Malaysia Tire Market (2019-2025) | Size, Share, Revenue, Analysis, Forecast, Trends, Growth, industry, Outlook & COVID-19 IMPACT

Market Forecast By Origin (Local Manufacturing and Imports), By Types (Radial Tires and Bias Tires), By End Users (OEM and Replacement), By Vehicle Types (Trucks, Light Trucks, Two-Wheelers, and Passenger Cars), and Competitive Landscape

| Product Code: ETC001386 | Publication Date: Mar 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 80 | No. of Figures: 45 | No. of Tables: 4 |

The Malaysia tire market report comprehensively covers the Malaysia tire market by origin, types, vehicle types, and end-users. Malaysia tire market outlook report provides an unbiased and detailed analysis of the ongoing Malaysia tire market trends, opportunities/high growth areas, and market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of the Malaysia Tire Market

Malaysia Tire Market is experiencing enormous growth primarily due to several latest developments and trends driving the market expansion. There has been a growing interest in eco-friendly tires or green tires in Malaysia which can improve fuel efficiency and reduce carbon emissions. The huge investments in Tire Production Facilities by several companies are one of the major developments in this market. Moreover, the partnership with e-commerce Platforms by tire manufacturers in Malaysia to increase their sales also turn out to be the major development factor for Malaysia Tire Industry. The economy of Malaysia has been growing steadily, which has led to an increase in disposable income and a higher standard of living. This has resulted in an increasing demand for vehicles and further propels the growth of the tire market.

The introduction of smart tires which features embedded sensors that can monitor tire pressure and temperature in real-time is expected to improve safety and reduce the risk of accidents. Overall, the Malaysia tire market has been growing steadily with companies investing in production facilities and introducing new technologies. The tire industry is constantly evolving, and new technologies are being developed to improve the performance and lifespan of tires.

Malaysia Tire Market Synopsis

Malaysia Tire Market has witnessed robust growth in tire sales in recent years on account of a rising second-hand vehicle fleet, rising middle-class population, developing transportation infrastructure as well as rising import of Chinese tires in the country. Further, an increase in vehicle sales and a drop in vehicle price would remain the key drivers behind Malaysia Tire Market Growth.

According to 6Wresearch, Malaysia Tire Market size is projected to grow at a CAGR of 3.0% during 2019-2025. Growing automotive manufacturing driven by rising vehicle exports and domestic demand, and the rapidly growing requirement for electric vehicles in the region would present favourable opportunities for the tire market growth in Malaysia during the forecast period. Radial tires are the key revenue-generating segment in the overall tire market, owing to the high installation of radial tires in vehicles due to their better puncture resistance and fuel-saving capacity. Rising penetration towards increasing the life of vehicles backed by surging disposable income is driving the Malaysia Tire Industry. Increasing awareness among commuters regarding the maintenance of vehicles is also developing in the market. Increasing expenditure by the people and rising penetration towards a replacement of old tires are adding to the Malaysia Tire Market Share. Rising product automobile is also accelerating the growth of the market.

Passenger car tires are the leading revenue-generating segment in the overall Malaysia Tire Market Revenue owing to the increase in passenger car fleet size and the establishment of automobile manufacturing facilities in the country. Further, the government's push for infrastructure and tourism development in the country would further lift the demand for light truck tires during the forecast period.

Key Highlights of the Report:

- Malaysia Tire Market Overview

- Malaysia Tire Market Outlook

- Malaysia Tire Market Forecast

- Historical Data of Malaysia Tire Market Revenues & Volume for the Period 2016-2018

- Malaysia Tire Market Size & Malaysia Tire Market Forecast of Revenues & Volume until 2025F

- Historical Data of Malaysia Tire Market Revenues & Volume for the Period 2016-2018, By Origin

- Market Size & Forecast of Malaysia Tire Market Revenues & Volume until 2025F, By Origin

- Historical Data of Malaysia Tire Market Revenues & Volume for the Period 2016-2018, By End Users

- Market Size & Forecast of Malaysia Tire Market Revenues & Volume until 2025F, By End Users

- Historical Data of Malaysia Tire Market Revenues & Volume for the Period 2016-2018, By Types

- Market Size & Forecast of Malaysia Tire Market Revenues & Volume until 2025F, By Types

- Historical Data of Malaysia Tire Market Revenues & Volume for the Period 2016-2018, By Vehicle Types

- Market Size & Forecast of Malaysia Tire Market Revenues & Volume until 2025F, By Vehicle Types

- Market Drivers and Restraints

- Malaysia Tire Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Malaysia Tire Market Opportunity Assessment

- Malaysia Tire Market Share, By Players

- Malaysia Tire Market Overview, By Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Malaysia Tire Market Report Covered:

The report provides a detailed analysis of the following market segments:

By Origin:

- Local Manufacturing

- Imports

By Types:

- Radial Tires

- Bias Tires

By End Users:

- OEM

- Replacement

By Vehicle Types:

- Trucks

- Light Trucks

- Two-Wheelers

- Passenger Cars

Malaysia Tire Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Malaysia Tire Market Overview |

| 3.1 Malaysia Country Indicators |

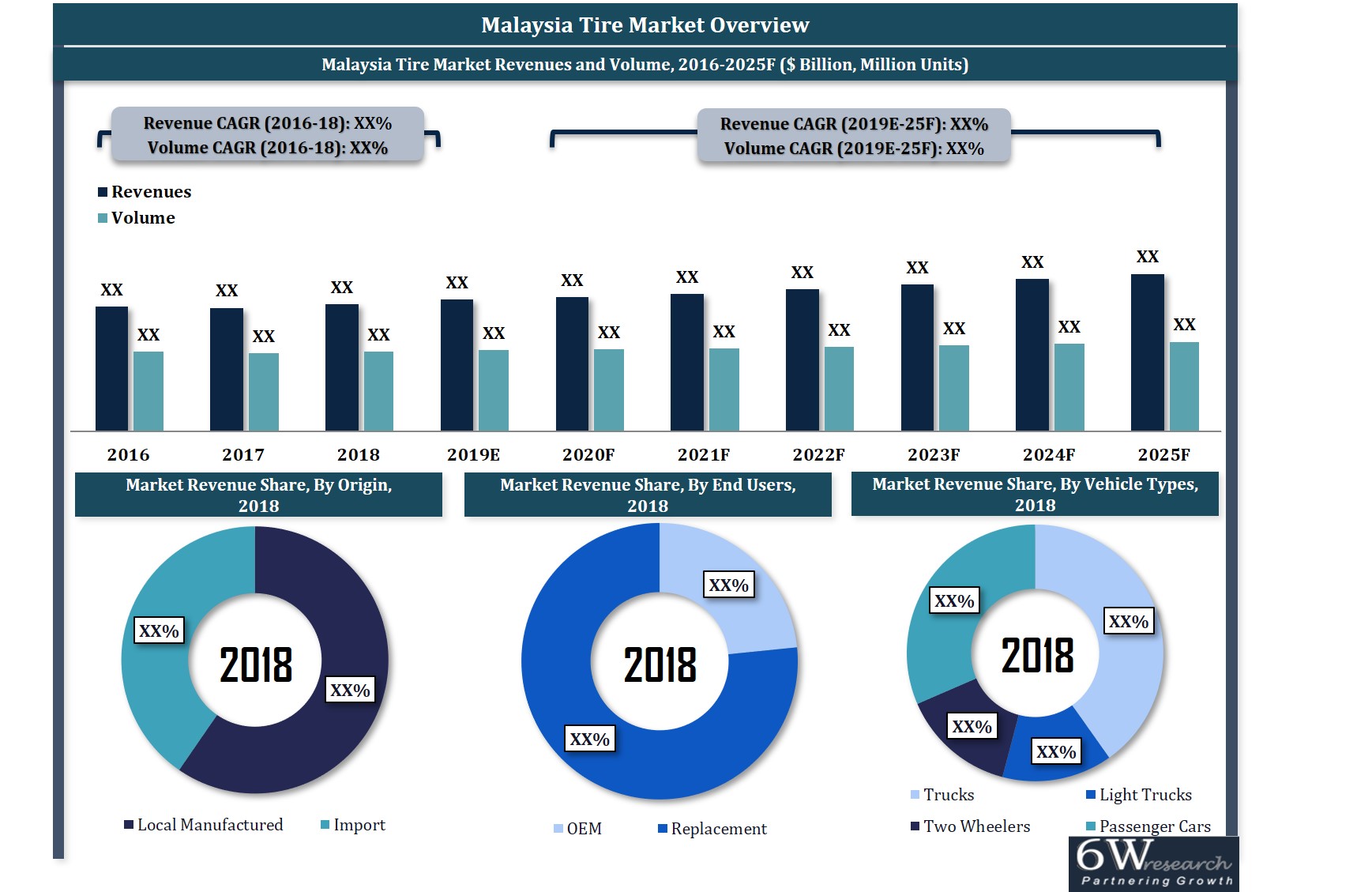

| 3.2 Malaysia Tire Market Revenues and Volume, 2016-2025F |

| 3.3 Malaysia Tire Market -Industry Life Cycle, 2018 |

| 3.4 Malaysia Tire Market –Porter’s Five Force Model |

| 4. Malaysia Tire Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing automotive sales and production in Malaysia |

| 4.2.2 Growing demand for replacement tires due to a rising number of vehicles on the road |

| 4.2.3 Government initiatives promoting eco-friendly and energy-efficient tires |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating raw material prices impacting tire manufacturing costs |

| 4.3.2 Intense competition from international tire brands |

| 4.3.3 Economic factors affecting consumer purchasing power |

| 5. Malaysia Tire Market Overview, By Origin |

| 5.1 Malaysia Tire Market Revenues and Volume Share, By Origin, 2018 & 2025F |

| 5.1.1 Malaysia Tire Market Revenues and Volume, By Origin, 2016-2025F |

| 5.1.1.1 Malaysia Local Manufactured Tire Market Revenues and Volume, 2016-2025F |

| 5.1.1.2 Malaysia Imported Tire Market Revenues and Volume, 2016-2025F |

| 6. Malaysia Tire Market Overview, By End Users |

| 6.1 Malaysia Tire Market Revenues and Volume Share, By End Users, 2018 & 2025F |

| 6.1.1 Malaysia Tire Market Revenues and Volume, By End Users, 2016-2025F |

| 6.1.1.1 Malaysia Tire Market Revenues and Volume, By OEM, 2016-2025F |

| 6.1.1.2 Malaysia Tire Market Revenues and Volume, By Replacement, 2016-2025F |

| 7. Malaysia Tire Market Overview, By Vehicle Types |

| 7.1 Malaysia Tire Market Revenues and Volume Share, By Vehicle Types, 2018 & 2025F |

| 7.2 Malaysia Passenger Car Tire Market Revenues and Volume, 2016-2025F |

| 7.2.1 Malaysia Passenger Car Tire Market Revenues and Volume Share, By Origin, 2018 & 2025F |

| 7.2.1.1 Malaysia Passenger Car Tire Market Revenues and Volume, By Origin, 2016-2025F |

| 7.3 Malaysia Truck and Bus Tire Market Revenues and Volume, 2016-2025F |

| 7.3.1 Malaysia Truck and Bus Tire Market Revenues and Volume Share, By Origin, 2018 & 2025F |

| 7.3.1.1 Malaysia Truck and Bus Tire Market Revenues and Volume, By Origin, 2016-2025F |

| 7.3.2 Malaysia Truck and Bus Tire Market Revenues and Volume Share, By Types, 2018 & 2025F |

| 7.3.2.1 Malaysia Truck and Bus Tire Market Revenues and Volume, By Types, 2016-2025F |

| 7.3.2.1.1 Malaysia Truck and Bus Radial Tire Market Revenues and Volume, 2016-2025F |

| 7.3.2.1.2 Malaysia Truck and Bus Bias Tire Market Revenues and Volume, 2016-2025F |

| 7.4 Malaysia Light Truck Tire Market Revenues and Volume, 2016-2025F |

| 7.4.1 Malaysia Light Truck Tire Market Revenues and Volume Share, By Origin, 2018 & 2025F |

| 7.4.1.1 Malaysia Light Truck Tire Market Revenues and Volume, By Origin, 2016-2025F |

| 7.4.2 Malaysia Light Truck Tire Market Revenues and Volume Share, By Types, 2018 & 2025F |

| 7.4.2.1 Malaysia Light Truck Tire Market Revenues and Volume, By Types, 2016-2025F |

| 7.4.2.1.1 Malaysia Light Truck Radial Tire Market Revenues and Volume, 2016-2025F |

| 7.4.2.1.2 Malaysia Light Truck Bias Tire Market Revenues and Volume, 2016-2025F |

| 7.5 Malaysia Two Wheeler Tire Market Revenues and Volume, 2016-2025F |

| 7.5.1 Malaysia Two Wheeler Tire Market Revenue and Volume Share, By Origin, 2018 & 2025F |

| 7.5.1.1 Malaysia Two Wheeler Tire Market Revenues and Volume, By Origin, 2016-2025F |

| 8. Malaysia Tire Market –Key Performance Indicators |

| 8.1 Malaysia Government Spending Outlook |

| 8.2 Malaysia Automotive Sector Outlook |

| 9. Malaysia Tire Market Opportunity Assessment |

| 9.1 Malaysia Tire Market Opportunity Assessment, By Origin, 2025F |

| 9.2 Malaysia Tire Market Opportunity Assessment, By Vehicle Types, 2025F |

| 9.3 Malaysia Tire Market Opportunity Assessment, By End Users, 2025F |

| 10. Malaysia Tire Market –Competitive Landscape |

| 10.1 Malaysia Tire Market Competitive Benchmarking, By Tire Types |

| 10.2 Malaysia Tire Market Revenue Share, By Companies, 2018 |

| 11. Company Profiles |

| 11.1 Bridgestone Tyre Sales (Malaysia) Sdn. Bhd |

| 11.2 Michelin Malaysia Sdn Bhd |

| 11.3 Goodyear Tire & Rubber Co. |

| 11.4 Giti Tire (Malaysia) Sdn. Bhd. |

| 11.5 Hankook Tire Malaysia Sdn. Bhd. |

| 11.6 Maxxis Tires Malaysia |

| 11.7 MRF Limited |

| 11.8 Continental Tyre PJ Malaysia Sdn Bhd |

| 11.9 Toyo Engineering & Construction Sdn. Bhd. |

| 11.10 Sumitomo Rubber Industries, Ltd. |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures |

| Figure 1. Malaysia Tire Market Revenues and Volume, 2016-2025F ($ Billion/Million Units) |

| Figure 2. Malaysia Passenger Car Sales, 2015-18 (in Units) |

| Figure 3. Malaysia Tire Market Revenue Share, By Origin, 2018 & 2025F |

| Figure 4. Malaysia Tire Market Volume Share, By Origin, 2018 & 2025F |

| Figure 5. Malaysia Local Manufactured Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 6. Malaysia Imported Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 7. Malaysia Tire Market Revenue Share, By End Users, 2018 & 2025F |

| Figure 8. Malaysia Tire Market Volume Share, By End Users, 2018 & 2025F |

| Figure 9. Malaysia Tire Market Revenues and Volume, By OEM, 2016-2025F ($ Million/Million Units) |

| Figure 10. Malaysia Tire Market Revenues and Volume, By Replacement, 2016-2025F ($ Million/Million Units) |

| Figure 11. Malaysia Tire Market Revenue Share, By Vehicle Types, 2018 & 2025F |

| Figure 12. Malaysia Tire Market Volume Share, By Vehicle Types, 2018 & 2025F |

| Figure 13. Malaysia Passenger Car Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 14. Malaysia Passenger Car Tire Market Revenue Share, By Origin, 2018 & 2025F |

| Figure 15. Malaysia Passenger Car Tire Market Volume Share, By Origin, 2018 & 2025F |

| Figure 16. Malaysia Local Manufactured Passenger Car Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 17. Malaysia Import Passenger Car Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 18. Malaysia Truck and Bus Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 19. Malaysia Truck and Bus Tire Market Revenue Share, By Origin, 2018 & 2025F |

| Figure 20. Malaysia Truck and Bus Tire Market Volume Share, By Origin, 2018 & 2025F |

| Figure 21. Malaysia Local Manufactured Truck and Bus Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 22. Malaysia Import Truck and Bus Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 23. Malaysia Truck and Bus Tire Market Revenue Share, By Types, 2018 & 2025F |

| Figure 24. Malaysia Truck and Bus Tire Market Volume Share, By Types, 2018 & 2025F |

| Figure 25. Malaysia Radial Truck Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 26. Malaysia Bias Truck Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 27. Malaysia Light Truck Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 28. Malaysia Light Truck Tire Market Revenue Share, By Origin, 2018 & 2025F |

| Figure 29. Malaysia Light Truck Tire Market Volume Share, By Origin, 2018 & 2025F |

| Figure 30. Malaysia Local Manufactured Light Truck Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 31. Malaysia Import Truck Light Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 32. Malaysia Light Truck Tire Market Revenue Share, By Types, 2018 & 2025F |

| Figure 33. Malaysia Light Truck Tire Market Volume Share, By Types, 2018 & 2025F |

| Figure 34. Malaysia Radial Light Truck Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure35. Malaysia Bias Light Truck Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 36. Malaysia Two Wheeler Vehicle Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 37. Malaysia Two Wheeler Tire Market Revenue Share, By Origin, 2018 & 2025F |

| Figure 38. Malaysia Two Wheeler Tire Market Volume Share, By Origin, 2018 & 2025F |

| Figure 39. Malaysia Local Manufactured Two Wheeler Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 40. Malaysia Import Two Wheeler Tire Market Revenues and Volume, 2016-2025F ($ Million/Million Units) |

| Figure 41. Malaysia Actual Government Spending Vs Actual Government Revenues, 2014-2024F (MYR Billion) |

| Figure 42. Malaysia Tire Market Opportunity Matrix, By Origin, 2025F |

| Figure 43. Malaysia Tire Market Opportunity Matrix, By Vehicle Type, 2025F |

| Figure 44. Malaysia Tire Market Opportunity Matrix, By End User, 2025F |

| Figure 45. Malaysia Tire Market Revenue Share, By Companies, 2018 |

| List of Tables |

| Table 1. Malaysia Upcoming Transportation Projects |

| Table 2. Malaysia Expected Government Budget Outlook, FY2020 |

| Table 3. Malaysia Vehicle Sales Data (2016-18) |

| Table 4. Malaysia Vehicle Production Data (2016-18) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero