Kenya Ethanol Market (2022-2028) | Trends, Value, Revenue, Outlook, Forecast, Size, Analysis, Growth, Industry, Share, Segmentation & COVID-19 IMPACT

MarketForecastBy Purity (Denatured, Non-Denatured), By Sources (Sugar & Molasses Based, Grained Based, Second Generation) By Application (Industrial Solvent, Fuel & Fuel Additives, Beverages, Disinfectant, Personal Care, Others) And Competitive Landscape

| Product Code: ETC003154 | Publication Date: Jan 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 62 | No. of Figures: 17 | No. of Tables: 3 |

Kenya Ethanol Market | Country-Wise Share and Competition Analysis

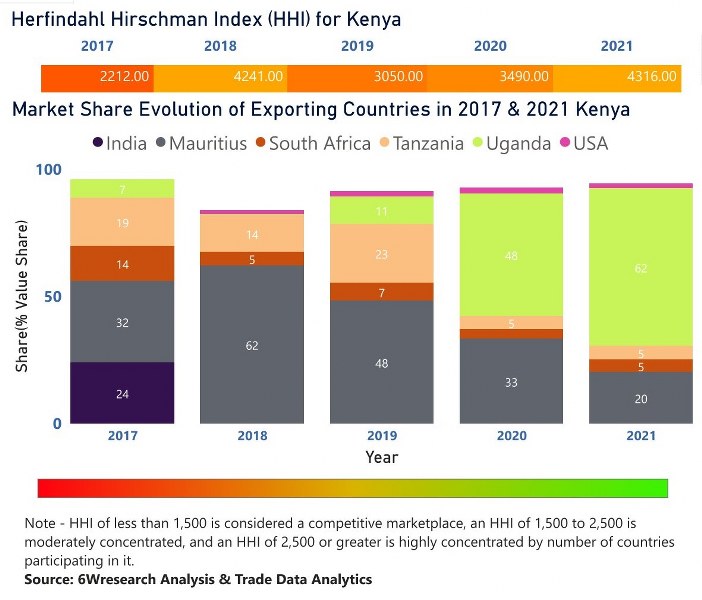

In the year 2021, Uganda was the largest exporter in terms of value, followed by Mauritius. It has registered a growth of 38.37% over the previous year. While Mauritius registered a decline of -34.45% as compare to the previous year. In the year 2017 Mauritius was the largest exporter followed by India. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Kenya has the Herfindahl index of 2212 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 4316 which signifies high concentration in the market.

Kenya Ethanol Market - Export Market Opportunities

The Kenya Ethanol Market report comprehensively covers the market by types, applications, and regions. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Kenya Ethanol Market Synopsis

Kenya ethanol market was growing rapidly prior to the COVID-19 outbreak as the country has been witnessing sharp growth in the overall consumption due to urbanization, women employment and industrial growth, hence, the major share of ethanol market was possessed by the food and beverage industry of the country which is one of the major contributor to the Kenyan economy. The year 2020 witnessed disruption in the trend coupled by demand and supply shocks to the ethanol market, resulting in disinfectants gaining the largest share in the demand as the virus was controlled by using alcohol concentrated sanitizers and disinfectants, thereby, ethanol market saw the highest growth in revenue as the demand was coming from all the sectors of the economy including government, commercial, industrial as well as residential applications. However, the interim trend is gradually fading away and disinfectants share would return to the pre-covid levels with a minimal positive change as the consumption pattern returns to normal.

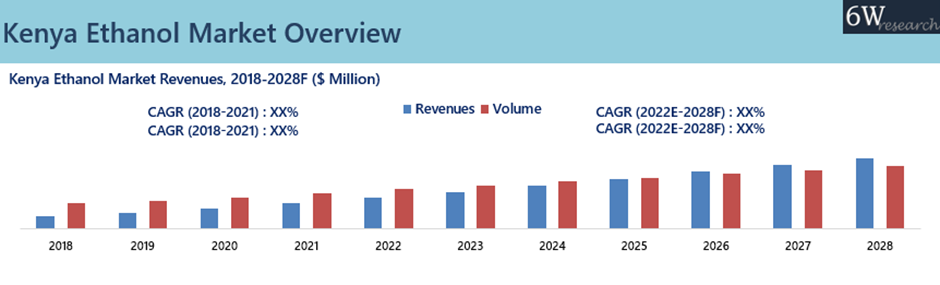

According to 6Wresearch, Kenya Ethanol Market size is anticipated to grow at a CAGR of 15.0% in terms of revenues during 2022-2028. The market would grow rapidly in coming years as the country’s economic structure is in the transition phase and the country is witnessing expansion in the cosmetics and personal care industry, thereby, Kenya would witness exponential growth in the denatured ethanol. Also, the pharma industry of the country would also spur demand for denatured alcohols in industrial solvents, lacquers, anti-infective drugs owing to rising capacity additions in the country such as the Bangladesh’s Square Pharmaceuticals is investing $74 million in Nairobi for setting up of new manufacturing plant along with growing private investment would cause the market to grow rapidly in coming years.

Furthermore, the growing requirements of the power and fuel to support the emerging economy would further strengthen ethanol position in the fuels and fuel additive segments, as Kenya has planned to substitute primary fuels such as wood, coal, LPG and Kerosene with ethanol fuel would increase the revenues in the fuels and fuel additives application of ethanol in the country. Hence, the Kenya Ethanol Cooking fuel masterplan, 2020 for the establishment of the ECF industry in Kenya would serve as a gamechanger for the overall revenue generation potential in the country.

Market by Purity

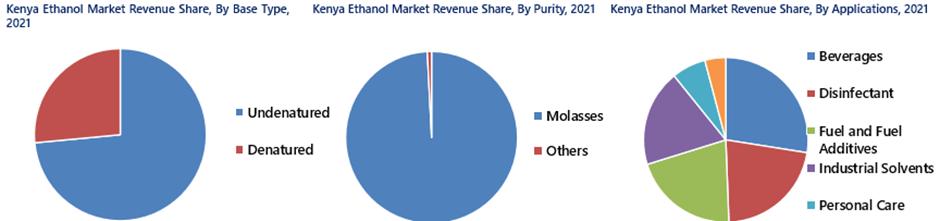

Sugarcane is the main crop in western Kenya, and most of the sugar processing plants are situated in and near Kisumu county. The country has gained competence in sugarcane production and thus in the sugar processing over the last century. Hence, molasses present the greater cost efficacy and productivity in relation to its counterparts in the country.

Market by Applications

Owing to the contribution of the beverage sector in the manufacturing of the country, rapidly growing urbanization and increasing disposable incomes, the beverage industry is expected to contribute the most to the ethanol revenues of the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- Historical Data Starting from 2018 to 2028.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

Key Highlights of the Report:

- Kenya Ethanol Market Overview

- Kenya Ethanol Market Outlook

- Kenya Ethanol Market Forecast

- Historical Data and Forecast of Kenya Ethanol Market Revenues and Volume for the Period 2018-2028F

- Historical Data and Forecast of Kenya Ethanol Market Revenues and Volume, By Source Types, for the Period 2018-2028F

- Historical Data and Forecast of Kenya Ethanol Market Revenues and Volume, By Purity, for the Period 2018-2028F

- Historical Data and Forecast of Kenya Ethanol Market Revenues, By Applications, for the Period 2018-2028F

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of COVID-19

- Market Drivers and Restraints

- Market Trends and Evolution

- Kenya Ethanol Revenues Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Source Types

- Molasses

- Others (Wheat, Maize, Sugarcane, Roots and Tubers)

By Purity

- Denatured

- Undentaured

By Applications

- Fuel & Fuel Additives

- Disinfectant

- Industrial Solvents

- Personal Care

- Beverages

- Others (Plastic, Paint, and Lacquers)

Kenya Ethanol Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Kenya Ethanol Market Overview |

| 3.1. Kenya Ethanol Market Revenues and Volume, 2018-2028F |

| 3.2. Kenya Ethanol Market- Industry Life Cycle, 2021 |

| 3.3. Kenya Ethanol Market Porter's 5 Forces |

| 4. COVID-19 Impact Analysis on Kenya Ethanol Market |

| 5. Kenya Ethanol Market Dynamics |

| 5.1 Impact Analysis |

| 5.2. Market Drivers |

| 5.3 Market Restraint |

| 6. Kenya Ethanol Market Trends & Evolution |

| 7. Kenya Ethanol Market Overview, By Source |

| 7.1 Kenya Ethanol Market Revenues, By Source |

| 7.1.1 Kenya Molasses Ethanol Market Revenues (2018-2028F) |

| 7.1.2 Kenya Others Ethanol Market Revenues (2018-2028F) |

| 8. Kenya Ethanol Market Overview, By Purity |

| 8.1 Kenya Ethanol Market Revenues, By Purity |

| 8.1.1 Kenya Ethanol Market Revenues, By Non-Denatured (2018-2028F) |

| 8.1.2 Kenya Ethanol Market Revenues, By Denatured (2018-2028F) |

| 9. Kenya Ethanol Market Overview, By Applications |

| 9.1 Kenya Ethanol Market Revenues, By Applications |

| 9.1.1 Kenya Ethanol Market Revenues, By Pharmaceutical (2018-2028F) |

| 9.1.2 Kenya Ethanol Market Revenues, By Disinfectants (2018-2028F) |

| 9.1.3 Kenya Ethanol Market Revenues, By Industrial Solvents (2018-2028F) |

| 9.1.4 Kenya Ethanol Market Revenues, By Personal Care (2018-2028F) |

| 9.1.5 Kenya Ethanol Market Revenues, By Beverages (2018-2028F) |

| 9.1.6 Kenya Ethanol Market Revenues, By Others (2018-2028F) |

| 10. Kenya Ethanol Market Import Export Trade Analysis |

| 10.1 Kenya Ethanol Market Volume, By Import & Export |

| 10.1.1 Kenya Ethanol Market Volume, By Import (2015-2021) |

| 10.1.2 Kenya Ethanol Market Volume, By Export (2015-2021) |

| 11. Kenya Ethanol Market Key Performance Indicators |

| 11.1 Kenya Beauty and Personal Care Outlook Outlook |

| 11.2 Kenya Beverage Industry Outlook |

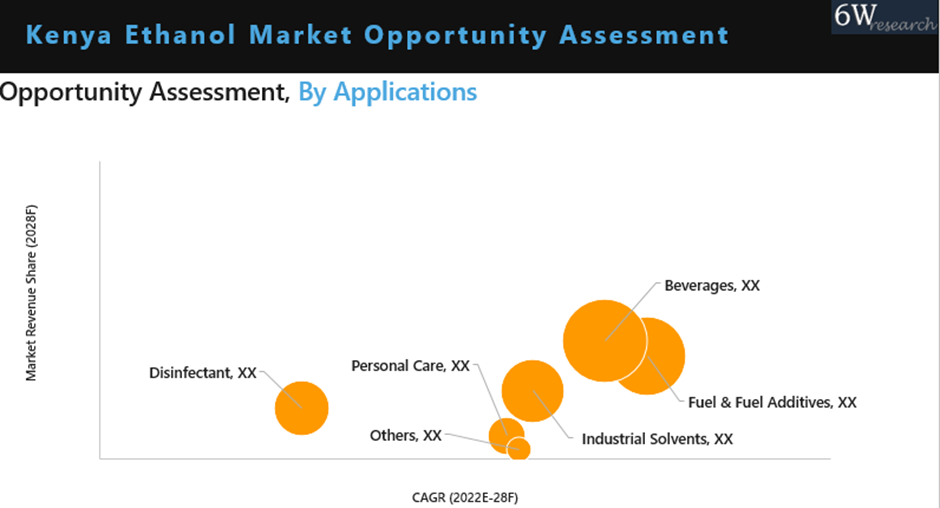

| 12. Kenya Ethanol Market Opportunity Assessment |

| 12.1 Kenya Ethanol Opportunity Assessment, By Source (2028F) |

| 12.2 Kenya Ethanol Opportunity Assessment, By Purity (2028F) |

| 12.3 Kenya Ethanol Opportunity Assessment, By Applications (2028F) |

| 13. Kenya Ethanol Market – Competitive Landscape |

| 13.1 Kenya Ethanol Market Revenue Ranking, By Company (2021) |

| 13.2.1 Kenya Ethanol Market Competitive Benchmarking, By Technical Parameters |

| 13.2.2 Kenya Ethanol Market Competitive Benchmarking, By Operating Parameters |

| 14. Company Profiles |

| 14.1 Agro Chemicals and Food Company |

| 14.2 Kibos Sugar and Allied Industries |

| 14.3 Kwale International Sugar Co. Ltd (Kiscol) |

| 14.4 Mumias Sugar Company |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. Kenya Ethanol Market Revenues and Volume (2018 – 2028F) in $ Million and Million Liters |

| 2. Kenya Ethanol Market Covid Impact in Production and Consumption, 2019 & 2020 in (Million Liters) |

| 3. Kenya Urban Population, Millions |

| 4. Kenya Sugar Consumption (MY-2022 & MY-2023) in Million Metric Tonnes |

| 5. Kenya Consumer Price Index |

| 6 . Kenya Ethanol Revenue Share, By Base Type, 2021 & 2028F |

| 7. Kenya Ethanol Revenue Share, By Purity, 2021 & 2028F |

| 8. Kenya Ethanol Revenue Share, by Applications, 2021 & 2028F |

| 9. Kenya Ethanol Export Volume, 2015-2021 (Tons) |

| 10. Kenya Ethanol Import Volume, 2015-2021 (Tons) |

| 11. Kenya Beauty and Personal Care Industry, in hundred $ |

| 12. Kenya Distilled Spirits and Wine Market, $ Million |

| 13. Kenya Food, Beverages and Tobacco Production, $ Billion |

| 14. Kenya Ethanol Market Opportunity Assessment, By Base Type, 2028F ($ Million) |

| 15. Kenya Ethanol Market Opportunity Assessment, By Purity, 2028F ($ Million) |

| 16. Kenya Ethanol Market Opportunity Assessment, By Applications, 2028F ($ Million) |

| 17. Kenya Key Strategic Recommendation Map, 2022 |

| List of Tables |

| 1. Kenya Ethanol Market Revenues, By Base Type, 2018–2028F, ($ Million) |

| 2. Kenya Ethanol Market Revenues, By Purity, 2018-2028F, (S Million) |

| 3. Kenya Ethanol Market Revenues, By Applications, 2018-2028F, $ Million |

Market Forecast By Purity (Denatured, Non-Denatured), By Sources (Sugar & Molasses Based, Grained Based, Second Generation) By Application (Industrial Solvent, Fuel & Fuel Additives, Beverages, Disinfectant, Personal Care, Others) And Competitive Landscape

| Product Code: ETC003154 | Publication Date: Jul 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Kenya Ethanol Market is anticipated to register growth over the upcoming years due to the increasing popularity of premium quality alcoholic beverages coupled with rising production of alcoholic beverages through fermentation of sugar in grains, fruits, and other sources. The oil crises, growing demand for ethanol as fuel, and rising Kenyan government investment in ethanol production would further boost the ethanol market in Kenya.

According to 6wresearch, the Kenya Ethanol Market size is expected to grow during 2020-2026. The ethanol market in Kenya is anticipated to face a decline in economic growth owing to the outbreak of the coronavirus pandemic in the country which has created an imbalance in the demand for ethanol as a fuel and has impacted various sectors in the country. However, in Kenya, the ethanol market is expected to recover healthy growth in the economy over the coming years. Moreover, the rising awareness regarding indoor and outdoor hygiene coupled with the disinfectant properties of ethanol is expected to enhance the ethanol market in Kenya.

Based on source, the sugar & molasses-based segment is expected to lead the ethanol market revenue share in Kenya owing to the surging production of ethanol from sugar beet and sugarcane along with the government has also declared that there would be no separate environment clearance needed to produce extra ethanol from molasses as it doesn’t enhance the pollution load. In application, the fuel & fuel additives segment is expected to hold the ethanol market revenue share in Kenya due to its various beneficial factors such as better fuel efficiency, cost-saving, and easy to use coupled with increasing demand in the automotive industry.

The Kenya Ethanol Market report thoroughly covers the Kenya Ethanol Market by purity, source, and application. The Kenya Ethanol Market outlook report provides an unbiased and detailed analysis of the on-going Kenya Ethanol Market trends, opportunities/high growth areas, market drivers, and Kenya Ethanol Market share by companies, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Kenya Ethanol market is expected to register sound revenues in the coming timeframe on the back of the rising use of cosmetic products and personal care products such as deodorant underpinned by rising appearance concern in the country is expected to instigate the use of ethanol solution in the forthcoming years. Further, rising ethanol use in the food industry as a flavoring aspect tends to enhance food flavors. Moreover, the rising use of cosmetic products and the emerging food industry act as a catalyst that is estimated to propel the use of ethanol and would benefit the Kenya ethanol market in the upcoming six years.

Kenya Ethanol market is expected to gain traction in the forthcoming years on the back of the rising population growth, the rise in the number of middle-class families, improving population lifestyle towards physical appearance, as a result, the use of cosmetics products is high, to set up their style statement. All these drivers are expected to act as growth proliferating factors and are estimated to benefit the Kenya ethanol market to grow considerably in the foreseeable future. Further, Kenya registered as a sales and distribution hub of cosmetic products in the entire east African country, with an availability of international brands is leading to accelerate the use of ethanol in perfumes and deodorant and would benefit the Kenya ethanol market in the coming years.

Key Highlights of The Reports

- Kenya Ethanol Market Overview

- Kenya Ethanol Market Outlook

- Kenya Ethanol Market Forecast

- Historical Data of Kenya Ethanol Market Revenues and Volumes, for the Period 2016-2019.

- Market Size & Forecast of Kenya Ethanol Market Revenues and Volumes, until 2026.

- Historical Data of Kenya Ethanol Market Revenues and Volumes, by purity, for the Period 2016-2019.

- Market Size & Forecast of Kenya Ethanol Market Revenues and Volumes, by purity, until 2026.

- Historical Data of Kenya Ethanol Market Revenues and Volumes, by Source, for the Period 2016-2019.

- Market Size & Forecast of Kenya Ethanol Market Revenues and Volumes, by source, until 2026.

- Historical Data of Kenya Ethanol Market Revenues and Volumes, by application, for the Period 2016-2019.

- Market Size & Forecast of Kenya Ethanol Market Revenues and Volumes, by application, until 2026.

- Market Drivers and Restraints

- Kenya Ethanol Market Price Trends

- Kenya Ethanol Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Kenya Ethanol Market Share, By Players

- Kenya Ethanol Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Kenya Ethanol Market report provides a detailed analysis of the following market segments:

- By Purity:

-

- Denatured

- Non-Denatured

- By Source:

-

- Sugar & molasses Based

- Second Generation

- Grain Based

- By Application:

- Fuel & Fuel Additives

- Disinfectant

- Industrial Solvents

- Personal Care

- Beverages

- Others

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero