India Water Purifier Market Outlook (2020-2026) | Growth, Industry, Analysis, Share, Trends, Revenue, Size, Companies, Value, Forecast & COVID-19 IMPACT

Market Forecast By Technology (RO, RO + UV, RO + UV + UF, UF & Others (RO + UV + UF + TDS And Water Softeners)), By Distribution Channels (Retail Sales, Direct Sales, Online), By End Users (Commercial, Residential) And Competitive Landscape

| Product Code: ETC160137 | Publication Date: Feb 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 80 | No. of Figures: 12 | No. of Tables: 6 |

India Water Purifier Market Synopsis

People across the nation are becoming more aware of the health hazards associated with water pollution caused by commercial and industrial effluent wastes, domestic wastes, and atmospheric deposition. This, in turn, has resulted in higher adoption of water purifiers in the country in recent years. Further, the market witnessed a slowdown during 2020 owing to the Covid-19 pandemic. The country witnessed lockdowns and production halts. However, the market is recovering gradually and is likely to gain momentum over the coming years.

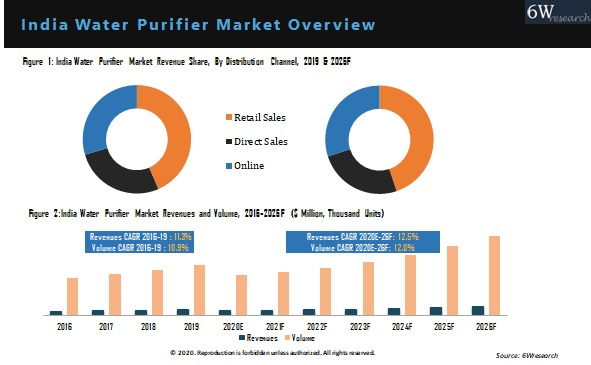

According to 6Wresearch, India water purifier Market size is expected to grow at a CAGR of 12.5% during 2020-26. Continuous expansion of infrastructure and concentrated efforts of government authorities to expand the availability of safe water in households has significantly boosted the water purifier growth in the country.

According to 6Wresearch, India water purifier Market size is expected to grow at a CAGR of 12.5% during 2020-26. Continuous expansion of infrastructure and concentrated efforts of government authorities to expand the availability of safe water in households has significantly boosted the water purifier growth in the country.

Market Analysis By Distribution Channels

Retail sales acquired the largest revenue and volume share in the India water purifier market in 2019 and the same trend is expected to continue in the coming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019.

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India water purifier Market Overview

- India water purifier Market Outlook

- India water purifier Market Forecast

- Historical Data & Forecast of India Water Purifier Market Revenues and Volume for the Period 2016-2026F

- Historical Data & Forecast of India Water Purifier Market Revenues and Volume, By Technology, for the Period 2016-2026F

- Historical Data & Forecast of India Water Purifier Market Revenues and Volume, By Distribution Channels, for the Period 2016-2026F

- Historical Data & Forecast of India Water Purifier Market Revenues and Volume, By End Users, for the Period 2016-2026F

- India Water Purifier Market Outlook on Drivers and Restraints

- India Water Purifier Market Trends

- India Water Purifier Industry Life Cycle

- Porter’s Five Force Analysis

- India Water Purifier Market Opportunity Assessment

- India Water Purifier Market Share, By Company

- India Water Purifier Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Technology:

- RO

- RO + UV

- RO + UV + UF

- UF

- Others (RO + UV + UF + TDS and Water Softeners)

By Distribution Channels:

- Retail Sales

- Direct Sales

- Online

By End Users:

- Commercial

- Residential

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Water Purifier Market Overview |

| 3.1 India Water Purifier Market Revenues and Volume, 2016-2026F |

| 3.2 India Water Purifier Market - Industry Life Cycle |

| 3.3 India Water Purifier Market - Porter’s Five Forces |

| 3.4 India Water Purifier Market Revenue Share, By Regions, 2019 & 2026F |

| 4 India Water Purifier Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 India Water Purifier Market Trends |

| 6 India Water Purifier Market Competitive Benchmarking, By Operating Parameters & Technical Parameters |

| 7 Company Profiles |

| 7.1 Unilever PLC |

| 7.2 3M Company |

| 7.3 Panasonic Corporation |

| 7.4 Xiaomi Corporation |

| 7.5 Honeywell International Inc. |

| 7.6 Sharp Corporation |

| 7.7 Royal Philips Group |

| 7.8 Pentair plc |

| 7.9 LG Electronics Inc. |

| 7.10 Coway Co., Ltd. |

| 8 Key Strategic Recommendation |

| 9 Disclaimer |

| List of Figures |

| Figure 1. India Water Purifier Market Revenues and Volume, 2016-2026F ($ Million, Thousand Units) |

| Figure 2. India Water Purifier Market - Industry Life Cycle, 2019 |

| Figure 3. India Water Purifier Market Revenue Share, By Regions, 2019 & 2026F |

| Figure 4. India Water Purifier Market Volume Share, By Regions, 2019 & 2026F |

| Figure 5. Spatial Distribution of Water Borne Diseases, 2018 |

| Figure 6. India Urban Population, By Size of City, 2018 & 2030E |

| Figure 7. Annual Average Housing Completion, 2012-2025E (Thousand Units) |

| Figure 8. India Upcoming Skyscraper Projects, 2021E-2026E (Units) |

| Figure 9. India Water Purifier Market – Ansoff Matrix |

| Figure 10. India Water Purifier Market Revenues and Volume CAGR, By Regions, 2020E & 2026F |

| List of Tables |

| Table 1. India Water Purifier Market Revenues, By Technology, 2016-2026F ($ Million) |

| Table 2. India Water Purifier Market Volume, By Technology, 2016-2026F (Thousand Units) |

| Table 3. India Water Purifier Market Revenues, By Distribution Channels, 2016-2026F ($ Million) |

| Table 4. India Water Purifier Market Volume, By Distribution Channels, 2016-2026F (Thousand Units) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero