Mexico Gambling Market (2020-2026) | Size, Share, Analysis, Revenue, Forecast, Trends, Growth, value, industry, Outlook & COVID-19 IMPACT

Market Forecast By Product Type (Betting, Casino, Lottery & Others (Poker, Bingo, etc), By Channel Type (Online, Land-based) and by competitive landscape

| Product Code: ETC053982 | Publication Date: Mar 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 14 | No. of Tables: 5 |

Mexico Gambling Market Size & Growth Rate

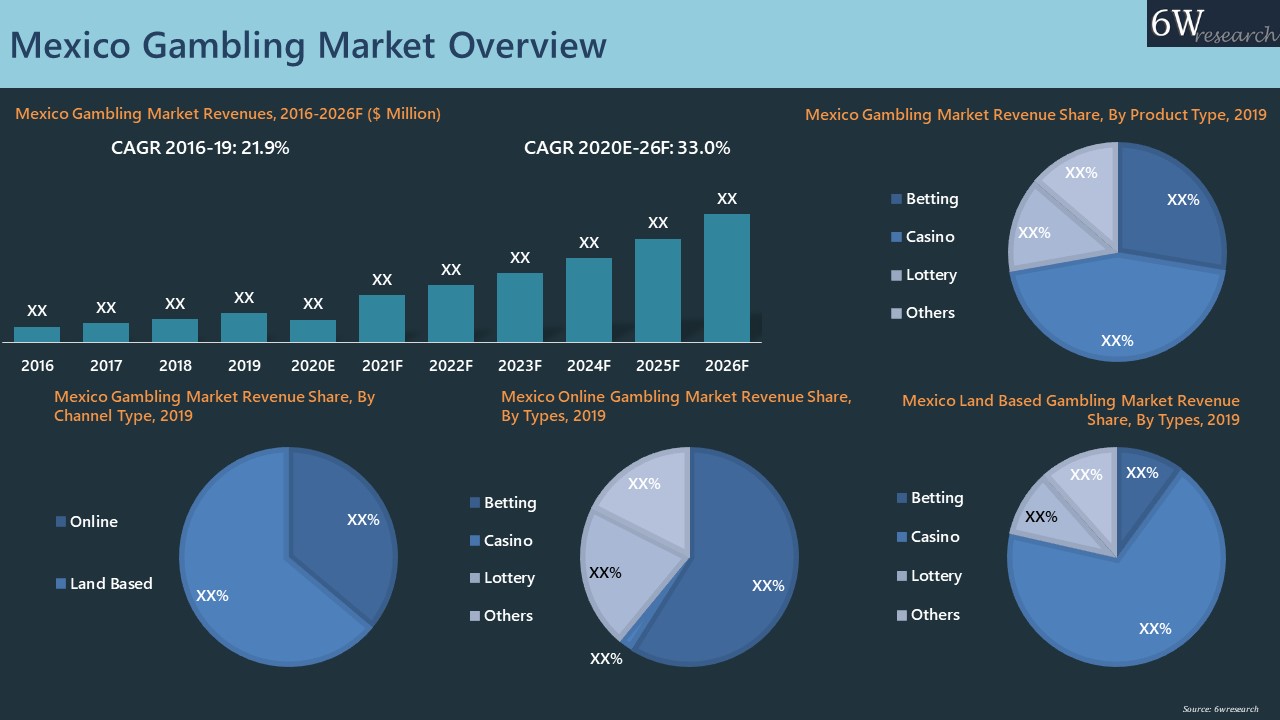

The Mexico Gambling Market is projected to grow at a remarkable CAGR of 33% during 2020–2026, driven by rising internet penetration, growing smartphone adoption, and increasing digitalization.

Mexico Gambling Market Synopsis

Mexico Gambling Market has been growing significantly owing to the changing lifestyles and rise in purchasing power of consumers. Increasing adoption of smartphones and rising penetration of the internet which provides easy access to online casino gaming platforms are also driving the market. The outbreak of the Covid-19 pandemic led to a decrease in market revenues in the year 2020 owing to the closing of land-based gambling platforms due to the pandemic. However, the market is expected to register growth in the forecast period. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in overall market growth.

According to 6Wresearch, Mexico Gambling Market size is projected to grow at a CAGR of 33% during 2020-2026. Although Covid-19 led to a decrease in the market revenue of land-based casinos, it had a positive impact on online gambling platforms. As customers could not step out of their houses during the lockdown, many of them started using online gambling platforms as a leisure activity. Factors such as increasing internet penetration and the availability of cost-effective mobile applications contributed to this trend. Moreover, increasing digitalization coupled with secure digital payment options are also some factors contributing to the online gambling market growth. The market is further expected to gain momentum over the forecast period attributed to the rising use of digital currency and websites provided by companies for betting and gambling.

Market Analysis by Product Type

By product type, the gambling market is segmented into betting, casino, lottery and others. The casino segment has been dominating the market and is expected to register growth in future.

Market Analysis by Channel Type

By channel type, the gambling market is segmented into online and land-based. The land-based segment is dominating the market revenues in 2019, but the online segment is expected to register maximum growth in the forecast period.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2020.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Mexico Gambling Market Overview

- Mexico Gambling Market Outlook

- Mexico Gambling Market Forecast

- Historical Data and Forecast of Mexico Gambling Market Revenues, for the Period 2016-2026F

- Historical Data and Forecast of Mexico Gambling Market Revenues, By Product Type, for the Period 2016-2026F

- Historical Data and Forecast of Mexico Gambling Market Revenues, By Channel Type, for the Period 2016-2026F

- Historical Data and Forecast of Mexico Online Gambling Market Revenues, By Types, for the Period 2016-2026F

- Historical Data and Forecast of Mexico Land Based Gambling Market Revenues, By Types, for the Period 2016-2026F

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Channel Type

- Market Drivers and Restraints

- Market Trends

- Competitive Benchmarking

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Product Type

- Betting

- Casino

- Lottery

- Others (Poker, Bingo, etc)

By Channel Type

- Online

- Land-based

Mexico Gambling Market: FAQs

| TABLE OF CONTENT |

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Mexico Gambling Market Overview |

| 3.1 Mexico Gambling Market Revenues, 2016-2026F |

| 3.2 Mexico Gambling Market-Industry Life Cycle |

| 3.3 Mexico Gambling Market-Porter’s Five Forces |

| 4. Mexico Gambling Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Favorable regulatory environment for gambling industry in Mexico |

| 4.2.2 Growing disposable income of the population leading to increased spending on leisure activities |

| 4.2.3 Rising popularity of online gambling platforms in Mexico |

| 4.3 Market Restraints |

| 4.3.1 High tax rates imposed on gambling operators in Mexico |

| 4.3.2 Stringent regulations and oversight from government authorities |

| 4.3.3 Concerns over gambling addiction and social implications in the Mexican society |

| 5. Mexico Gambling Market Trends |

| 6. Mexico Gambling Market Overview, By Product Type |

| 6.1 Mexico Gambling Market Revenue Share, By Product Type |

| 6.2 Mexico Gambling Market Revenues, By Product Type, 2016-2026F |

| 6.2.1 Mexico Gambling Market Revenues, By Betting, 2016-2026F |

| 6.2.2 Mexico Gambling Market Revenues, By Casino, 2016-2026F |

| 6.2.3 Mexico Gambling Market Revenues, By Lottery, 2016-2026F |

| 6.2.4 Mexico Gambling Market Volume, By Others, 2016-2026F |

| 7. Mexico Gambling Market Overview, By Channel Type |

| 7.1 Mexico Gambling Market Revenue Share, By Channel Type |

| 7.2 Mexico Gambling Market Revenues, By Channel Type, 2016-2026F |

| 7.2.1 Mexico Gambling Market Revenues, By Online, 2016-2026F |

| 7.2.2 Mexico Gambling Market Revenues, By Land-Based, 2016-2026F |

| 8. Mexico Online Gambling Market Overview, By Types |

| 8.1 Mexico Online Gambling Market Revenue Share, By Types |

| 8.2 Mexico Online Gambling Market Revenues, By Types, 2016-2026F |

| 8.2.1 Mexico Online Gambling Market Revenues, By Betting, 2016-2026F |

| 8.2.2 Mexico Online Gambling Market Revenues, By Casino, 2016-2026F |

| 8.2.3 Mexico Online Gambling Market Revenues, By Lottery, 2016-2026F |

| 8.2.4 Mexico Online Gambling Market Revenues, By Others, 2016-2026F |

| 9. Mexico Land-Based Gambling Market Overview, By Types |

| 9.1 Mexico Land-Based Gambling Market Revenue Share, By Types |

| 9.2 Mexico Land-Based Gambling Market Revenues, By Types, 2016-2026F |

| 9.2.1 Mexico Land-Based Gambling Market Revenues, By Betting, 2016-2026F |

| 9.2.2 Mexico Land-Based Gambling Market Revenues, By Casino, 2016-2026F |

| 9.2.3 Mexico Land-Based Gambling Market Revenues, By Lottery, 2016-2026F |

| 9.2.4 Mexico Land-Based Gambling Market Revenues, By Others, 2016-2026F |

| 10. Mexico Gambling Market Key Performance Indicators |

| 11 Mexico Gambling Market Opportunity Assessment |

| 11.1 Mexico Gambling Market, Opportunity Assessment, By Product Type, 2026F |

| 11.2 Mexico Gambling Market, Opportunity Assessment, By Channel Type, 2026F |

| 11.3 Mexico Online Gambling Market, Opportunity Assessment, By Type, 2026F |

| 11.4 Mexico Land-Based Gambling Market, Opportunity Assessment, By Type, 2026F |

| 12. Mexico Gambling Market Competitive Landscape |

| 12.1 Mexico Gambling Market Competitive Benchmarking |

| 12.1.1 Mexico Gambling Market Competitive Benchmarking, By Technical Parameters |

| 12.1.2 Mexico Gambling Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Codere Group |

| 13.2 Winland Group |

| 13.3 Caliente Casino |

| 13.4 Bet365 |

| 13.5 Intertops |

| 13.6 1xBet |

| 13.7 Interwetten |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| LIST OF FIGURES |

| 1. Mexico Gambling Market Revenues, 2016-2026F ($ Million) |

| 2. GDP Per Capita of Mexico 2018-2025 (US$) |

| 3. Purchasing Power Parity of Mexico (Local Currency Unit per USD) |

| 4. Percentage of Mexico’s population using the Internet |

| 5. Secure Internet Servers per 1 Million People in Mexico |

| 6. Mexico Gambling Market Revenue Share, By Product Type, 2019 & 2026F |

| 7. Mexico Gambling Market Revenue Share, By Channel Type, 2019 & 2026F |

| 8. Mexico Online Gambling Market Revenue Share, By Types, 2019 & 2026F |

| 9. Mexico Land-Based Gambling Market Revenue Share, By Types, 2019 & 2026F |

| 10. Tourist Arrivals in Mexico Jan 2020 – Nov 2020 (in thousand) |

| 11. Mexico Gambling Market Opportunity Assessment, By Product Type, 2026F |

| 12. Mexico Gambling Market Opportunity Assessment, By Channel Type, 2026F |

| 13. Mexico Online Gambling Market Opportunity Assessment, By Types, 2026F |

| 14. Mexico Land-Based Gambling Market Opportunity Assessment, By Types, 2026F |

| LIST OF TABLES |

| 1. Household Final Consumption Expenditure of Mexico 2017-2019 |

| 2. Mexico Gambling Market Revenues, By Product Type, 2016-2026F ($ Million) |

| 3. Mexico Gambling Market Revenues, By Channel Type, 2016-2026F ($ Million) |

| 4. Mexico Online Gambling Market Revenues, By Types, 2016-2026F ($ Million) |

| 5. Mexico Land-Based Gambling Market Revenues, By Types, 2016-2026F ($ Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero