Malaysia Furniture Market (2025-2031) | Growth, Share, Trends, Outlook, Forecast, Size, Value, Industry, Analysis, Revenue & Companies

Market Forecast By Material Types (Plastic, Wood, Metal, Other), By Applications (Residential, Commercial) And Competitive Landscape

| Product Code: ETC009766 | Publication Date: Jun 2023 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

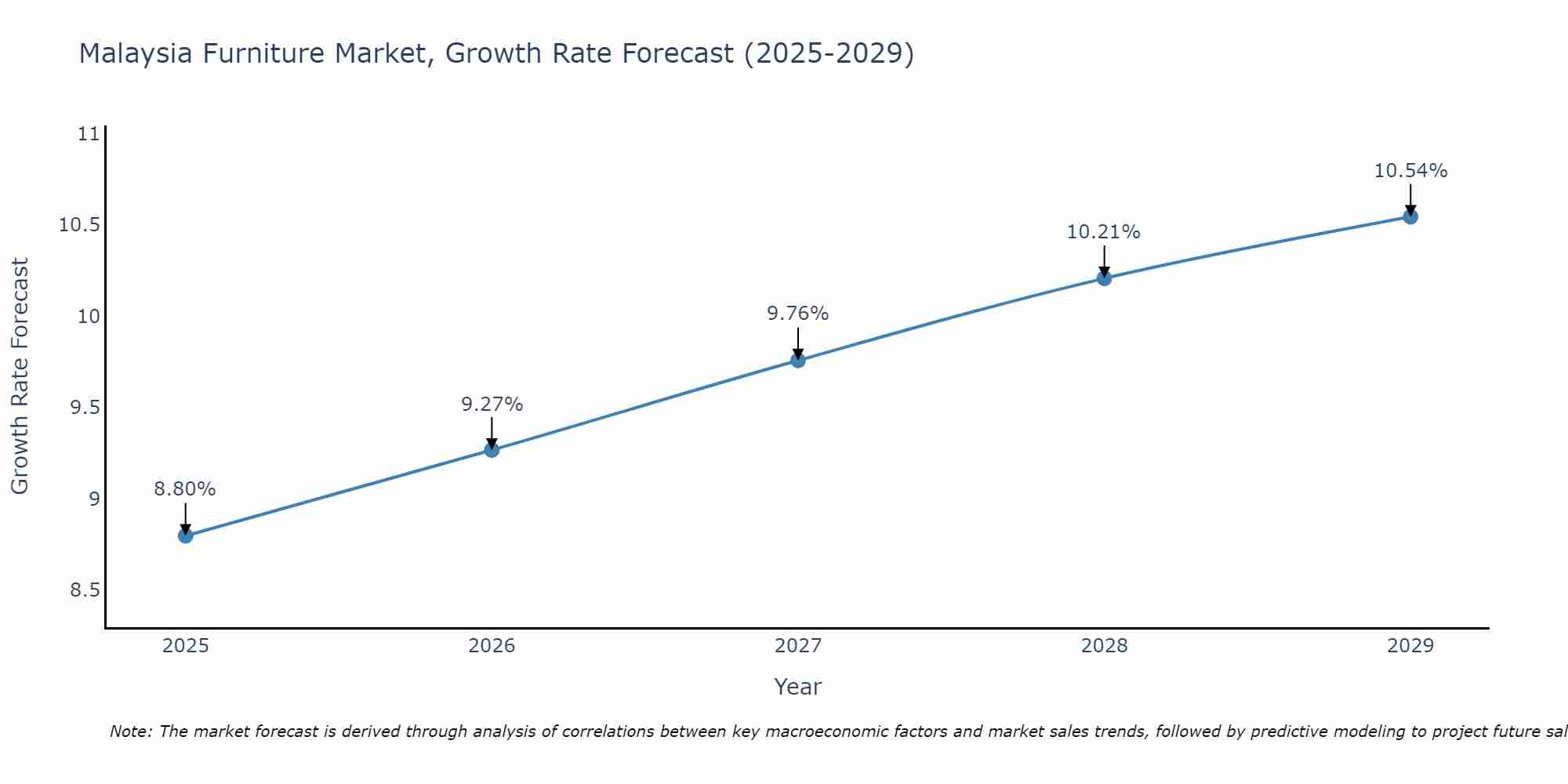

Malaysia Furniture Market Size Growth Rate

The Malaysia Furniture Market is likely to experience consistent growth rate gains over the period 2025 to 2029. The growth rate starts at 8.80% in 2025 and reaches 10.54% by 2029.

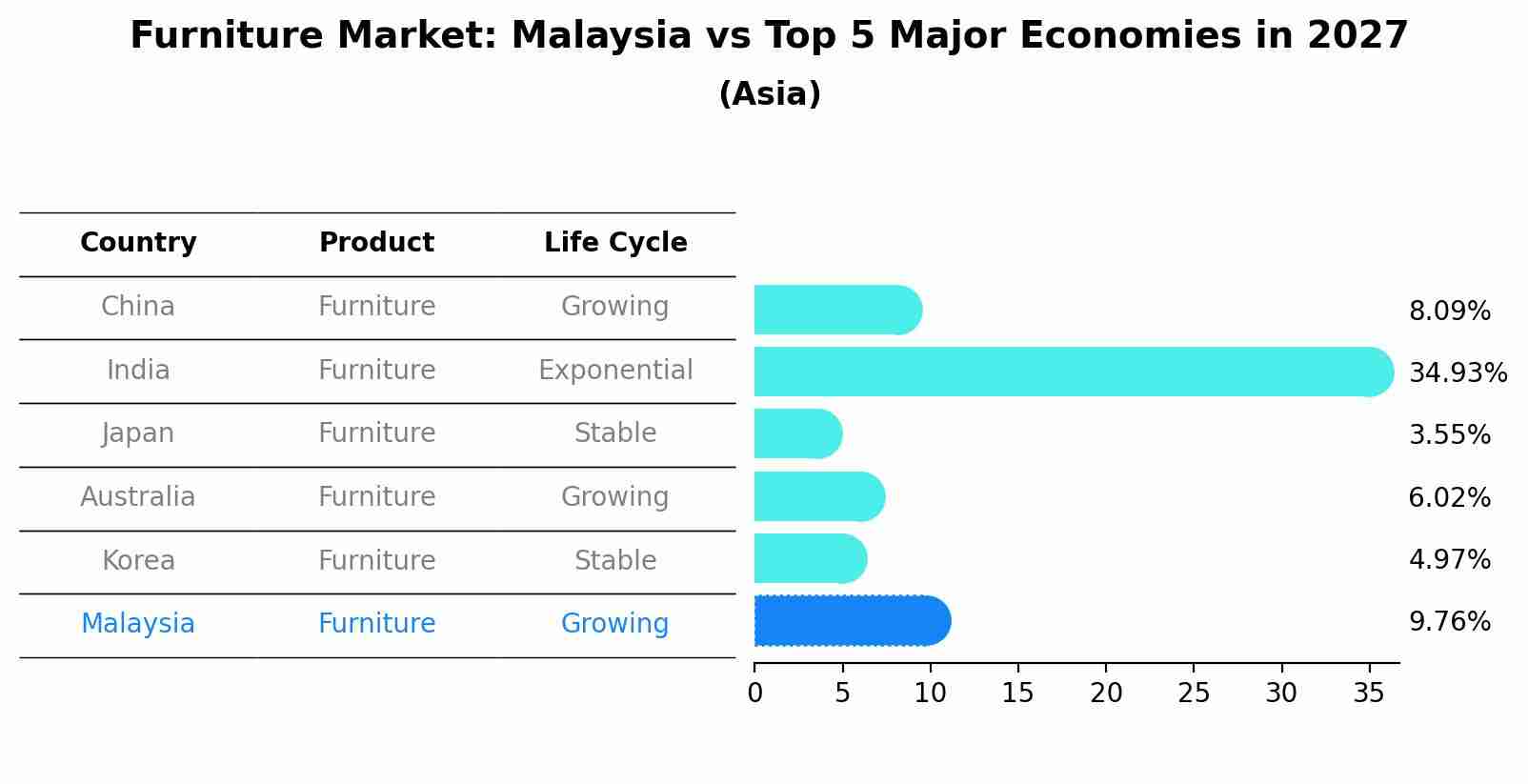

Furniture Market: Malaysia vs Top 5 Major Economies in 2027 (Asia)

The Furniture market in Malaysia is projected to grow at a growing growth rate of 9.76% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Malaysia Furniture Market Highlights

| Report Name | Malaysia Furniture Market |

| Forecast period | 2025-2031 |

| CAGR | 3.95% |

| Growing Sector | Residential |

Topics Covered in the Malaysia Furniture Market Report

Malaysia Furniture Market report thoroughly covers the market By Material type and by Application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Malaysia Furniture Market Synopsis

Malaysia furniture market is experiencing steady growth, driven by rising urbanization and increasing consumer demand for modern furnishings. Expanding residential and commercial construction activities further contribute to market expansion. Additionally, the country’s strong export potential, supported by high-quality craftsmanship and sustainable materials, enhances its global competitiveness. However, challenges such as fluctuating raw material costs and supply chain disruptions may impact overall market stability.

According to 6Wresearch, the Malaysia Furniture Market is estimated to reach at CAGR of 3.95% during the forecast period 2025-2031. This growth is primarily driven by rising urbanization, increasing disposable income, and evolving consumer preferences toward modern and customized furniture designs. The expanding real estate sector, particularly in residential and commercial spaces, further stimulates demand for furniture products. Additionally, Malaysia's strong position as a global furniture exporter enhances market prospects, supported by high-quality craftsmanship, sustainable materials, and government initiatives promoting the industry. The growing popularity of e-commerce platforms has also facilitated easy access to a diverse range of furniture options, contributing to Malaysia Furniture Market Growth.

Despite these growth drivers, the market faces several challenges that may impact its overall performance. Fluctuating raw material prices, particularly for wood and metal, pose a significant concern for manufacturers, leading to increased production costs. Supply chain disruptions and labor shortages further add to operational constraints. Additionally, rising competition from regional and international players intensifies market pressure, requiring local manufacturers to differentiate through innovation and product quality. Environmental regulations and sustainability concern also compel businesses to adopt eco-friendly practices, which may involve higher costs. Nevertheless, continuous advancements in design, technology, and sustainable production methods are expected to support the long-term growth of the Malaysia furniture market.

Malaysia Furniture Market Trends

Malaysia Furniture Market is witnessing evolving trends driven by changing consumer preferences, technological advancements, and sustainability initiatives. The growing demand for multifunctional and space-saving furniture, particularly in urban areas with compact living spaces, is influencing product innovation. Additionally, the rising popularity of online retail channels has enhanced market accessibility, enabling consumers to explore a wide range of furniture options. Sustainable and eco-friendly furniture is gaining traction, with manufacturers increasingly adopting recycled materials and responsible sourcing practices. The integration of smart furniture with IoT technology is also emerging as a key trend, enhancing convenience and functionality. Furthermore, the expansion of Malaysia’s furniture exports, particularly to markets such as the United States and Europe, is fostering industry growth. Despite challenges such as fluctuating raw material costs, the market continues to advance through product innovation and strategic industry collaborations.

Investments Opportunities in the Malaysia Furniture Market

Malaysia Furniture Market presents substantial investment opportunities, driven by factors such as increasing urbanization, rising disposable incomes, and the growing demand for modern and multifunctional furniture. The expansion of e-commerce platforms has further enhanced market accessibility, creating opportunities for online retailers and digital marketing strategies. Additionally, Malaysia’s strong position as a global furniture exporter, particularly to markets in North America and Europe, offers lucrative prospects for manufacturers and investors. Investments in sustainable and eco-friendly furniture production, including the use of recycled materials and responsible sourcing, are gaining traction due to increasing environmental awareness. Furthermore, the adoption of advanced manufacturing technologies, such as automation and smart furniture integration, provides opportunities for innovation and efficiency. With government support in promoting exports and sustainable practices, the Malaysian furniture market remains a promising sector for domestic and foreign investors seeking long-term growth.

Leading Players in the Malaysia Furniture Market

Malaysia Furniture Industry is driven by key industry players that have established a strong presence both domestically and internationally. Companies such as Poh Huat Furniture Industries, LY Furniture SD Bud, Merry fair Chair System, and Wegmans Furniture Holdings Bershad play a significant role in shaping market dynamics. These companies focus on product innovation, quality craftsmanship, and efficient manufacturing processes to maintain competitiveness. Poh Huat and LY Furniture have gained recognition for their extensive export networks, particularly in North America and Europe. Merry fair Chair System specializes in ergonomic office furniture, catering to the growing demand for workplace solutions. Additionally, Wegmans Furniture emphasizes sustainable practices and modern designs, appealing to environmentally conscious consumers. With a focus on expanding product portfolios and leveraging technological advancements, these leading players continue to drive growth and innovation in the Malaysian furniture market.

Government Regulations

Malaysia furniture market is governed by various regulations aimed at ensuring product quality, sustainability, and fair trade practices. The government enforces strict compliance with safety and environmental standards, including the Malaysian Timber Certification Scheme (MTCS), which promotes sustainable forestry and responsible sourcing of raw materials. Additionally, the Furniture Industry Licensing requirements mandate manufacturers to adhere to industry guidelines related to production, labor laws, and export policies. Import and export regulations under the Ministry of International Trade and Industry (MITI) oversee trade activities, ensuring that furniture products meet international quality and safety benchmarks. Furthermore, taxation policies, including the Sales and Service Tax (SST), impact the cost structure within the sector. By implementing these regulations, the government aims to enhance industry competitiveness, support eco-friendly manufacturing practices, and strengthen Malaysia’s position as a key player in the global furniture market.

Future Insights of the Malaysia Furniture Market

Malaysia furniture market size is poised for steady growth, driven by rising domestic demand, increasing exports, and advancements in manufacturing technologies. The adoption of sustainable practices and eco-friendly materials is expected to gain momentum, aligning with global environmental concerns. Additionally, digitalization and e-commerce expansion will play a crucial role in transforming sales channels, offering manufacturers and retailers broader market reach. Government support through favorable trade policies and investment incentives is likely to further boost industry expansion. Moreover, the shift towards customizable and multifunctional furniture designs, influenced by changing consumer preferences and urbanization, will shape future trends.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Wood to Dominate the Market-By Material types

Wood segment is projected to grow in the coming years due to its strong demand in both residential and commercial applications. Malaysia is a major exporter of wooden furniture, benefiting from its abundant timber resources and well-established manufacturing capabilities.

Residential to Dominate the Market-By Applications

According to Vasudha, Senior Research Analyst, 6Wresearch, Residential segment is expected to dominate the market share during the forecast period, driven by increasing urbanization, rising disposable incomes, and growing housing developments. The demand for home furniture, including living room, bedroom, and kitchen furnishings, continues to rise due to changing lifestyle preferences and an emphasis on aesthetic interior designs.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Malaysia Furniture Market Outlook

- Market Size of Malaysia Furniture Market, 2024

- Forecast of Malaysia Furniture Market, 2031

- Historical Data and Forecast of Malaysia Furniture Revenues & Volume for the Period 2021 - 2031

- Malaysia Furniture Market Trend Evolution

- Malaysia Furniture Market Drivers and Challenges

- Malaysia Furniture Price Trends

- Malaysia Furniture Porter's Five Forces

- Malaysia Furniture Industry Life Cycle

- Historical Data and Forecast of Malaysia Furniture Market Revenues & Volume By Material Types for the Period 2021 - 2031

- Historical Data and Forecast of Malaysia Furniture Market Revenues & Volume By Plastic for the Period 2021 - 2031

- Historical Data and Forecast of Malaysia Furniture Market Revenues & Volume By Wood for the Period 2021 - 2031

- Historical Data and Forecast of Malaysia Furniture Market Revenues & Volume By Metal for the Period 2021 - 2031

- Historical Data and Forecast of Malaysia Furniture Market Revenues & Volume By Other for the Period 2021 - 2031

- Historical Data and Forecast of Malaysia Furniture Market Revenues & Volume By Applications for the Period 2021 - 2031

- Historical Data and Forecast of Malaysia Furniture Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of Malaysia Furniture Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Malaysia Furniture Import Export Trade Statistics

- Market Opportunity Assessment By Material Types

- Market Opportunity Assessment By Applications

- Malaysia Furniture Top Companies Market Share

- Malaysia Furniture Competitive Benchmarking By Technical and Operational Parameters

- Malaysia Furniture Company Profiles

- Malaysia Furniture Key Strategic Recommendations

Market Segmentation Analysis

The Report offers a comprehensive study of the subsequent market segments and their leading categories.

By Material Type

- Plastic

- Wood

- Metal

- Other

By Application

- Commercial

- Residential

Malaysia Furniture Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Malaysia Furniture Market Overview |

| 3.1 Malaysia Country Macro Economic Indicators |

| 3.2 Malaysia Furniture Market Revenues & Volume, 2021 & 2031F |

| 3.3 Malaysia Furniture Market - Industry Life Cycle |

| 3.4 Malaysia Furniture Market - Porter's Five Forces |

| 3.5 Malaysia Furniture Market Revenues & Volume Share, By Material Types, 2021 & 2031F |

| 3.6 Malaysia Furniture Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 4 Malaysia Furniture Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Malaysia Furniture Market Trends |

| 6 Malaysia Furniture Market, By Types |

| 6.1 Malaysia Furniture Market, By Material Types |

| 6.1.1 Overview and Analysis |

| 6.1.2 Malaysia Furniture Market Revenues & Volume, By Material Types, 2021 - 2031F |

| 6.1.3 Malaysia Furniture Market Revenues & Volume, By Plastic, 2021 - 2031F |

| 6.1.4 Malaysia Furniture Market Revenues & Volume, By Wood, 2021 - 2031F |

| 6.1.5 Malaysia Furniture Market Revenues & Volume, By Metal, 2021 - 2031F |

| 6.1.6 Malaysia Furniture Market Revenues & Volume, By Other, 2021 - 2031F |

| 6.2 Malaysia Furniture Market, By Applications |

| 6.2.1 Overview and Analysis |

| 6.2.2 Malaysia Furniture Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 Malaysia Furniture Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 7 Malaysia Furniture Market Import-Export Trade Statistics |

| 7.1 Malaysia Furniture Market Export to Major Countries |

| 7.2 Malaysia Furniture Market Imports from Major Countries |

| 8 Malaysia Furniture Market Key Performance Indicators |

| 9 Malaysia Furniture Market - Opportunity Assessment |

| 9.1 Malaysia Furniture Market Opportunity Assessment, By Material Types, 2021 & 2031F |

| 9.2 Malaysia Furniture Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 10 Malaysia Furniture Market - Competitive Landscape |

| 10.1 Malaysia Furniture Market Revenue Share, By Companies, 2024 |

| 10.2 Malaysia Furniture Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero