Iraq Smartphone Market (2020-2026) | Share, industry, Growth, Forecast, Size, Trends, Analysis, Outlook & COVID-19 IMPACT

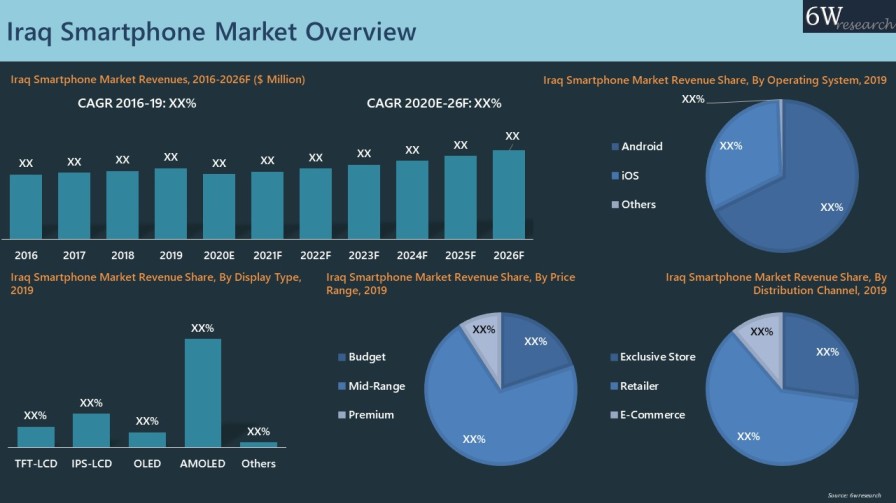

Market Forecast By Operating System (Android, iOS, Others (Linux, Tizen, Bada, Blackberry, Windows)), By Display Type (TFT-LCD, IPS-LCD, OLED, AMOLED, Others (Capacitive, Super AMOLED)), By Display Size (Below 4 inches, 4.1-6 inches, Above 6 inches), By Price Range (Budget Smartphones (Below $250), Mid-Range Smartphones ($250-750), Premium Smartphones (Above $750)), By Distribution Channel (Exclusive Store, Retailer, e-Commerce) and competitive landscape

| Product Code: ETC054439 | Publication Date: Feb 2023 | Product Type: Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 76 | No. of Figures: 20 | No. of Tables: 6 |

Iraq Smartphone Market report thoroughly covers the market by the operating system, display type, display size, price range and distribution channel. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of the Iraq Smartphone Market

Iraq Smartphone Market is forecast to grow over the years on the back of Increasing internet penetration and the growing young population of Iraq who is tech-savvy and interested in the latest gadgets. In addition, rising disposable income enables consumers to spend on smartphones and other luxury goods. Moreover, the government of Iraq has made huge investments in recent years to improve the country's telecommunications infrastructure which includes expanding mobile network coverage and increasing internet speeds.

However, the country's political instability has created an unstable environment for businesses, which affects the Iraq smartphone market growth in the coming years. Moreover, there are only a few international brands available in the market, which limits consumer choices and affects market development. Nevertheless, with a growing population and increasing internet penetration, the demand for smartphones in Iraq continues to rise. The smartphone market of Iraq is relatively underdeveloped which presents an opportunity for smartphone manufacturers to tap into this market.

Iraq Smartphone Market Synopsis

Iraq smartphone market witnessed moderate growth during the period 2016-2019 underpinned by decent growth in mobile subscribers owing to the improving living standard of the population of Iraq. The increasing demand for smartphones by youngsters is the major driver for the smartphone market in Iraq. However, the outbreak of the COVID-19 pandemic brought a decline in market revenues during the year 2020 as a result of the supply chain disruptions caused by the closure of international borders, along with the stringent lockdown imposed in the country that further reduced consumer demand. Moreover, recovery is expected in market revenues post-2020, with the gradual opening of the retail sector and restart of the business operations which would improve the economic conditions of the country resulting in an increased purchasing power of the consumers. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in overall market growth.

According to 6Wresearch, the Iraq Smartphone Market size is projected to grow at a CAGR of 5.2% during 2020-2026. Iraq Government has allowed the operators to extend their spectrum for 5 years and in return, the operators pledged to launch 4G services across the country by 2021. The government is currently examining the use of spectrum at 450 MHz, 1,500 MHz, 2,300MHz, 2,600MHzand 3,500MHz taking into account the need for 4G and 5G services in the country. Global smartphone giants like Samsung, Apple, Huawei and Xiaomi are working on several latest technologies for making high-end smartphones with enhanced energy efficiency, brighter display, high-resolution cameras and high-performance processors for creating the best user experience. Thus, the striving government efforts to provide the necessary infrastructure for supporting 4G and 5G along with rising internet penetration would bode well for the smartphone market in the country over the coming years.

Market Analysis by Operating System

The android operating system has captured the majority of the market revenue share in the smartphone market of Iraq during 2019, and the segment is expected to dominate the overall market in the forecast period as well since android smartphones are loaded with fancy features at an affordable price. Smartphones with AMOLED display type and screen size ranging between 4.1 inches to 6 inches held the majority share in the market revenues during the year 2019.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Iraq Smartphone Market Overview

- Iraq Smartphone Market Outlook

- Iraq Smartphone Market Forecast

- Historical Data and Forecast of Iraq Smartphone Market Revenues and Volume, for the Period 2016-2026F

- Historical Data and Forecast of Iraq Smartphone Market Revenues and Volume, By Operating System, for the Period 2016-2026F

- Historical Data and Forecast of Iraq Smartphone Market Revenues, By Display Type, for the Period 2016-2026F

- Historical Data and Forecast of Iraq Smartphone Market Revenues, By Display Size, for the Period 2016-2026F

- Historical Data and Forecast of Iraq Smartphone Market Revenues, By Price Range, for the Period 2016-2026F

- Historical Data and Forecast of Iraq Smartphone Market Revenues, By Distribution Channel, for the Period 2016-2026F

- Iraq Smartphone Market Revenue Share, By Market Players

- Market Drivers and Restraints

- Market Trends

- Competitive Benchmarking

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Operating System

- Android

- iOS

- Others (Linux, Tizen, Bada, Blackberry, Windows)

By Display Type

- TFT-LCD

- IPS-LCD

- OLED

- AMOLED

- Others (CapacitiveSuper AMOLED)

By Display Size

- Below 4 inches

- 4.1-6 inches

- Above 6 inches

By Price Range

- Budget Smartphones (Below $250)

- Mid-Range Smartphones ($250-750)

- Premium Smartphones (Above $750)

By Distribution Channel

- Exclusive Store

- Retailer

- e-Commerce

Iraq Smartphone Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Iraq Smartphone Market Overview |

| 3.1 Iraq Smartphone Market Revenues and Volume, 2016-2026F |

| 3.2 Iraq Smartphone Market-Industry Life Cycle |

| 3.3 Iraq Smartphone Market-Porter’s Five Forces |

| 4. Iraq Smartphone Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Iraq Smartphone Market Trends |

| 6. Iraq Smartphone Market Overview, By Operating System |

| 6.1 Iraq Smartphone Market Revenue and Volume Share, By Operating System |

| 6.2 Iraq Smartphone Market Revenues, By Operating System, 2016-2026F |

| 6.2.1 Iraq Smartphone Market Revenues, By Android Operating System, 2016-2026F |

| 6.2.2 Iraq Smartphone Market Revenues, By iOS Operating System, 2016-2026F |

| 6.2.3 Iraq Smartphone Market Revenues, By Other Operating System, 2016-2026F |

| 6.3 Iraq Smartphone Market Volume, By Operating System, 2016-2026F |

| 6.3.1 Iraq Smartphone Market Volume, By Android Operating System, 2016-2026F |

| 6.3.2 Iraq Smartphone Market Volume, By iOS Operating System, 2016-2026F |

| 6.3.3 Iraq Smartphone Market Volume, By Other Operating System, 2016-2026F |

| 7. Iraq Smartphone Market Overview, By Display Type |

| 7.1 Iraq Smartphone Market Revenue Share, By Display Type |

| 7.2 Iraq Smartphone Market Revenues, By Display Type, 2016-2026F |

| 7.2.1 Iraq Smartphone Market Revenues, By TFT-LCD Display Type, 2016-2026F |

| 7.2.2 Iraq Smartphone Market Revenues, By IPS-LCD Display Type, 2016-2026F |

| 7.2.3 Iraq Smartphone Market Revenues, By OLED Display Type, 2016-2026F |

| 7.2.4 Iraq Smartphone Market Revenues, By AMOLED Display Type, 2016-2026F |

| 7.2.5 Iraq Smartphone Market Revenues, By Other Display Type, 2016-2026F |

| 8. Iraq Smartphone Market Overview, By Display Size |

| 8.1 Iraq Smartphone Market Revenue Share and Revenues, By Display Size |

| 8.1.1 Iraq Smartphone Market Revenues, By Below 4 Inches, 2016-2026F |

| 8.1.2 Iraq Smartphone Market Revenues, By 4.1-6 Inches, 2016-2026F |

| 8.1.3 Iraq Smartphone Market Revenues, By Above 6 Inches, 2016-2026F |

| 9. Iraq Smartphone Market Overview, By Price Range |

| 9.1 Iraq Smartphone Market Revenue Share and Revenues, By Price Range |

| 9.1.1 Iraq Budget Smartphone Market Revenues, 2016-2026F |

| 9.1.2 Iraq Mid Range Smartphone Market Revenues, 2016-2026F |

| 9.1.3 Iraq Premium Smartphone Market Revenues, 2016-2026F |

| 10. Iraq Smartphone Market Overview, By Distribution Channel |

| 10.1 Iraq Smartphone Market Revenue Share and Revenues, By Distribution Channel |

| 10.1.1 Iraq Smartphone Market Revenues, By Exclusive Stores, 2016-2026F |

| 10.1.2 Iraq Smartphone Market Revenues, By Retailer, 2016-2026F |

| 10.1.3 Iraq Smartphone Market Revenues, By E-Commerce, 2016-2026F |

| 11. Iraq Smartphone Market Key Performance Indicators |

| 12. Iraq Smartphone Market Opportunity Assessment |

| 12.1 Iraq Smartphone Market, Opportunity Assessment, By Operating System, 2026F |

| 12.2 Iraq Smartphone Market, Opportunity Assessment, By Display Type, 2026F |

| 12.3 Iraq Smartphone Market, Opportunity Assessment, By Display Size, 2026F |

| 12.4 Iraq Smartphone Market, Opportunity Assessment, By Price Range, 2026F |

| 12.5 Iraq Smartphone Market, Opportunity Assessment, By Distribution Channel, 2026F |

| 13. Iraq Smartphone Market Competitive Landscape |

| 13.1 Iraq Smartphone Market Revenue Share, By Company, 2019 |

| 13.2 Iraq Smartphone Market Competitive Benchmarking |

| 13.2.1 Iraq Smartphone Market Competitive Benchmarking, By Technical Parameters |

| 13.2.2 Iraq Smartphone Market Competitive Benchmarking, By Operating Parameters |

| 14. Company Profiles |

| 14.1 Huawei Technologies Co. Ltd. |

| 14.2 Apple Inc. |

| 14.3 Xiaomi Corporation |

| 14.4 Realme Chongqing Mobile Telecommunications Corp. Ltd. |

| 14.5 Shenzhen Transsion Holdings Co. Limited |

| 14.6 Nokia Corporation |

| 14.7 Samsung Electronics Co. Ltd. |

| 14.8 Lenovo Group Limited |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures: |

| 1. Iraq Smartphone Market Revenues and Volume, 2016-2026F ($ Million, Thousand Units) |

| 2. Mobile phone subscriptions per 100 people in Iraq |

| 3. Percentage of Iraq’s population using the Internet |

| 4. Number of Facebook and Instagram users (in thousand units) in the months of September, October, and November in the year 2020. |

| 5. Secure Internet Servers per million people in Iraq |

| 6. Urban Population percentage in Iraq |

| 7. GDP Per Capita of Iraq (US$) |

| 8. Iraq Smartphone Market Revenue Share, By Operating System, 2019 & 2026F |

| 9. Iraq Smartphone Market Volume Share, By Operating System, 2019 & 2026F |

| 10. Iraq Smartphone Market Revenue Share, By Display Type, 2019 & 2026F |

| 11. Iraq Smartphone Market Revenue Share, By Display Size, 2019 & 2026F |

| 12. Iraq Smartphone Market Revenue Share, By Price Range, 2019 & 2026F |

| 13. Iraq Smartphone Market Revenue Share, By Distribution Channel, 2019 & 2026F |

| 14. Overview of Mobile Connections with Share by Payment Type and Connection Bandwidth, Jan 2020 |

| 15. Iraq Smartphone Market Opportunity Assessment, By Operating System, 2026F |

| 16. Iraq Smartphone Market Opportunity Assessment, By Display Type, 2026F |

| 17. Iraq Smartphone Market Opportunity Assessment, By Display Size, 2026F |

| 18. Iraq Smartphone Market Opportunity Assessment, By Price Range, 2026F |

| 19. Iraq Smartphone Market Opportunity Assessment, By Distribution Channel, 2026F |

| 20. Iraq Smartphone Market Revenue Share, By Companies, 2019 |

| List of Tables: |

| 1. Iraq Smartphone Market Revenues, By Operating System, 2016-2026F ($ Million) |

| 2. Iraq Smartphone Market Volume, By Operating System, 2016-2026F (Units) |

| 3. Iraq Smartphone Market Revenues, By Display Type, 2016-2026F ($ Million) |

| 4. Iraq Smartphone Market Revenues, By Display Size, 2016-2026F ($ Million) |

| 5. Iraq Smartphone Market Revenues, By Price Range, 2016-2026F ($ Million) |

| 6. Iraq Smartphone Market Revenues, By Distribution Channel, 2016-2026F ($ Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero