Morocco Ethanol Market (2025-2031) | Share, Revenue, Trends, Companies, Growth, Outlook, Size, Analysis, Industry, Value & Forecast

MarketForecastBy Purity (Denatured, Non-Denatured), By Sources (Sugar & Molasses Based, Grained Based, Second Generation) By Application (Industrial Solvent, Fuel & Fuel Additives, Beverages, Disinfectant, Personal Care, Others) And Competitive Landscape

| Product Code: ETC003155 | Publication Date: Jul 2020 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Morocco Ethanol Market | Country-Wise Share and Competition Analysis

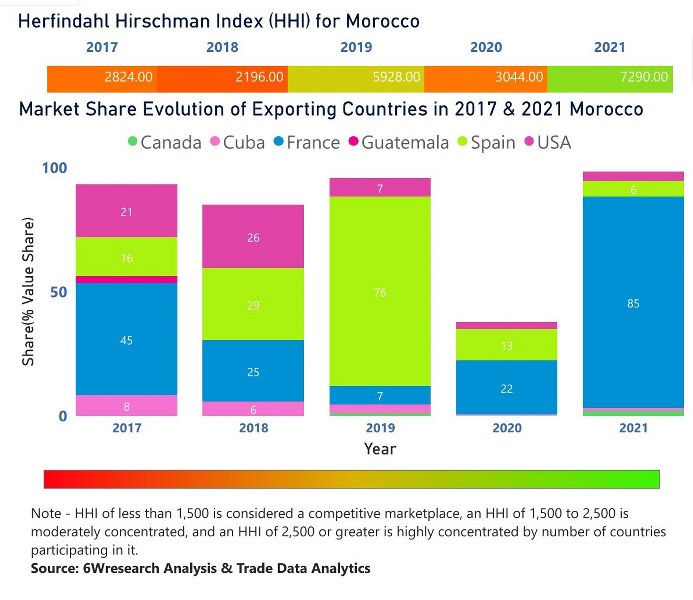

In the year 2021, France was the largest exporter in terms of value, followed by Spain. It has registered a decline of -16.15% over the previous year. While Spain registered a decline of -89.41% as compare to the previous year. In the year 2017 France was the largest exporter followed by USA. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Morocco has the Herfindahl index of 2824 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 7290 which signifies high concentration in the market.

Topics Covered in the Morocco Ethanol Market Report

The Morocco Ethanol Market report thoroughly covers the market by Purity, Source, and Application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Morocco Ethanol Market Synopsis

The Morocco Ethanol Market has witnessed growth in the past years. The market will continue its growth steadily in the coming years. Factors such as reducing carbon footprint, rise in oil prices, production from locally grown crops, growing population, and government initiatives are contributing to the growth of the market.

According to 6Wresearch, the Morocco Ethanol Market size is expected to grow at a significant CAGR of 5% during 2025-2031. One of the main drivers of the ethanol market in Morocco is the country’s commitment to reducing its carbon footprint. Ethanol is a cleaner fuel alternative as it emits less carbon while burning. Additionally, with the rise in global oil prices and concerns over security, the country is looking towards ethanol as a more affordable and sustainable option. Ethanol is produced from locally grown crops such as sugarcane, corn, and sorghum, which reduces the country’s reliance on imported fossil fuels. Moreover, the growing demand for cleaner and more environmentally friendly transportation options has also contributed to the growth of the ethanol market in Morocco. The use of ethanol-blended fuels can significantly reduce emissions of harmful pollutants such as carbon monoxide and particulate matter.

One of the main challenges is the lack of infrastructure for the production and distribution of ethanol. Another challenge is the competition from other alternative fuels such as compressed natural gas (CNG) and electric vehicles. Moreover, there are concerns about the impact of large-scale ethanol production on food security and water resources in Morocco.

Morocco Ethanol Industry: Leading Players

The Moroccan ethanol market is dominated by two major players such as Addoha Bioenergy and Société de Bioénergie Renouvelable (SBR). Addoha Bioenergy is a subsidiary of the Moroccan real estate company Addoha Group, and it produces ethanol from sugar cane. SBR is a joint venture between the state-owned sugar producer Cosumar and French energy company Albioma. It also produces ethanol from sugar cane. Other players in the market include Maghreb Ethanol Company (MEC), which is owned by the Moroccan conglomerate Ynna Holding, and Lydec Biotechnology, a subsidiary of the utility company Lydec that focuses on producing ethanol from waste products.

Morocco Ethanol Market: Government Regulations

One of the main initiatives by the Moroccan government is its commitment to blending ethanol with gasoline. The government has also implemented various fiscal incentives and subsidies to promote domestic ethanol production. This includes tax exemptions, reduced import duties on machinery and equipment used in ethanol production, and financial support for research and development activities. Additionally, the government has also launched awareness campaigns and educational programs to promote the benefits of using ethanol as a fuel source. Moreover, the Moroccan government is actively working towards creating a favourable regulatory framework for the ethanol market.

Future Insights of the Market

The Morocco ethanol market is expected to witness significant growth in the coming years due to increasing awareness about renewable energy sources and the government's efforts towards promoting cleaner fuel alternatives. The country's heavy reliance on imported fossil fuels also makes investing in domestic ethanol production an attractive option for both economic and sustainability reasons. Furthermore, the growing demand for biofuels in Europe, Morocco's main export market, provides a lucrative opportunity for local ethanol producers.

Market Segmentation by Purity

According to Ravi Bhandari, Research Head, 6Wresearch, the non-denatured segment is expected to grow significantly due to the increasing demand for high-purity ethanol in various industries such as personal care and beverages.

Market Segmentation by Source

In terms of source, the sugar & molasses-based segment is expected to dominate the market due to its wide availability and low cost compared to other sources.

Market Segmentation by Applications

The fuel & fuel additives application segment holds the largest share of the market as ethanol is widely used as a biofuel additive due to its ability to reduce emissions and improve fuel efficiency.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Morocco Ethanol Market Overview

- Morocco Ethanol Market Outlook

- Morocco Ethanol Market Forecast

- Historical Data of Morocco Ethanol Market Revenues and Volumes, for the Period 2021-2031

- Market Size & Forecast of Morocco Ethanol Market Revenues and Volumes, until 2031.

- Historical Data of Morocco Ethanol Market Revenues and Volumes, by purity, for the Period 2021-2031

- Market Size & Forecast of Morocco Ethanol Market Revenues and Volumes, by purity, until 2031.

- Historical Data of Morocco Ethanol Market Revenues and Volumes, by Source, for the Period 2021-2031

- Market Size & Forecast of Morocco Ethanol Market Revenues and Volumes, by source, until 2031.

- Historical Data of Morocco Ethanol Market Revenues and Volumes, by application, for the Period 2021-2031

- Market Size & Forecast of Morocco Ethanol Market Revenues and Volumes, by application, until 2031.

- Market Drivers and Restraints

- Morocco Ethanol Market Price Trends

- Morocco Ethanol Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Morocco Ethanol Market Share, By Players

- Morocco Ethanol Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

By Purity

- Denatured

- Non-Denatured

By Source

- Sugar & molasses Based

- Second Generation

- Grain Based

By Application

- Fuel & Fuel Additives

- Disinfectant

- Industrial Solvents

- Personal Care

- Beverages

- Others

Morocco Ethanol Market (2025-2031): FAQ

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Morocco Ethanol Market Overview |

| 3.1 Morocco Ethanol Market Revenues and Volume, 2021-2031F |

| 3.2 Morocco Ethanol Market Revenue Share, By Purity, 2021&2031F |

| 3.3 Morocco Ethanol Market Revenue Share, By Source, 2021&2031F |

| 3.4 Morocco Ethanol Market Revenue Share, By Application, 2021&2031F |

| 3.5 Morocco Ethanol Market - Industry Life Cycle |

| 3.6 Morocco Ethanol Market - Porter’s Five Forces |

| 4. Morocco Ethanol Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Morocco Ethanol Market Trends |

| 6. Morocco Ethanol Market Overview, by Source |

| 6.1 Morocco Sugar & Molasses Based Ethanol Market Revenues and Volume, 2021-2031F |

| 6.2 Morocco Grained Based Ethanol Market Revenues and Volume, 2021-2031F |

| 6.3 Morocco Second Generation Ethanol Market Revenues and Volume, 2021-2031F |

| 7. Morocco Ethanol Market Overview, by Purity |

| 7.1 Morocco Ethanol Market Revenue and Volumes, By Denatured, 2021-2031F |

| 7.2 Morocco Ethanol Market Revenue and Volumes, By Non-Denatured, 2021-2031F |

| 8. Morocco Ethanol Market Overview, by Application |

| 8.1 Morocco Ethanol Market Revenue and Volumes, By Industrial Solvent, 2021-2031F |

| 8.2 Morocco Ethanol Market Revenue and Volumes, By Fuel & Fuel Additives, 2021-2031F |

| 8.3 Morocco Ethanol Market Revenue and Volumes, By Beverages, 2021-2031F |

| 8.4 Morocco Ethanol Market Revenue and Volumes, By Disinfectant, 2021-2031F |

| 8.5 Morocco Ethanol Market Revenue and Volumes, By Personal Care, 2021-2031F |

| 8.6 Morocco Ethanol Market Revenue and Volumes, By Others, 2021-2031F |

| 9. Morocco Ethanol Market Key Performance Indicators |

| 10. Morocco Ethanol Market Opportunity Assessment |

| 10.1 Morocco Ethanol Market Opportunity Assessment, By Purity, 2031F |

| 10.2 Morocco Ethanol Market Opportunity Assessment, By Source, 2031F |

| 10.3 Morocco Ethanol Market Opportunity Assessment, By Application, 2031F |

| 11. Morocco Ethanol Market Competitive Landscape |

| 11.1 Morocco Ethanol Market By Companies, 2024 |

| 11.2 Morocco Ethanol Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero