Mexico Crude Oil Market (2025-2031) | Revenue, Value, Size, Share, Companies, Trends, Outlook, Growth, Forecast, Analysis & Industry

Market Forecast By Derivatives (Paraffin, Pentane, Octane, Naphthene, Aromatics, Asphaltic), By Composition (Hydrocarbon Compounds, Carbon, Hydrogen, Non-Hydrocarbon Compounds, Organometallic Compounds, Sodium, Calcium), By Type (Light Distillates, Light Oils, Medium Oils, Heavy Fuel Oil), By End Use (Light Commercial Vehicles, Passenger Vehicles, Mining, Agriculture, Residential) And Competitive Landscape

| Product Code: ETC412619 | Publication Date: Oct 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Mexico Crude Oil Market Growth Rate

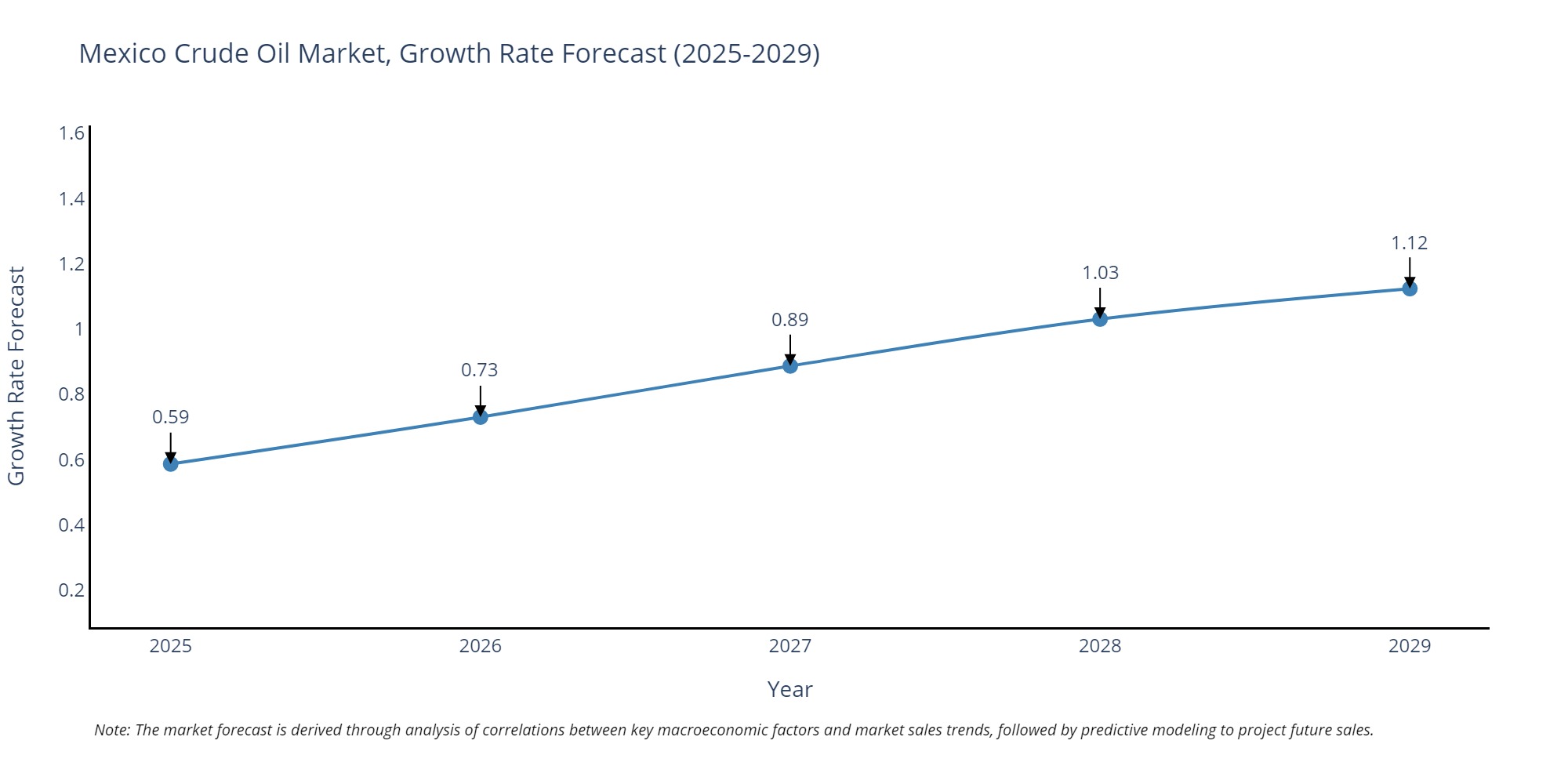

Mexico is projected to witness a 0.89% Stable growth in the Crude Oil market by 2027.

Mexico Crude Oil Market Highlights

| Report Name | Mexico Crude Oil Market |

| Forecast period | 2025-2031 |

| CAGR | 0.89% |

| Growing Sector | Renewable energy sources |

Topics Covered in the Mexico Crude Oil Market Report

The Mexico Crude Oil Market report thoroughly covers the market by derivatives, by type, by composition and by end use. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Mexico Crude Oil Market Synopsis

Mexico Crude Oil Market plays a pivotal role in the country's economy, given its status as one of the leading oil producers in the world. The nation’s oil industry is dominated by Pemex, the state-owned petroleum company, which has been the primary driver of oil exploration, production, and distribution. Mexico's crude oil production mainly occurs in offshore fields in the Gulf of Mexico, alongside significant onshore activities. In recent years, the market has seen a shift due to energy reforms that opened the sector to private and foreign investment, aiming to enhance efficiency and technological advancement.

According to 6Wresearch, the Mexico Crude Oil Market size is expected to grow at a CAGR of 0.89% during the forecast period 2025-2031. One of the primary growth factors is the country's abundant oil reserves and its strategic efforts to increase production capabilities. Trends in the market include the adoption of advanced extraction technologies and the implementation of sustainable practices to reduce environmental impact. However, the industry faces challenges such as fluctuating global oil prices, regulatory hurdles, and the need to modernize aging infrastructure. Despite these obstacles, opportunities are emerging in the form of foreign investments, partnerships, and government reforms aimed at liberalizing the energy sector. Additionally, the global push towards renewable energy sources presents a potential shift in the market dynamics, encouraging the diversification of energy portfolios while still leveraging Mexico's rich oil resources.

The abundance of oil reserves in Mexico has been a significant driver of the country's economic growth for decades. With over 10 billion barrels of proven oil reserves, Mexico ranks as one of the top ten countries in terms of crude oil production. The government has made strategic efforts to increase production capabilities, such as opening bidding rounds for foreign companies to explore and develop new fields. This move has not only boosted the country's oil output but also attracted valuable investments from major international players.

Mexico Crude Oil Industry: Leading Players

Some of the key players operating in the Mexico Crude Oil Market include Pemex, ExxonMobil, Chevron, Royal Dutch Shell, BP, and Total. These companies have a significant presence in the Mexican market and are actively involved in exploration, production, and refining of crude oil. Currently, Pemex holds the largest share in the Market. However, with the growing demand for Crude Oil other companies have an opportunity to make significant strides and gain market share.

Mexico Crude Oil Market: Government Regulations

The Mexico Crude Oil market growth is also influenced by government regulations and policies. The Mexican government has implemented various regulations and policies to promote and regulate the country's crude oil market. These include opening up the sector to private investment, implementing energy reforms, and promoting sustainable practices. These initiatives have played a crucial role in attracting investments, boosting production, and increasing competitiveness in the global market. Additionally, the government has also encouraged partnerships between Mexican and foreign companies to further develop the industry.

Future Insights of the Market

The Mexico Crude Oil Market has been experiencing steady growth over the past few years. Several factors will shape the future of the market. Mexico's crude oil market is expected to experience significant growth in the coming years. This can be attributed to the country's abundant reserves of crude oil and its strategic geographic location, making it a key player in the global energy market. In addition, favourable government policies aimed at promoting domestic production and reducing reliance on foreign imports are expected to further boost the growth of Mexico's crude oil market. The government has also been investing in modernizing and expanding its oil infrastructure, which will enable the country to increase production and export volumes.

Market Segmentation by Derivatives

According to Dhaval, Research Manager, 6Wresearch, the paraffin derivatives are among the leading exports of Mexico's crude oil industry. Paraffin is commonly used in the production of various industrial and consumer products such as candles, wax coatings, and packaging materials.

Market Segmentation by Type

The light distillates segment is expected to hold the dominant share in Mexico crude oil market. This segment includes products such as gasoline, kerosene, and diesel which are in high demand for various purposes such as transportation and power generation.

Market Segmentation by Composition

The hydrocarbon compounds are expected to remain key components of the industry. Hydrocarbons make up the majority of crude oil and are essential for producing various fuels such as gasoline, diesel, and jet fuel.

Market Segmentation by End Use

The transportation sector is the largest consumer of crude oil in Mexico and it will lead the Mexico Crude Oil Market Share in the years to come.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Mexico Crude Oil Market Outlook

- Market Size of Mexico Crude Oil Market, 2024

- Forecast of Mexico Crude Oil Market, 2031

- Historical Data and Forecast of Mexico Crude Oil Revenues & Volume for the Period 2021-2031

- Mexico Crude Oil Market Trend Evolution

- Mexico Crude Oil Market Drivers and Challenges

- Mexico Crude Oil Price Trends

- Mexico Crude Oil Porter's Five Forces

- Mexico Crude Oil Industry Life Cycle

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Derivatives for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Paraffin for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Pentane for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Octane for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Naphthene for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Aromatics for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Asphaltic for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Composition for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Hydrocarbon Compounds for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Carbon for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Hydrogen for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Non-Hydrocarbon Compounds for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Organometallic Compounds for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Sodium for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Calcium for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Light Distillates for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Light Oils for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Medium Oils for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Heavy Fuel Oil for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By End Use for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Light Commercial Vehicles for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Passenger Vehicles for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Mining for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Agriculture for the Period 2021-2031

- Historical Data and Forecast of Mexico Crude Oil Market Revenues & Volume By Residential for the Period 2021-2031

- Mexico Crude Oil Import Export Trade Statistics

- Market Opportunity Assessment By Derivatives

- Market Opportunity Assessment By Composition

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By End Use

- Mexico Crude Oil Top Companies Market Share

- Mexico Crude Oil Competitive Benchmarking By Technical and Operational Parameters

- Mexico Crude Oil Company Profiles

- Mexico Crude Oil Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Derivatives

- Paraffin

- Pentane

- Octane

- Naphthene

- Aromatics

- Asphaltic

By Composition

- Hydrocarbon Compounds

- Carbon

- Hydrogen

- Non-Hydrocarbon Compounds

- Organometallic Compounds

- Sodium

- Calcium

By Type

- Light Distillates

- Light Oils

- Medium Oils

- Heavy Fuel Oil

By End Use

- Light Commercial Vehicles

- Passenger Vehicles

- Mining

- Agriculture

- Residential

Mexico Crude Oil Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3Mexico Crude Oil Market Overview |

| 3.1Mexico Country Macro Economic Indicators |

| 3.2Mexico Crude Oil Market Revenues & Volume, 2021 & 2031F |

| 3.3Mexico Crude Oil Market - Industry Life Cycle |

| 3.4Mexico Crude Oil Market - Porter's Five Forces |

| 3.5Mexico Crude Oil Market Revenues & Volume Share, By Derivatives, 2021 & 2031F |

| 3.6Mexico Crude Oil Market Revenues & Volume Share, By Composition 2021 & 2031F |

| 3.7Mexico Crude Oil Market Revenues & Volume Share, By Type 2021 & 2031F |

| 3.8Mexico Crude Oil Market Revenues & Volume Share, By End Use 2021 & 2031F |

| 4Mexico Crude Oil Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing global demand for crude oil |

| 4.2.2 Favorable government policies and regulations supporting the oil industry |

| 4.2.3 Technological advancements in oil exploration and extraction processes |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating global oil prices |

| 4.3.2 Environmental concerns and regulations impacting oil production and exploration |

| 4.3.3 Geopolitical tensions affecting oil supply and demand |

| 5Mexico Crude Oil Market Trends |

| 6Mexico Crude Oil Market, By Derivatives |

| 6.1Mexico Crude Oil Market, By Composition |

| 6.2Mexico Crude Oil Market, By Type |

| 6.3Mexico Crude Oil Market, By End Use |

| 6.1.1 Overview and Analysis |

| 6.1.2Mexico Crude Oil Market Revenues & Volume, By Derivatives, 2021-2031F |

| 6.1.3Mexico Crude Oil Market Revenues & Volume, By Paraffin, 2021-2031F |

| 6.1.4Mexico Crude Oil Market Revenues & Volume, By Pentane, 2021-2031F |

| 6.1.4Mexico Crude Oil Market Revenues & Volume, By Octane, 2021-2031F |

| 6.1.4Mexico Crude Oil Market Revenues & Volume, By Naphthene, 2021-2031F |

| 6.1.4Mexico Crude Oil Market Revenues & Volume, By Aromatics, 2021-2031F |

| 6.1.4Mexico Crude Oil Market Revenues & Volume, By Asphaltic, 2021-2031F |

| 6.2Mexico Crude Oil Market, By Composition |

| 6.2.1 Overview and Analysis |

| 6.2.2Mexico Crude Oil Market Revenues & Volume, By Hydrocarbon Compounds, 2021-2031F |

| 6.2.3Mexico Crude Oil Market Revenues & Volume, By Carbon, 2021-2031F |

| 6.2.4Mexico Crude Oil Market Revenues & Volume, By Hydrogen, 2021-2031F |

| 6.2.5Mexico Crude Oil Market Revenues & Volume, By Non-Hydrocarbon Compounds, 2021-2031F |

| 6.2.5Mexico Crude Oil Market Revenues & Volume, By Compounds, 2021-2031F |

| 6.2.5Mexico Crude Oil Market Revenues & Volume, By Organometallic Compounds, 2021-2031F |

| 6.2.5Mexico Crude Oil Market Revenues & Volume, By Sodium, 2021-2031F |

| 6.2.5Mexico Crude Oil Market Revenues & Volume, By Calcium, 2021-2031F |

| 6.3.1Mexico Crude Oil Market, By Type |

| 6.3.2 Overview and Analysis |

| 6.3.3Mexico Crude Oil Market Revenues & Volume, By Light Distillates, 2021-2031F |

| 6.3.4Mexico Crude Oil Market Revenues & Volume, By Light Oils, 2021-2031F |

| 6.3.4Mexico Crude Oil Market Revenues & Volume, By Medium Oils, 2021-2031F |

| 6.3.4Mexico Crude Oil Market Revenues & Volume, By Heavy Fuel Oil, 2021-2031F |

| 6.4.1Mexico Crude Oil Market, By End Use |

| 6.4.2 Overview and Analysis |

| 6.4.3Mexico Crude Oil Market Revenues & Volume, By Light Commercial Vehicles, 2021-2031F |

| 6.4.4Mexico Crude Oil Market Revenues & Volume, By Passenger Vehicles, 2021-2031F |

| 6.4.5Mexico Crude Oil Market Revenues & Volume, By Mining, 2021-2031F |

| 6.4.4Mexico Crude Oil Market Revenues & Volume, By Agriculture, 2021-2031F |

| 6.4.4Mexico Crude Oil Market Revenues & Volume, By Residential, 2021-2031F |

| 7Mexico Crude Oil Market Import-Export Trade Statistics |

| 7.1Mexico Crude Oil Market Export to Major Derivatives |

| 7.2Mexico Crude Oil Market Imports from Major Derivatives |

| 8Mexico Crude Oil Market Key Performance Indicators |

| 8Mexico.1 Investment in research and development for improved extraction techniques |

| 8Mexico.2 Infrastructure development for oil transportation and storage facilities |

| 8Mexico.3 Number of new drilling permits issued by the Mexican government |

| 8Mexico.4 Adoption of sustainable practices in oil production |

| 8Mexico.5 Percentage of oil reserves utilized in Mexico |

| 9Mexico Crude Oil Market - Opportunity Assessment |

| 9.1Mexico Crude Oil Market Opportunity Assessment, By Derivatives, 2021 & 2031F |

| 9.2Mexico Crude Oil Market Opportunity Assessment, By Composition, 2021 & 2031F |

| 9.3Mexico Crude Oil Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.4Mexico Crude Oil Market Opportunity Assessment, By End Use, 2021 & 2031F |

| 10Mexico Crude Oil Market - Competitive Landscape |

| 10.1Mexico Crude Oil Market Revenue Share, By Companies, 2024 |

| 10.2Mexico Crude Oil Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero