Latin America Voluntary Carbon Credit Market Outlook (2021-2027) | Trends, Forecast, COVID-19 IMPACT, Growth, Analysis, Revenue, Share, Value, Industry, Size & Companies

Market Forecast By Types (Voluntary and Compliance), By Project Types (Forestry & Land Use Project, Transportation, Industry and Others), By Countries (Mexico and Brazil), And Competitive Landscape.

| Product Code: ETC072165 | Publication Date: May 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 120 | No. of Figures: 24 | No. of Tables: 14 |

Latin America Voluntary Carbon Credit Market report comprehensively covers the market by types, project types, and by countries. Latin America voluntary carbon credit market report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latin America Voluntary Carbon Credit Market Synopsis

Latin America has the world’s largest rainforest. Thus, the region has a lot of offsets generating potential from forest conservation and reforestation projects and is expected to be the fastest-growing region in terms of supply over the forecast period. However, the outbreak of the COVID-19 pandemic has resulted in a slowdown in the projects, especially during 2020 and the market has recovered gradually over the next few years.

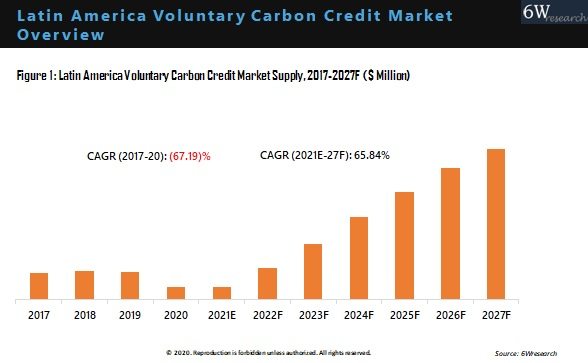

According to 6Wresearch, Latin America Voluntary Carbon Credit market is expected to grow at a CAGR of 65.84% during 2021-2027. As regulatory agencies and governments are becoming supportive of the voluntary carbon credit markets. The region is expected to be a key contributor to the overall global carbon offsets supply in the coming years.

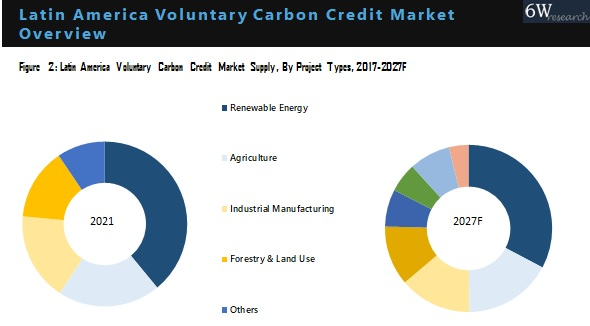

Market Analysis By Project Type

The agriculture sector held the highest revenue share in the overall Latin America Carbon Credit Market. Additionally, issues prevailing in the region for project developers such as lack of funds, lack of corporation from local authorities, and disruption of projects by local communities have led to low delivery from carbon offset projects in the region.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 6 Years Market Numbers.

- Estimated Data Starting from 2021 to 2027F.

- Base Year: 2021

- Forecast Data until 2027F.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Latin America Carbon Credit Market Overview

- Latin America Carbon Credit Market Outlook

- Latin America Carbon Credit Market Forecast

- Historical Data and Forecast of Latin America Carbon Credit Market Transaction Values, for the Period 2017-2027F

- Historical Data and Forecast of Latin America Carbon Credit Market Values, for the Period 2017-2027F

- Historical Data and Forecast of Latin America Carbon Credit Market, By Types, for the Period 2017-2027F

- Historical Data and Forecast of Latin America Carbon Credit Market, By Project Types, for the Period 2017-2027F

- Historical Data and Forecast of Latin America Carbon Credit Market, By Countries, for the Period 2017-2027F

- Impact Analysis of Covid-19

- Market Drivers, Restraints, and Trends

- Key Performance Indicators

- Industry Life Cycle & Porter’s Five Force Analysis

- Market Opportunity Assessment

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- Voluntary

- Compliance

By Project Types

- Forestry & Land Use Project

- Transportation

- Industry

- Others

By Countries

- Mexico

- Brazil

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Latin America Carbon Credit Market Overview |

| 3.1 Latin America Carbon Credit Market Transaction Values (2017-2027F) |

| 3.2 Latin America Carbon Credit Market Supply and Demand, In MtCO2e (2017-2027F) |

| 3.3 Latin America Carbon Credit Market Industry Life Cycle |

| 3.4 Latin America Carbon Credit Market Porter’s Five Forces Model |

| 3.5 Latin America Carbon Credit Market Ecosystem |

| 3.6 Latin America Carbon Credit Market Value Share, By Types (2020 & 2027F) |

| 3.7 Latin America Carbon Credit Market Value Share, By Countries (2020 & 2027F) |

| 4 Latin America Carbon Credit Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Latin America Carbon Credit Market Trends & Evolution |

| 6 Latin America Carbon Credit Market - Impact Analysis of COVID-19 |

| 7. Latin America Voluntary Carbon Credit Market Overview |

| 7.1 Latin America Voluntary Carbon Credit Market Supply, By Project Type (2017-2027F) |

| 8. Latin America Carbon Credit Market - Key Performance Indicators |

| 9. Latin America Carbon Credit Market - Price Trend Analysis (2017-2027F) |

| 10. Latin America Carbon Credit Market - Country Initiatives & Regulatory Scenario |

| 11. Analysis of Key Participants Involved in Carbon Credit Market |

| 12. Latin America Carbon Credit Market - Opportunity Assessment |

| 13. Latin America Carbon Credit Market Competitive Landscape |

| 14. Company Profiles |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- Saudi Arabia Conductors Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Australia Fire Doors Market (2023-2029) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- UAE Online Gifting Market (2023-2029) | Size, industry, Revenue, Growth, Size, Share, Value, Outlook & COVID-19 IMPACT

- India Baby Product Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- India Multiprotocol Label Switching-Transport Profile Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- India Plant Protein Market (2023-2029) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- India Switches Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Indonesia System Integrator Market (2024-2030) | Companies, Analysis, Industry, Growth, Forecast, Size, Value, Share, Revenue & Trends

- India LV Switchgear Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Hungary Air Conditioner Market (2024-2030) | Size, Trends, Industry, Forecast, Share, Growth, Value, Revenue, Analysis, Outlook & COVID-19 IMPACT

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines