surveillance Market Overview |

| 3.1. India Video Surveillance Market Revenues and Volume, 2022 & 2032F |

| 3.2. India Video Surveillance Market Industry Life Cycle |

| 3.3. India Video Surveillance Market - Porter’s Five Forces |

| 4. India Video Surveillance Market COVID-19 Impact Analysis |

| 5. India Video Surveillance Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing government initiatives for public safety and security |

| 5.2.2 Rising awareness about the benefits of video surveillance systems |

| 5.2.3 Growing adoption of advanced technologies like AI and IoT in surveillance solutions |

| 5.3. Market Restraints |

| 5.3.1 High initial investment costs for setting up video surveillance systems |

| 5.3.2 Concerns regarding data privacy and security issues |

| 5.3.3 Lack of standardized regulations and guidelines for video surveillance in India |

| 6. India Video Surveillance Market Trends and Evolution |

| 7. India Video Surveillance Market Overview |

| 7.1 India Video Surveillance Market Revenue and Volume Share, By Component, 2022 & 2032F |

| 7.1.1 India Video Surveillance Market Revenue and Volume Share, By Camera, 2022 & 2032F |

| 7.1.2 India Video Surveillance Market Revenue and Volume Share, By Recorder, 2022 & 2032F |

| 7.1.3 India Video Surveillance Market Revenue and Volume Share, By Encoder, 2022 & 2032F |

| 7.1.4 India Video Surveillance Market Revenue Share, By Software, 2022 & 2032F |

| 7.2 India Video Surveillance Market Revenues and Volume, By Component, 2022 & 2032F |

| 7.2.1 India Video Surveillance Market Revenues and Volume, By Camera, 2022 & 2032F |

| 7.2.2 India Video Surveillance Market Revenues and Volume, By Recorder, 2022 & 2032F |

| 7.2.3 India Video Surveillance Market Revenues and Volume, By Encoder, 2022 & 2032F |

| 7.2.4 India Video Surveillance Market Revenues, By Software, 2022 & 2032F |

| 8. India Video Surveillance Market Overview, By Camera |

| 8.1.1 India Video Surveillance Camera Market Revenue and Volume Share, By Camera Type, By IP Camera, 2022 & 2032F |

| 8.1.1 India Video Surveillance Camera Market Revenue and Volume Share, By Camera Type, By Analog Camera, 2022 & 2032F |

| 8.1.2 India Video Surveillance Camera Market Revenues and Volume, By Camera Type, By IP Camera, 2022 & 2032F |

| 8.1.2 India Video Surveillance Camera Market Revenues and Volume, By Camera Type, By Analog Camera, 2022 & 2032F |

| 8.2.1 India Video Surveillance Camera Market Revenues and Volume, By Form Factor, By Dome, 2022 & 2032F |

| 8.2.1 India Video Surveillance Camera Market Revenues and Volume, By Form Factor, By Bullet, 2022 & 2032F |

| 8.2.1 India Video Surveillance Camera Market Revenues and Volume, By Form Factor, By Others, 2022 & 2032F |

| 8.2.2 India Video Surveillance Camera Market Revenues and Volume, By Form Factor, By Dome, 2022 & 2032F |

| 8.2.2 India Video Surveillance Camera Market Revenues and Volume, By Form Factor, By Bullet, 2022 & 2032F |

| 8.2.2 India Video Surveillance Camera Market Revenues and Volume, By Form Factor, By Others, 2022 & 2032F |

| 8.3.1 India Video Surveillance Camera Market Revenue and Volume Share, By Megapixels, By Below 1 MP, 2022 & 2032F |

| 8.3.1 India Video Surveillance Camera Market Revenue and Volume Share, By Megapixels, By 1.1-2 MP, 2022 & 2032F |

| 8.3.1 India Video Surveillance Camera Market Revenue and Volume Share, By Megapixels, By 2.1-3 MP, 2022 & 2032F |

| 8.3.1 India Video Surveillance Camera Market Revenue and Volume Share, By Megapixels, By 3.1-5 MP, 2022 & 2032F |

| 8.3.1 India Video Surveillance Camera Market Revenue and Volume Share, By Megapixels, By Above 5 MP, 2022 & 2032F |

| 8.3.2 India Video Surveillance Camera Market Revenues and Volume, By Megapixels, By Below 1 MP, 2022 & 2032F |

| 8.3.2 India Video Surveillance Camera Market Revenues and Volume, By Megapixels, By 1.1-2 MP, 2022 & 2032F |

| 8.3.2 India Video Surveillance Camera Market Revenues and Volume, By Megapixels, By 2.1-3 MP, 2022 & 2032F |

| 8.3.2 India Video Surveillance Camera Market Revenues and Volume, By Megapixels, By 3.1-5 MP, 2022 & 2032F |

| 8.3.2 India Video Surveillance Camera Market Revenues and Volume, By Megapixels, By Above 5 MP, 2022 & 2032F |

| 8.4.1 India Video Surveillance Camera Market Revenue and Volume Share, By Camera Slot, By With Slot, 2022 & 2032F |

| 8.4.1 India Video Surveillance Camera Market Revenue and Volume Share, By Camera Slot, By Without Slot, 2022 & 2032F |

| 8.4.2 India Video Surveillance Camera Market Revenues and Volume, By Camera Slot, By With Slot, 2022 & 2032F -2029F |

| 8.4.2 India Video Surveillance Camera Market Revenues and Volume, By Camera Slot, By Without Slot, 2022 & 2032F -2029F |

| 9. India Video Surveillance Market Overview, By Recorder |

| 9.1 India Video Surveillance Market Revenue and Volume Share, By Recorder Types, 2022 & 2032F |

| 9.1.1 India Video Surveillance Recorder Market Revenue and Volume Share, By Network Video Recorder, 2022 & 2032F |

| 9.1.2 India Video Surveillance Recorder Market Revenue and Volume Share, By Digital Video Recorder, 2022 & 2032F |

| 9.2 India Video Surveillance Market Revenues and Volume, By Recorder Type, 2022 & 2032F -2029F |

| 9.2.1 India Video Surveillance Recorder Market Revenues and Volume, By Network Video Recorder, 2022 & 2032F -2029F |

| 9.2.2 India Video Surveillance Recorder Market Revenues and Volume, By Digital Video Recorder, 2022 & 2032F -2029F |

| 10. India Video Surveillance Market Overview, By Verticals |

| 10.1 India Video Surveillance Market Revenue and Volume Share, By Verticals, 2022 & 2032F |

| 10.1.1 India Video Surveillance Market Revenue and Volume Share, By Government & Transportation, 2022 & 2032F |

| 10.1.2 India Video Surveillance Market Revenue and Volume Share, By Retail & Logistics, 2022 & 2032F |

| 10.1.3 India Video Surveillance Market Revenue and Volume Share, By Commercial Buildings, 2022 & 2032F |

| 10.1.4 India Video Surveillance Market Revenue and Volume Share, By BFSI, 2022 & 2032F |

| 10.1.5 India Video Surveillance Market Revenue and Volume Share, By Hospitality & Healthcare, 2022 & 2032F |

| 10.1.6 India Video Surveillance Market Revenue and Volume Share, By Residential, 2022 & 2032F |

| 10.1.7 India Video Surveillance Market Revenue and Volume Share, By Educational Institutions, 2022 & 2032F |

| 10.1.8 India Video Surveillance Market Revenue and Volume Share, By Industry, 2022 & 2032F |

| 10.2 India Video Surveillance Market Revenues and Volume, By Verticals, 2022 & 2032F |

| 10.2.1 India Video Surveillance Market Revenues and Volume, By Government & Transportation, 2022 & 2032F |

| 10.2.2 India Video Surveillance Market Revenues and Volume, By Retail & Logistics, 2022 & 2032F |

| 10.2.3 India Video Surveillance Market Revenues and Volume, By Commercial Buildings, 2022 & 2032F |

| 10.2.4 India Video Surveillance Market Revenues and Volume, By BFSI, 2022 & 2032F |

| 10.2.5 India Video Surveillance Market Revenues and Volume, By Hospitality & Healthcare, 2022 & 2032F |

| 10.2.6 India Video Surveillance Market Revenues and Volume, By Residential, 2022 & 2032F |

| 10.2.7 India Video Surveillance Market Revenues and Volume, By Educational Institutions, 2022 & 2032F |

| 10.2.8 India Video Surveillance Market Revenues and Volume, By Industry, 2022 & 2032F |

| 11. India Video Surveillance Market Overview, By Region |

| 11.1.1 India Video Surveillance Market Revenue Share, By Region, By North, 2022 & 2032F |

| 11.1.1 India Video Surveillance Market Revenue Share, By Region, By South, 2022 & 2032F |

| 11.1.1 India Video Surveillance Market Revenue Share, By Region, By East, 2022 & 2032F |

| 11.1.1 India Video Surveillance Market Revenue Share, By Region, By West, 2022 & 2032F |

| 11.1.2 India Video Surveillance Market Revenues, By Region, By North, 2022 & 2032F |

| 11.1.2 India Video Surveillance Market Revenues, By Region, By South, 2022 & 2032F |

| 11.1.2 India Video Surveillance Market Revenues, By Region, By East, 2022 & 2032F |

| 11.1.2 India Video Surveillance Market Revenues, By Region, By West, 2022 & 2032F |

| 12. India Video Surveillance Market Price Trend Analysis |

| 12.1 India Video Surveillance Market Price Trend Analysis, By Analog Camera, 2022 & 2032F |

| 12.1 India Video Surveillance Market Price Trend Analysis, By IP Camera, 2022 & 2032F |

| 12.1 India Video Surveillance Market Price Trend Analysis, By NVR, 2022 & 2032F |

| 12.1 India Video Surveillance Market Price Trend Analysis, By DVR, 2022 & 2032F |

| 12.1 India Video Surveillance Market Price Trend Analysis, By Encoder, 2022 & 2032F |

| 13. India Video Surveillance Market - Key Performance Indicators |

| 13.1 Number of smart city projects integrating video surveillance solutions |

| 13.2 Percentage increase in the adoption of cloud-based video surveillance systems |

| 13.3 Rate of implementation of AI-powered video analytics in surveillance applications |

| 14. India Video Surveillance Market Opportunity Assessment |

| 14.1. India Video Surveillance Market Opportunity Assessment, By Components,2022 & 2032F |

| 14.2. India Video Surveillance Market Opportunity Assessment, By Verticals,2022 & 2032F |

| 15. India Video Surveillance Market Competitive Landscape |

| 15.1. India Video Surveillance Camera Market Revenue Share, By Companies, 2022 & 2032F |

| 15.2. India Video Surveillance Market Company Revenue Share, By Verticals, 2022 & 2032F |

| 15.3. India Video Surveillance Market Competitive Benchmarking, By Technical Parameters |

| 15.4. India Video Surveillance Market Competitive Benchmarking, By Operating Parameters |

| 15.5. India Video Surveillance Market Manufacturing Capability |

| 16. Company Profiles |

| 16.1. Axis Communication Pvt. Ltd. |

| 16.2. Bosch Limited |

| 16.3. CP Plus India Pvt. Ltd. |

| 16.4. Teledyne FLIR LLC |

| 16.5. Prama Hikvision India Pvt. Ltd. |

| 16.6. Hanwha International India Pvt. Ltd. |

| 16.7. Honeywell International (India) Pvt. Ltd. |

| 16.8. Panasonic India Pvt. Ltd. |

| 16.9. Pelco Inc. |

| 16.10. Dahua Technology India Pvt. Ltd. |

| 17. India Video Surveillance Market Key Strategic Recommendation |

| 18. India Dash Cam Camera Market Overview |

| 19. Disclaimer |

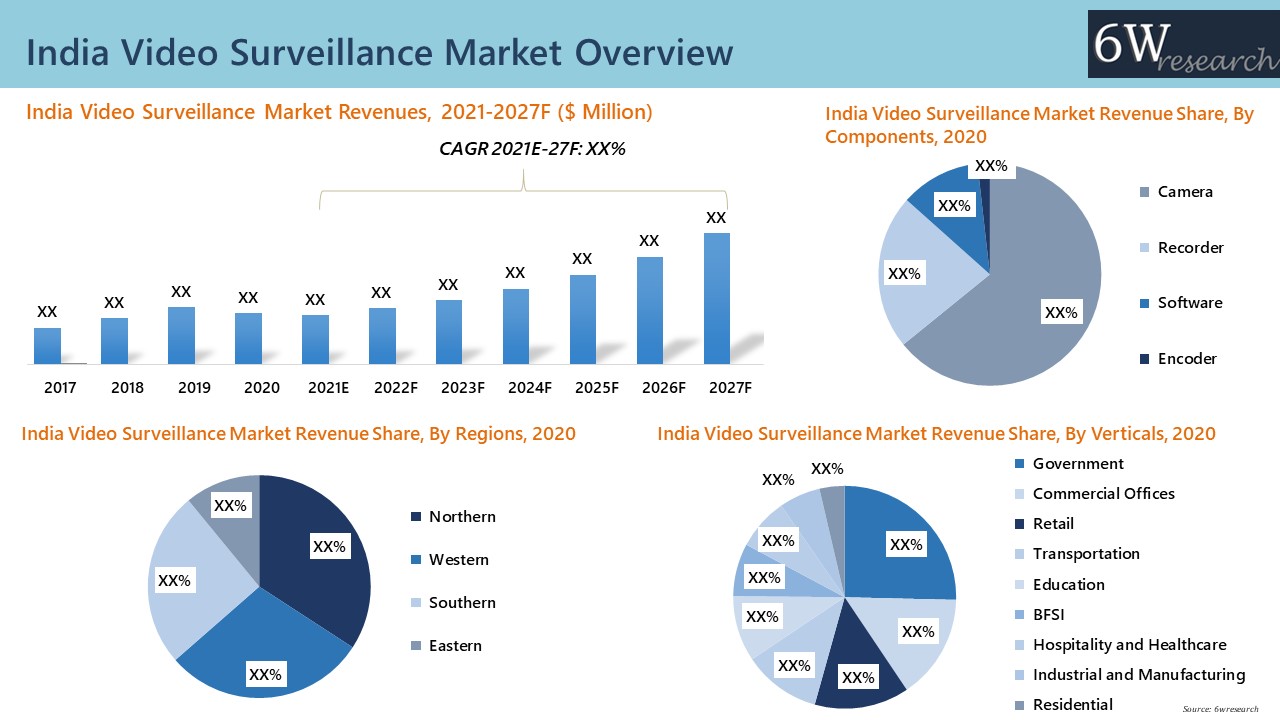

Market Forecast By Components (Camera, Recorder, Software and Encoder), By Verticals (Commercial Offices, Residential, Industrial and Manufacturing, Transportation, Government, Retail and Logistics, BFSI, Hospitality and Healthcare and Education), By Camera Types (Analog and IP), By Megapixels (Up to 1 MP, 1.1-2 MP, 2.1-3 MP, 3.1-5 MP and Above 5 MP), By Form Factor (Dome, Bullet and Others), By Recorder Types (Network Video Recorder and Digital Video Recorder), By Slot Types (With Slot and Without Slot), By Regions (Northern, Western, Eastern and Southern) and Competitive Landscape

| Product Code: ETC081272 | Publication Date: Feb 2023 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 443 | No. of Figures: 333 | No. of Tables: 22 |

India Video Surveillance Market report comprehensively covers the market by components, verticals, and regions. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of India Video Surveillance Market

India Video Surveillance Market has seen a significant increase in demand in recent years. The growth is primarily attributed to several key developments. For instance, growing awareness about security has led to an increase in the demand for video surveillance systems, as they provide a secure way to monitor properties and people. The government's Smart Cities mission has increased the demand for video surveillance systems, as they are considered essential components of smart cities. Advancements in technology have made video surveillance systems more advanced and affordable which has increased their popularity among consumers in India.

The government has increased its expenditure on security and surveillance systems, which led to an increase in demand for the video surveillance market in India. The growth of the e-commerce and retail industry in India has increased the demand for video surveillance due to its essential features for ensuring the security of properties and people. Furthermore, the expansion of infrastructure in India has created new opportunities for the video surveillance industry for security purposes.

The adoption of advanced technologies such as AI and facial recognition has increased in the industry and many companies have launched cost-effective video surveillance solutions to cater to the growing demand in the market. The video surveillance market size in India is expected to grow significantly in the coming years due to the surging need for security in public places, buildings, and residential complexes. Several leading players in the video surveillance market have expanded their operations in India by setting up manufacturing facilities and sales offices.

India Video Surveillance Market Synopsis

India Video Surveillance Market has been growing at a significant rate over the past few years owing to the rising security concerns, primarily arising from growing incidents of theft, domestic crime and acts of terrorism. However, uncertainties raised due to COVID-19 resulted in an economic slowdown by creating an obstruction in the construction projects along with the contraction in the fund allocated for infrastructural projects which brought a negative impact on the demand for surveillance cameras in 2020. Besides, with the gradual lifting of lockdown restrictions post-2020 and increasing government initiatives, such as the smart city mission, installation of video surveillance systems for traffic management, rapid infrastructural growth and growing deployment of video surveillance systems in schools, banks, coupled with rising awareness among the end users and businesses in the country about the advantages of video surveillance systems would act as a key driving force behind the growth of the market during the forecast period.

According to 6Wresearch, India Video Surveillance Market size is projected to grow at a CAGR of 17.8% during 2021-2027. India video surveillance market is predicted to witness significant growth during the forecast period due to rising crime, terrorism, communal violence and growing government, commercial and IT infrastructure in the country. Further, increased competencies and low penetration of CCTVs would also play a significant role in raising the demand for surveillance systems in India.

Leaders in the India Video Surveillance Market

- There are a number of players in the India Video Surveillance Market and each player in the sector has an essential role to play in the success of the market. The key players in the sector are CP Plus India, Prama Hikvision, Dahua, Bosch, and others.

- Hikvision as well as CP Plus dominated the market on account of adequate brand awareness amongst the consumers as well as the signature product offerings available for many verticals.

- Bosch is also dominating the sector and emerging as an essential player in the market owing to the quality of products it has been offering to consumers. Bosch offers analogue, IP & hybrid-based video surveillance systems, alarm systems as well as access control systems.

India Video Surveillance Market Trends

There is a rising trend of deep learning in video surveillance software. In the Video Surveillance Market in India, there is a substantial availability of deep learning algorithms. There is also the availability of deep learning infrastructure for the pattern analysis of the surveillance market. The new models of graphic processing units provide deep-learning algorithms for recorders and cameras.

There is also a rising trend in video analytics integration. There is a huge increase in the integration of analytics capabilities with cameras owing to the fact that advanced microprocessors are becoming increasingly available to the manufacturers of video surveillance systems in the country.

Top Impacting Factors of the market

The essential factors positively affecting the India Video Surveillance Market evolvement include an increase in the requirement for safety in high-risk areas, growth in the transition from analogue to IP cameras, as well as integration of IoT in the surveillance cameras. The Video Surveillance Sector in India is projected to experience more growth with the government initiatives to install CCTV solutions in public places.

However, high investments like initial instalment investments as well as large data storage issues, with a lack of professional expertise in managing IP cameras incur extra costs for the systems. This factor is projected to restrain the market growth. Also, growing trends toward the development of smart cities offer significant market opportunities in the years to come.

Market Analysis by Components

By components, cameras accounted for the highest revenue share in the market in 2020 owing to the surging use of cameras by law enforcement agencies and the deployment of CCTV cameras across verticals like transportation with advanced intelligent functionalities like AI and machine learning solutions which enables facial recognition, thermal scanning and monitoring in order to combat COVID- 19 limitations. Further, with the growing development of smart cities and smart home applications in the country along with the strengthening IT infrastructure due to the National Digital Communication Policy-2018, it is expected that IP surveillance cameras would remain the largest revenue shareholder, by type, during the forecast period.

Market Analysis by Verticals

The government and commercial verticals are estimated to experience faster growth in the coming years with the government's initiatives to install CCTV solutions in public places.

Market Analysis by Regions

The northern region accounted for the majority share in the video surveillance market of India owing to the increasing investment in the construction of accommodation spaces, educational establishments, the hospitality sector as well as HORECA (hotels, restaurants and cafes). The northern region is likely to maintain its dominant share in the future.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- India Video Surveillance Market Overview

- India Video Surveillance Market Outlook

- India Video Surveillance Market Forecast

- Historical Data and Forecast of India Video Surveillance Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of Revenues, By Components for the Period 2017-2027F

- Historical Data and Forecast of Revenues, By Verticals for the Period 2017-2027F

- Historical Data and Forecast of Revenues, By Regions for the Period 2017-2027F

- Market Drivers, Restraints

- India Video Surveillance Market Trends

- Industry Life Cycle

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- India Video Surveillance Market Share/Ranking, By Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Components

- Camera

- Analog Video Surveillance Camera

- IP Video Surveillance Camera

- Dome

- Bullet

- Others (PTZ Cameras, C- Mount Cameras etc.)

- Up to 1 MP

- 2 MP

- 1- 3 MP

- 3- 5 MP

- Above 5 MP

- With Slot

- Without Slot

- By Types

- Network Video Surveillance Recorder

- Digital Video Surveillance Recorder

- Encoder

- Software

- By Types

- By Form Factor

- By Megapixels

- By Slot Types

- Recorder

By Verticals

- Residential

- Industrial and Manufacturing

- Government

- Retail and Logistics

- BFSI

- Commercial

- Education

- Hospitality & Healthcare Offices

- Transportation

By Regions

- Northern

- Southern

- Eastern

- Western

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero