Indonesia Beet sugar Market (2025-2031) Outlook | Industry, Size, Value, Forecast, Revenue, Growth, Companies, Share, Trends & Analysis

| Product Code: ETC091067 | Publication Date: Jul 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

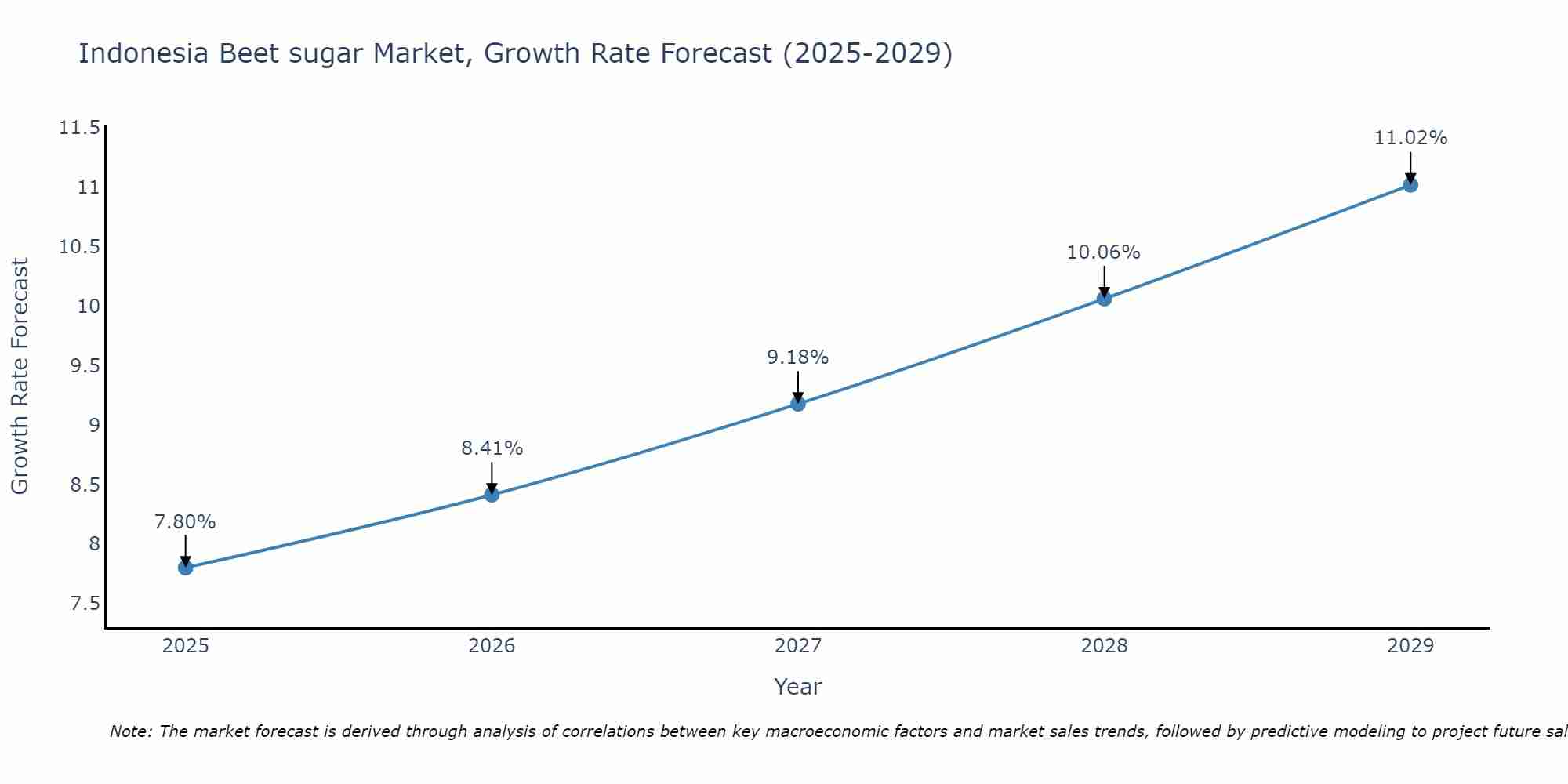

Indonesia Beet sugar Market Size Growth Rate

The Indonesia Beet sugar Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 7.80% in 2025, the growth rate steadily ascends to 11.02% in 2029.

Beet sugar Market: Indonesia vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Beet sugar market in Indonesia is projected to expand at a growing growth rate of 9.18% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Indonesia Beet sugar Market Synopsis

Indonesia is one of the leading producers and exporters of sugar in Asia. The country has a long tradition of producing high quality beet sugar for domestic consumption as well as export to other countries. Sugar production in Indonesia relies heavily on cane-based refining, with some minor contributions from beet manufacturing plants. Generally speaking, Indonesia Beet Sugar Market is currently dominated by imported products due to its low cost relative to local production costs and also due to the higher yields that can be achieved through imported knowhow.

Market Trends

The trend in the Indonesia Beet Sugar Market has been towards increased investment in modern technologies which have enabled more efficient production processes over recent years. This includes investments into new machinery and automation systems such as automated packaging lines, electronic weighing scales, automated storage systems etc., which have helped reduce labor costs significantly while also boosting yields substantially. Additionally, there have been increasing efforts by companies operating within this market segment to diversify their product portfolio?s beyond basic refined white table sugars and move towards specialty foods like syrups or jams made using natural sweeteners derived from raw materials such as dates or coconut sap syrup (nira). As an example Mayora Indah Tbk produces various kinds of food ingredients including Sucralose Sweetener under its brand name Splenda? which is widely used across food sectors including baking & confectioneries industries for healthier alternatives compared to regular white sugars produced from cane juice or molasses sources.

Market Drivers

The key drivers behind growth within this market are mainly driven by rising demand for alternative healthy sweeteners among consumers who are trying shift away from processed sugars; growing population & income levels resulting in expanding purchasing power; increasing consumer awareness about nutrition & health benefits associated with certain types of products; government support programs designed at encouraging further development within this sector; along with advances technology allowing manufacturers to produce better quality products at competitive prices compared to traditional forms of sweetening agents like honey or jaggery (gur). In addition, changes in dietary behaviors such as reduced meat consumption among younger generations are driving up demands for plant-based proteins which require significant amounts of sweetness during processing ? making beet sugar a highly sought after ingredient within these industries too! These all factor together into driving significant expansion opportunities across many different segments related directly or indirectly connected with the use case scenarios mentioned above.

COVID-19 Impact on the Market

The outbreak of the COVID-19 pandemic has significantly impacted the Indonesia Beet Sugar market due to disruption in supply chain activities. The temporary closure of factories, lack of labour and transportation issues have led to a reduction in production capabilities, resulting in higher prices for beet sugar. In addition, the restrictions on international trade imposed by various countries have affected exports from Indonesia, leading to reduced revenue opportunities for local producers.

Challenges of the Market

The main challenge faced by the Indonesia Beet Sugar industry is managing its cost structure while maintaining profitability amidst global economic uncertainty as a result of the coronavirus pandemic. This includes managing rising input costs such as raw materials like beetroots and other chemicals used during processing along with overhead costs associated with running operations that can easily become unmanageable due to lower demand levels and tighter margins caused by competition among producers. Other challenges include finding new markets for exports amid travel restrictions imposed across borders and ensuring adequate availability of skilled labour required for efficient production processes at competitive wages.

Industry Key Players

Some key players operating in the Indonesia Beet Sugar market are PT Perkebunan Nusantara XI (PTPN), Cargill Inc., Sinta Karya Group, Indofood Sukses Makmur Tbk., Royal FrieslandCampina NV, Sinar Mas Agro Resources & Technology (SMART) Tbk., IndoAgri Group Ltd., PT Mayora Indah Tbk., Musim Mas Holdings Pte Ltd., Wilmar International Limited, etc. These companies invest heavily in research & development activities towards innovations related to product quality improvement as well as increasing their capacity through expansion projects which would help them capitalize on growth opportunities available within this sector over time despite current disruptions caused by COVID-19 pandemic.

Key Highlights of the Report:

- Indonesia Beet sugar Market Outlook

- Market Size of Indonesia Beet sugar Market, 2024

- Forecast of Indonesia Beet sugar Market, 2031

- Historical Data and Forecast of Indonesia Beet sugar Revenues & Volume for the Period 2021-2031

- Indonesia Beet sugar Market Trend Evolution

- Indonesia Beet sugar Market Drivers and Challenges

- Indonesia Beet sugar Price Trends

- Indonesia Beet sugar Porter's Five Forces

- Indonesia Beet sugar Industry Life Cycle

- Historical Data and Forecast of Indonesia Beet sugar Market Revenues & Volume By Function for the Period 2021-2031

- Historical Data and Forecast of Indonesia Beet sugar Market Revenues & Volume By Regular for the Period 2021-2031

- Historical Data and Forecast of Indonesia Beet sugar Market Revenues & Volume By Medical Conditions for the Period 2021-2031

- Historical Data and Forecast of Indonesia Beet sugar Market Revenues & Volume By Organizational Strucuture for the Period 2021-2031

- Historical Data and Forecast of Indonesia Beet sugar Market Revenues & Volume By Organized Market for the Period 2021-2031

- Historical Data and Forecast of Indonesia Beet sugar Market Revenues & Volume By Unorganized Market for the Period 2021-2031

- Indonesia Beet sugar Import Export Trade Statistics

- Market Opportunity Assessment By Function

- Market Opportunity Assessment By Organizational Strucuture

- Indonesia Beet sugar Top Companies Market Share

- Indonesia Beet sugar Competitive Benchmarking By Technical and Operational Parameters

- Indonesia Beet sugar Company Profiles

- Indonesia Beet sugar Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Indonesia Beet sugar Market Overview |

3.1 Indonesia Country Macro Economic Indicators |

3.2 Indonesia Beet sugar Market Revenues & Volume, 2021 & 2031F |

3.3 Indonesia Beet sugar Market - Industry Life Cycle |

3.4 Indonesia Beet sugar Market - Porter's Five Forces |

3.5 Indonesia Beet sugar Market Revenues & Volume Share, By Function, 2021 & 2031F |

3.6 Indonesia Beet sugar Market Revenues & Volume Share, By Organizational Strucuture, 2021 & 2031F |

4 Indonesia Beet sugar Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing consumer awareness about the health benefits of beet sugar |

4.2.2 Growing demand for natural and organic sweeteners in Indonesia |

4.2.3 Government support and initiatives to promote domestic sugar production |

4.3 Market Restraints |

4.3.1 Fluctuations in beet sugar prices due to weather conditions and global market trends |

4.3.2 Competition from other sweeteners such as cane sugar, palm sugar, and artificial sweeteners |

5 Indonesia Beet sugar Market Trends |

6 Indonesia Beet sugar Market, By Types |

6.1 Indonesia Beet sugar Market, By Function |

6.1.1 Overview and Analysis |

6.1.2 Indonesia Beet sugar Market Revenues & Volume, By Function, 2021-2031F |

6.1.3 Indonesia Beet sugar Market Revenues & Volume, By Regular, 2021-2031F |

6.1.4 Indonesia Beet sugar Market Revenues & Volume, By Medical Conditions, 2021-2031F |

6.2 Indonesia Beet sugar Market, By Organizational Strucuture |

6.2.1 Overview and Analysis |

6.2.2 Indonesia Beet sugar Market Revenues & Volume, By Organized Market, 2021-2031F |

6.2.3 Indonesia Beet sugar Market Revenues & Volume, By Unorganized Market, 2021-2031F |

7 Indonesia Beet sugar Market Import-Export Trade Statistics |

7.1 Indonesia Beet sugar Market Export to Major Countries |

7.2 Indonesia Beet sugar Market Imports from Major Countries |

8 Indonesia Beet sugar Market Key Performance Indicators |

8.1 Average selling price of beet sugar in Indonesia |

8.2 Percentage of market share captured by beet sugar compared to other sweeteners |

8.3 Growth rate of domestic beet sugar production in Indonesia |

8.4 Consumer perception and preference towards beet sugar compared to other sweeteners |

8.5 Number of government policies and incentives supporting the beet sugar industry in Indonesia |

9 Indonesia Beet sugar Market - Opportunity Assessment |

9.1 Indonesia Beet sugar Market Opportunity Assessment, By Function, 2021 & 2031F |

9.2 Indonesia Beet sugar Market Opportunity Assessment, By Organizational Strucuture, 2021 & 2031F |

10 Indonesia Beet sugar Market - Competitive Landscape |

10.1 Indonesia Beet sugar Market Revenue Share, By Companies, 2024 |

10.2 Indonesia Beet sugar Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero