New Zealand UPS Systems Market Outlook (2022-2028) | Size, Revenue, Growth, Forecast, Industry, Analysis, Share, COVID-19 IMPACT, Companies, Value & Trends

Market Forecast By KVA Ratings (Below 1 KVA, 1.1-5 KVA, 5.1-20 KVA, 20.1-50 KVA, 50.1-200 KVA and Above 200 KVA), By Phase (1 Phase, 3 Phase), By Applications (Residential, Industrial and Commercial), By Regions (Northern Region, Southern Region, Central Region) and Competitive Landscape

| Product Code: ETC081274 | Publication Date: May 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 82 | No. of Figures: 18 | No. of Tables: 7 |

New Zealand UPS systems market report comprehensively covers the market by kVA rating, applications, phases, and regions. New Zealand UPS systems market report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

New Zealand UPS Systems Market Synopsis

New Zealand UPS systems market experienced a significant growth in the previous years owing to rise expanding digital infrastructure, with developing data centers in the country. The market continued to witness growth during 2022 as the demand for UPS systems rises in data centers, hospitality and healthcare industry. The covid-19 pandemic has not only presented challenges but also several opportunities for businesses in New Zealand to grow. The crisis has opened the gates for digitisation in infrastructure, many of which includes healthcare infrastructure, roads, tourism and manufacturing. Further, the pandemic has provided an impetus to the expansion of digital banking and finance in the country.

According to 6Wresearch, New Zealand UPS Systems Market size is projected to grow at a CAGR of 6.4% during 2022-2028. New Zealand UPS systems market is in the growing stage of industry life cycle as the UPS systems are rapidly witnessing growth in the country such that the Ministry of Health project Hira launched in 2021 would assist demand for UPS systems in the market. Also, increasing tourism, rapid digitisation is also contributing significantly to the market growth. New Zealand UPS systems market is expected to drive positively during the forecast period due to rising number of data centers along with increasing technological advancments.

Market by Regions

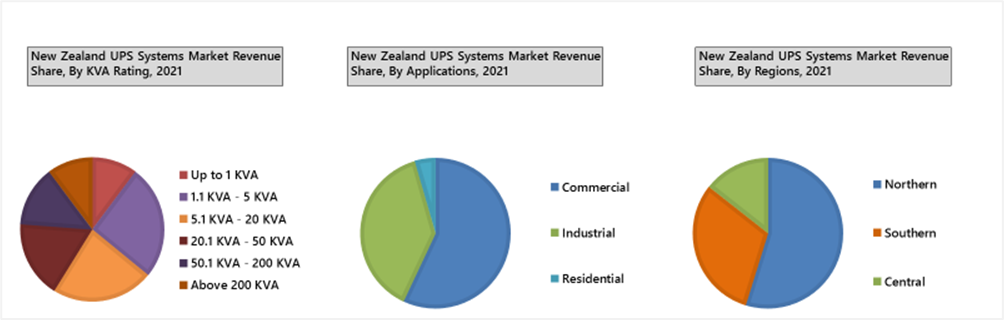

Northern region captured majority of revenues in New Zealand UPS systems market as Northern region of New Zealand would be the focal point in the coming years on the account of upcoming AWS first data center in Auckland and DCI data center which would further increase the New Zealand UPS systems market share in the country. Numerous cloud infrastructure development by Microsoft and AWS in this region would create positive demand for UPS systems market in this region.

Market by kVA ratings

1.1-5 KVA rating UPS systems would be dominating the New Zealand UPS systems market share due to its wider applications in residential and commercial uses such as offices, educational institutions, SMEs, and so on. Furthermore, a significant increase in demand for UPS systems is likely to be seen over the projection period, owing to rising ATM penetration, a growing number of retail stores, and expansion of the country's commercial sector.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- New Zealand UPS Systems Market Overview

- New Zealand UPS Systems Market Outlook

- New Zealand UPS Systems Market Forecast

- Historical Data and Forecast of New Zealand UPS Systems Market Revenues and Volume, for the Period 2018-2028F

- Historical Data and Forecast of New Zealand UPS Systems Market Revenues and Volume, By kVA Rating, for the Period 2018-2028F

- Historical Data and Forecast of New Zealand UPS Systems Market Revenues, By Phases, for the Period 2018-2028F

- Historical Data and Forecast of New Zealand UPS Systems Market Revenues, By Applications, for the Period 2018-2028F

- Historical Data and Forecast of New Zealand UPS Systems Market Revenues, By Regions, for the Period 2018-2028F

- New Zealand UPS Systems Market Drivers and Restraints

- New Zealand UPS Systems Market Trends

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- New Zealand UPS Systems Market Revenue Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By KVA Ratings

- Below 1 KVA

- 1.1-5 KVA

- 5.1-20 KVA

- 20.1-50 KVA

- 50.1-200 KVA and

- Above 200 KVA

By Phase

- 1 Phase

- 3 Phase

By Applications

- Residential

- Industrial

- Commercial

By Regions

- Northern Region

- Southern Region

- Central Region

New Zealand UPS Systems Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

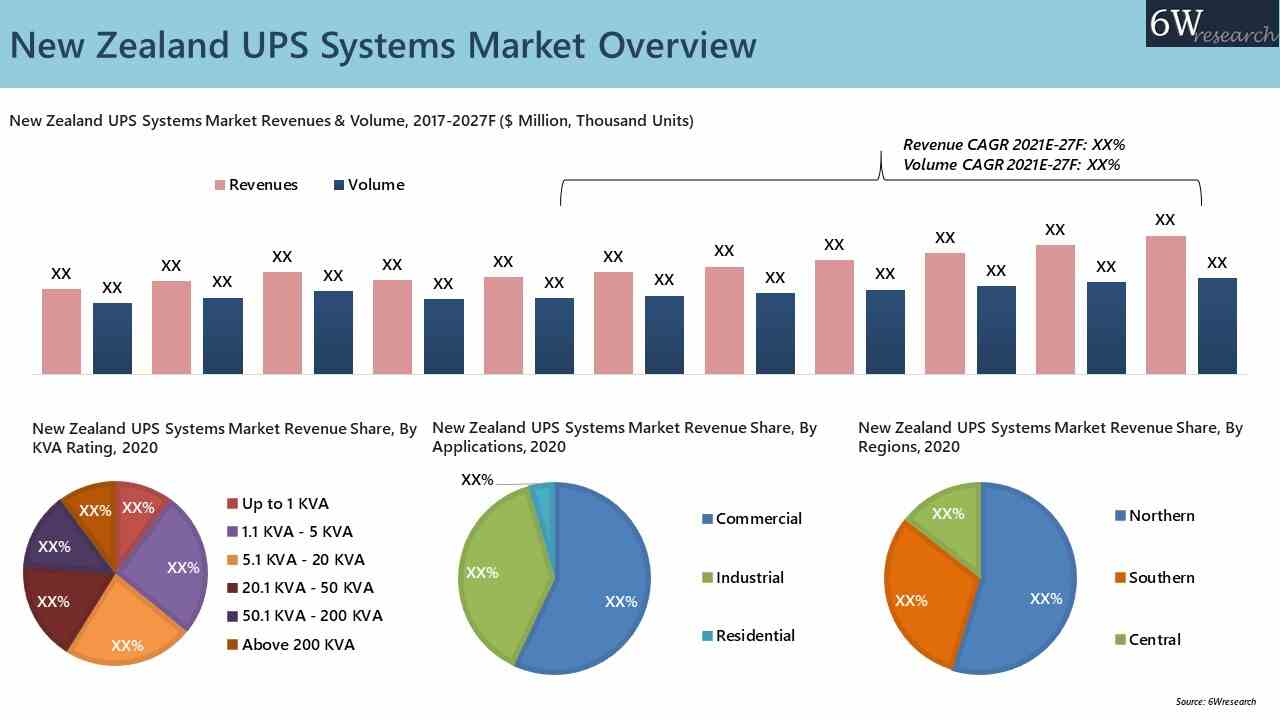

| 3. New Zealand UPS Systems Market Overview |

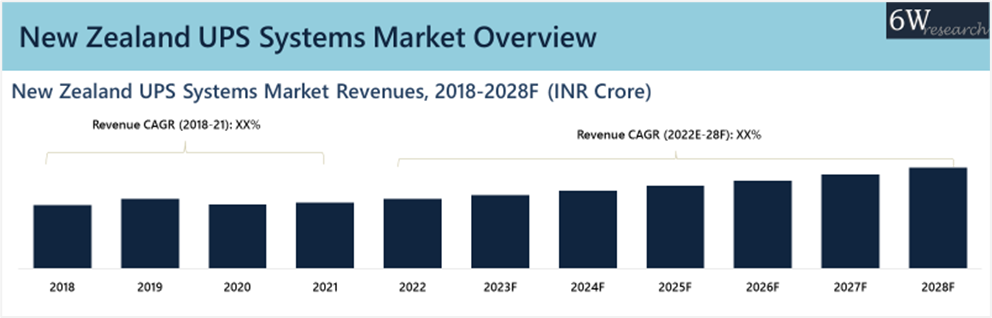

| 3.1 New Zealand UPS Systems Market Revenues & Volume, 2018-2028F |

| 3.2 New Zealand UPS Systems Market Industry Life Cycle |

| 3.3 New Zealand UPS Systems Market Ecosystem |

| 3.4 New Zealand UPS Systems Market Porter’s Five Forces |

| 3.5 New Zealand UPS Systems Market Revenue & Volume Share, By kVA Rating, 2021 & 2028F |

| 3.6 New Zealand UPS Systems Market Revenue Share, By Phases, 2021 & 2028F |

| 3.7 New Zealand UPS Systems Market Revenue Share, By Applications, 2021 & 2028F |

| 3.8 New Zealand UPS Systems Market Revenue Share, By Regions, 2021 & 2028F |

| 4. New Zealand UPS Systems Market COVID-19 Impact Analysis |

| 5. New Zealand UPS Systems Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing demand for uninterrupted power supply in critical industries such as healthcare, telecommunications, and data centers. |

| 5.2.2 Growing awareness about the importance of backup power solutions in the face of natural disasters and power outages. |

| 5.2.3 Government initiatives promoting the adoption of renewable energy sources, driving the need for energy storage solutions like UPS systems. |

| 5.3. Market Restraints |

| 5.3.1 High initial investment costs associated with the installation of UPS systems may limit adoption, especially among small and medium-sized enterprises. |

| 5.3.2 Technical challenges and complexities related to integrating UPS systems with existing infrastructure. |

| 5.3.3 Limited awareness among certain consumer segments about the benefits of UPS systems, leading to slower adoption rates. |

| 6. New Zealand UPS Systems Market Trends & Evolution |

| 7. New Zealand UPS Systems Market Overview, By kVA Rating |

| 7.1 New Zealand UPS Systems Market Revenues and Volume, By Up to 1kVA, 2018-2028F |

| 7.2 New Zealand UPS Systems Market Revenues and Volume, By 1.1- 5kVA, 2018-2028F |

| 7.3 New Zealand UPS Systems Market Revenues and Volume, By 5.1-20kVA, 2018-2028F |

| 7.4 New Zealand UPS Systems Market Revenues and Volume, By 20.1-50kVA, 2018-2028F |

| 7.5 New Zealand UPS Systems Market Revenues and Volume, By 50.1-200kVA, 2018-2028F |

| 7.6 New Zealand UPS Systems Market Revenues and Volume, By Above 200kVA, 2018-2028F |

| 8. New Zealand UPS Systems Market Overview, By Phases |

| 8.1 New Zealand UPS Systems Market Revenues, By 1 Phase, 2018-2028F |

| 8.2 New Zealand UPS Systems Market Revenues, By 3 Phase, 2018-2028F |

| 9. New Zealand UPS Systems Market Overview, By Applications |

| 9.1 New Zealand UPS Systems Market Revenues, By Residential Application, 2018-2028F |

| 9.2 New Zealand UPS Systems Market Revenues, By Industrial Application, 2018-2028F |

| 9.3 New Zealand UPS Systems Market Revenues, By Commercial Application, 2018-2028F |

| 9.3.1 New Zealand UPS Systems Market Revenue Share, By Commercial Application, 2021 & 2028F |

| 9.3.2 New Zealand UPS Systems Market Revenues, By Commercial Application, 2018-2028F |

| 10. New Zealand UPS Systems Market Overview, By Regions |

| 10.1 New Zealand UPS Systems Market Revenues, By Northern Region, 2018-2028F |

| 10.2. New Zealand UPS Systems Market Revenues, By Southern Region, 2018-2028F |

| 10.3. New Zealand UPS Systems Market Revenue, By Central Region, 2018-2028F |

| 11. New Zealand UPS Systems Market – Key Performance Indicators |

| 11.1 Average uptime percentage of UPS systems in use. |

| 11.2 Number of new installations or deployments of UPS systems in key industries. |

| 11.3 Energy efficiency ratings of UPS systems deployed in the market. |

| 11.4 Percentage of businesses conducting regular maintenance and testing of their UPS systems. |

| 11.5 Number of reported power outages and their impact on businesses using UPS systems. |

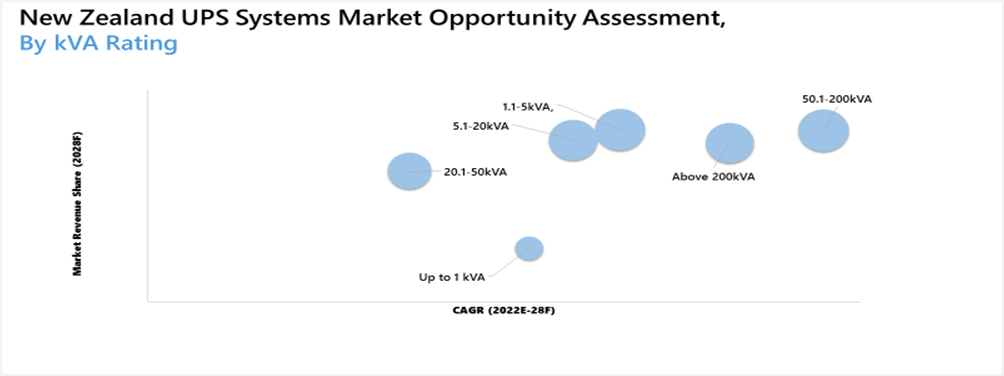

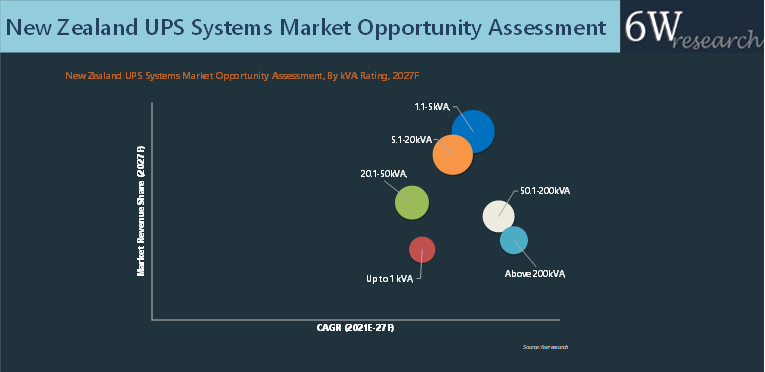

| 12. New Zealand UPS Systems Market Opportunity Assessment |

| 12.1 New Zealand UPS Systems Market Opportunity Assessment, By kVA Rating, 2028F |

| 12.2 New Zealand UPS Systems Market Opportunity Assessment, By Phases, 2028F |

| 12.3 New Zealand UPS Systems Market Opportunity Assessment, By Applications, 2028F |

| 12.4 New Zealand UPS Systems Market Opportunity Assessment, By Regions, 2028F |

| 13. New Zealand UPS Systems Market - Competitive Landscape |

| 13.1 New Zealand UPS Systems Market Revenue Share, By Companies, 2021 |

| 13.2 New Zealand UPS Systems Market Competitive Benchmarking, By Operating Parameters |

| 14. Company Profiles |

| 14.1 ABB Group |

| 14.2 Cyberpower Systems Inc. |

| 14.3 Delta Electronics (NZ) Ltd. |

| 14.4 Eaton Corporation plc |

| 14.5 Helios Power Solutions |

| 14.6 Riello UPS Ltd. |

| 14.7 Schneider Electric (NZ) Ltd. |

| 14.8 Socomec Group |

| 14.9 Legrand Group |

| 14.10 Vertiv Holdings LLC |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

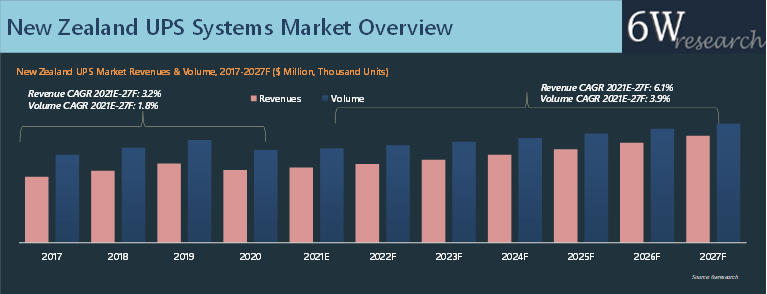

| Figure 1: New Zealand UPS Systems Market Revenues & Volume, 2018-2028F ($ Million, Thousand Units) |

| Figure 2: New Zealand UPS Systems Market Revenue Share, By kVA Rating, 2021 & 2028F |

| Figure 3: New Zealand UPS Market Volume Share, By kVA Rating, 2021 & 2028F |

| Figure 4: New Zealand UPS Market Revenue Share, By Phases, 2021 & 2028F |

| Figure 5: New Zealand UPS Market Revenue Share, By Applications, 2021 & 2028F |

| Figure 6: New Zealand UPS Market Revenue Share, By Regions, 2021 & 2028F |

| Figure 7: New Zealand Data Center Infrastructure Overview, 2021 |

| Figure 8: New Zealand Annual Electricity Consumption (Terawatt hours), 2018-2020 |

| Figure 9: Top Contributors to New Zealand’s GDP, 2020 |

| Figure 10: Lead Prices (USD/ Metric Ton), 2021-2022 |

| Figure 11: New Zealand UPS Systems Market Revenue Share, By Commercial Application, 2021 & 2028F |

| Figure 12: New Zealand Ministry of Health Presence, By Cities, 2021 |

| Figure 13: New Zealand Electricity Consumption in Peta Joules (PJ), By Application Types, 2018-2021 |

| Figure 14: New Zealand UPS Systems Market Opportunity Assessment, By kVA Rating, 2028F |

| Figure 15: New Zealand UPS Systems Market Opportunity Assessment, By Phases, 2028F |

| Figure 16: New Zealand UPS Systems Market Opportunity Assessment, By Applications, 2028F |

| Figure 17: New Zealand UPS Systems Market Opportunity Assessment, By Regions, 2028F |

| Figure 18: New Zealand UPS Systems Market Revenue Share, By Companies, 2021 |

| List of Tables |

| Table 1: New Zealand UPS Systems Market Revenues, By kVA Rating, 2018-2028F (Thousand Units) |

| Table 2: New Zealand UPS Systems Market Volume, By kVA Rating, 2018-2028F (Thousand Units) |

| Table 3: New Zealand UPS Systems Market Revenues, By Phases, 2018-2028F ($ Million) |

| Table 4: New Zealand UPS Systems Market Revenues, By Applications, 2017-2027F ($ Million) |

| Table 5: New Zealand Digital Signage Market Revenues, By Commercial Application, 2018-2028F |

| Table 6: New Zealand UPS Systems Market Revenues, By Regions, 2018-2028F ($ Million) |

| Table 7: New Zealand ICT Industry Market Overview, 2017-2020 ($ Million) |

Market Forecast By KVA Ratings (Up to 1 KVA, 1.1-5 KVA, 5.1-20 KVA, 20.1-50 KVA, 50.1-200 KVA and Above 200 KVA), By Phase (1 Phase, 3 Phase), By Applications (Residential, Industrial and Commercial), By Regions (Northern Region, Southern Region, Central Region) and Competitive Landscape

| Product Code: ETC081274 | Publication Date: Aug 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 89 | No. of Figures: 23 | No. of Tables: 9 |

New Zealand UPS Market report thoroughly covers the UPS market by kVA ratings, phases, applications and regions. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, market drivers, and market share by companies, which would help stakeholders to devise and align market strategies according to the current and future market dynamics.

New Zealand UPS Market Synopsis

New Zealand UPS market witnessed healthy growth during the period 2017-20 underpinned by rapid growth in the commercial sector owing to the ongoing digitization of the country. The upcoming development projects which are cloud-based and the increasing number of a data center in the country are the major drivers for the UPS market in New Zealand.

However, the outbreak of the COVID-19 pandemic resulted in a slowdown in the market during the year 2020, as a result of a halt in the business operations, manufacturing units, and the stringent lockdown imposed in the country. The falling demand from commercial and manufacturing sector have hampered the growth of the UPS market in IT and BFSI sector. Recovery is expected in market revenues post 2020, with a gradual opening of economic activities and restart of the manufacturing sector along with industrial activities, which would result in increased demand for UPS across the country.

According to 6Wresearch, New Zealand UPS Market size is projected to grow at CAGR of 6.1% during 2021-27. The growth can be attributed to rising investment in the IT, cloud computing, data center and the manufacturing industry with the aim of making New Zealand a favoured destination for foreign investments. Global Tech giants like Microsoft, Meridian Energy and Datagrid New Zealand are in the process of setting up manufacturing plants of UPS in New Zealand. The Cloud Act, Climate Change Response (Zero carbon) Amendment Act, would focus on increasing the share of renewable energy sources to generate electricity and thus it would in-turn increase the demand for UPS in the country. Further, the increasing investment for technological advancement of sectors such as healthcare, banking & finance, would strengthen the ICT sector which would drive the demand for UPS even further.

Market Analysis by KVA Ratings

In terms of KVA Ratings, the segments 1.1 KVA-5 KVA, 5.1 KVA-20 KVA and 20.1 KVA to 50 KVA cumulatively have captured 60% of the market revenues in 2020, with 1.1 KVA-5 KVA leading the market. The segment 1.1 KVA-5 KVA generated majority of the market revenues on account of its wide application in residential and commercial sectors. The COVID-19 brought a paradigm shift in work culture and along with it the work-from-home culture was adopted by many companies which also increased the consumption rate of electricity and in-turn increased the demand for UPS by household and corporate sector of the society as well.

Market Analysis by Applications

In New Zealand UPS Market, industrial and commercial applications have led the overall market revenues accounting more than 90% of the market revenues in 2020. Commercial application captured key share of the market pie, led by deployment across various areas such as data centers, BFSI, etc.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- New Zealand UPS Market Overview

- New Zealand UPS Market Outlook

- New Zealand UPS Market Forecast

- Historical data and Forecast of New Zealand UPS Market Revenues and Volume, for the Period, 2017-2027F

- Historical data and Forecast of Revenues and Volume, By kVA Ratings, for the Period, 2017-2027F

- Historical data and Forecast of Revenues, By Phase, for the Period, 2017-2027F

- Historical data and Forecast of Revenues, By Application, for the Period, 2017-2027F

- Historical data and Forecast of Revenues, By Regions, for the Period, 2017-2027F

- Market Drivers and Restraints

- New Zealand UPS Market Trends

- Industry Life Cycle

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- New Zealand UPS Market Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By kVA Ratings

-

- Up to 1 kVA

- 1 – 20 kVA

- 1 - 50 kVA

- 1 - 200 kVA

- Above 200 kVA

- By Phase

- 1 Phase

- 3 Phase

- By Applications

- Residential

- Commercial

- Industrial

- By Regions

- Northern Region

- Southern Region

- Central Region

Frequently Asked Questions About the Market Study:

- Does the report consider COVID-19 impact?

The report not only has considered COVID-19 impact but also current market dynamics, trends, and KPIs into consideration.

- How much growth is expected in the New Zealand UPS Market over the coming years?

The New Zealand UPS Market revenue is anticipated to record a CAGR of 6.1% during 2021-27.

- Which segment has captured key share of the market?

The segment, 1.1KVA to 5KVA has dominated the market revenues led by usage across commercial and industrial segments.

- Which segment is exhibited to gain traction over the forecast period?

3 Phase type UPS would record key growth throughout the forecast period 2021-27.

- Who are key the key players of the market?

The key players of the market include- ABB, Cyberpower, Delta, Eaton, Helios Power, Reillo, Schneider Electric, Socomec, Tripp-Lite, and Vertiv.

- Is customization available in the market study?

Yes, we can do customization as per your requirements. Please feel free to write to us sales@6wresearch.com for any customized or any other requirements

- We also want to have market reports for other countries/regions.

6Wresearch has the database of more than 60 countries globally, which can make us your first choice of all your research needs.

Other Key Reports Available:

- Australia UPS Market (2021-2027)

- India UPS Market (2021-2027)

- APAC UPS Market (2021-2027)

- South East Asia UPS Market (2021-2027)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero