Mexico Marine Engines Market (2025-2031) | Industry, Outlook, Size, Companies, Analysis, Revenue, Value, Trends, Forecast, Growth & Share

Market Forecast By Power Range (Up to 1,000 hp, 1,001 – 5,000 hp, 5,001 – 10,000 hp, 10,001 – 20,000 hp, Above 20,000 hp), By Vessel (Commercial, Offshore support, Others), By Fuel (Heavy Fuel Oil, Intermediate Fuel Oil, Marine Diesel Oil, Marine Gas Oil, Others), By Engine (Propulsion, Auxiliary), By Type (Two-stroke, Four-stroke) And Competitive Landscape

| Product Code: ETC049603 | Publication Date: Jan 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Mexico Marine Engines Market | Country-Wise Share and Competition Analysis

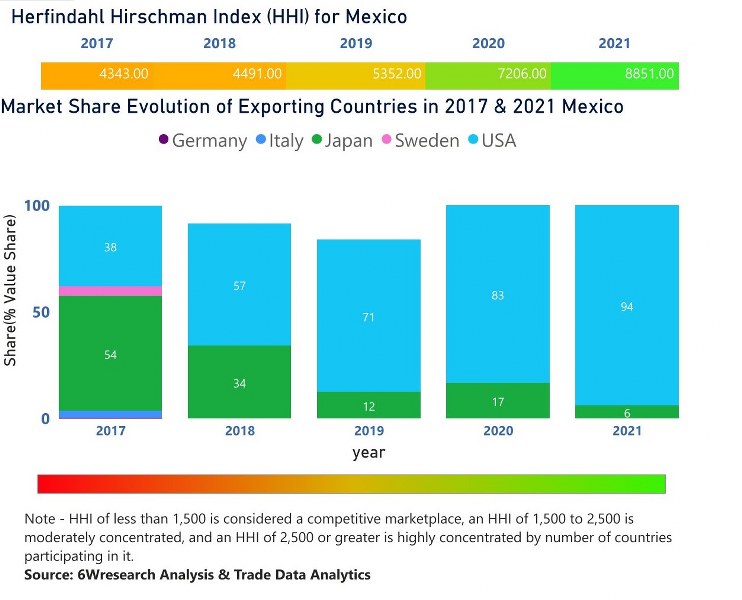

In the year 2021, USA was the largest exporter in terms of value, followed by Japan. It has registered a decline of -0.72% over the previous year. While Japan registered a decline of -67.92% as compare to the previous year. In the year 2017 Japan was the largest exporter followed by USA. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Mexico has the Herfindahl index of 4343 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 8851 which signifies high concentration in the market.

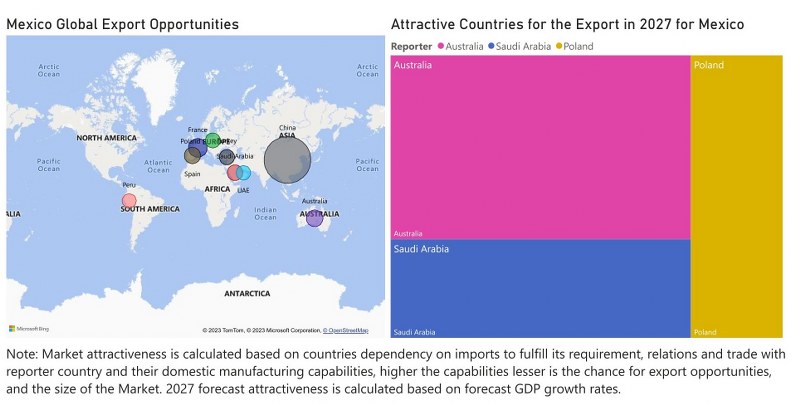

Mexico Marine Engines Market - Export Market Opportunities

Mexico Marine Engines Market Highlights

| Report Name | Mexico Marine Engines Market |

| Forecast period | 2025-2031 |

| CAGR | 4% |

| Growing Sector | Commercial Shipping |

Topics Covered in Mexico Marine Engines Market Report

Mexico Marine Engines Market report thoroughly covers the market By Power Range, By Vessel, By Fuel, By Engine. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Mexico Marine Engines Market Synopsis

Mexico Marine Engines Market is set for considerable development in the coming years due to several influential factors. The rise in global maritime trade and Mexico's advantageous geographic position are cultivating an environment ripe for growth in the marine industry. Key drivers include the increasing demand for state-of-the-art engines that improve fuel efficiency and meet stringent environmental regulations. Both commercial and recreational sectors are leaning towards adopting these advanced engines to enhance performance and sustainability. Moreover, governmental policies and investments aimed at boosting maritime infrastructure are likely to underpin the Mexico Marine Engines Market Growth.

According to 6Wresearch, Mexico Marine Engines Market Size is projected to grow at a CAGR of 4% during the forecast period 2025-2031. Several growth factors are propelling the marine engines market in Mexico. Among these, the demand for eco-friendly and efficient engines stands out as a major driver, with both national and international regulations aiming to reduce emissions from maritime operations. This shift towards sustainability encourages manufacturers to innovate and develop cleaner technologies. Additionally, Mexico's strategic location as a gateway between North and South America positions it favorably for increased shipping and transit activities, further boosting the marine industry.

However, the industry also faces significant challenges. One of the primary hurdles is the need for substantial investment in infrastructure to support the expanding market. Developing ports, enhancing maintenance facilities, and improving supply chains are essential to accommodate increased maritime traffic and the operation of newer, more complex engines. Another challenge is the potential shortage of skilled labor familiar with advanced marine technologies, which could hinder growth if not addressed through targeted training and education programs. Navigating these challenges while leveraging growth opportunities will be crucial for sustaining the marine engines market's momentum in Mexico.

Mexico Marine Engines Market Trends

One of the major trends in the Mexico marine engines market is the increasing adoption of electric and hybrid engines. With growing concerns about climate change and pollution, there has been a push towards cleaner and more sustainable forms of propulsion for marine vessels. This has led to the development and introduction of electric and hybrid engines that offer lower emissions, greater fuel efficiency, and quieter operations.

Another trend that is gaining traction in the Mexico marine engines industry is digitalization and connectivity. With the development of advanced sensor technology and internet connectivity, marine engines are becoming more connected and capable of collecting and transmitting data in real-time. This allows for better monitoring, diagnostics, and predictive maintenance, resulting in improved overall performance and reduced downtime.

Investment Opportunities in Mexico Marine Engines Market

The burgeoning marine engines market in Mexico presents numerous investment opportunities for both domestic and international stakeholders. Key investment areas include the development of green technology ventures aimed at producing eco-friendly engines that comply with emerging environmental regulations. Companies that focus on research and innovation stand to benefit from government incentives and partnerships, as Mexico prioritizes sustainable maritime practices. Additionally, infrastructure development offers a promising avenue for investment. This includes modernizing ports, augmenting repair and maintenance facilities, and upgrading supply chain logistics to meet the demands of increased maritime activity. There is also potential for investment in education and training programs to build a skilled workforce knowledgeable in advanced marine engine technologies. By capitalizing on these opportunities, investors can play a pivotal role in shaping a resilient and progressive marine industry in Mexico.

Leading Players in the Mexico Marine Engines Market

Several leading players dominate the Mexico Marine Engines Market Share, including both international and local manufacturers. include Caterpillar Inc., Rolls-Royce plc, Volvo Penta, MAN Diesel & Turbo SE, and Wärtsilä Corporation. These companies are focused on research and development activities to enhance their product portfolio and maintain a competitive edge in the market.

Government Regulations

The government has implemented several regulations to ensure the sustainable growth of the marine engines market while addressing environmental concerns. One prominent regulation is the mandatory adherence to emission standards akin to the International Maritime Organization's (IMO) regulations, which aim to reduce sulfur oxide emissions from ships. For example, ships operating in Mexican waters must use fuels with a sulfur content of no more than 0.5% m/m, a significant reduction from previous allowances. Additionally, the government has introduced incentives for adopting alternative fuels, such as LNG (liquefied natural gas), which produce fewer emissions. There are also specific requirements for the retrofitting of older engines to increase their efficiency and reduce environmental impact. Such regulations not only help protect marine ecosystems but also drive innovation and investment in cleaner technologies within the industry.

Future Insights of the Mexico Marine Engines Market

The Mexico marine engines market is expected to witness significant growth in the coming years, driven by advancements in technology and increasing demand for eco-friendly and energy-efficient engines. With government regulations becoming more stringent, there will be a growing need for cleaner marine engines, creating opportunities for market players to expand their product offerings. Furthermore, the rise in maritime trade activities and recreational boat ownership is expected to further propel market growth. In conclusion, the Mexico marine engines market presents lucrative opportunities for businesses operating in this industry. By focusing on innovation and sustainability, companies can capitalize on these opportunities and stay ahead in this competitive market.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

1,001 - 5,000 hp to Dominate the Market- By Power Range

The power range of 1,001 - 5,000 hp has seen an increase in demand in Mexico. This is due to the growing popularity of mid-sized boats and vessels for various commercial and recreational purposes.

Offshore support to Dominate the Market-By Vessel

According to Nitesh Kumar, Research Manager, 6Wresearch, one of the vessel segments that has been experiencing a significant increase in demand in the Mexico marine engines market is the offshore support vessels segment. This can be attributed to several factors such as the growth in offshore oil and gas exploration activities, increasing demand for renewable energy sources, and the expansion of maritime trade routes.

Propulsion engines to Dominate the Market by Engine

The propulsion engines segment is experiencing significant growth in demand in the Mexico marine engines market. These types of engines are responsible for providing the primary source of power and drive for a vessel's movement, making them essential for any marine craft.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Mexico Marine Engines Market Outlook

- Market Size of Mexico Marine Engines Market, 2024

- Forecast of Mexico Marine Engines Market, 2031

- Historical Data and Forecast of Mexico Marine Engines Revenues & Volume for the Period 2021 - 2031

- Mexico Marine Engines Market Trend Evolution

- Mexico Marine Engines Market Drivers and Challenges

- Mexico Marine Engines Price Trends

- Mexico Marine Engines Porter's Five Forces

- Mexico Marine Engines IndMexico try Life Cycle

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Power Range for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Up to 1,000 hp for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By 1,001 ? 5,000 hp for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By 5,001 ? 10,000 hp for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By 10,001 ? 20,000 hp for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Above 20,000 hp for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Vessel for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Offshore support for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Fuel for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Heavy Fuel Oil for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Intermediate Fuel Oil for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Marine Diesel Oil for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Marine Gas Oil for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Engine for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Propulsion for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Auxiliary for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Two-stroke for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Marine Engines Market Revenues & Volume By Four-stroke for the Period 2021 - 2031

- Mexico Marine Engines Import Export Trade Statistics

- Market Opportunity Assessment By Power Range

- Market Opportunity Assessment By Vessel

- Market Opportunity Assessment By Fuel

- Market Opportunity Assessment By Engine

- Market Opportunity Assessment By Type

- Mexico Marine Engines Top Companies Market Share

- Mexico Marine Engines Competitive Benchmarking By Technical and Operational Parameters

- Mexico Marine Engines Company Profiles

- Mexico Marine Engines Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Power Range

- Up to 1,000 hp

- 1,001 – 5,000 hp

- 5,001 – 10,000 hp

- 10,001 – 20,000 hp

- Above 20,000 hp

By Vessel

- Commercial

- Offshore support

- Others

By Fuel

- Heavy Fuel Oil

- Intermediate Fuel Oil

- Marine Diesel Oil

- Marine Gas Oil

- Others

By Engine

- Propulsion

- Auxiliary

By Type

- Two-stroke

- Four-stroke

Mexico Marine Engines Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Mexico Marine Engines Market Overview |

| 3.1 Mexico Country Macro Economic Indicators |

| 3.2 Mexico Marine Engines Market Revenues & Volume, 2021 & 2031F |

| 3.3 Mexico Marine Engines Market - Industry Life Cycle |

| 3.4 Mexico Marine Engines Market - Porter's Five Forces |

| 3.5 Mexico Marine Engines Market Revenues & Volume Share, By Power Range, 2021 & 2031F |

| 3.6 Mexico Marine Engines Market Revenues & Volume Share, By Vessel, 2021 & 2031F |

| 3.7 Mexico Marine Engines Market Revenues & Volume Share, By Fuel, 2021 & 2031F |

| 3.8 Mexico Marine Engines Market Revenues & Volume Share, By Engine, 2021 & 2031F |

| 3.9 Mexico Marine Engines Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 4 Mexico Marine Engines Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growth in marine tourism industry in Mexico |

| 4.2.2 Increasing demand for recreational boating activities |

| 4.2.3 Government initiatives promoting maritime transportation infrastructure development |

| 4.3 Market Restraints |

| 4.3.1 High initial investment costs for marine engines |

| 4.3.2 Fluctuating prices of raw materials impacting manufacturing costs |

| 4.3.3 Stringent environmental regulations regarding emissions and fuel efficiency |

| 5 Mexico Marine Engines Market Trends |

| 6 Mexico Marine Engines Market, By Types |

| 6.1 Mexico Marine Engines Market, By Power Range |

| 6.1.1 Overview and Analysis |

| 6.1.2 Mexico Marine Engines Market Revenues & Volume, By Power Range, 2021 - 2031F |

| 6.1.3 Mexico Marine Engines Market Revenues & Volume, By Up to 1,000 hp, 2021 - 2031F |

| 6.1.4 Mexico Marine Engines Market Revenues & Volume, By 1,001 ? 5,000 hp, 2021 - 2031F |

| 6.1.5 Mexico Marine Engines Market Revenues & Volume, By 5,001 ? 10,000 hp, 2021 - 2031F |

| 6.1.6 Mexico Marine Engines Market Revenues & Volume, By 10,001 ? 20,000 hp, 2021 - 2031F |

| 6.1.7 Mexico Marine Engines Market Revenues & Volume, By Above 20,000 hp, 2021 - 2031F |

| 6.2 Mexico Marine Engines Market, By Vessel |

| 6.2.1 Overview and Analysis |

| 6.2.2 Mexico Marine Engines Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 6.2.3 Mexico Marine Engines Market Revenues & Volume, By Offshore support, 2021 - 2031F |

| 6.2.4 Mexico Marine Engines Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3 Mexico Marine Engines Market, By Fuel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Mexico Marine Engines Market Revenues & Volume, By Heavy Fuel Oil, 2021 - 2031F |

| 6.3.3 Mexico Marine Engines Market Revenues & Volume, By Intermediate Fuel Oil, 2021 - 2031F |

| 6.3.4 Mexico Marine Engines Market Revenues & Volume, By Marine Diesel Oil, 2021 - 2031F |

| 6.3.5 Mexico Marine Engines Market Revenues & Volume, By Marine Gas Oil, 2021 - 2031F |

| 6.3.6 Mexico Marine Engines Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.4 Mexico Marine Engines Market, By Engine |

| 6.4.1 Overview and Analysis |

| 6.4.2 Mexico Marine Engines Market Revenues & Volume, By Propulsion, 2021 - 2031F |

| 6.4.3 Mexico Marine Engines Market Revenues & Volume, By Auxiliary, 2021 - 2031F |

| 6.5 Mexico Marine Engines Market, By Type |

| 6.5.1 Overview and Analysis |

| 6.5.2 Mexico Marine Engines Market Revenues & Volume, By Two-stroke, 2021 - 2031F |

| 6.5.3 Mexico Marine Engines Market Revenues & Volume, By Four-stroke, 2021 - 2031F |

| 7 Mexico Marine Engines Market Import-Export Trade Statistics |

| 7.1 Mexico Marine Engines Market Export to Major Countries |

| 7.2 Mexico Marine Engines Market Imports from Major Countries |

| 8 Mexico Marine Engines Market Key Performance Indicators |

| 8.1 Average age of marine engines in use |

| 8.2 Number of new boat registrations |

| 8.3 Adoption rate of eco-friendly marine engines |

| 8.4 Average fuel efficiency of marine engines |

| 8.5 Investment in marine engine research and development |

| 9 Mexico Marine Engines Market - Opportunity Assessment |

| 9.1 Mexico Marine Engines Market Opportunity Assessment, By Power Range, 2021 & 2031F |

| 9.2 Mexico Marine Engines Market Opportunity Assessment, By Vessel, 2021 & 2031F |

| 9.3 Mexico Marine Engines Market Opportunity Assessment, By Fuel, 2021 & 2031F |

| 9.4 Mexico Marine Engines Market Opportunity Assessment, By Engine, 2021 & 2031F |

| 9.5 Mexico Marine Engines Market Opportunity Assessment, By Type, 2021 & 2031F |

| 10 Mexico Marine Engines Market - Competitive Landscape |

| 10.1 Mexico Marine Engines Market Revenue Share, By Companies, 2024 |

| 10.2 Mexico Marine Engines Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero