Mexico Diesel Genset Rental Market (2022-2028) | Size, Trends, Growth, Revenue, Analysis, Forecast, Value, Industry, Outlook & COVID-19 IMPACT

Market Forecast By kVA Ratings (5.1 to 75 kVA, 75.1 – 375 kVA, 375.1 - 750 kVA, 750.1 - 1000 kVA, Above 1000 kVA), By Application (Commercial (Hospitality, BFSI, IT & ITES, Construction, Healthcare, and Offices), Industrial, Residential, Transportation & Infrastructure (Government Buildings, and Public Infrastructure, such as Stadium, Museum, etc.)) and Competitive Landscape

| Product Code: ETC406674 | Publication Date: Sep 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 68 | No. of Figures: 20 | No. of Tables: 3 |

Mexico Diesel Genset Rental Market report thoroughly covers the market kVA Ratings, Applications. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Mexico Diesel Genset Rental Market Synopsis

Mexico diesel genset rental market is anticipated to witness notable growth during the forecast period, on the back of growth in construction industry which contributes 6.8 per cent to Mexico's GDP and accounts for USD 82.56 bn in 2021. The growth during the forecast period is anticipated in the construction industry owing to government initiatives such as allocating USD 1.25 billion for the construction of 478 educational institutions, health, public and mobility infrastructure projects under annual infrastructure plan. The plan also includes rising building projects such as roads, trains, metros, hotels, houses, towers, entertainment, and economic cities, and many more. In the last year, the outburst of coronavirus had adversely affected the Mexico Diesel Genset Rental market, as the government imposed nation-wide lockdown that had led to the closure of all construction operations and disrupted the demand and supply of diesel genset rental systems.

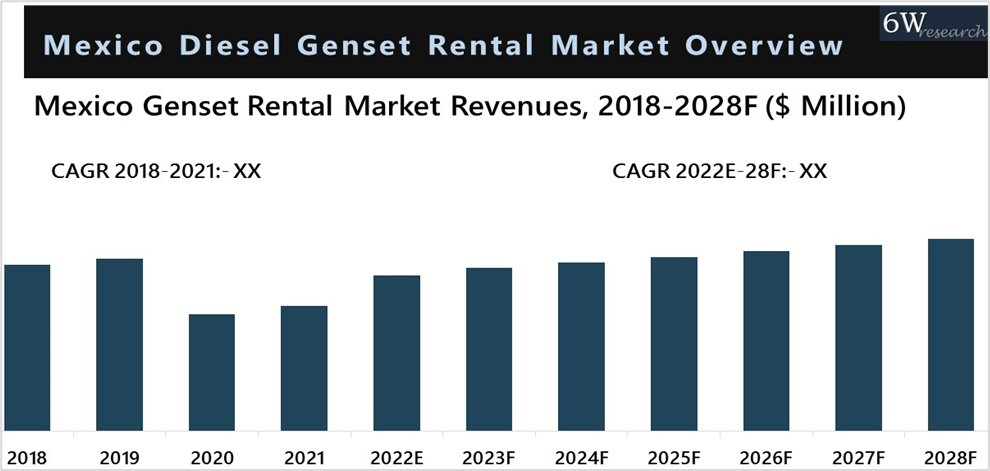

According to 6Wresearch, Mexico Diesel Genset Rental market size is projected to grow at CAGR of 3.6% during 2022-2028. Due to Covid-19 the Mexico Diesel Genset Rental Market growth is attributed to the presence of a robust industrial sector along with a rapidly evolving manufacturing sector and rallying healthcare sector. Standalone power solutions such as renewable energy source and gas genset, a substitute for diesel genset rental would not be able to meet the entire demand for standalone power solutions in the country. Henceforth, the market of diesel genset rental is expected to recapitalize and grow during the forecast years.

Market by kVA Rating Analysis

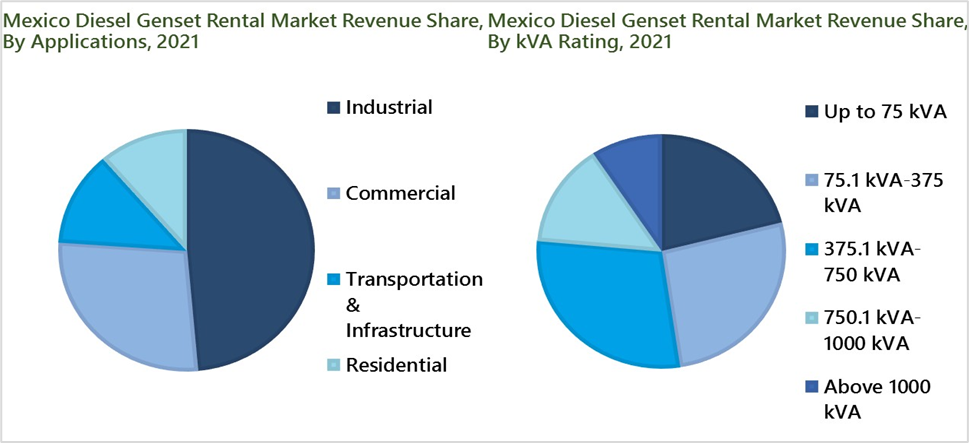

In terms of kVA ratings, 375.1kVA - 750kVA Diesel Genset Rentals segment accounted for 28.7% of market revenue in 2021 and leads the market. The results are extrapolations of the market capitalization of electronics and semiconductor companies compared to other industries. The kVA ratings, 375.1kVA - 750kVA diesel genset rentals have emerged as a major shareholder in the market in 2021, owing to its major deployment as power backup systems in the industrial and logistics sector. Moreover, within industrial segment, oil and gas industries provide opportunities for the diesel genset rentals demand in the country during the forecast period on account of government initiative such as Pemex’s investment plan for 2021-2025 which includes 399 new exploration, extraction, and production projects in shallow waters, deep water, and onshore projects in the states of Tamaulipas, Veracruz, Tabasco, and Campeche.

Market by Application Analysis

In the Mexico Diesel Genset Rental market, industrial sector is the most popular type of application, accounting for more than 48.6% of the market revenues in 2021. The industrial sector would continue to acquire the highest market revenue share in the Mexico diesel genset rental market in the coming years on account of rising government’s focus on industrial development including implementation of the required infrastructure, construction of hotels such as Smes in Yucatan, Playa Hotels & Resorts N.V. (“Playa”) and its affiliates, tourist locations such as Mexico City, Acapulco and others, contributing as a catalyst as well as other manufacturing hotspots in various regions of the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Mexico Diesel Genset Rental Market Overview

- Mexico Diesel Genset Rental market Outlook

- Mexico Diesel Genset Rental Market Forecast

- Mexico Diesel Genset Rental Market Revenue Share, By kVA Ratings

- Mexico Diesel Genset Rental Market Revenue Share, By Applications, 2021 & 2028F

- Market Drivers and Restraints

- Mexico Diesel Genset Rental Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Mexico Diesel Genset Rental market - Impact Analysis of COVID-19

- Market Opportunity Assessment

- Mexico Diesel Genset Rental Market Revenue Ranking, By Company

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By kVA Ratings

- 5.1 to 75 kVA

- 75.1 – 375 kVA

- 375.1 - 750 kVA

- 750.1 - 1000 kVA

- Above 1000 kVA

By Application

- Commercial (Hospitality, BFSI, IT & ITES, Construction, Healthcare, and Offices)

- Industrial

- Residential

- Transportation & Infrastructure (Government Buildings, and Public Infrastructure, such as Stadium, Museum, etc.)

Mexico Diesel Genset Rental Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Mexico Diesel Genset Rental Market Overview |

| 3.1. Mexico Diesel Genset Rental Market Revenues, 2018-2028F |

| 3.2. Mexico Diesel Genset Rental Market - Industry Life Cycle, 2021 |

| 3.3. Mexico Diesel Genset Rental Market - Porter’s Five Forces |

| 3.4. Mexico Diesel Genset Rental Market Ecosystem |

| 4. Mexico Diesel Genset Rental Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Growing demand for reliable backup power solutions in Mexico due to frequent power outages |

| 4.2.2 Increasing construction activities and infrastructure development projects in Mexico |

| 4.2.3 Rise in events and festivals requiring temporary power solutions |

| 4.3. Market Restraints |

| 4.3.1 High initial investment required for diesel genset rental equipment |

| 4.3.2 Environmental concerns and regulations regarding emissions from diesel gensets |

| 5. Mexico Diesel Genset Rental Market Trends |

| 6. Mexico Diesel Genset Rental Market , By kVA Ratings |

| 6.1. Mexico Diesel Genset Rental Market Revenues Share, By kVA Ratings, 2021 & 2028F |

| 6.2. Mexico Diesel Genset Rental Market Revenues, By kVA Ratings, 2021 & 2028F |

| 6.2.1. Mexico 5 - 75 kVA Rating Diesel Genset Rental Market Revenues, 2021 & 2028F |

| 6.2.2. Mexico 75.1-375 kVA Rating Diesel Genset Rental Market Revenues, 2021 & 2028F |

| 6.2.3. Mexico 375.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2021 & 2028F |

| 6.2.4. Mexico 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2021 & 2028F |

| 6.2.5. Mexico Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2021 & 2028F |

| 7. Mexico Diesel Genset Rental Market , By Applications |

| 7.1. Mexico Diesel Genset Rental Market Revenues Share, By Applications, 2021 & 2028F |

| 7.2. Mexico Diesel Genset Rental Market Revenues, By Applications, 2021 & 2028F |

| 7.2.1. Mexico Diesel Genset Rental Market Revenues, By Residential Applications, 2018-2028F |

| 7.2.2. Mexico Diesel Genset Rental Market Revenues, By Commercial Applications, 2018-2028F |

| 7.2.1. Mexico Diesel Genset Rental Market Revenues, By Industrial Applications, 2018-2028F |

| 8. Mexico Diesel Genset Rental Market – Key Performance Indicators |

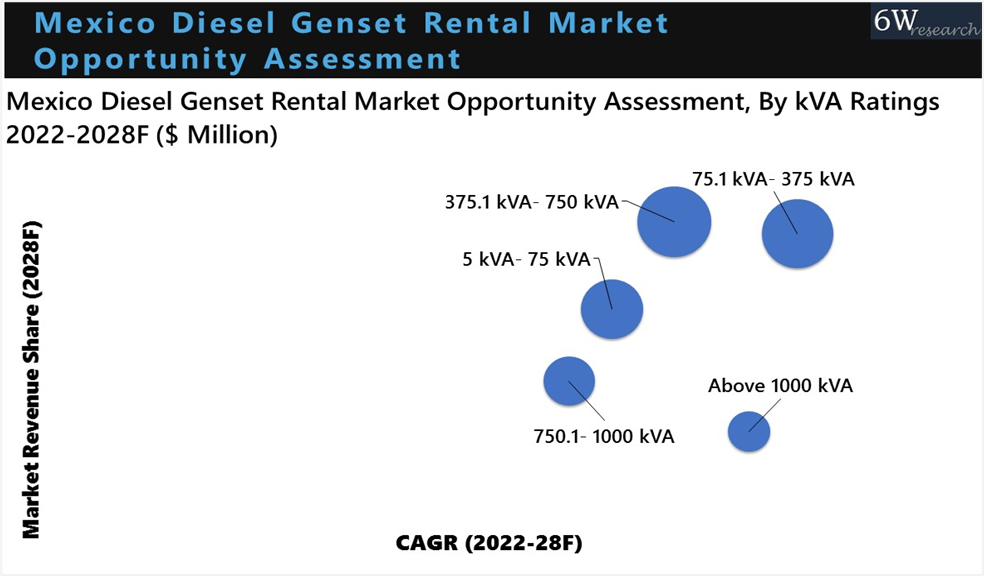

| 9. Mexico Diesel Genset Rental Market Opportunity Assessment |

| 9.1. Mexico Diesel Genset Rental Market Opportunity Assessment, By kVA Ratings, 2028F |

| 9.2. Mexico Diesel Genset Rental Market Opportunity Assessment, By Applications, 2028F |

| 10. Mexico Diesel Genset Rental Market Competitive Landscape |

| 10.1. Mexico Diesel Genset Rental Market , By Company Ranking, 2021 |

| 10.2. Mexico Diesel Genset Rental Market Competitive Benchmarking, By Technical Parameters |

| 10.3. Mexico Diesel Genset Rental Market Competitive Benchmarking, By Operating Parameters |

| 11. Company Profiles |

| 11.1. Aggreko plc |

| 11.2. Atlas Copco AB. |

| 11.3. Audiosystems |

| 11.4. Generac Power Systems, Inc. |

| 11.5. Kohler Power Systems |

| 11.6. APR Energy |

| 11.7. Cimerent |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures |

| Figure 1. Mexico Genset Rental Market Revenues, 2018-2028F ($ Million) |

| Figure 2. Mexico City, O?ice Projected Delivery Date and Buildings Currently Under Construction Unit/Sqm, (2022-2023) |

| Figure 3. Mexico Diesel Genset Rental Market Revenue Share, By kVA Ratings, 2021 & 2028F |

| Figure 4. Mexico 5 - 75 kVA Rating Diesel Genset Rental Market Revenues, 2018-2028F ($ Million) |

| Figure 5. Mexico Up to 75.1-375 kVA Rating Diesel Genset Rental Market Revenues, 2018-2028F ($ Million) |

| Figure 6. Mexico Up to 375.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2018-2028F ($ Million) |

| Figure 7. Mexico Up to 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2018-2028F ($ Million) |

| Figure 8. Mexico above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2018-2028F ($ Million) |

| Figure 9. Mexico Diesel Genset Rental Market Revenues Share, By Applications, 2021 & 2028F |

| Figure 10. Number of Upcoming Hotel Projects in Mexico, 2021-2024F |

| Figure 11. Mexico Hotel Projects By State, 2020 |

| Figure 12. Percentage Share of Upcoming Hotel Projects in Mexico, By Types, 2024F |

| Figure 13. Aerospace Industry In Queretaro State Key Figures, (in Units), (2020) |

| Figure 14. Aerospace Industry in Mexico, By Segment, 2020 |

| Figure 15. Mexico Automotive Output, YOY % Change, 2020-2022 |

| Figure 16. Mexico Automotive Industry, FDI, By Sector, 2020 |

| Figure 17. Mexico Light Vehicles outlook,2021 |

| Figure 18. Mexico Diesel Genset Rental Market Opportunity Assessment, By kVA Ratings, 2028F |

| Figure 19. Mexico Diesel Genset Rental Market Opportunity Assessment, By Applications, 2028F |

| Figure 20. Mexico Diesel Genset Rental Market Revenue Ranking, By Company, 2021 |

| List of tables |

| Table 1. Mexico Oil & Gas Ongoing Projects |

| Table 2. Mexico NDC Updated In 2020, Baseline Of Gross Greenhouse Gas Emissions (Millions Of Tons Of Carbon Dioxide Equivalent, Mtco2e) |

| Table 3. Mexico Diesel Genset Rental Market Revenues, By Commercial Application, 2018–2028F ($ Million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero