India Wood Charcoal Market (2025-2031) | Companies, Outlook, Forecast, Industry, Analysis, Growth, Value, Revenue, Share, Trends & Size

Market Forecast By Product (Charcoal Lumps, Charcoal Briquettes, Charcoal Powder), By Wood (Softwood, Hardwood), By Application (Fuel Feedstock, Reducing Agent, Filtration Agent & Gas Masking, Decolorizing Agent, Gastric Medicine, Sketches & Paints, Soil Conditioning, Others), By End Use (Residential, Cooking Fuel, Gardening, Commercial Paints & Sketches, Water Treatment, Industrial) And Competitive Landscape

| Product Code: ETC353004 | Publication Date: Aug 2023 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

India Wood Charcoal Market Size Growth Rate

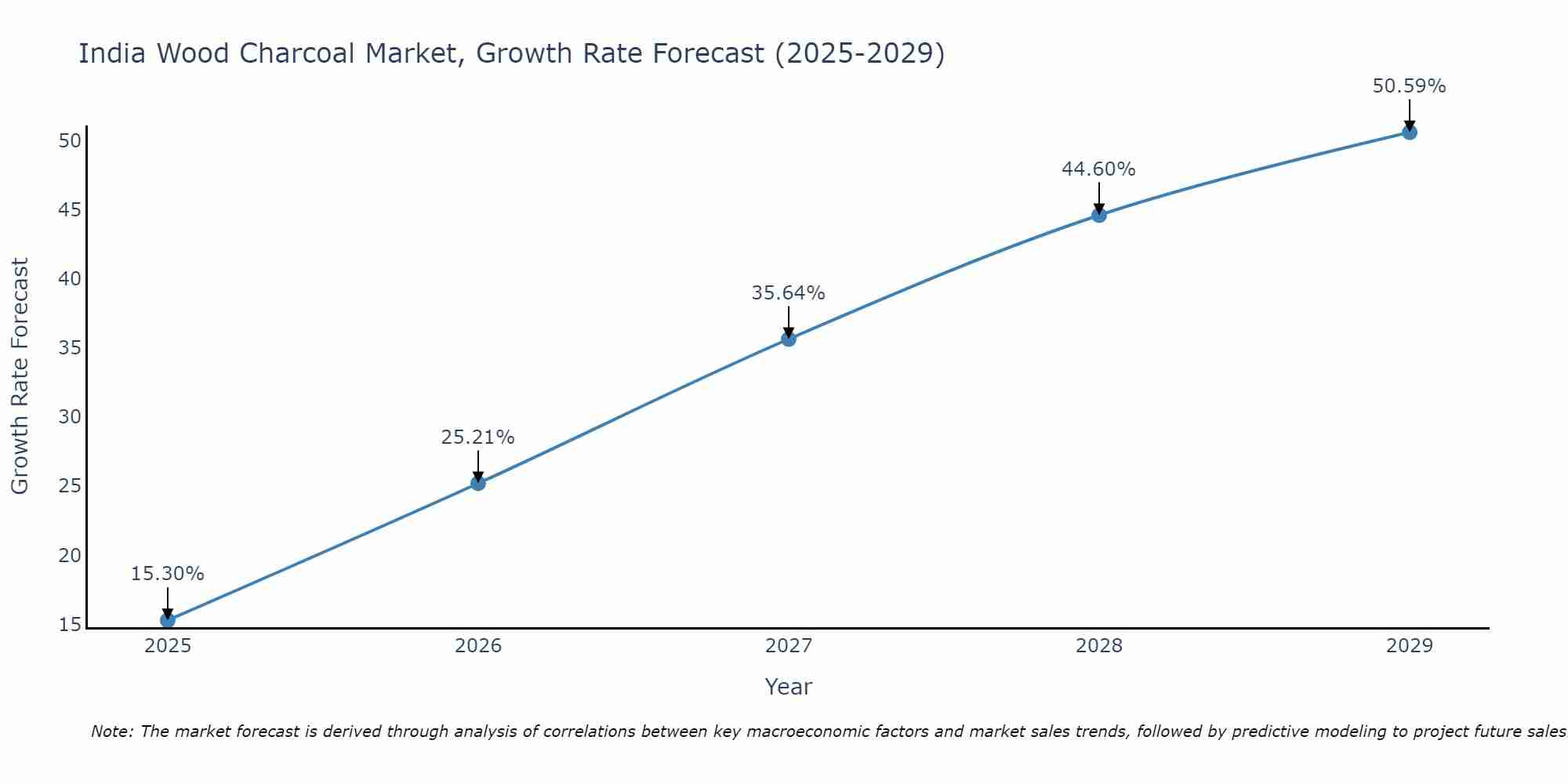

The India Wood Charcoal Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 15.30% in 2025, the growth rate steadily ascends to 50.59% in 2029.

India Wood Charcoal Market Size Growth Rate

As per 6Wresearch, India Wood Charcoal Market Size is projected to reach USD 18.9 billion by 2031 from USD 7.5 billion, growing at a CAGR between 4.6% during the 2025 to 2031. Wood charcoal serves as a key raw material in the production of activated carbon, which is highly sought after in water purification and air filtration applications.

India Wood Charcoal Market Highlights

| Report Name | India Wood Charcoal Market |

| Forecast period | 2025-2031 |

| CAGR | 4.6% |

| Growing Sector | Energy and Industrial |

Topics Covered in the India Wood Charcoal Market Report

India Wood Charcoal Market report thoroughly covers the market By Product, By Wood, By Application, and By End Use. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Wood Charcoal Market Synopsis

The India Wood Charcoal Industry is experiencing significant growth which is proliferated by multiple factors. One of the contributing factors is growing use of charcoal as a source of renewable energy, in alignment with the government's emphasis on sustainable development. The growing consumption of wood charcoal in metallurgical, cement manufacturing, and chemical processing industries is also driving demand. In addition, in rural areas, usage of wood charcoal for heating and cooking remains in favour of powering market expansion.

The India Wood Charcoal Market size is projected to gain traction, reaching a CAGR of 4.6% during the forecast period of 2025-2031. Renewable and eco-friendly energy sources fuel demand for wood charcoal in India. Awareness of fossil fuels' environmental impacts is also leading many industries and homes to adopt sustainable energy alternatives like wood charcoal. Adding to this is the expansion of industries that use metallurgical processes, cement production, chemical processes, and others, which require mostly economical and reliable energy for their industries.

However, even if the wood charcoal is gaining demand, many challenges destroy the industry in India. Topmost of these include the environmental impact of deforestation, as well as unsustainable logging practices that lay waste to soil and biodiversity. Strict enforcement against illegal logging combined with forest conservation efforts may inhibit the growth of the wood charcoal market.

India Wood Charcoal Market Trends

The Indian Wood Charcoal Market Size is experiencing some prominent trends influenced by evolving consumer tastes and environmental factors. One of the major trends is the growing demand for sustainable and environmentally friendly charcoal. With increased awareness about the conservation of the environment, more consumers and industries are moving towards carbon-neutral and certified sustainable products.

Investment Opportunities in the India Wood Charcoal Market

The India Wood Charcoal Market Shares provides a plenty of investment opportunities which are influenced by changing consumer behaviour, export opportunities, and sustainable practices. As more and more businesses adopt eco-friendly measures, companies that make better quality charcoal from sustainable sources will have the highest competitive advantage. Furthermore, investments in innovative production technologies with carbonization methods that yield products with maximum efficiency and minimal environmental impacts have good returns potential.

Leading Players in the India Wood Charcoal Market

The India Wood Charcoal Market Growth is steered by a few leading players who contribute immensely to its growth. These players tend to the domestic market, but also supply to foreign demand through exports. Shree Ashapura Enterprise, Vishnu International, and Sagar Charcoal Depot are key players in the wood charcoal industry. They enjoy a reputation for maintaining consistent quality, being environmentally friendly, and adopting innovative production methods.

Government Regulations

Wood charcoal in India is almost strictly managed by the government in terms of sustainability and environmental concern. The production and trading with the charcoal wood from trees or plants are closely monitored based on the provisions of the Forest Conservation Act of 1980 and the Environment Protection Act of 1986 to achieve certain standards. To achieve these objectives, deforestation, reliance on renewable sources for materials, and sustainable sourcing are regulated, inter alia.

Future Insights of the India Wood Charcoal Market

The future of the Indian wood charcoal market is anticipated to be dominated by stricter environmental policies which would be coupled with advances in sustainable charcoal production techniques. The trends of growing awareness on climate change and the significance of reduced carbon footprints are likely to shift the demand for eco-freed and sustainably produced charcoal alternatives. Innovations such as biochar production and the use of agricultural waste for charcoal production could completely redefine the sector as it reduces reliance on the conventional woods.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Charcoal briquettes to dominate The Market- By Product

According to Ravi, Research Head at 6Wresearch, the charcoal market is segmented into charcoal lumps, charcoal briquettes, and charcoal powder, with each product type catering to distinct demands. Charcoal briquettes dominate due to their consistent shape, longer burning time, and convenience, making them ideal for residential cooking and grilling purposes. Charcoal lumps, on the other hand, are favoured by traditional users and artisanal practices due to their natural composition.

Hardwood charcoal to dominate The Market- By Wood

The type of wood used in charcoal production significantly influences its characteristics and applications. Hardwood charcoal continues to hold a dominant position, owing to its higher density and longer burning capability, making it suitable for both industrial and residential use. Softwood charcoal, while less dense, is often preferred for quick ignitions and lighter applications like gardening and soil enhancement.

Fuel feedstock to dominate The Market- By Application

Each application of charcoal serves a unique purpose, with fuel feedstock dominating as a primary use in residential and industrial sectors due to its efficiency in combustion. Charcoal's role as a reducing agent is crucial in metallurgical industries, while its utility as a filtration agent finds substantial demand in water purification systems and gas masking equipment.

Residential applications to dominate The Market- By End Use

The end-use segmentation reveals varied dominance across different sectors. Residential applications, particularly cooking fuel, drive significant demand for charcoal briquettes and lumps due to their affordability and availability. Gardening and soil conditioning sectors benefit from charcoal’s moisture retention and nutrient-enhancement properties.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- India Wood Charcoal Market Outlook

- Market Size of India Wood Charcoal Market, 2024

- Forecast of India Wood Charcoal Market, 2031

- Historical Data and Forecast of India Wood Charcoal Revenues & Volume for the Period 2021-2031

- India Wood Charcoal Market Trend Evolution

- India Wood Charcoal Market Drivers and Challenges

- India Wood Charcoal Price Trends

- India Wood Charcoal Porter's Five Forces

- India Wood Charcoal Industry Life Cycle

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Charcoal Lumps for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Charcoal Briquettes for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Charcoal Powder for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Wood for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Softwood for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Hardwood for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Fuel Feedstock for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Reducing Agent for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Filtration Agent & Gas Masking for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Decolorizing Agent for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Gastric Medicine for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Sketches & Paints for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Soil Conditioning for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By End Use for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Residential for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Cooking Fuel for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Gardening for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Commercial Paints & Sketches for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Water Treatment for the Period 2021-2031

- Historical Data and Forecast of India Wood Charcoal Market Revenues & Volume By Industrial for the Period 2021-2031

- India Wood Charcoal Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Wood

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End Use

- India Wood Charcoal Top Companies Market Share

- India Wood Charcoal Competitive Benchmarking By Technical and Operational Parameters

- India Wood Charcoal Company Profiles

- India Wood Charcoal Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

By Product

- Charcoal Lumps

- Charcoal Briquettes

- Charcoal Powder

By Wood

- Softwood

- Hardwood

By Application

- Fuel Feedstock

- Reducing Agent

- Filtration Agent & Gas Masking

- Decolorizing Agent

- Gastric Medicine

- Sketches & Paints

- Soil Conditioning

- Others

By End Use

- Residential

- Cooking Fuel

- Gardening

- Commercial Paints & Sketches

- Water Treatment

- Industrial

India Wood Charcoal Market (2025-2031): FAQs

|

1 Executive Summary |

|

2 Introduction |

|

2.1 Key Highlights of the Report |

|

2.2 Report Description |

|

2.3 Market Scope & Segmentation |

|

2.4 Research Methodology |

|

2.5 Assumptions |

|

3 India Wood Charcoal Market Overview |

|

3.1 India Country Macro Economic Indicators |

|

3.2 India Wood Charcoal Market Revenues & Volume, 2021 & 2031F |

|

3.3 India Wood Charcoal Market - Industry Life Cycle |

|

3.4 India Wood Charcoal Market - Porter's Five Forces |

|

3.5 India Wood Charcoal Market Revenues & Volume Share, By Product, 2021 & 2031F |

|

3.6 India Wood Charcoal Market Revenues & Volume Share, By Wood, 2021 & 2031F |

|

3.7 India Wood Charcoal Market Revenues & Volume Share, By Application, 2021 & 2031F |

|

3.8 India Wood Charcoal Market Revenues & Volume Share, By End Use, 2021 & 2031F |

|

4 India Wood Charcoal Market Dynamics |

|

4.1 Impact Analysis |

|

4.2 Market Drivers |

|

4.3 Market Restraints |

|

5 India Wood Charcoal Market Trends |

|

6 India Wood Charcoal Market, By Types |

|

6.1 India Wood Charcoal Market, By Product |

|

6.1.1 Overview and Analysis |

|

6.1.2 India Wood Charcoal Market Revenues & Volume, By Product, 2021-2031F |

|

6.1.3 India Wood Charcoal Market Revenues & Volume, By Charcoal Lumps, 2021-2031F |

|

6.1.4 India Wood Charcoal Market Revenues & Volume, By Charcoal Briquettes, 2021-2031F |

|

6.1.5 India Wood Charcoal Market Revenues & Volume, By Charcoal Powder, 2021-2031F |

|

6.2 India Wood Charcoal Market, By Wood |

|

6.2.1 Overview and Analysis |

|

6.2.2 India Wood Charcoal Market Revenues & Volume, By Softwood, 2021-2031F |

|

6.2.3 India Wood Charcoal Market Revenues & Volume, By Hardwood, 2021-2031F |

|

6.3 India Wood Charcoal Market, By Application |

|

6.3.1 Overview and Analysis |

|

6.3.2 India Wood Charcoal Market Revenues & Volume, By Fuel Feedstock, 2021-2031F |

|

6.3.3 India Wood Charcoal Market Revenues & Volume, By Reducing Agent, 2021-2031F |

|

6.3.4 India Wood Charcoal Market Revenues & Volume, By Filtration Agent & Gas Masking, 2021-2031F |

|

6.3.5 India Wood Charcoal Market Revenues & Volume, By Decolorizing Agent, 2021-2031F |

|

6.3.6 India Wood Charcoal Market Revenues & Volume, By Gastric Medicine, 2021-2031F |

|

6.3.7 India Wood Charcoal Market Revenues & Volume, By Sketches & Paints, 2021-2031F |

|

6.3.8 India Wood Charcoal Market Revenues & Volume, By Others, 2021-2031F |

|

6.3.9 India Wood Charcoal Market Revenues & Volume, By Others, 2021-2031F |

|

6.4 India Wood Charcoal Market, By End Use |

|

6.4.1 Overview and Analysis |

|

6.4.2 India Wood Charcoal Market Revenues & Volume, By Residential, 2021-2031F |

|

6.4.3 India Wood Charcoal Market Revenues & Volume, By Cooking Fuel, 2021-2031F |

|

6.4.4 India Wood Charcoal Market Revenues & Volume, By Gardening, 2021-2031F |

|

6.4.5 India Wood Charcoal Market Revenues & Volume, By Commercial Paints & Sketches, 2021-2031F |

|

6.4.6 India Wood Charcoal Market Revenues & Volume, By Water Treatment, 2021-2031F |

|

6.4.7 India Wood Charcoal Market Revenues & Volume, By Industrial, 2021-2031F |

|

7 India Wood Charcoal Market Import-Export Trade Statistics |

|

7.1 India Wood Charcoal Market Export to Major Countries |

|

7.2 India Wood Charcoal Market Imports from Major Countries |

|

8 India Wood Charcoal Market Key Performance Indicators |

|

9 India Wood Charcoal Market - Opportunity Assessment |

|

9.1 India Wood Charcoal Market Opportunity Assessment, By Product, 2021 & 2031F |

|

9.2 India Wood Charcoal Market Opportunity Assessment, By Wood, 2021 & 2031F |

|

9.3 India Wood Charcoal Market Opportunity Assessment, By Application, 2021 & 2031F |

|

9.4 India Wood Charcoal Market Opportunity Assessment, By End Use, 2021 & 2031F |

|

10 India Wood Charcoal Market - Competitive Landscape |

|

10.1 India Wood Charcoal Market Revenue Share, By Companies, 2024 |

|

10.2 India Wood Charcoal Market Competitive Benchmarking, By Operating and Technical Parameters |

|

11 Company Profiles |

|

12 Recommendations |

|

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero