Myanmar Canned Food Market Outlook | Companies, Share, Analysis, Revenue, Trends, Industry, Forecast, Growth, Size, COVID-19 IMPACT & Value

| Product Code: ETC218014 | Publication Date: Aug 2022 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

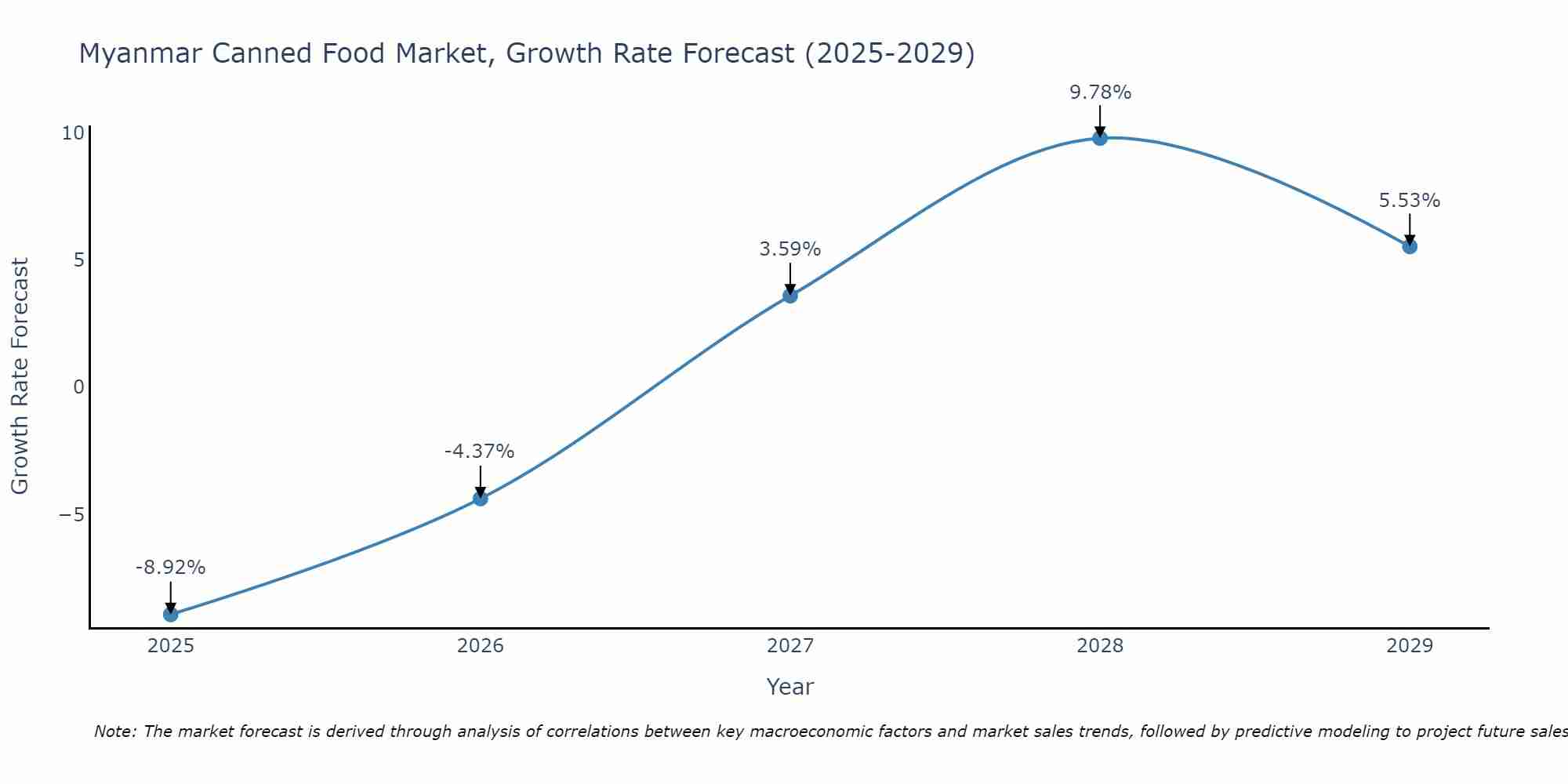

Myanmar Canned Food Market Size Growth Rate

The Myanmar Canned Food Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at -8.92% in 2025, climbs to a high of 9.78% in 2028, and moderates to 5.53% by 2029.

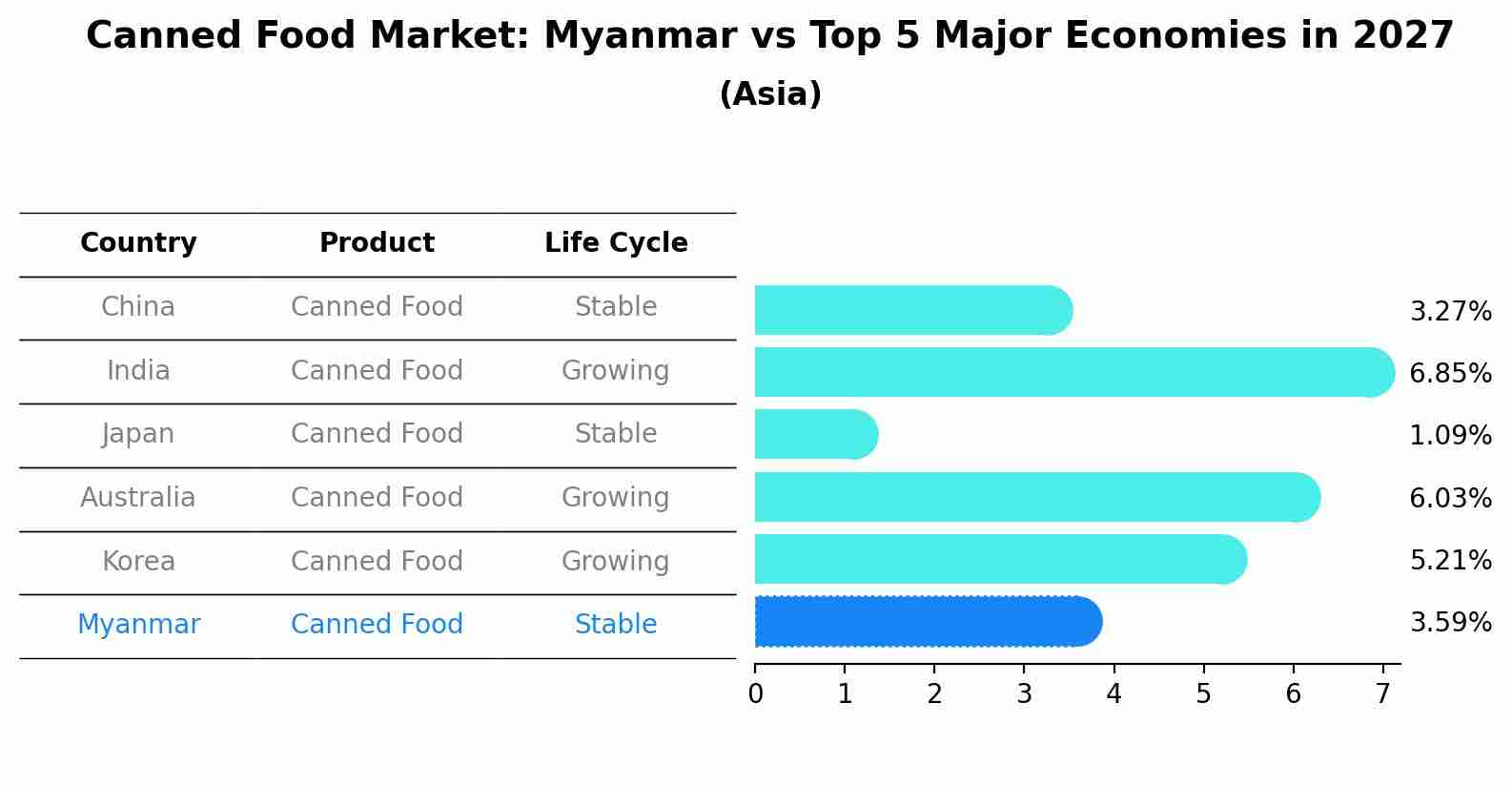

Canned Food Market: Myanmar vs Top 5 Major Economies in 2027 (Asia)

By 2027, Myanmar's Canned Food market is forecasted to achieve a stable growth rate of 3.59%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Myanmar Canned Food Market Overview

The overall canned food market in Myanmar encompasses a wide range of products, including fruits, vegetables, meats, seafood, and ready-to-eat meals. This market is driven by the convenience and longer shelf life of canned foods, making them appealing to busy urban consumers. The market is supported by both domestic production and imports. Growth is further propelled by the expansion of supermarkets and hypermarkets, which provide greater access to a variety of canned food products. Challenges include competition from fresh and frozen alternatives, but the convenience factor continues to sustain market growth.

Drivers of the market

The canned food market in Myanmar is experiencing growth due to several factors, including the increasing number of working professionals and changing dietary habits. The convenience of canned foods, which offer quick meal solutions without the need for extensive preparation, is particularly appealing to urban dwellers. Furthermore, the expanding middle class with higher disposable incomes is contributing to the demand for a diverse range of canned food products. Advances in food processing technology and improvements in packaging also enhance the appeal of canned foods by ensuring better quality and safety.

Challenges of the market

The broader Myanmar canned food market is confronted with challenges that stem from both supply-side and demand-side issues. On the supply side, the industry grapples with outdated production equipment, insufficient cold storage facilities, and unreliable electricity supply, all of which impact the efficiency and quality of canned food production. On the demand side, there is a limited consumer base due to low purchasing power and a cultural preference for fresh over processed foods. Additionally, regulatory hurdles and a lack of stringent food safety standards make it difficult for local producers to meet international quality benchmarks, restricting their ability to penetrate global markets.

Government Policy of the market

The government of Myanmar has prioritized the development of the canned food industry through various initiatives aimed at enhancing food safety standards and boosting production capabilities. Policies include providing incentives for setting up food processing units, improving the supply chain logistics, and ensuring compliance with international food safety standards to facilitate exports. The establishment of special economic zones (SEZs) has also played a crucial role in attracting foreign investment into the canned food sector.

Key Highlights of the Report:

- Myanmar Canned Food Market Outlook

- Market Size of Myanmar Canned Food Market, 2024

- Forecast of Myanmar Canned Food Market, 2031

- Historical Data and Forecast of Myanmar Canned Food Revenues & Volume for the Period 2018 - 2031

- Myanmar Canned Food Market Trend Evolution

- Myanmar Canned Food Market Drivers and Challenges

- Myanmar Canned Food Price Trends

- Myanmar Canned Food Porter's Five Forces

- Myanmar Canned Food Industry Life Cycle

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Product Type for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Canned meat & seafood for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Canned fruit & vegetables for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Canned ready meals for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Others for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Type for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Organic for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Conventional for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Distribution Channel for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Supermarket/Hypermarket for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Convenience stores for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By E-commerce for the Period 2018 - 2031

- Historical Data and Forecast of Myanmar Canned Food Market Revenues & Volume By Others for the Period 2018 - 2031

- Myanmar Canned Food Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Distribution Channel

- Myanmar Canned Food Top Companies Market Share

- Myanmar Canned Food Competitive Benchmarking By Technical and Operational Parameters

- Myanmar Canned Food Company Profiles

- Myanmar Canned Food Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Myanmar Canned Food Market Overview |

3.1 Myanmar Country Macro Economic Indicators |

3.2 Myanmar Canned Food Market Revenues & Volume, 2021 & 2031F |

3.3 Myanmar Canned Food Market - Industry Life Cycle |

3.4 Myanmar Canned Food Market - Porter's Five Forces |

3.5 Myanmar Canned Food Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

3.6 Myanmar Canned Food Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.7 Myanmar Canned Food Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

4 Myanmar Canned Food Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Myanmar Canned Food Market Trends |

6 Myanmar Canned Food Market, By Types |

6.1 Myanmar Canned Food Market, By Product Type |

6.1.1 Overview and Analysis |

6.1.2 Myanmar Canned Food Market Revenues & Volume, By Product Type, 2018 - 2031F |

6.1.3 Myanmar Canned Food Market Revenues & Volume, By Canned meat & seafood, 2018 - 2031F |

6.1.4 Myanmar Canned Food Market Revenues & Volume, By Canned fruit & vegetables, 2018 - 2031F |

6.1.5 Myanmar Canned Food Market Revenues & Volume, By Canned ready meals, 2018 - 2031F |

6.1.6 Myanmar Canned Food Market Revenues & Volume, By Others, 2018 - 2031F |

6.2 Myanmar Canned Food Market, By Type |

6.2.1 Overview and Analysis |

6.2.2 Myanmar Canned Food Market Revenues & Volume, By Organic, 2018 - 2031F |

6.2.3 Myanmar Canned Food Market Revenues & Volume, By Conventional, 2018 - 2031F |

6.3 Myanmar Canned Food Market, By Distribution Channel |

6.3.1 Overview and Analysis |

6.3.2 Myanmar Canned Food Market Revenues & Volume, By Supermarket/Hypermarket, 2018 - 2031F |

6.3.3 Myanmar Canned Food Market Revenues & Volume, By Convenience stores, 2018 - 2031F |

6.3.4 Myanmar Canned Food Market Revenues & Volume, By E-commerce, 2018 - 2031F |

6.3.5 Myanmar Canned Food Market Revenues & Volume, By Others, 2018 - 2031F |

7 Myanmar Canned Food Market Import-Export Trade Statistics |

7.1 Myanmar Canned Food Market Export to Major Countries |

7.2 Myanmar Canned Food Market Imports from Major Countries |

8 Myanmar Canned Food Market Key Performance Indicators |

9 Myanmar Canned Food Market - Opportunity Assessment |

9.1 Myanmar Canned Food Market Opportunity Assessment, By Product Type, 2021 & 2031F |

9.2 Myanmar Canned Food Market Opportunity Assessment, By Type, 2021 & 2031F |

9.3 Myanmar Canned Food Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

10 Myanmar Canned Food Market - Competitive Landscape |

10.1 Myanmar Canned Food Market Revenue Share, By Companies, 2024 |

10.2 Myanmar Canned Food Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero