Indonesia Ceramic Tableware Market (2025-2031) | Industry, Forecast, Revenue, Growth, Outlook, Analysis, Trends, Share, Companies, Value & Size

Market Forecast By Products (Ceramic Dinnerware, Ceramic Beverageware, Ceramic Flatware), By Materials (China, Stoneware, Porcelain, Others), By Applications (Household Purpose, Commercial Purpose), By Distribution Channels (Online Channel, Offline Channel) And Competitive Landscape

| Product Code: ETC042728 | Publication Date: Jul 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

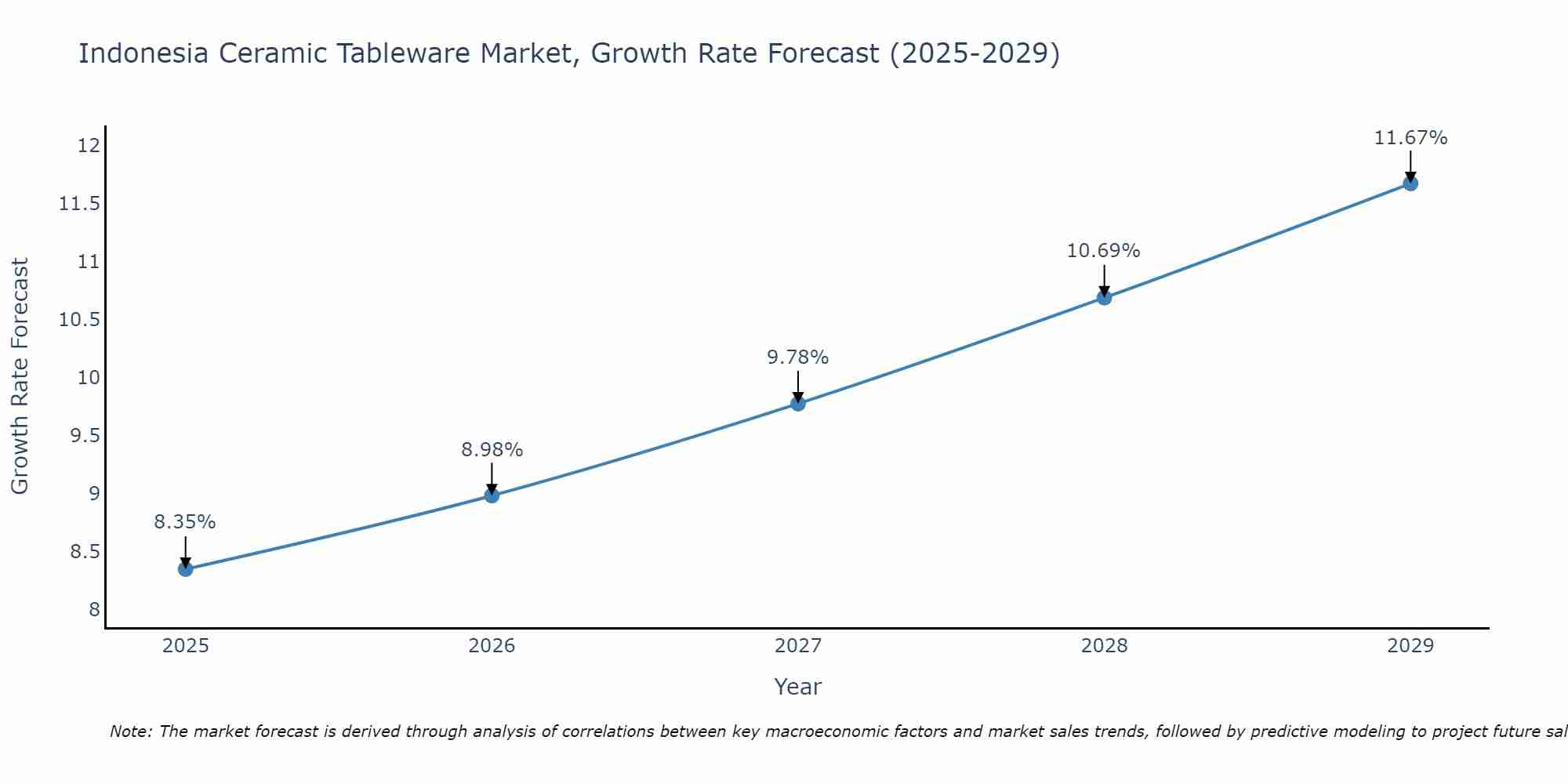

Indonesia Ceramic Tableware Market Size Growth Rate

The Indonesia Ceramic Tableware Market is poised for steady growth rate improvements from 2025 to 2029. The growth rate starts at 8.35% in 2025 and reaches 11.67% by 2029.

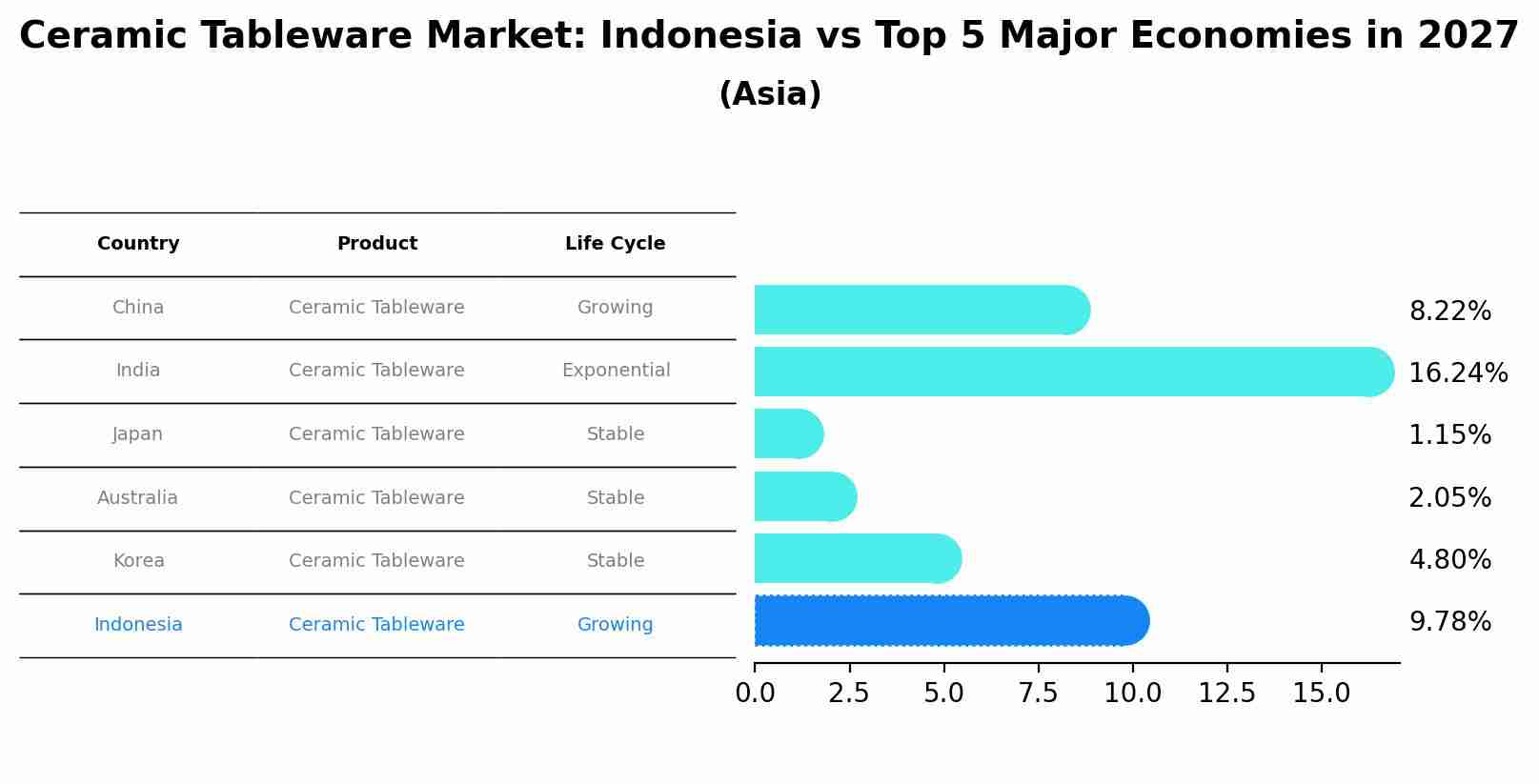

Ceramic Tableware Market: Indonesia vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Ceramic Tableware market in Indonesia is projected to expand at a growing growth rate of 9.78% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Indonesia Ceramic Tableware Market Size and Growth Rate

According to 6Wresearch, the Indonesia Ceramic Tableware Market size is expected to grow at a significant CAGR of 7.4% during the forecast period, 2025-2031.

Indonesia Ceramic Tableware Market Highlights

| Report Name | Indonesia Ceramic Tableware Market |

| Forecast period | 2025-2031 |

| CAGR | 7.4% |

| Growing Sector | Commercial Usage |

Topics Covered in the Indonesia Ceramic Tableware Market Report

The Indonesia Ceramic Tableware Market report comprehensively covers the market by products, materials, applications, and distribution channels. The report provides an unbiased and insightful analysis of current market trends, growth opportunities, challenges, and key drivers. It serves as a valuable resource for stakeholders to align their strategies with evolving market dynamics.

Indonesia Ceramic Tableware Market Synopsis

The Indonesia Ceramic Tableware Market is showing a calculated growth pattern with an acknowledgement of the increase in urbanization and changes to consumer preference for dining that is aesthetically pleasing. Ceramic tableware used for dinnerware, beverageware, and flatware continues to be a popular item because of its durability and sustainability, as well as design flexibility. From stoneware, porcelain, and chinaware of different price and performance ranges, the market has domestic and commercial uses. Such factors as the growth of online retail channels, the growth of the hospitality sector, and the growth in the consumer income level bid that this induced demand keeps growing. Nevertheless, growth in the market is constrained, with discomfort such as fluctuating costs of raw materials and competition from non-ceramic alternatives. All in all, the Indonesia Ceramic Tableware Market signals a great opportunity for continuous growth.

The Indonesia Ceramic Tableware Market size is expected to grow at a significant CAGR of 7.4% during the forecast period, 2025-2031. The growing preference for eco-friendly and sustainable dining solutions is a key driver of the Indonesia Ceramic Tableware Market. Proliferation of households and the growth of the hospitality industry, including restaurants and cafes, will finance copious demand for advanced tableware choices. Due to online distribution channels, it is easier for customers to access diverse product lines, which has led to increased sales. Furthermore, production technologies have improved, which has led manufacturers to make high-quality products at affordable prices, hence increasing the consumer base. Another support to this trend is that the preference for premium dining continues to grow, particularly in the urban population. Indonesia Ceramic Tableware Market growth looks highly promising.

The Indonesia Ceramic Tableware Market faces several challenges, including rising raw material costs, which directly impact product pricing and reduce profit margins for manufacturers. Additionally, the availability of cheaper non-ceramic alternatives, such as plastic and melamine tableware, presents stiff competition, particularly in the low-cost segment. Manufacturing and distribution inefficiencies further hinder market expansion, especially for smaller players. Environmental regulations and the sustainability push also pressure manufacturers to adopt eco-friendly processes, which may require significant upfront investments. Despite these obstacles, the rising preference for durable and environmentally friendly products sustains positive prospects for Indonesia Ceramic Tableware Market growth.

Indonesia Ceramic Tableware Market Trends

The Ceramic Tableware Market in Indonesia is witnessing notable trends, such as the growing adoption of e-commerce platforms. Businesses are increasingly leveraging digital tools for customer engagement and streamlined logistics. Online platforms offer diverse product options with easy price comparison, facilitating higher consumer adoption. Another significant trend is the emergence of customizable ceramic tableware, where both households and commercial buyers can personalize designs to match their preferences. This approach aligns with the consumer inclination towards unique and exclusive products. Retailers are also integrating omnichannel strategies, combining brick-and-mortar stores with online channels, ensuring a seamless customer experience through options like click-and-collect services and home delivery.

Investment Opportunities in the Indonesia Ceramic Tableware Market

The Indonesia Ceramic Tableware Industry offers significant investment opportunities, primarily in expanding production capacities and enhancing supply chain efficiency. Investments in advanced ceramic technologies, such as energy-efficient firing techniques, can reduce manufacturing costs and environmental impact. The e-commerce sector provides a lucrative area for investment, with the growing demand for direct-to-consumer sales models. Additionally, upgrading logistical networks and warehouse facilities to accommodate rising demand in both urban and rural areas presents a major investment avenue. Retail infrastructure such as specialized ceramic stores and robust online platforms presents another opportunity, ensuring wider product availability and enhanced customer experiences.

Leading Players in the Indonesia Ceramic Tableware Market

Prominent companies operating in the Indonesia Ceramic Tableware Market share include PT Sango Ceramics Indonesia, Lenox Corporation, and Narumi Corporation. PT Sango Ceramics Indonesia is recognized for its innovative and stylish ceramic dinnerware, catering to domestic and global markets. Lenox Corporation emphasizes luxury and premium tableware solutions, while Narumi Corporation is known for its high-quality porcelain products. These companies continue to bolster their market positions through investments in R&D, sustainability initiatives, and enhanced distribution networks.

Government Regulations Introduced in the Indonesia Ceramic Tableware Market

The Indonesian government has enacted several regulations to encourage sustainability within the ceramic industry. The nation promotes the adoption of energy-efficient kilns to reduce carbon emissions during production. Policies are also in place to limit environmental damage caused by raw material extraction, while incentivizing the use of recycled clays and eco-friendly glazing materials. The Industries Regulation Act includes provisions for occupational safety standards within factories. Additionally, trade policies have streamlined the import of high-quality raw materials and advanced machinery to improve production standards. These measures collectively aid the transition towards a more sustainable and globally competitive ceramic tableware industry.

Future Insights of the Indonesia Ceramic Tableware Market

The Indonesia Ceramic Tableware Industry is poised for consistent growth in the coming years, driven by rising consumer interest in sustainable and premium tableware options. Technological advancements in production processes, coupled with innovative product designs, are expected to enhance the appeal and affordability of ceramic tableware. Investment in omnichannel retail strategies and the expansion of distribution channels will further improve market penetration. However, addressing challenges such as environmental compliance, cost management, and competition from non-ceramic tableware will remain critical. With evolving consumer preferences and modernization efforts across industries, the market is set for robust development and diversification.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Ceramic Dinnerware to Dominate the Market - By Products

According to Ravi Bhandari, Research Analyst, 6wresearch, within the Indonesia ceramic tableware market, ceramic dinnerware is the fastest-growing segment. This growth is propelled by its widespread usage in both household and commercial settings. The aesthetic appeal, durability, and variety of designs offered by ceramic dinnerware make it the preferred choice among consumers.

Porcelain to Dominate the Market - By Materials

Porcelain stands out as the most rapidly expanding category in the materials segment. Its high resistance to heat, stain, and scratch, coupled with its lightweight nature and elegant finish, makes it highly desirable.

Commercial Purpose to Dominate the Market - By Applications

The commercial sector, particularly in hospitality and food service industries, is witnessing the fastest growth in terms of ceramic tableware applications. With the ongoing rise in tourism and the rapid expansion of cafés, restaurants, and hotels in Indonesia, the demand for high-quality tableware in the commercial domain has surged. Commercial buyers often prioritize durability and bulk availability, making ceramic tableware a practical and stylish option for their needs.

Online Channels to Dominate the Market - By Distribution Channels

Online sales channels represent the fastest-growing distribution segment for ceramic tableware in Indonesia. The convenience of e-commerce platforms and the availability of a wide range of options for customers to compare and purchase have been key drivers of this growth.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Indonesia Ceramic Tableware Market Outlook

- Market Size of Indonesia Ceramic Tableware Market, 2024

- Forecast of Indonesia Ceramic Tableware Market, 2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Revenues & Volume for the Period 2021-2031

- Indonesia Ceramic Tableware Market Trend Evolution

- Indonesia Ceramic Tableware Market Drivers and Challenges

- Indonesia Ceramic Tableware Price Trends

- Indonesia Ceramic Tableware Porter's Five Forces

- Indonesia Ceramic Tableware Industry Life Cycle

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Products for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Ceramic Dinnerware for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Ceramic Beverageware for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Ceramic Flatware for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Materials for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By China for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Stoneware for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Porcelain for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Household Purpose for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Commercial Purpose for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Distribution Channels for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Online Channel for the Period 2021-2031

- Historical Data and Forecast of Indonesia Ceramic Tableware Market Revenues & Volume By Offline Channel for the Period 2021-2031

- Indonesia Ceramic Tableware Import Export Trade Statistics

- Market Opportunity Assessment By Products

- Market Opportunity Assessment By Materials

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Distribution Channels

- Indonesia Ceramic Tableware Top Companies Market Share

- Indonesia Ceramic Tableware Competitive Benchmarking By Technical and Operational Parameters

- Indonesia Ceramic Tableware Company Profiles

- Indonesia Ceramic Tableware Key Strategic Recommendations

Markets Covered

The report offers a comprehensive study of the subsequent market segments

By Products

- Ceramic Dinnerware

- Ceramic Beverageware

- Ceramic Flatware

By Materials

- China

- Stoneware

- Porcelain

- Others

By Applications

- Household Purpose

- Commercial Purpose

By Distribution Channels

- Online Channel

- Offline Channel

Indonesia Ceramic Tableware Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Indonesia Ceramic Tableware Market Overview |

| 3.1 Indonesia Country Macro Economic Indicators |

| 3.2 Indonesia Ceramic Tableware Market Revenues & Volume, 2021 & 2031F |

| 3.3 Indonesia Ceramic Tableware Market - Industry Life Cycle |

| 3.4 Indonesia Ceramic Tableware Market - Porter's Five Forces |

| 3.5 Indonesia Ceramic Tableware Market Revenues & Volume Share, By Products, 2021 & 2031F |

| 3.6 Indonesia Ceramic Tableware Market Revenues & Volume Share, By Materials, 2021 & 2031F |

| 3.7 Indonesia Ceramic Tableware Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 3.8 Indonesia Ceramic Tableware Market Revenues & Volume Share, By Distribution Channels, 2021 & 2031F |

| 4 Indonesia Ceramic Tableware Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing disposable income of consumers in Indonesia leading to higher spending on household items like ceramic tableware. |

| 4.2.2 Growing trend of home dining and entertaining, driving the demand for aesthetically pleasing ceramic tableware products. |

| 4.2.3 Rising preference for eco-friendly and sustainable products, promoting the use of ceramic tableware over plastic or disposable alternatives. |

| 4.3 Market Restraints |

| 4.3.1 Competition from alternative materials like glass, stainless steel, and melamine impacting the market share of ceramic tableware. |

| 4.3.2 Fluctuating raw material prices affecting the production costs of ceramic tableware manufacturers. |

| 4.3.3 Limited innovation and design differentiation leading to a lack of product uniqueness in the market. |

| 5 Indonesia Ceramic Tableware Market Trends |

| 6 Indonesia Ceramic Tableware Market, By Types |

| 6.1 Indonesia Ceramic Tableware Market, By Products |

| 6.1.1 Overview and Analysis |

| 6.1.2 Indonesia Ceramic Tableware Market Revenues & Volume, By Products, 2021-2031F |

| 6.1.3 Indonesia Ceramic Tableware Market Revenues & Volume, By Ceramic Dinnerware, 2021-2031F |

| 6.1.4 Indonesia Ceramic Tableware Market Revenues & Volume, By Ceramic Beverageware, 2021-2031F |

| 6.1.5 Indonesia Ceramic Tableware Market Revenues & Volume, By Ceramic Flatware, 2021-2031F |

| 6.2 Indonesia Ceramic Tableware Market, By Materials |

| 6.2.1 Overview and Analysis |

| 6.2.2 Indonesia Ceramic Tableware Market Revenues & Volume, By China, 2021-2031F |

| 6.2.3 Indonesia Ceramic Tableware Market Revenues & Volume, By Stoneware, 2021-2031F |

| 6.2.4 Indonesia Ceramic Tableware Market Revenues & Volume, By Porcelain, 2021-2031F |

| 6.2.5 Indonesia Ceramic Tableware Market Revenues & Volume, By Others, 2021-2031F |

| 6.3 Indonesia Ceramic Tableware Market, By Applications |

| 6.3.1 Overview and Analysis |

| 6.3.2 Indonesia Ceramic Tableware Market Revenues & Volume, By Household Purpose, 2021-2031F |

| 6.3.3 Indonesia Ceramic Tableware Market Revenues & Volume, By Commercial Purpose, 2021-2031F |

| 6.4 Indonesia Ceramic Tableware Market, By Distribution Channels |

| 6.4.1 Overview and Analysis |

| 6.4.2 Indonesia Ceramic Tableware Market Revenues & Volume, By Online Channel, 2021-2031F |

| 6.4.3 Indonesia Ceramic Tableware Market Revenues & Volume, By Offline Channel, 2021-2031F |

| 7 Indonesia Ceramic Tableware Market Import-Export Trade Statistics |

| 7.1 Indonesia Ceramic Tableware Market Export to Major Countries |

| 7.2 Indonesia Ceramic Tableware Market Imports from Major Countries |

| 8 Indonesia Ceramic Tableware Market Key Performance Indicators |

| 8.1 Percentage of households in Indonesia using ceramic tableware. |

| 8.2 Consumer satisfaction levels with the quality and durability of ceramic tableware products. |

| 8.3 Percentage of manufacturers offering eco-friendly and sustainable ceramic tableware options. |

| 8.4 Number of new entrants or competitors in the Indonesia ceramic tableware market. |

| 8.5 Average selling price of ceramic tableware products in the market. |

| 9 Indonesia Ceramic Tableware Market - Opportunity Assessment |

| 9.1 Indonesia Ceramic Tableware Market Opportunity Assessment, By Products, 2021 & 2031F |

| 9.2 Indonesia Ceramic Tableware Market Opportunity Assessment, By Materials, 2021 & 2031F |

| 9.3 Indonesia Ceramic Tableware Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 9.4 Indonesia Ceramic Tableware Market Opportunity Assessment, By Distribution Channels, 2021 & 2031F |

| 10 Indonesia Ceramic Tableware Market - Competitive Landscape |

| 10.1 Indonesia Ceramic Tableware Market Revenue Share, By Companies, 2024 |

| 10.2 Indonesia Ceramic Tableware Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero