Indonesia Construction Chemical Market (2024-2030) | Outlook, Revenue, Growth, Size, Forecast, Analysis, Trends, Value, Share, Industry & Companies

| Product Code: ETC041349 | Publication Date: Jul 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Indonesia Construction Chemical Market: Import Trend Analysis

Indonesia`s construction chemical market experienced a -0.46% import trend from 2023 to 2024, with a 6.18% compound annual growth rate (CAGR) from 2020 to 2024. This decline in import momentum in 2024 could be attributed to shifting demand patterns or changes in trade policies affecting market stability.

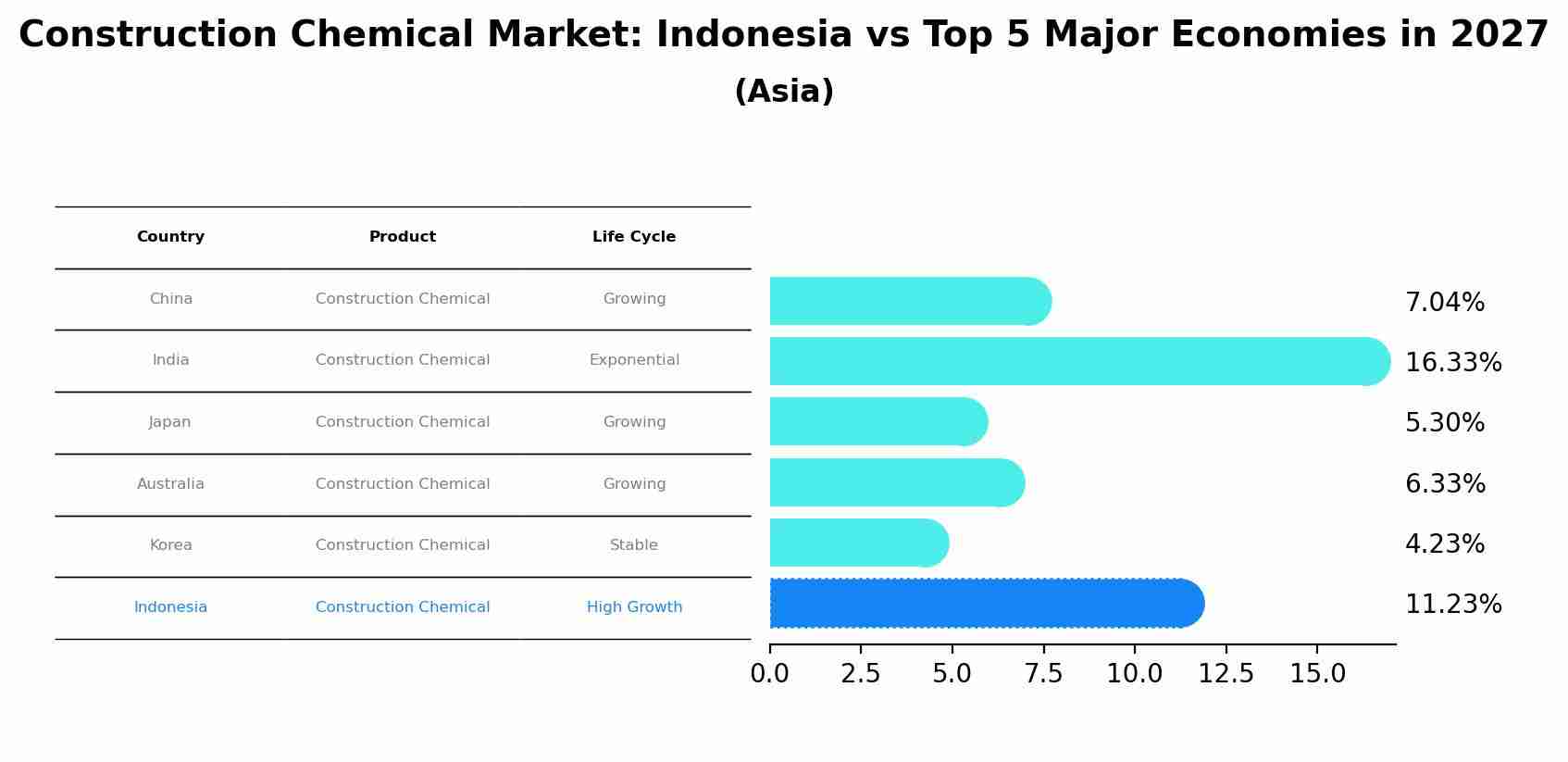

Construction Chemical Market: Indonesia vs Top 5 Major Economies in 2027 (Asia)

The Construction Chemical market in Indonesia is projected to grow at a high growth rate of 11.23% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Indonesia Construction Chemical Market Synopsis

The Indonesia construction chemical market is projected to grow at a CAGR of approximately 8.6% during theperiod of 2020-2026. Thiscan be attributed to increasing investments in infrastructure development projects rising demand for eco-friendly products and rapid urbanization industrialization activities across the country.

Key Factors Driving the Market

The Indonesia government has been investing heavily in infrastructure development projects such as bridges roads tunnels and power plants across Indonesia over the past few years which is expected to drive the overall construction chemicalduring theperiod. Increasing environmental regulations have created a need for environmentally friendly construction chemicals like low VOC or no VOC materials which are not harmful to human beings or the environment when used in building structures or interior designing purposes thus driving their consumption among builders and other stakeholders involved in construction activity.With rapid industrialization and urbanization taking place across Indonesia there has been an increase in residential complexes malls offices etc. leading to increased demand for various types of construction chemicals such as sealantsadhesives grouts etc. thereby propelling the market .

Challenges Facing the Market

High prices associated with various types of construction chemicals pose a challenge for their adoption by end users due to budget constraints on account of limited resources available. Despite ongoing efforts taken up by different players operating within this sector lack of awareness regarding usage benefits offered by various types of construction chemicals still plays a major role while hindering adoption rates due to nonavailability.

Key Market Players

Some key players operating within this sector include BASF SE (Germany) Sika AG (Switzerland) Wacker Chemie AG (Germany) Pidilite Industries Ltd.(India) Fosroc International Limited(UK) RPM International Inc.(US).

Key Highlights of the Report:

- Indonesia Construction Chemical Market Outlook

- Market Size of Indonesia Construction Chemical Market, 2023

- Forecast of Indonesia Construction Chemical Market, 2030

- Historical Data and Forecast of Indonesia Construction Chemical Revenues & Volume for the Period 2020-2030

- Indonesia Construction Chemical Market Trend Evolution

- Indonesia Construction Chemical Market Drivers and Challenges

- Indonesia Construction Chemical Price Trends

- Indonesia Construction Chemical Porter's Five Forces

- Indonesia Construction Chemical Industry Life Cycle

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Type for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Concrete Admixtures for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Water Proofing & Roofing for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Repair for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Flooring for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Sealants & Adhesives for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Other chemicals for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By End-Use for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Residential for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Industrial/Commercial for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Infrastructure for the Period 2020-2030

- Historical Data and Forecast of Indonesia Construction Chemical Market Revenues & Volume By Repair Structures for the Period 2020-2030

- Indonesia Construction Chemical Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By End-Use

- Indonesia Construction Chemical Top Companies Market Share

- Indonesia Construction Chemical Competitive Benchmarking By Technical and Operational Parameters

- Indonesia Construction Chemical Company Profiles

- Indonesia Construction Chemical Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Indonesia Construction Chemical Market Overview |

3.1 Indonesia Country Macro Economic Indicators |

3.2 Indonesia Construction Chemical Market Revenues & Volume, 2020 & 2030F |

3.3 Indonesia Construction Chemical Market - Industry Life Cycle |

3.4 Indonesia Construction Chemical Market - Porter's Five Forces |

3.5 Indonesia Construction Chemical Market Revenues & Volume Share, By Type, 2020 & 2030F |

3.6 Indonesia Construction Chemical Market Revenues & Volume Share, By End-Use, 2020 & 2030F |

4 Indonesia Construction Chemical Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing urbanization and industrialization in Indonesia leading to higher demand for construction chemicals. |

4.2.2 Government initiatives and investments in infrastructure development projects driving the construction sector. |

4.2.3 Growing awareness about the benefits of using construction chemicals for enhancing the durability and sustainability of buildings. |

4.3 Market Restraints |

4.3.1 Fluctuating raw material prices impacting the production cost of construction chemicals. |

4.3.2 Lack of skilled labor and limited technical expertise for the proper application of construction chemicals. |

4.3.3 Stringent regulations and environmental concerns regarding the use of certain chemical compounds in construction. |

5 Indonesia Construction Chemical Market Trends |

6 Indonesia Construction Chemical Market, By Types |

6.1 Indonesia Construction Chemical Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Indonesia Construction Chemical Market Revenues & Volume, By Type, 2020-2030F |

6.1.3 Indonesia Construction Chemical Market Revenues & Volume, By Concrete Admixtures, 2020-2030F |

6.1.4 Indonesia Construction Chemical Market Revenues & Volume, By Water Proofing & Roofing, 2020-2030F |

6.1.5 Indonesia Construction Chemical Market Revenues & Volume, By Repair, 2020-2030F |

6.1.6 Indonesia Construction Chemical Market Revenues & Volume, By Flooring, 2020-2030F |

6.1.7 Indonesia Construction Chemical Market Revenues & Volume, By Sealants & Adhesives, 2020-2030F |

6.1.8 Indonesia Construction Chemical Market Revenues & Volume, By Other chemicals, 2020-2030F |

6.2 Indonesia Construction Chemical Market, By End-Use |

6.2.1 Overview and Analysis |

6.2.2 Indonesia Construction Chemical Market Revenues & Volume, By Residential , 2020-2030F |

6.2.3 Indonesia Construction Chemical Market Revenues & Volume, By Industrial/Commercial , 2020-2030F |

6.2.4 Indonesia Construction Chemical Market Revenues & Volume, By Infrastructure, 2020-2030F |

6.2.5 Indonesia Construction Chemical Market Revenues & Volume, By Repair Structures, 2020-2030F |

7 Indonesia Construction Chemical Market Import-Export Trade Statistics |

7.1 Indonesia Construction Chemical Market Export to Major Countries |

7.2 Indonesia Construction Chemical Market Imports from Major Countries |

8 Indonesia Construction Chemical Market Key Performance Indicators |

8.1 Adoption rate of advanced construction chemical technologies in the Indonesian market. |

8.2 Number of infrastructure projects incorporating construction chemicals for improved performance. |

8.3 Rate of innovation and introduction of eco-friendly construction chemical products in the market. |

8.4 Percentage of construction companies investing in RD for developing customized chemical solutions. |

8.5 Level of government support and incentives for promoting the use of sustainable construction chemicals. |

9 Indonesia Construction Chemical Market - Opportunity Assessment |

9.1 Indonesia Construction Chemical Market Opportunity Assessment, By Type, 2020 & 2030F |

9.2 Indonesia Construction Chemical Market Opportunity Assessment, By End-Use, 2020 & 2030F |

10 Indonesia Construction Chemical Market - Competitive Landscape |

10.1 Indonesia Construction Chemical Market Revenue Share, By Companies, 2023 |

10.2 Indonesia Construction Chemical Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero