Kazakhstan Ethanol Market (2025-2031) | Size, Value, Analysis, Companies, Industry, Growth, Revenue, Share, Outlook, COVID-19 IMPACT, Forecast & Trends

MarketForecastBy Purity (Denatured, Non-Denatured), By Sources (Sugar & Molasses Based, Grained Based, Second Generation) By Application (Industrial Solvent, Fuel & Fuel Additives, Beverages, Disinfectant, Personal Care, Others) And Competitive Landscape

| Product Code: ETC003153 | Publication Date: Jul 2020 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

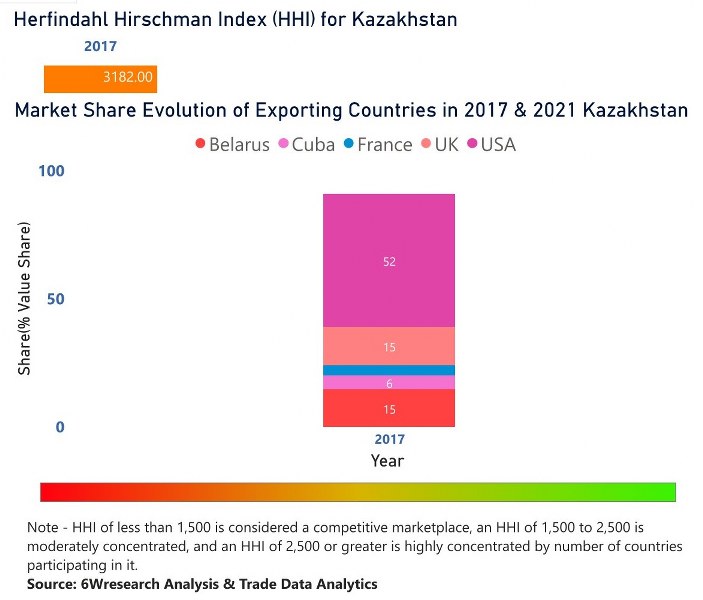

Kazakhstan Ethanol Market | Country-Wise Share and Competition Analysis

Kazakhstan Ethanol Market - Export Market Opportunities

Kazakhstan Ethanol Market Highlights

| Report Name | Kazakhstan Ethanol Market |

| Forecast period | 2025-2031 |

| CAGR | 4.3% |

| Growing Sector | Transportation |

Topics Covered in the Kazakhstan Ethanol Market Report

The Kazakhstan Ethanol Market report thoroughly covers the market by Purity, Source, and Application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Kazakhstan Ethanol Market Synopsis

The Kazakhstan Ethanol Market has witnessed growth in the past years. It is expected to grow significantly in the coming years. This growth is attributed to various factors such as policies implemented by the government, increasing population, rising people's concerns about climate change, improving the country’s economy, and diversification of the agriculture sector.

According to 6Wresearch, the Kazakhstan Ethanol Market size is expected to grow at a significant CAGR of 8% during 2025-2031. One of the primary drivers for the market is government policies. They have implemented policies to encourage the use of renewable energy sources, including ethanol production. With increasing concerns about air pollution and climate change, there is a growing demand for clean fuels such as ethanol. This has led to an increase in the production and use of ethanol in Kazakhstan. Moreover, ethanol production provides an additional source of income for Kazakh farmers, allowing them to diversify their crops and mitigate risks associated with relying on a single crop. Additionally, the ethanol industry creates job opportunities both in production and distribution, contributing to economic growth and development.

The production of ethanol requires large quantities of feedstock, and Kazakhstan is facing challenges in meeting this demand due to limited land availability and competition with other agricultural commodities. The lack of proper infrastructure for transportation, storage, and distribution of ethanol hinders the growth of the market. Kazakhstan also faces competition from imported ethanol, which is cheaper than domestically produced ethanol due to subsidies and lower production costs in other countries.

Kazakhstan Ethanol Industry: Leading Players

Some of the major players in the Kazakhstan ethanol market include JSC “Kazanorgsintez”, KazMunayGas, PetroKazakhstan Oil Products LLP, Kazakhmys Corporation, and Emir Oil Company. These companies are actively involved in the production and distribution of ethanol within Kazakhstan and also export to other countries.

Kazakhstan Ethanol Market: Government Regulations

One of the key initiatives taken by the government is the adoption of a biofuel mandate, which requires all gasoline sold in Kazakhstan to contain at least 2% ethanol. Additionally, the government provides subsidies and tax breaks for companies investing in ethanol production facilities. The government has also established the National Biofuels Development Program, which aims to increase the share of biofuels, including ethanol, in the country's overall energy mix. Furthermore, the government has entered into partnerships with other countries, such as Brazil and the United States, to exchange knowledge and technology related to ethanol production.

Future Insights of the Market

The demand for ethanol in Kazakhstan is expected to grow significantly in the coming years due to increasing awareness about environmental sustainability and the government's push towards renewable energy sources. The country's plans to increase ethanol production capacity and promote the use of alternative fuels are expected to drive market growth. Additionally, Kazakhstan's geographical location as a land-locked country presents an opportunity for the development of a strong domestic ethanol industry for both fuel and industrial purposes.

Market Segmentation by Purity

According to Ravi Bhandari, Research Head, 6Wresearch, the non-denatured segment is currently experiencing significant growth in the Kazakhstan ethanol market due to the increasing demand for high-purity ethanol in various industries such as personal care, disinfectants, and beverages.

Market Segmentation by Source

In terms of source, the sugar & molasses-based segment is expected to witness considerable growth due to the abundance of these materials in Kazakhstan and advancements in technologies.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kazakhstan Ethanol Market Overview

- Kazakhstan Ethanol Market Outlook

- Kazakhstan Ethanol Market Forecast

- Historical Data of Kazakhstan Ethanol Market Revenues and Volumes, for the Period 2021-2031

- Market Size & Forecast of Kazakhstan Ethanol Market Revenues and Volumes, until 2031

- Historical Data of Kazakhstan Ethanol Market Revenues and Volumes, by purity, for the Period 2021-2031

- Market Size & Forecast of Kazakhstan Ethanol Market Revenues and Volumes, by purity, until 2031

- Historical Data of Kazakhstan Ethanol Market Revenues and Volumes, by Source, for the Period 2021-2031

- Market Size & Forecast of Kazakhstan Ethanol Market Revenues and Volumes, by source, until 2031

- Historical Data of Kazakhstan Ethanol Market Revenues and Volumes, by application, for the Period 2021-2031

- Market Size & Forecast of Kazakhstan Ethanol Market Revenues and Volumes, by application, until 2031

- Market Drivers and Restraints

- Kazakhstan Ethanol Market Price Trends

- Kazakhstan Ethanol Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Kazakhstan Ethanol Market Share, By Players

- Kazakhstan Ethanol Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

By Purity

- Denatured

- Non-Denatured

By Source

- Sugar & molasses Based

- Second Generation

- Grain Based

By Application

- Fuel & Fuel Additives

- Disinfectant

- Industrial Solvents

- Personal Care

- Beverages

- Others

Kazakhstan Ethanol Market (2025-2031) :FAQ

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Kazakhstan Ethanol Market Overview |

| 3.1 Kazakhstan Ethanol Market Revenues and Volume, 2021-2031F |

| 3.2 Kazakhstan Ethanol Market Revenue Share, By Purity, 2021&2031F |

| 3.3 Kazakhstan Ethanol Market Revenue Share, By Source, 2021&2031F |

| 3.4 Kazakhstan Ethanol Market Revenue Share, By Application, 2021&2031F |

| 3.5 Kazakhstan Ethanol Market - Industry Life Cycle |

| 3.6 Kazakhstan Ethanol Market - Porter’s Five Forces |

| 4. Kazakhstan Ethanol Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Kazakhstan Ethanol Market Trends |

| 6. Kazakhstan Ethanol Market Overview, by Source |

| 6.1 Kazakhstan Sugar & Molasses Based Ethanol Market Revenues and Volume, 2021-2031F |

| 6.2 Kazakhstan Grained Based Ethanol Market Revenues and Volume, 2021-2031F |

| 6.3 Kazakhstan Second Generation Ethanol Market Revenues and Volume, 2021-2031F |

| 7. Kazakhstan Ethanol Market Overview, by Purity |

| 7.1 Kazakhstan Ethanol Market Revenue and Volumes, By Denatured, 2021-2031F |

| 7.2 Kazakhstan Ethanol Market Revenue and Volumes, By Non-Denatured, 2021-2031F |

| 8. Kazakhstan Ethanol Market Overview, by Application |

| 8.1 Kazakhstan Ethanol Market Revenue and Volumes, By Industrial Solvent, 2021-2031F |

| 8.2 Kazakhstan Ethanol Market Revenue and Volumes, By Fuel & Fuel Additives, 2021-2031F |

| 8.3 Kazakhstan Ethanol Market Revenue and Volumes, By Beverages, 2021-2031F |

| 8.4 Kazakhstan Ethanol Market Revenue and Volumes, By Disinfectant, 2021-2031F |

| 8.5 Kazakhstan Ethanol Market Revenue and Volumes, By Personal Care, 2021-2031F |

| 8.6 Kazakhstan Ethanol Market Revenue and Volumes, By Others, 2021-2031F |

| 9. Kazakhstan Ethanol Market Key Performance Indicators |

| 10. Kazakhstan Ethanol Market Opportunity Assessment |

| 10.1 Kazakhstan Ethanol Market Opportunity Assessment, By Purity, 2031F |

| 10.2 Kazakhstan Ethanol Market Opportunity Assessment, By Source, 2031F |

| 10.3 Kazakhstan Ethanol Market Opportunity Assessment, By Application, 2031F |

| 11. Kazakhstan Ethanol Market Competitive Landscape |

| 11.1 Kazakhstan Ethanol Market By Companies, 2024 |

| 11.2 Kazakhstan Ethanol Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero