Japan Hydraulics Market (2024-2030) | Revenue, Outlook, Trends, Companies, Industry, Size, Share, Growth, Analysis, Value & Forecast

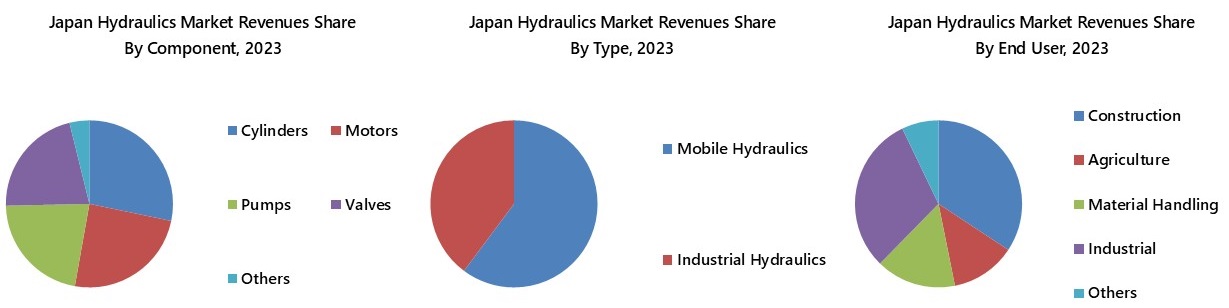

Market Forecast By Components (Motors, Pumps, Cylinders, Valves, Others (Filters, Accumulators, Transmissions)), By Type (Mobile Hydraulics, Industrial Hydraulics), By End User (Construction, Mining and Oil & Gas,Agriculture,Material Handling,Industrial,Others (Energy & Utilities, Offshore etc.)) And Competitive Landscape

| Product Code: ETC4582403 | Publication Date: Jul 2023 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 66 | No. of Figures: 15 | No. of Tables: 5 |

Japan Hydraulics Market Import Shipment by Countries (Top 5) & Competition (HHI)

In 2024, Japan continued to heavily rely on hydraulic import shipments, with top exporters being China, USA, South Korea, Taiwan, Province of China, and Thailand. Despite the high concentration of Herfindahl-Hirschman Index (HHI) in the market, the industry demonstrated steady growth with a compound annual growth rate (CAGR) of 5.67% from 2020 to 2024. However, there was a slight decline in the growth rate from 2023 to 2024, indicating potential challenges or shifts in the market dynamics. Monitoring these trends will be crucial for stakeholders in the hydraulics import sector.

Topics Covered in Japan Hydraulics Market Report

Japan Hydraulics Market Report thoroughly covers the market by components, type, and end-user. Japan Hydraulics Market Outlook report provides an unbiased and detailed analysis of the ongoing Japan Hydraulics Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Japan Hydraulics Market Synopsis

Japan hydraulics market witnessed robust growth between 2020 and 2023, underpinned by key infrastructure developments such as the NRT14 Inzai Data Center. This upward trend was further supported by a thriving industrial sector, particularly in automotive production, which saw an increase from 7.39 million units in 2021 to 8.57 million units by 2023. Additionally, Japanese manufacturers experienced a record $7.35 billion in industrial robot orders in FY2022, reflecting a 1.6% year-on-year increase, along with a 5.6% rise in robot production. These factors contributed significantly to the market's expansion. Moreover, strategic investments in large-scale projects, such as high-rise office redevelopments, hotel constructions, and railway initiatives in areas like Yaesu – Nihonbashi, further fueled this growth, complemented by ongoing earthquake reconstruction efforts and heightened demand driven by global events such as the Tokyo Olympics.

According to 6Wresearch, the Japan Hydraulics Market is projected to grow at a CAGR of 3.4% from 2024 to 2030. The market is expected to witness steady expansion, driven by increasing demand across key sectors. The surge in major infrastructure projects in Japan, such as the Minami Ekimae Hotel and the Shitara Dam Project, is anticipated to boost construction activities. This rise in infrastructure development, including affordable housing and commercial buildings, will likely drive demand for construction equipment like excavators, bulldozers, and cranes, all of which rely on hydraulic systems.

Additionally, Japan Gold's 2023 exploration plan, which includes multiple drilling projects across Kyushu and Hokkaido, is expected to increase mining activity. This surge in mining operations will fuel demand for hydraulic systems, which are critical for powering mining equipment such as drills and loaders. The combined demand from the construction and mining sectors is poised to contribute significantly to the growth of the hydraulics market. Moreover, Japan’s strategic investment of over $75 billion in Indo-Pacific infrastructure by 2030, including projects like the Manila Light Rail Transit extension and Jakarta’s East-West Metro Line, will further boost demand for hydraulic systems. Renewable energy projects such as the Nimaida Wind Farm, set for completion in 2026, and the Karatsu Biomass Power Plant are also expected to increase the demand for hydraulic equipment.

Market Segmentation By Type

Mobile hydraulics are expected to experience the fastest growth in Japan's hydraulics market, driven by their essential role in construction, agriculture, and material handling. This growth is fueled by the rise in infrastructure projects, the mechanization of agriculture, and the increasing demand for flexible, energy-efficient machinery across various sectors.

Market Segmentation By End User

Construction is expected to experience the most rapid growth in Japan’s hydraulics market, driven by large-scale infrastructure projects, urban development, and a rising demand for advanced machinery. Increased investments in roads, bridges, and renewable energy infrastructure are significantly enhancing the need for hydraulic systems in heavy construction equipment, thereby propelling growth in this sector.

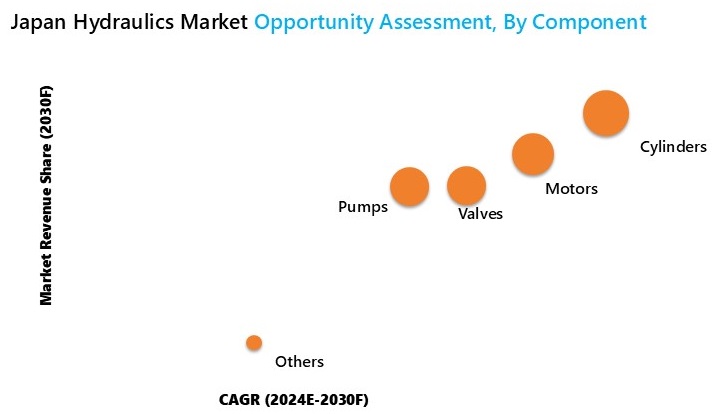

Market Segmentation By Component

Cylinders are anticipated to exhibit the most rapid growth in Japan's hydraulics market, owing to their critical function in construction, agriculture, and manufacturing. This growth is propelled by an increasing demand for heavy machinery, the mechanization of agriculture, and advancements in automation, alongside significant progress in smart cylinder technology within these sectors.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Japan Hydraulics Market Overview

- Japan Hydraulics Market Outlook

- Japan Hydraulics Market Forecast

- Historical Data and Forecast of Japan Hydraulics Market Revenues, for the Period 2020-2030F

- Historical Data and Forecast of Japan Hydraulics Market Revenues, By Component, for the Period 2020-2030F

- Historical Data and Forecast of Japan Hydraulics Market Revenues, By Type, for the Period 2020-2030F

- Historical Data and Forecast of Japan Hydraulics Market Revenues, By End User, for the Period 2020-2030F

- Japan Hydraulics Market Revenue Ranking, By Companies

- Japan Hydraulics Market Drivers and Restraints

- Japan Hydraulics Market Trends

- Japan Hydraulics Market Porters Five Forces

- Japan Hydraulics Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Component

- Motors

- Pumps

- Cylinders

- Valves

- Others (Filters, Accumulators, Transmissions etc.)

By Type

- Mobile Hydraulics

- Industrial Hydraulics

By End User

- Construction, Mining and Oil & Gas

- Agriculture

- Material Handling

- Industrial

- Others (Energy & Utilities, Offshore etc.)

Japan Hydraulics Market (2024-2030): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope and Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Japan Hydraulics Market Overview |

| 3.1 Japan Hydraulics Market Revenues, 2020-2030F |

| 3.2 Japan Hydraulics Market Industry Life Cycle |

| 3.3 Japan Hydraulics Market Porter Five Forces |

| 4. Japan Hydraulics Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for automation and robotics in manufacturing industries in Japan, driving the need for hydraulic systems. |

| 4.2.2 Growth in construction and infrastructure development projects in Japan, leading to the adoption of hydraulics for heavy machinery. |

| 4.2.3 Technological advancements and innovations in hydraulic systems, improving efficiency and performance. |

| 4.3 Market Restraints |

| 4.3.1 High initial costs associated with installing hydraulic systems, limiting adoption rates. |

| 4.3.2 Environmental concerns related to hydraulic fluid leakage and disposal, leading to regulatory challenges. |

| 4.3.3 Competition from alternative technologies such as electric actuators, impacting the demand for hydraulic systems. |

| 5. Japan Hydraulics Market Trends |

| 6. Japan Hydraulics Market Overview, By Component |

| 6.1 Japan Hydraulics Market Revenues & Revenue Share, By Component, 2020-2030F |

| 6.1.1 Japan Hydraulics Market Revenues & Revenue Share, By Motors, 2020-2030F |

| 6.1.2 Japan Hydraulics Market Revenues & Revenue Share, By Pumps, 2020-2030F |

| 6.1.3 Japan Hydraulics Market Revenues & Revenue Share, By Cylinders, 2020-2030F |

| 6.1.4 Japan Hydraulics Market Revenues & Revenue Share, By Valves, 2020-2030F |

| 6.1.5 Japan Hydraulics Market Revenues & Revenue Share, By Others, 2020-2030F |

| 7. Japan Hydraulics Market Overview, By Type |

| 7.1 Japan Hydraulics Market Revenues & Revenue Share, By Type, 2020-2030F |

| 7.1.1 Japan Hydraulics Market Revenues & Revenue Share, By Mobile Hydraulics, 2020-2030F |

| 7.1.2 Japan Hydraulics Market Revenues & Revenue Share, By Industrial Hydraulics, 2020-2030F |

| 8. Japan Hydraulics Market Overview, By End User |

| 8.1 Japan Hydraulics Market Revenues & Revenue Share, By End User, 2020-2030F |

| 8.1.1 Japan Hydraulics Market Revenues & Revenue Share, By Construction 2020-2030F |

| 8.1.2 Japan Hydraulics Market Revenues & Revenue Share, By Agriculture, 2020-2030F |

| 8.1.3 Japan Hydraulics Market Revenues & Revenue Share, By Material Handling, 2020-2030F |

| 8.1.4 Japan Hydraulics Market Revenues & Revenue Share, By Industrial, 2020-2030F |

| 8.1.5 Japan Hydraulics Market Revenues & Revenue Share, By Others, 2020-2030F |

| 9. Japan Hydraulics Market Key Performance Indicators |

| 9.1 Adoption rate of smart hydraulic systems incorporating IoT technologies. |

| 9.2 Percentage increase in the use of energy-efficient hydraulic components. |

| 9.3 Number of patents filed for hydraulic system innovations. |

| 9.4 Customer satisfaction scores related to the reliability and durability of hydraulic systems. |

| 9.5 Rate of adoption of eco-friendly hydraulic fluids. |

| 10. Japan Hydraulics Market Opportunity Assessment |

| 10.1 Japan Hydraulics Market Opportunity Assessment, By Component |

| 10.2 Japan Hydraulics Market Opportunity Assessment, By Type |

| 10.3 Japan Hydraulics Market Opportunity Assessment, By End User |

| 11. Japan Hydraulics Market Competitive Landscape |

| 11.1 Japan Hydraulics Market Revenue Ranking, By Companies, 2024 |

| 11.2 Japan Hydraulics Market Competitive Benchmarking, By Operating and Technical Parameters |

| 12. Company Profiles |

| 12.1 Kawasaki Heavy Industries Ltd |

| 12.2 Nidec Motor Corporation |

| 12.3 Bosch Rexroth Corporation |

| 12.4 SMC Corporation |

| 12.5 KYB Corporation |

| 12.6 KOYO Seiki Co. Ltd. |

| 12.7 Nabtesco Group |

| 12.8 Nachi-Fujikoshi Corp |

| 12.9 Daikin Industries, Ltd. |

| 12.10 Shimadzu Precision Technology |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Japan Hydraulics Market Revenues, 2020-2030F ($ Million) |

| 2. Japan Infrastructure Investment, 2020-2040F ($ Billion) |

| 3. Electric Power Consumption of Pneumatic & Standard Hydraulics System |

| 4. Initial Cost Comparison Pneumatic & Standard Hydraulics System |

| 5. Japan Hydraulics Market Revenues Share, By Component, 2023 & 2030F |

| 6. Japan Hydraulics Market Revenues Share, By Type, 2023 & 2030F |

| 7. Japan Hydraulics Market Revenues Share, By End User, 2023 & 2030F |

| 8. Japan Construction Market Investment Trends and Estimates, 2020-2025F, ($ Billion) |

| 9. Japan Battery Electric Vehicle Sales, 2020-2023, (In Units) |

| 10. Japan Automotive Production Volume, 2020-2024, (In Units) |

| 11. Japan Car Sales Volume, 2020-2023, (In Units) |

| 12. Japan Hydraulics Market Opportunity Assessment, By Component (2030F) |

| 13. Japan Hydraulics Market Opportunity Assessment, By Type (2030F) |

| 14. Japan Hydraulics Market Opportunity Assessment, By End User (2030F) |

| 15. Japan Hydraulics Market Revenue Ranking, By Companies, 2023 |

| List of Tables |

| 1. Major Upcoming Infrastructure Projects in Japan |

| 2. Japan Hydraulics Market Revenues, By Component, 2020-2030F ($ Million) |

| 3. Japan Hydraulics Market Revenues, By Type, 2020-2030F ($ Million) |

| 4. Japan Hydraulics Market Revenues, By End User, 2020-2030F ($ Million) |

| 5. Upcoming Projects in Japan |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero