Indonesia Metallurgical Coke Market (2024-2030) Outlook | Trends, Revenue, Size, Industry, Companies, Growth, Share, Value, Forecast & Analysis

| Product Code: ETC126339 | Publication Date: Jul 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Indonesia Metallurgical Coke Market: Import Trend Analysis

In the Indonesia metallurgical coke market, the import trend showed a decline from 2023 to 2024, with a growth rate of -18.66%. However, the compound annual growth rate (CAGR) for imports between 2020 and 2024 stood at 11.61%. This decrease in import momentum can be attributed to shifts in demand or changes in trade policies impacting market stability.

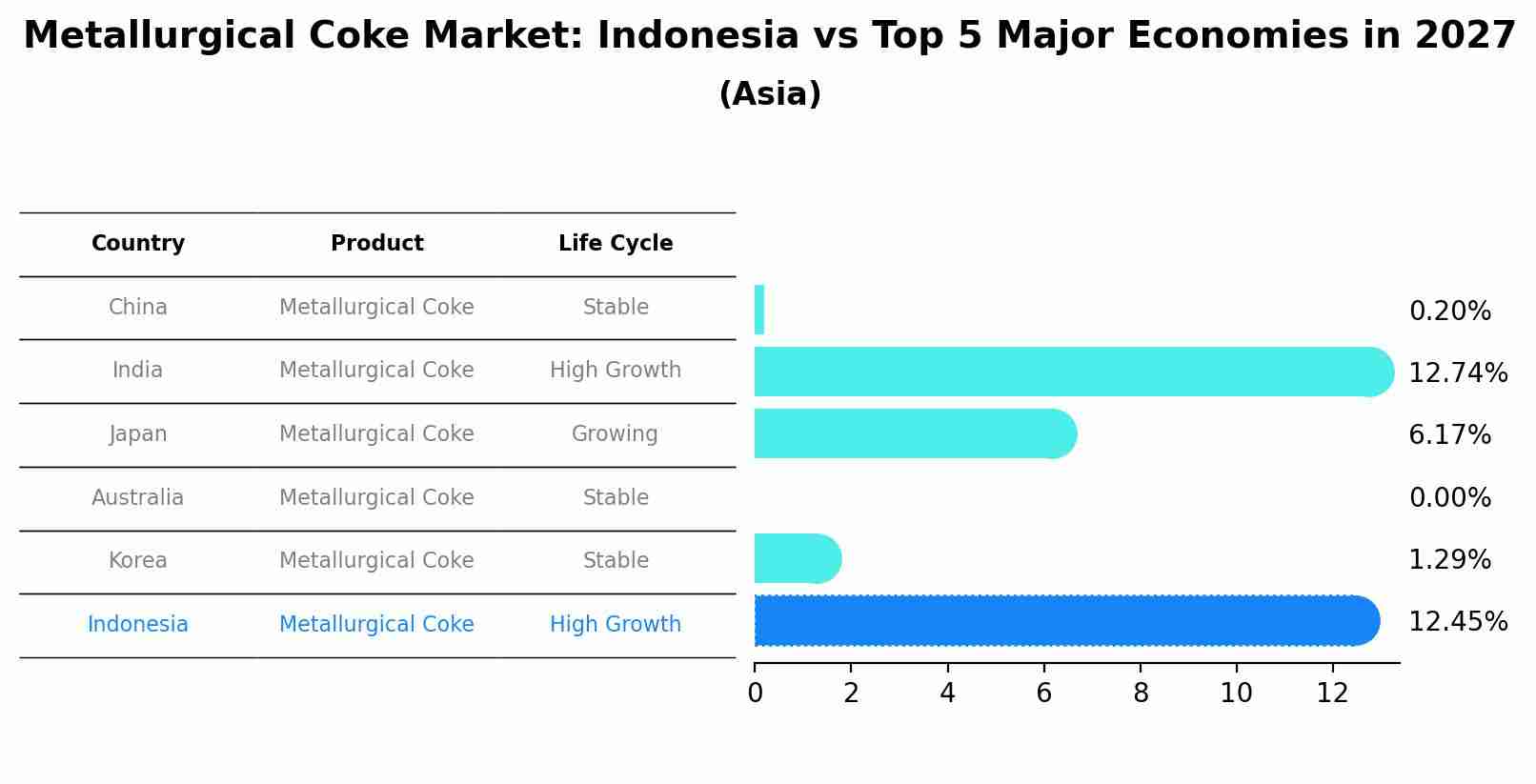

Metallurgical Coke Market: Indonesia vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Metallurgical Coke market in Indonesia is projected to expand at a high growth rate of 12.45% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Indonesia Metallurgical Coke Market Synopsis

Indonesia metallurgical coke market is driven by strong demand from the country`s steel sector, which relies heavily on imported metallurgical coke. Metallurgical coke is a type of fuel derived from coal that is used in the production of iron and steel. It has properties that make it ideal for use as a reducing agent, which helps to convert iron ore into iron and then into steel products. The Indonesia government has imposed several regulations to control emissions from the burning of metallurgical coke, but there are still significant opportunities available for growth in this industry due to Indonesia`s large population base and growing economy.

Indonesia rapidly expanding manufacturing industries have helped drive up demand for metallurgical coke in the country over recent years. This increased usage is further supported by government policies aimed at promoting economic development through infrastructure investment and industrialization efforts. Indonesia vast reserves of coal provide easy access to raw materials required for producing high-quality cokes with excellent performance parameters like low ash content and superior mechanical properties such as specific gravity, particle size distribution etc., making it feasible for producers to supply local markets with good quality product at competitive prices while meeting environmental standards set by authorities.

Metallurgical coke emits pollutants upon burning, leading Indonesia authorities imposing strict emission standards on its use within the country as well as tariffs or other restrictions on imports entering its borders . This can lead to higher costs both during production process itself (due to extra spending needed meet regulatory requirements ) as well as post-production (in form duties paid importing countries). The importation of foreign coals also faces various restrictions depending on their origin . For example , some countries place bans/restrictions on certain types of fuels based their geographical location or status international bodies like United Nations Security Council. In addition , domestic producers may be subject quotas to dissuade foreign competition from entering the market.

Key Market Players

The key players operating in Indonesia metallogical Coke market are PT Krakatau Steel Tbk; PT Gresik Petrokimia Jaya; Arutmin Group; Bukit Asam Group; Vista International Realty Investments Ltd.; INALUM Trading Corporation Sdn Bhd.; PANARUB INDUSTRY CO., LTD.; Barito Pacific Coal.

Key Highlights of the Report:

- Indonesia Metallurgical Coke Market Outlook

- Market Size of Indonesia Metallurgical Coke Market, 2020

- Forecast of Indonesia Metallurgical Coke Market, 2027

- Historical Data and Forecast of Indonesia Metallurgical Coke Revenues & Volume for the Period 2023 - 2027

- Indonesia Metallurgical Coke Market Trend Evolution

- Indonesia Metallurgical Coke Market Drivers and Challenges

- Indonesia Metallurgical Coke Price Trends

- Indonesia Metallurgical Coke Porter's Five Forces

- Indonesia Metallurgical Coke Industry Life Cycle

- Historical Data and Forecast of Indonesia Metallurgical Coke Market Revenues & Volume By Grade for the Period 2023 - 2027

- Historical Data and Forecast of Indonesia Metallurgical Coke Market Revenues & Volume By Low Ash for the Period 2023 - 2027

- Historical Data and Forecast of Indonesia Metallurgical Coke Market Revenues & Volume By High Ash for the Period 2023 - 2027

- Historical Data and Forecast of Indonesia Metallurgical Coke Market Revenues & Volume By Applications for the Period 2023 - 2027

- Historical Data and Forecast of Indonesia Metallurgical Coke Market Revenues & Volume By ron and Steel Making for the Period 2023 - 2027

- Historical Data and Forecast of Indonesia Metallurgical Coke Market Revenues & Volume By Sugar Processing for the Period 2023 - 2027

- Historical Data and Forecast of Indonesia Metallurgical Coke Market Revenues & Volume By Glass Manufacturing for the Period 2023 - 2027

- Historical Data and Forecast of Indonesia Metallurgical Coke Market Revenues & Volume By Others Applications for the Period 2023 - 2027

- Indonesia Metallurgical Coke Import Export Trade Statistics

- Market Opportunity Assessment By Grade

- Market Opportunity Assessment By Applications

- Indonesia Metallurgical Coke Top Companies Market Share

- Indonesia Metallurgical Coke Competitive Benchmarking By Technical and Operational Parameters

- Indonesia Metallurgical Coke Company Profiles

- Indonesia Metallurgical Coke Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

Indonesia Metallurgical Coke |

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Indonesia Metallurgical Coke Market Overview |

3.1 Indonesia Country Macro Economic Indicators |

3.2 Indonesia Metallurgical Coke Market Revenues & Volume, 2020 & 2027F |

3.3 Indonesia Metallurgical Coke Market - Industry Life Cycle |

3.4 Indonesia Metallurgical Coke Market - Porter's Five Forces |

3.5 Indonesia Metallurgical Coke Market Revenues & Volume Share, By Grade, 2020 & 2027F |

3.6 Indonesia Metallurgical Coke Market Revenues & Volume Share, By Applications, 2020 & 2027F |

4 Indonesia Metallurgical Coke Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Growth in the steel industry in Indonesia |

4.2.2 Increasing demand for metallurgical coke in various manufacturing processes |

4.2.3 Government initiatives to promote infrastructure development and industrial growth |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials |

4.3.2 Environmental concerns and regulations related to coke production |

4.3.3 Competition from alternative materials like coal and scrap metal |

5 Indonesia Metallurgical Coke Market Trends |

6 Indonesia Metallurgical Coke Market, By Types |

6.1 Indonesia Metallurgical Coke Market, By Grade |

6.1.1 Overview and Analysis |

6.1.2 Indonesia Metallurgical Coke Market Revenues & Volume, By Grade, 2018 - 2027F |

6.1.3 Indonesia Metallurgical Coke Market Revenues & Volume, By Low Ash, 2018 - 2027F |

6.1.4 Indonesia Metallurgical Coke Market Revenues & Volume, By High Ash, 2018 - 2027F |

6.2 Indonesia Metallurgical Coke Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 Indonesia Metallurgical Coke Market Revenues & Volume, By ron and Steel Making, 2018 - 2027F |

6.2.3 Indonesia Metallurgical Coke Market Revenues & Volume, By Sugar Processing, 2018 - 2027F |

6.2.4 Indonesia Metallurgical Coke Market Revenues & Volume, By Glass Manufacturing, 2018 - 2027F |

6.2.5 Indonesia Metallurgical Coke Market Revenues & Volume, By Others Applications, 2018 - 2027F |

7 Indonesia Metallurgical Coke Market Import-Export Trade Statistics |

7.1 Indonesia Metallurgical Coke Market Export to Major Countries |

7.2 Indonesia Metallurgical Coke Market Imports from Major Countries |

8 Indonesia Metallurgical Coke Market Key Performance Indicators |

8.1 Average selling price of metallurgical coke |

8.2 Capacity utilization rate of metallurgical coke plants in Indonesia |

8.3 Import/export volume of metallurgical coke in Indonesia |

9 Indonesia Metallurgical Coke Market - Opportunity Assessment |

9.1 Indonesia Metallurgical Coke Market Opportunity Assessment, By Grade, 2020 & 2027F |

9.2 Indonesia Metallurgical Coke Market Opportunity Assessment, By Applications, 2020 & 2027F |

10 Indonesia Metallurgical Coke Market - Competitive Landscape |

10.1 Indonesia Metallurgical Coke Market Revenue Share, By Companies, 2020 |

10.2 Indonesia Metallurgical Coke Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero