Indonesia Pet Food Market (2025-2031) | Growth, Trends, Industry, Size, Value, Outlook, Forecast, Share, Analysis, Companies & Revenue

Market Forecast By Type (Dry Food, Wet Food, Snacks/Treats), By Animal (Dog, Cat, Others) And Competitive Landscape

| Product Code: ETC383908 | Publication Date: Aug 2022 | Updated Date: Jan 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 5 | |

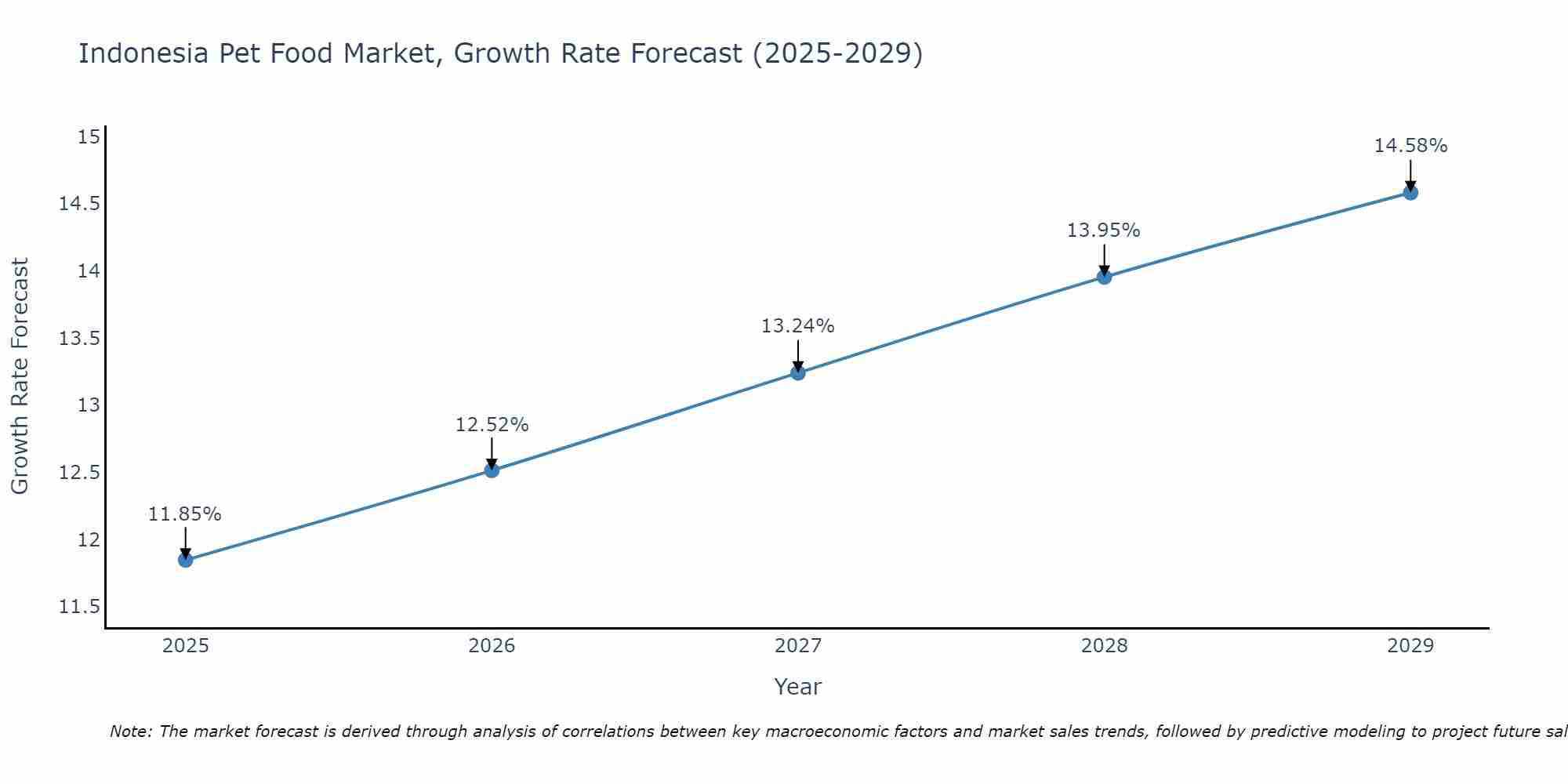

Indonesia Pet Food Market Size Growth Rate

The Indonesia Pet Food Market is poised for steady growth rate improvements from 2025 to 2029. From 11.85% in 2025, the growth rate steadily ascends to 14.58% in 2029.

Pet Food Market: Indonesia vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Pet Food market in Indonesia is projected to expand at a high growth rate of 13.24% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Topics Covered in Indonesia Pet Food Market Report

The Indonesia Pet Food Market Report thoroughly covers the market by type and animal. The Indonesia pet food Market Outlook report provides an unbiased and detailed analysis of the ongoing Indonesia pet food Market trends, opportunities/high growth areas, and market drivers. This would help the stakeholders devise and align their market strategies according to the current and future market dynamics.

Indonesia Pet Food Market Synopsis

The Indonesia Pet Food Market has witnessed significant growth and is expected to grow further in the future. This growth can be attributed to the rising demand for quality and organic pet food products, along with the increasing pet ownership rate, especially among millennials, who prefer pets over children as companions.

According to the 6Wresearch, Indonesia Pet Food Market size is projected to rise at a CAGR of 14.65% during 2025-2031. One of the main drivers of this market is the humanization of pets, as pet owners seek more nutritious and natural food products for their pets’ well-being. Another factor driving this market is the growing popularity of premium and exotic pet breeds, such as koi, lohan, African parrots, and others, which require high-quality and specialized pet food products. These factors have been playing a key role in the Indonesia Pet Food Market growth.

However, there are also some challenges faced by this market, such as the high initial and maintenance costs of pet food products, the competition from alternative products, and the cultural and religious barriers to dog ownership, which may limit the market potential. The market is also likely to overcome these challenges due to the continuous efforts of key players.

Pet Food Market in Indonesia: Leading Players

Some key players in the in the Indonesia pet food market, include Nestle Purina, Mars Incorporated, Colgate-Palmolive Company, EBOS Group Limited, and FARMINA PET FOODS. These companies dominate the market with their extensive product lines and strategic brand offerings. They remain at the forefront of innovation, consistently introducing new products to cater to evolving consumer preferences and market demands.

Indonesia Pet Food Industry: Government Initiatives

The Indonesian government has introduced several initiatives to support the growth of the pet food industry. Through the Make in Indonesia policy, domestic manufacturing and entrepreneurship are encouraged, fostering a favourable environment for industry expansion. Additionally, the Startup Indonesia program promotes innovation and creativity among young entrepreneurs, particularly in the pet food sector. Regulatory measures ensure product quality and safety, with producers mandated to obtain licenses and comply with Indonesian National Standards (SNI). These initiatives collectively aim to nurture a robust and sustainable pet food industry in Indonesia.

Future Insights of the Market

The Indonesia pet food market is poised for steady growth, driven by rising demand from diverse pet owner segments like millennials and nuclear families. Technological advancements, including the use of natural ingredients and biodegradable packaging, are expected to enhance product quality and sustainability. However, challenges such as high costs and cultural barriers to dog ownership may limit market potential. Nevertheless, ongoing innovation and industry efforts are expected to fuel market expansion, meeting evolving consumer needs.

Market Segmentation by Type

According to Ravi Bhandari, Research Head, 6Wresearch, one of the key factors driving growth in the Indonesian pet food market is the increasing popularity of dry food products. This segment has been witnessing steady growth over the years, as it offers convenience and a longer shelf life compared to other types of pet food. Additionally, dry food is considered to be more affordable for pet owners, making it a popular choice among price-sensitive consumers.

Market Segmentation by Animal

Currently, the dog segment is leading the growth in the Indonesian pet food market. With a large population of dogs in Indonesia. There is a high demand for dog food products. This segment is expected to continue its dominance in the market due to several factors.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Indonesia Pet Food Market Outlook

- Market Size of Indonesia Pet Food Market, 2024

- Forecast of Indonesia Pet Food Market, 2031

- Historical Data and Forecast of Indonesia Pet Food Revenues & Volume for the Period 2021 - 2031

- Indonesia Pet Food Market Trend Evolution

- Indonesia Pet Food Market Drivers and Challenges

- Indonesia Pet Food Price Trends

- Indonesia Pet Food Porter's Five Forces

- Indonesia Pet Food Industry Life Cycle

- Historical Data and Forecast of Indonesia Pet Food Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Indonesia Pet Food Market Revenues & Volume By Dry Food for the Period 2021 - 2031

- Historical Data and Forecast of Indonesia Pet Food Market Revenues & Volume By Wet Food for the Period 2021 - 2031

- Historical Data and Forecast of Indonesia Pet Food Market Revenues & Volume By Snacks/Treats for the Period 2021 - 2031

- Historical Data and Forecast of Indonesia Pet Food Market Revenues & Volume By Animal for the Period 2021 - 2031

- Historical Data and Forecast of Indonesia Pet Food Market Revenues & Volume By Dog for the Period 2021 - 2031

- Historical Data and Forecast of Indonesia Pet Food Market Revenues & Volume By Cat for the Period 2021 - 2031

- Historical Data and Forecast of Indonesia Pet Food Market Revenues & Volume By Others for the Period 2021 - 2031

- Indonesia Pet Food Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Animal

- Indonesia Pet Food Top Companies Market Share

- Indonesia Pet Food Competitive Benchmarking By Technical and Operational Parameters

- Indonesia Pet Food Company Profiles

- Indonesia Pet Food Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Dry Food

- Wet Food

- Snacks/Treats

By Animal

- Dog

- Cat

- Others

Indonesia Pet Food Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Indonesia Pet Food Market Overview |

| 3.1 Indonesia Country Macro Economic Indicators |

| 3.2 Indonesia Pet Food Market Revenues & Volume, 2021 & 2031F |

| 3.3 Indonesia Pet Food Market - Industry Life Cycle |

| 3.4 Indonesia Pet Food Market - Porter's Five Forces |

| 3.5 Indonesia Pet Food Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Indonesia Pet Food Market Revenues & Volume Share, By Animal, 2021 & 2031F |

| 4 Indonesia Pet Food Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Indonesia Pet Food Market Trends |

| 6 Indonesia Pet Food Market Segmentations |

| 6.1 Indonesia Pet Food Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Indonesia Pet Food Market Revenues & Volume, By Dry Food, 2021 - 2031F |

| 6.1.3 Indonesia Pet Food Market Revenues & Volume, By Wet Food, 2021 - 2031F |

| 6.1.4 Indonesia Pet Food Market Revenues & Volume, By Snacks/Treats, 2021 - 2031F |

| 6.2 Indonesia Pet Food Market, By Animal |

| 6.2.1 Overview and Analysis |

| 6.2.2 Indonesia Pet Food Market Revenues & Volume, By Dog, 2021 - 2031F |

| 6.2.3 Indonesia Pet Food Market Revenues & Volume, By Cat, 2021 - 2031F |

| 6.2.4 Indonesia Pet Food Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Indonesia Pet Food Market Import-Export Trade Statistics |

| 7.1 Indonesia Pet Food Market Export to Major Countries |

| 7.2 Indonesia Pet Food Market Imports from Major Countries |

| 8 Indonesia Pet Food Market Key Performance Indicators |

| 9 Indonesia Pet Food Market - Opportunity Assessment |

| 9.1 Indonesia Pet Food Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Indonesia Pet Food Market Opportunity Assessment, By Animal, 2021 & 2031F |

| 10 Indonesia Pet Food Market - Competitive Landscape |

| 10.1 Indonesia Pet Food Market Revenue Share, By Companies, 2024 |

| 10.2 Indonesia Pet Food Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero