Myanmar Medical Devices Market (2025-2031) | Growth, Value, Companies, Industry, Revenue, Analysis, Outlook, Share, Size, Trends & Forecast

Market Forecast By Types (Orthopedic Devices, Cardiovascular Devices, Diagnostic Devices, IVD, MIS, Wound Management, Diabetes Care, Others), By Applications (Hospitals & Ambulatory Surgical Centers, Clinics, Others) And Competitive Landscape

| Product Code: ETC036474 | Publication Date: Jun 2024 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

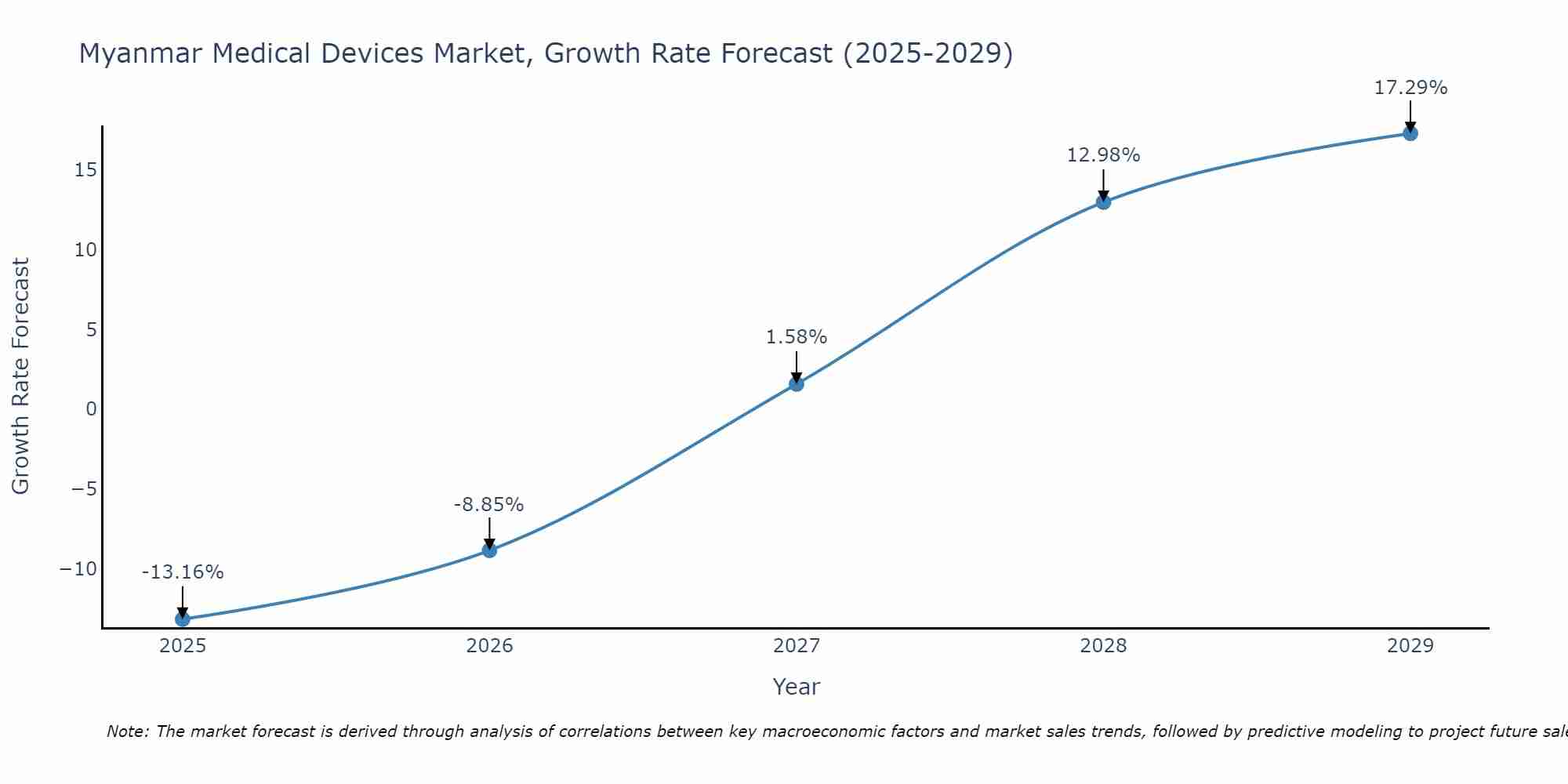

Myanmar Medical Devices Market Size Growth Rate

The Myanmar Medical Devices Market is poised for steady growth rate improvements from 2025 to 2029. From -13.16% in 2025, the growth rate steadily ascends to 17.29% in 2029.

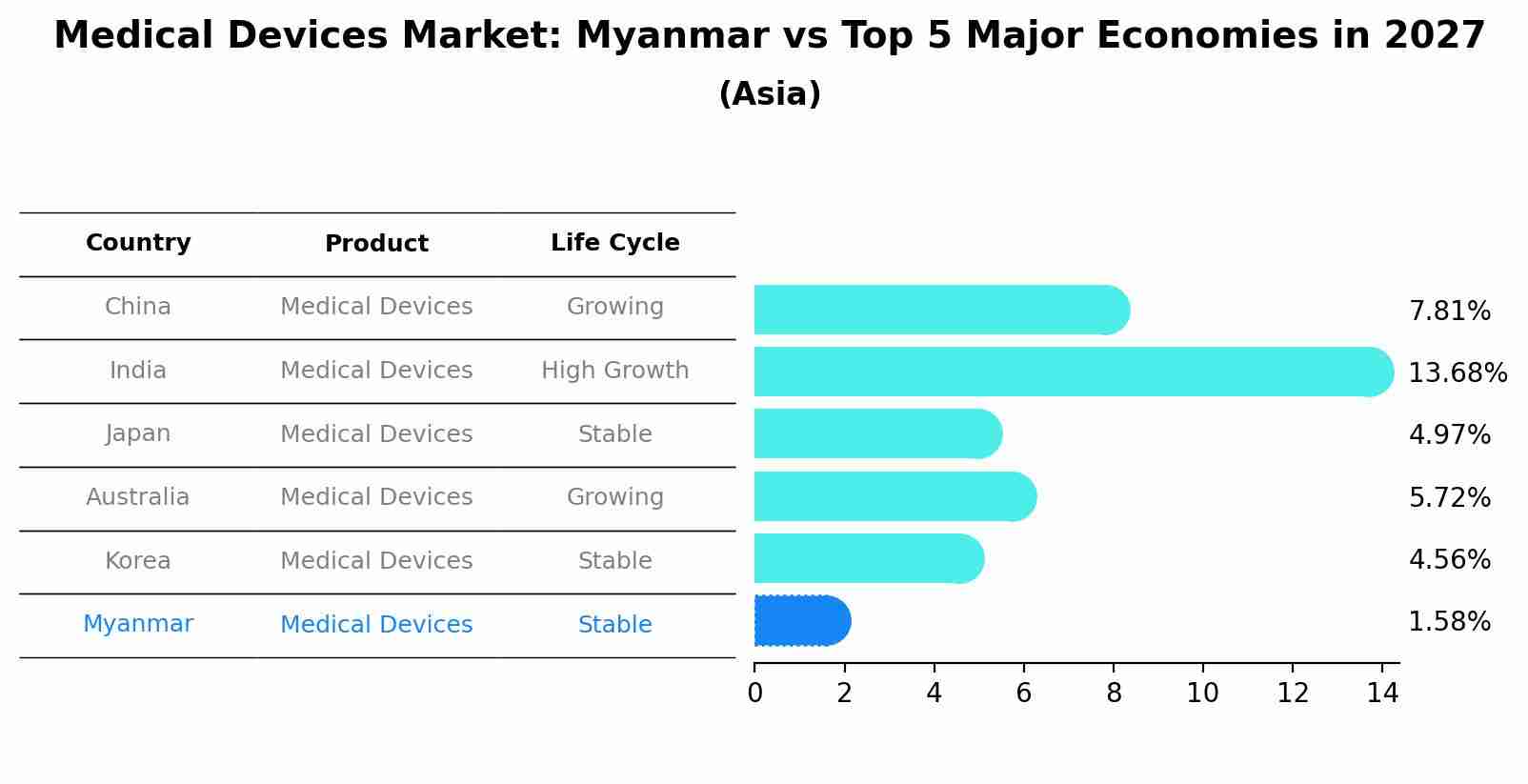

Medical Devices Market: Myanmar vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Medical Devices market in Myanmar is projected to expand at a stable growth rate of 1.58% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Myanmar Medical Devices market Highlights

| Report Name | Myanmar Medical Devices market |

| Forecast period | 2025-2031 |

| Market Size | USD 12 Billion – USD 17 Billion |

| CAGR | 10.4% |

| Growing Sector | Healthcare |

Topics Covered in the Myanmar Medical Devices Market Report

The Myanmar Medical Devices market report thoroughly covers the market by type and by application. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Myanmar Medical Devices Market Size & Analysis

In 2025, the Myanmar Medical Devices market is valued at approximately $ 12 billion, with a projected compound annual growth rate (CAGR) of 10.4% over the next five years. Additionally, by 2031, the market is expected to reach around $ 17 billion. The healthcare sector holds significant position in the overall market.

Myanmar Medical Devices Market Synopsis

The Myanmar medical devices market is expanding, driven by increasing healthcare needs, government efforts to improve healthcare infrastructure, and the rising prevalence of chronic diseases. The country’s healthcare sector is evolving with a focus on enhancing access to essential medical equipment and modernizing hospitals and clinics. Demand for diagnostic and therapeutic devices is growing, particularly in urban areas where private hospitals and clinics are also investing in advanced equipment to meet higher standards of care. Despite challenges such as limited infrastructure and regulatory complexities, the market presents opportunities for growth as both public and private sectors seek to close healthcare gaps and improve the quality of medical services available to Myanmar’s population.

According to 6Wresearch, Myanmar Medical Devices market size is projected to grow at a CAGR of 10.4% during 2025-2031. The Myanmar medical devices market is propelled by several key growth drivers, including a rising awareness of healthcare and increasing incidences of chronic diseases such as diabetes, hypertension, and heart disease, which demand better diagnostic and treatment options. Government efforts to expand healthcare infrastructure, especially in underserved regions, are fostering demand for essential medical devices, and the private healthcare sector is also playing a role by investing in advanced equipment to cater to the growing middle class seeking quality care. Additionally, Myanmar’s integration into regional trade agreements, such as the ASEAN Economic Community, has encouraged the import and availability of international medical devices.

However, the Myanmar Medical Devices industry faces challenges such as regulatory and logistical hurdles that slow market entry for new products, limited healthcare funding, and a shortage of trained healthcare professionals, particularly in rural areas. These issues make it difficult for the market to fully capitalize on growth opportunities, underscoring the need for enhanced regulatory frameworks, better infrastructure, and skilled workforce development to support the sector’s potential.

Myanmar Medical Devices Market Trends

Rising demand for diagnostic devices - With an increasing focus on preventive healthcare and early detection, diagnostic devices like imaging equipment and laboratory instruments are gaining popularity.

Growth in outpatient care and ambulatory surgical centers (ASCs) - ASCs are becoming more prevalent as they provide cost-effective alternatives for surgeries and treatments, boosting the demand for surgical and therapeutic devices.

Adoption of telemedicine and digital health solutions - The integration of digital health technologies, such as remote monitoring devices and telemedicine platforms, is increasing, especially in urban areas.

Government healthcare reforms - Ongoing government initiatives to improve the healthcare infrastructure and expand coverage are driving the demand for medical devices in both public and private healthcare sectors.

Investment Opportunities in the Myanmar Medical Devices Market

Healthcare infrastructure development - Investing in the expansion and upgrading of healthcare facilities, especially in underserved rural areas, presents significant opportunities for medical device suppliers.

Medical tourism growth - With an increasing focus on medical tourism, there is a demand for high-quality medical equipment and services catering to international patients.

Diagnostic device market - The rising demand for early disease detection and chronic disease management creates opportunities in the diagnostic equipment sector, including imaging, monitoring, and laboratory devices.

Telemedicine and digital health technologies - As digital health solutions gain traction, there is an opportunity to invest in telemedicine platforms, remote patient monitoring devices, and mobile health applications.

Private healthcare sector expansion - The growing number of private healthcare facilities presents a market for advanced medical devices, including surgical tools, diagnostic machines, and therapeutic equipment.

Key Players in the Myanmar Medical Devices Market

The Myanmar medical devices market is supported by both international and local companies, with key players including Siemens Healthineers, Philips Healthcare, and GE Healthcare, which provide a wide range of diagnostic and imaging equipment. Local distributors such as Myan Shwe Pyi Group and Star Medical Co., Ltd. also play significant roles in supplying medical devices and supporting after-sales services. Other notable global brands like Medtronic and Johnson & Johnson are active in the surgical and therapeutic device segments.

Additionally, companies like Stryker and Boston Scientific contribute to the growing market through their high-tech surgical and interventional products. Additionally, some of these players hold majority of the Myanmar Medical Devices market share. Moreover, the market is also witnessing the entry of more specialized companies catering to emerging needs in telemedicine and digital health solutions.

Government Regulations in the Myanmar Medical Devices Market

In Myanmar, the medical devices market is regulated by the Ministry of Health and Sports (MOHS), which oversees the registration, import, and sale of medical devices. The Food and Drug Administration (FDA) Myanmar plays a central role in ensuring the safety, efficacy, and quality of medical devices through rigorous import licensing, product registration, and regular inspections. Medical devices must meet local standards and be registered with the FDA before being marketed in the country.

Additionally, the Myanmar Medical Council and other relevant bodies may impose additional regulations related to device usage and healthcare services. Further, these initiatives have further boosted the Myanmar Medical Devices market revenues. However, the regulatory environment is still evolving, and the enforcement of regulations can be inconsistent, posing challenges for manufacturers and distributors looking to enter or expand in the market.

Future Insights of the Myanmar Medical Devices Market

The future of Myanmar medical devices market is poised for growth, driven by increasing healthcare needs, a growing aging population, and a rise in non-communicable diseases. With the ongoing modernization of healthcare infrastructure, there is an expanding demand for advanced diagnostic, imaging, and surgical equipment. The government's focus on improving healthcare access and quality, along with increasing foreign investments, will continue to shape the market.

Additionally, the rise of telemedicine and digital health solutions is expected to open new opportunities for medical device companies. However, regulatory improvements and infrastructure development will be critical in supporting sustained market expansion, as the country transitions towards more advanced healthcare technologies.

Diagnostic Devices Category to Dominate the Market - By Type

According to Ravi Bhandari, Research Head, 6Wresearch, the diagnostic devices category in Myanmar is experiencing notable growth, driven by increasing healthcare awareness and demand for early disease detection. The rising prevalence of chronic diseases, such as diabetes, hypertension, and cardiovascular conditions, is fueling the need for diagnostic equipment like imaging devices, in-vitro diagnostics (IVD), and point-of-care testing solutions.

The government's efforts to modernize healthcare infrastructure and improve medical services further contribute to this expansion. Moreover, the growing focus on telemedicine and mobile health solutions is enhancing access to diagnostic services in remote areas, creating opportunities for diagnostic device manufacturers to tap into a broader market.

Hospitals & Ambulatory Surgical Centers to Dominate the Market – By Application

The application of medical devices in hospitals and ambulatory surgical centers (ASCs) in Myanmar is witnessing robust growth, driven by increasing healthcare infrastructure development and rising patient demand for advanced medical treatments. Hospitals and ASCs are increasingly adopting state-of-the-art medical technologies, including surgical instruments, diagnostic devices, and patient monitoring systems, to improve care quality and efficiency.

The expansion of private healthcare facilities, coupled with the rising need for specialized surgeries and treatments, is fueling this growth. Additionally, the demand for minimally invasive procedures, which often require advanced medical devices, is contributing to the expansion of both hospitals and ASCs in Myanmar.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Myanmar Medical Devices Market Outlook

- Market Size of Myanmar Medical Devices Market, 2024

- Forecast of Myanmar Medical Devices Market, 2031

- Historical Data and Forecast of Myanmar Medical Devices Revenues & Volume for the Period 2021-2031

- Myanmar Medical Devices Market Trend Evolution

- Myanmar Medical Devices Market Drivers and Challenges

- Myanmar Medical Devices Price Trends

- Myanmar Medical Devices Porter's Five Forces

- Myanmar Medical Devices Industry Life Cycle

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Types for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Orthopedic Devices for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Cardiovascular Devices for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Diagnostic Devices for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By IVD for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By MIS for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Wound Management for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Diabetes Care for the Period 2021-2031

- Historical Data and Forecast of Myanmar Orthopedic Devices Medical Devices Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Hospitals & Ambulatory Surgical Centers for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Clinics for the Period 2021-2031

- Historical Data and Forecast of Myanmar Medical Devices Market Revenues & Volume By Others for the Period 2021-2031

- Myanmar Medical Devices Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Applications

- Myanmar Medical Devices Top Companies Market Share

- Myanmar Medical Devices Competitive Benchmarking By Technical and Operational Parameters

- Myanmar Medical Devices Company Profiles

- Myanmar Medical Devices Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Types

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Devices

- IVD

- MIS

- Wound Management

- Diabetes Care

- Others

By Applications

- Hospitals & Ambulatory Surgical Centers

- Clinics

- Others

Myanmar Medical Devices Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Myanmar Medical Devices Market Overview |

| 3.1 Myanmar Country Macro Economic Indicators |

| 3.2 Myanmar Medical Devices Market Revenues & Volume, 2021 & 2031F |

| 3.3 Myanmar Medical Devices Market - Industry Life Cycle |

| 3.4 Myanmar Medical Devices Market - Porter's Five Forces |

| 3.5 Myanmar Medical Devices Market Revenues & Volume Share, By Types, 2021 & 2031F |

| 3.6 Myanmar Medical Devices Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 4 Myanmar Medical Devices Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Myanmar Medical Devices Market Trends |

| 6 Myanmar Medical Devices Market, By Types |

| 6.1 Myanmar Medical Devices Market, By Types |

| 6.1.1 Overview and Analysis |

| 6.1.2 Myanmar Medical Devices Market Revenues & Volume, By Types, 2021 - 2031F |

| 6.1.3 Myanmar Medical Devices Market Revenues & Volume, By Orthopedic Devices, 2021 - 2031F |

| 6.1.4 Myanmar Medical Devices Market Revenues & Volume, By Cardiovascular Devices, 2021 - 2031F |

| 6.1.5 Myanmar Medical Devices Market Revenues & Volume, By Diagnostic Devices, 2021 - 2031F |

| 6.1.6 Myanmar Medical Devices Market Revenues & Volume, By IVD, 2021 - 2031F |

| 6.1.7 Myanmar Medical Devices Market Revenues & Volume, By MIS, 2021 - 2031F |

| 6.1.8 Myanmar Medical Devices Market Revenues & Volume, By Wound Management, 2021 - 2031F |

| 6.1.9 Myanmar Medical Devices Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.1.10 Myanmar Medical Devices Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2 Myanmar Medical Devices Market, By Applications |

| 6.2.1 Overview and Analysis |

| 6.2.2 Myanmar Medical Devices Market Revenues & Volume, By Hospitals & Ambulatory Surgical Centers, 2021 - 2031F |

| 6.2.3 Myanmar Medical Devices Market Revenues & Volume, By Clinics, 2021 - 2031F |

| 6.2.4 Myanmar Medical Devices Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Myanmar Medical Devices Market Import-Export Trade Statistics |

| 7.1 Myanmar Medical Devices Market Export to Major Countries |

| 7.2 Myanmar Medical Devices Market Imports from Major Countries |

| 8 Myanmar Medical Devices Market Key Performance Indicators |

| 9 Myanmar Medical Devices Market - Opportunity Assessment |

| 9.1 Myanmar Medical Devices Market Opportunity Assessment, By Types, 2021 & 2031F |

| 9.2 Myanmar Medical Devices Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 10 Myanmar Medical Devices Market - Competitive Landscape |

| 10.1 Myanmar Medical Devices Market Revenue Share, By Companies, 2024 |

| 10.2 Myanmar Medical Devices Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero