Kuwait Wires and Cables Market (2024-2030) | Share, Companies, Analysis, Trends, Size, Revenue, Value, Industry, Forecast & Growth

Market Forecast By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra High Voltage), By Products (Multi Conductor, Twisted Pair, Coaxial and Fibre Optics), By Installations (Overhead and Underground), By Materials (Copper, Aluminum and Glass), By Applications (Residential, Commercial, Industrial, Energy and Power, IT and Telecommunication and Others ((Hospitality, Healthcare, Aerospace, etc.)) And Competitive Landscape

| Product Code: ETC072094 | Publication Date: Aug 2024 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 56 | No. of Figures: 10 | No. of Tables: 8 |

Topics Covered in Kuwait Wires and Cables Market Report

Kuwait Wires and Cables Market Report thoroughly covers the market by voltage, cable and application. Kuwait Wires and Cables Market Outlook report provides an unbiased and detailed analysis of the ongoing Kuwait Wires and Cables Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Kuwait Wires and Cables Market Synopsis

Kuwait wires and cables market has experienced significant growth in recent years, driven by substantial government investments in infrastructure. In 2023, Kuwait allocated $27.6 billion to infrastructure projects, with an additional $1.4 billion set aside for 2024-2025. Key projects include the expansion of Kuwait International Airport to increase passenger capacity to 25 million and the development of a metro rail network in Kuwait City to ease road congestion and improve urban mobility. The ongoing improvement in Kuwait’s infrastructure and residential sectors, under the Vision 2035 initiative, is expected to further boost demand for cables and wires. Notably, the government’s commitment to large-scale housing projects, valued at approximately USD 135 billion, including the expansion of Saad Al Abdullah, South Sabah Al Ahmad, and East Sabah Al Ahmad, will drive growth in the construction sector and, consequently, elevate the demand for cables and wires.

According to 6Wresearch, Kuwait Wires and Cables Market revenue size is projected to grow at a Revenue CAGR of 5.7% during 2024-2030. This growth can be attributed to government initiatives aimed at promoting residential and commercial development, nearly $45 billion investment in allocations to build new cities and develop its infrastructure which are expected to drive the demand for wires and cables in the years ahead. Furthermore, Kuwait has approved 239 projects with a combined value of around $3.15 billion for the new fiscal year and also revealed a four-year plan for 2023-2027, which included 107 major projects covering all economic, social, entertainment, and human resource fields by 2027, and would drive robust demand for wires and cables in the Kuwait market during the forecast period.

Market Segmentation by Voltage

In 2023, the low voltage segment dominated the Kuwait wires and cables market, driven by high demand across the residential and commercial sector, security, building and construction power distribution, and infrastructure sectors. Additionally, the Public Authority for Housing and Welfare announced plans to construct 250,000 housing units over the next decade and increasing the need for low voltage cables.

Market Segmentation by Cable

In 2023, power cables held the highest revenue share in the Kuwait cables segment, driven by their essential role in extensive infrastructure and power projects. Significant investments in power generation, transmission, and distribution networks, spurred by Kuwait's development plans and urbanization, fuel this demand. This trend is expected to continue, supported by economic growth under the Kuwait Vision 2035 development program. The $100 billion five-year development plan is set to further boost demand, opening avenues for future projects, further bolstering the demand for power cables and securing their market dominance.

Market Segmentation by Application

Power utilities dominate the applications segment of Kuwait's wires and cables market due to significant investments in national power infrastructure upgrades and expansions. Rising electricity demand, driven by rapid urbanization and industrial growth, along with large-scale projects like new power plants and grid expansions, boosts the need for wires and cables. Additionally, the expansion of residential suburbs such as Saad Al Abdullah, South Sabah Al Ahmad, and East Sabah Al Ahmad will increase housing supply and further drive market growth in the coming years.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kuwait Wires and Cables Market Overview

- Kuwait Wires and Cables Market Outlook

- Kuwait Wires and Cables Market Forecast

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues for the Period 2020-2030F

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues, By Voltage, for the Period 2020-2030F

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues, By Cables, for the Period 2020-2030F

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues, By Application, for the Period 2020-2030F

- Market Drivers and Restraints

- Key Performance Indicators

- Kuwait Wires and Cables Market Revenue Share, By Companies, 2023

- Key Competitors Analysis

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Cable

- Power Cables

- Coaxial Cables

- Fiber Optic Cables

- Signal and Control Cables

- Telecom and Data Cables

By Application

- Commercial

- Residential

- Power Utilities

- Industrial

- Others

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Kuwait Wires and Cables Market Overview |

| 3.1 Kuwait Wires and Cables Market Revenues, 2020-2030F |

| 3.2 Kuwait Wires and Cables Market Industry Life Cycle |

| 3.3 Kuwait Wires and Cables Systems Market-Porter’s Five Forces |

| 4. Kuwait Wires and Cables Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing government investments in infrastructure projects in Kuwait |

| 4.2.2 Growing demand for electricity and power transmission infrastructure |

| 4.2.3 Technological advancements leading to the development of high-quality wires and cables |

| 4.3. Market Restraints |

| 4.3.1 Fluctuating prices of raw materials such as copper and aluminum |

| 4.3.2 Intense competition among market players |

| 4.3.3 Volatility in global economic conditions affecting the market |

| 5. Kuwait Wires and Cables Market Overview, By Voltage |

| 5.1 Kuwait Wires and Cables Market Revenue Share and Revenues, By Voltage |

| 5.1.1 Kuwait Wires and Cables Market Revenue, By Low Voltage |

| 5.1.2 Kuwait Wires and Cables Market Revenues, By Medium Voltage |

| 5.1.3 Kuwait Wires and Cables Market Revenues, By High Voltage |

| 5.1.4 Kuwait Wires and Cables Market Revenues, By Extra High Voltage |

| 6. Kuwait Wires and Cables Market Overview, By Cables |

| 6.1 Kuwait Wires and Cables Market Revenue Share and Revenues, By Cables |

| 6.1.1 Kuwait Wires and Cables Market Revenues, By Power Cables |

| 6.1.2 Kuwait Wires and Cables Market Revenues, By Coaxial Cables |

| 6.1.3 Kuwait Wires and Cables Market Revenues, By Fibre Optic Cables |

| 6.1.4 Kuwait Wires and Cables Market Revenues, By Signal and Control Cables |

| 6.1.5 Kuwait Wires and Cables Market Revenues, By Telecom and Data Cables |

| 7. Kuwait Wires and Cables Market Overview, By Applications |

| 7.1 Kuwait Wires and Cables Market Revenue Share and Revenues, By Applications |

| 7.1.1 Kuwait Wires and Cables Market Revenues, By Commercial |

| 7.1.2 Kuwait Wires and Cables Market Revenues, By Residential |

| 7.1.3 Kuwait Wires and Cables Market Revenues, By Power Utilities |

| 7.1.4 Kuwait Wires and Cables Market Revenues, By Industrial |

| 7.1.5 Kuwait Wires and Cables Market Revenues, By Others |

| 8.Kuwait Wires and Cables Market Opportunity Assessment |

| 8.1 Kuwait Wires and Cables Market Opportunity Assessment, By Voltage |

| 8.2 Kuwait Wires and Cables Market Opportunity Assessment, By Cables |

| 8.3 Kuwait Wires and Cables Market Opportunity Assessment, By Applications |

| 9. Kuwait Wires and Cables Market Key Performance Indicators |

| 9.1 Investment in research and development for new wire and cable technologies |

| 9.2 Adoption rate of energy-efficient wires and cables |

| 9.3 Demand for specialized wires and cables in industries such as oil and gas, construction, and telecommunications. |

| 10. Kuwait Wires and Cables Market- Competitive Landscape |

| 10.1 Kuwait Wires and Cables Market Revenue Share, By Companies |

| 10.2 Kuwait Wires and Cables Market Competitive Benchmarking, By Technical Parameters |

| 10.3 Kuwait Wires and Cables Market Competitive Benchmarking, By Operating Parameters |

| 11. Company Profiles |

| 11.1 Elsewedy Electric |

| 11.2 Alfanar Group |

| 11.3 MESC |

| 11.4 Bahra Cables |

| 11.5 Prysmian Group |

| 11.6 Gulf Cables & Electrical Industries Group Co. KSCP |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures |

| 1. Kuwait Wires and Cables Market Revenues, 2020-2030F ($ Million) |

| 2. Kuwait Wires and Cables Market Revenue Share, By Voltage, 2023 & 2030F |

| 3. Kuwait Wires and Cables Market Revenue Share, By Cables, 2023 & 2030F |

| 4. Kuwait Wires and Cables Market Revenue Share, By Applications, 2023 & 2030F |

| 5. Kuwait Wires and Cables Market Opportunity Assessment, By Voltage, 2030F |

| 6. Kuwait Wires and Cables Market Opportunity Assessment, By Cables, 2030F |

| 7. Kuwait Wires and Cables Market Opportunity Assessment, By Applications, 2030F |

| 8. Power generation Capacity Addition for MEWRE (2024-2029) |

| 9. Kuwait Proposed Construction Projects By Sector, 2021 (By Value) |

| 10. Kuwait Wires and Cables Market Revenue Share, By Companies, 2023 |

| List of Tables |

| 1. MEWRE Plan For Construction Of New Power Plants Till 2040 |

| 2. Upcoming Renewable Energy Projects |

| 3. Kuwait Main Imports (in %), 2023 |

| 4. Kuwait Wires and Cables Market Revenues, By Voltage, 2020-2030F ($ Million) |

| 5. Kuwait Wires and Cables Market Revenues, By Cables, 2020-2030F ($ Million) |

| 6. Kuwait Wires and Cables Market Revenues, By Applications, 2020-2030F ($ Million) |

| 7. List Of Power Generation Stations, By Capacity, 2022 |

| 8. Comparison of Different region/governorate in Kuwait |

Market Forecast By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra High Voltage), By Products (Multi Conductor, Twisted Pair, Coaxial and Fibre Optics), By Installations (Overhead and Underground), By Materials (Copper, Aluminum and Glass), By Applications (Residential, Commercial, Industrial, Energy and Power, IT and Telecommunication and Others ((Hospitality, Healthcare, Aerospace, etc.)) And Competitive Landscape

| Product Code: ETC072094 | Publication Date: Apr 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 80 | No. of Figures: 12 | No. of Tables: 8 |

Kuwait Wires and Cables Market report thoroughly covers the market by voltage, by-products, installations, materials, and applications. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

Kuwait Wires and Cables Market Synopsis

Kuwait wires and cables market has registered modest growth in 2021 on account of the government real estate projects for the development of the residential sector in the country such as Jaber Al Ahmad residential city and South Al Jahra labour city for immigrant workers. However, due to the outbreak of COVID-19 major construction projects came to a halt, which negatively impacted the demand for wires and cables in 2020. Although, as soon as the lockdown was lifted the market started recovering from the losses, and the market is expected to grow in the forecast period, fueled by the government plans to build an international airport, rail network, and logistics & industrial hub.

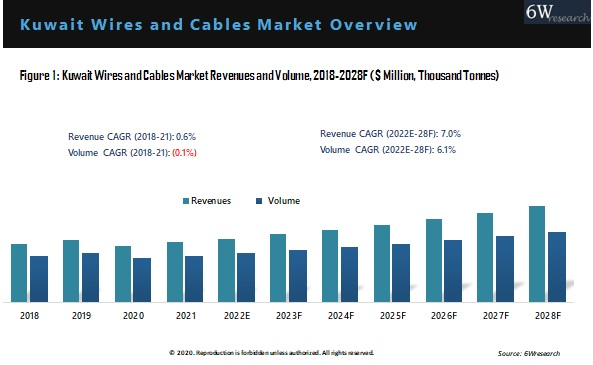

According to 6Wresearch, Kuwait Wires and Cables market size grew at a CAGR of 7.0% during 2022-2028. Government initiatives such as the Vision 2035 development program aimed at diversifying the economy by transforming Kuwait from a petro-state to a financial, logistics, and commercial trade hub by 2035 and reducing the reliance on the oil sector, boding well with the growing demand for wires and cables during the forecast period.

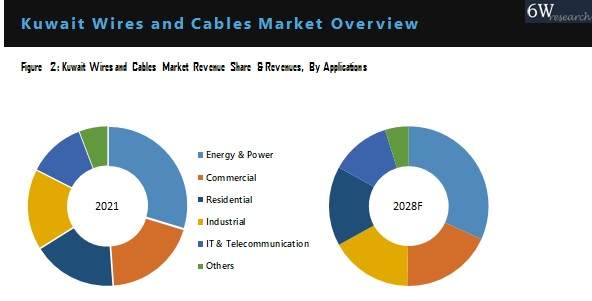

Market Analysis By Applications

In 2021, the energy & power segment held the majority of market revenue share in the Kuwait wires and cables market and is expected to maintain its dominance during the forecast period as well on account of the expansion of power transmission lines. Additionally, increasing power distribution efficiency by installing new power grids owing to government calls to increase electricity generation by 70%, reaching 32 GW in 2035, would further propel demand from the energy and power sector.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 6 Years Market Numbers.

- Estimated Data Starting from 2018 to 2028F.

- Base Year: 2021

- Forecast Data until 2028F.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Kuwait Wires and Cables Market Overview

- Kuwait Wires and Cables Market Outlook

- Kuwait Wires and Cables Market Forecast

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues and Volume for the Period 2018-2028F

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues, By Voltage for the Period 2018-2028F

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues, By-Products for the Period 2018-2028F

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues, By Installations for the Period 2018-2028F

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues, By Materials for the Period 2018-2028F

- Historical Data and Forecast of Kuwait Wires and Cables Market Revenues, By Applications for the Period 2018-2028F

- Market Drivers and Restraints

- Market Trends

- Industry Life Cycle

- Kuwait Wires and Cables Market – Porter’s Five Forces

- Market Opportunity Assessment

- Company Revenue Ranking/Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Products

- Multi-Conductor

- Twisted Pair

- Coaxial

- Fibre Optics

By Installations

- Overhead

- Underground

By Materials

- Copper

- Aluminum

- Glass

By Applications

- Residential

- Commercial

- Industrial

- Energy and Power

- IT and Telecommunication

- Others (Hospitality, Healthcare, Aerospace, etc.)

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero