Nigeria Air Conditioner Market (2023-2029) | Brands, Size, Share, Revenue, Forecast, Industry, Analysis, Outlook & COVID-19 IMPACT

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090108 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Nigeria Air Conditioner (AC) Market | Country-Wise Share and Competition Analysis

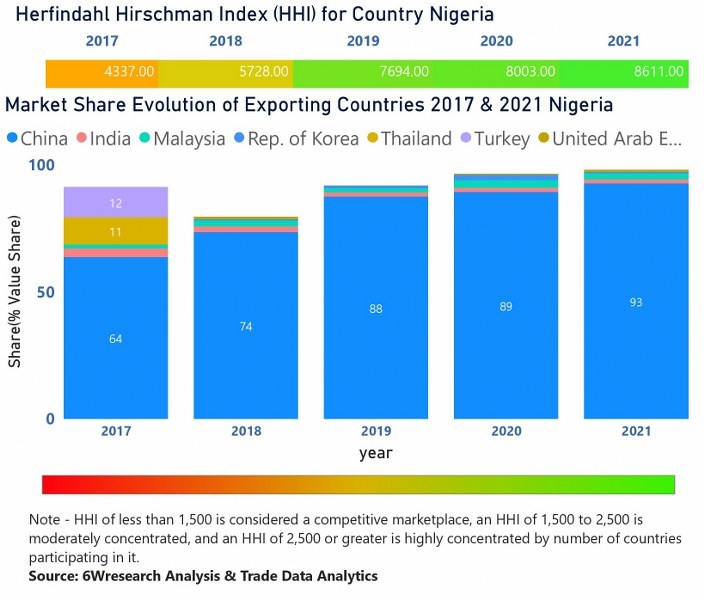

In the year 2021, China was the largest exporter in terms of value, followed by Malaysia. It has registered a decline of -34.8% over the previous year. While Malaysia registered a decline of -48.26% over the previous year. While in 2017 China was the largest exporter followed by Turkey. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, Nigeria had Herfindahl index of 4337 in 2017 which signifies high concentration while in 2021 it registered a Herfindahl index of 8611 which signifies high concentration in the market

Topics Covered in the Nigeria Air Conditioner (AC) Market

Nigeria Air Conditioner (AC) Market report thoroughly covers the market by type and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Nigeria Air Conditioner (AC) Market Synopsis

Nigeria, being one of the most industrialized countries in Africa, has a high temperature throughout the year. As a result, the air conditioners are in high demand. Moreover, the increasingly comfortable lifestyle living of the population is having a positive impact on air conditioners demand. The growing middle-class population and urbanization are some major growth proliferating factors of the market.

According to 6Wresearch, the Nigeria Air Conditioner (AC) Market size is estimated to widen at a CAGR of 6.8% during the forecast period 2023-2029. The market has been growing in recent years due to the growing demand for cooling solutions, especially in the residential and commercial sectors. The government has also taken steps to support the growth of the air conditioner market by implementing favourable policies. Additionally, the growth of the construction industry and the rising disposable income of consumers are expected to further proliferate the demand for air conditioners in Nigeria in the future years. There have been several developments in the Nigeria air conditioner industry which include growing demand for energy-efficient air conditioners in Nigeria as many consumers are opting for air conditioners with high SEER (Seasonal Energy Efficiency Ratio) ratings due to their capacity to consume less energy.

Many leading air conditioning brands have been expanding their retail networks in Nigeria, making it feasible for consumers to purchase air conditioners in cities and towns. Moreover, the increasing number of residential construction projects in Nigeria is creating new opportunities for the air conditioning market as several new homes are being built with air conditioning systems installed. Furthermore, the growth of commercial air conditioning such as the expansion of shopping malls, office buildings, and hotels. This creates new opportunities for the air conditioning industry. Lastly, there has been a growing demand for air conditioners.

Government Initiatives introduced in the Nigeria Air Conditioner (AC) Market

The government has made several initiatives launching certain favourable initiatives to promote energy efficiency, particularly in the air conditioning industry. The Nigerian Energy Support Programme (NESP) aims to promote the energy sector through technical assistance and financial support. Additionally, as part of the Nigerian Energy Roadmap, the government is stimulating manufacturers to develop low-energy-efficient air conditioners.

Key Players in the Nigeria Air Conditioner (AC) Market

The Nigeria Air Conditioner (AC) Market has various leading players, including both international and domestic manufacturers and suppliers.

- Daikin

- Samsung

- LG Electronics

- Haier Thermocool

- Panasonic

- Midea

- Gree

Market Analysis by Type

According to Dhaval, Research Manager, 6Wresearch, Room air conditioners and ductless air conditioners work well for small space rooms and homes. Other types of ACs also have a high demand with the rising expansion of sectors.

Market Analysis by Application

Based on the application, the healthcare application is leading in the market. As hospitals and clinics establishments expanding their facilities, leading to a rise in the demand for air conditioning units.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Nigeria Air Conditioner (AC) Market Outlook

- Market Size of Nigeria Air Conditioner (AC) Market, 2022

- Forecast of Nigeria Air Conditioner (AC) Market, 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Revenues & Volume for the Period 2019 - 2029

- Nigeria Air Conditioner (AC) Market Trend Evolution

- Nigeria Air Conditioner (AC) Market Drivers and Challenges

- Nigeria Air Conditioner (AC) Price Trends

- Nigeria Air Conditioner (AC) Porter's Five Forces

- Nigeria Air Conditioner (AC) Industry Life Cycle

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Type for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Room Air Conditioner for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Ducted Air Conditioner for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Ductless Air Conditioner for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Centralized Air Conditioner for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Application for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Residential for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Healthcare for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Commercial & Retail for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Transportation & Infrastructure for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Hospitality for the Period 2019 - 2029

- Historical Data and Forecast of Nigeria Air Conditioner (AC) Market Revenues & Volume by Others for the Period 2019 - 2029

- Nigeria Air Conditioner (AC) Import Export Trade Statistics

- Market Opportunity Assessment by Type

- Market Opportunity Assessment by Application

- Nigeria Air Conditioner (AC) Top Companies Market Share

- Nigeria Air Conditioner (AC) Competitive Benchmarking by Technical and Operational Parameters

- Nigeria Air Conditioner (AC) Company Profiles

- Nigeria Air Conditioner (AC) Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

Nigeria Air Conditioner (AC) Market (2023-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Nigeria Air Conditioner Market Overview |

| 3.1 Nigeria Air Conditioner Market Revenues & Volume, 2019 - 2029F |

| 3.2 Nigeria Air Conditioner Market - Industry Life Cycle |

| 3.3 Nigeria Air Conditioner Market - Porter's Five Forces |

| 3.4 Nigeria Air Conditioner Market Revenues & Volume Share, By Type, 2022 & 2029F |

| 3.5 Nigeria Air Conditioner Market Revenues & Volume Share, By Application, 2022 & 2029F |

| 4 Nigeria Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing urbanization and rising disposable income leading to higher demand for air conditioners in Nigeria. |

| 4.2.2 Hot and humid climate conditions in Nigeria driving the need for air conditioning solutions. |

| 4.2.3 Growing awareness about energy efficiency and environmental concerns leading to the adoption of energy-efficient air conditioners in the market. |

| 4.3 Market Restraints |

| 4.3.1 High initial costs of air conditioners making it unaffordable for a significant portion of the population. |

| 4.3.2 Unreliable power supply and frequent power outages in Nigeria affecting the usage of air conditioners. |

| 4.3.3 Lack of proper infrastructure for distribution and servicing of air conditioners in remote areas. |

| 5 Nigeria Air Conditioner Market Trends |

| 6 Nigeria Air Conditioner Market Segmentation |

| 6.1 Nigeria Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Nigeria Air Conditioner Market Revenues & Volume, By Type, 2019 - 2029F |

| 6.1.3 Nigeria Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2019 - 2029F |

| 6.1.4 Nigeria Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2019 - 2029F |

| 6.1.5 Nigeria Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2019 - 2029F |

| 6.1.6 Nigeria Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2019 - 2029F |

| 6.2 Nigeria Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Nigeria Air Conditioner Market Revenues & Volume, By Residential, 2019 - 2029F |

| 6.2.3 Nigeria Air Conditioner Market Revenues & Volume, By Healthcare, 2019 - 2029F |

| 6.2.4 Nigeria Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2019 - 2029F |

| 6.2.5 Nigeria Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2019 - 2029F |

| 6.2.6 Nigeria Air Conditioner Market Revenues & Volume, By Hospitality, 2019 - 2029F |

| 6.2.7 Nigeria Air Conditioner Market Revenues & Volume, By Others, 2019 - 2029F |

| 7 Nigeria Air Conditioner Market Import-Export Trade Statistics |

| 7.1 Nigeria Air Conditioner Market Export to Major Countries |

| 7.2 Nigeria Air Conditioner Market Imports from Major Countries |

| 8 Nigeria Air Conditioner Market Key Performance Indicators |

| 8.1 Average energy efficiency ratings of air conditioners sold in Nigeria. |

| 8.2 Adoption rate of inverter air conditioners in the market. |

| 8.3 Number of authorized service centers for air conditioners across different regions in Nigeria. |

| 9 Nigeria Air Conditioner Market - Opportunity Assessment |

| 9.1 Nigeria Air Conditioner Market Opportunity Assessment, By Type, 2022 & 2029F |

| 9.2 Nigeria Air Conditioner Market Opportunity Assessment, By Application, 2022 & 2029F |

| 10 Nigeria Air Conditioner Market - Competitive Landscape |

| 10.1 Nigeria Air Conditioner Market Revenue Share, By Companies, 2022 |

| 10.2 Nigeria Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090108 | Publication Date: Feb 2023 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Topics Covered in the Nigeria Air Conditioner (AC) Market

Nigeria Air Conditioner (AC) Market report thoroughly covers the market by types and by applications. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Nigeria Air Conditioner (AC) Market is projected to grow over the coming years. Nigeria Air Conditioner (AC) Market report is a part of our periodical regional publication Africa Air Conditioner (AC) Market outlook report. 6W tracks the air conditioner market for over 60 countries with individual country-wise market opportunity assessments and publishes the report titled Global Air Conditioner (AC) Market outlook report annually.

Latest 2023 Development of the Nigeria Air Conditioner Market

Nigeria Air Conditioner Market has been growing in recent years due to the growing demand for cooling solutions, especially in the residential and commercial sectors. The government has also taken steps to support the growth of the air conditioner market by implementing favorable policies. Additionally, the growth of the construction industry and the rising disposable income of consumers are expected to further proliferate the demand for air conditioners in Nigeria in the future years. There have been several developments in the Nigeria air conditioner market which include growing demand for energy-efficient air conditioners in Nigeria as many consumers are opting for air conditioners with high SEER (Seasonal Energy Efficiency Ratio) ratings due to their capacity to consume less energy.

Many leading air conditioning brands have been expanding their retail networks in Nigeria, making it feasible for consumers to purchase air conditioners in cities and towns. Moreover, the increasing number of residential construction projects in Nigeria is creating new opportunities for the air conditioning market as several new homes are being built with air conditioning systems installed. Furthermore, the growth of commercial air conditioning such as the expansion of shopping malls, office buildings, and hotels. This creates new opportunities for the air conditioning industry. Lastly, there has been a growing demand for air conditioners that can improve indoor air quality and provide a more comfortable and soothing living environment.

Nigeria Air Conditioner Market Synopsis

Air Conditioner Market in Nigeria is expected to project substantial growth during the forecast period owing to the expansion of the hospitality sector. The establishment of offices, private complexes and shopping malls are driving the demand for Air Conditioner. Moreover, the adoption of Air Conditioner as necessities instead of luxury due to soaring weather conditions further led to the development of the market. The soaring temperature along with unfavourable weather conditions is expected to further boost the growth of the market.

According to 6Wresearch, Nigeria Air Conditioner (AC) Market size is projected to grow at a CAGR of 4.4% during 2021-2027. Increasing disposable income backed by a rising population beholds the growth of the market. Increasing investment by the public and private sectors along with the development of commercial and residential projects led to an upsurge in the growth of the market. Growing migration towards urban areas coupled with the burgeoning purchasing power of the consumers. However, the market suffered a rapid decline due to the outburst of COVID-19 leading to disruption in the production and supply chain. The recent outbreak of the global pandemic led to the shutting down of retail stores further beholds the negative growth of Nigeria AC Market. Nigeria occupies the 4th position in terms of the market size in the Africa Air Conditioner Market.

The Impact of COVID-19 on the Nigeria Air Conditioner (AC) Market

The COVID-19 pandemic has had a significant impact on Nigeria Air Conditioner (AC) Industry. The pandemic caused disruptions in global supply chains and resulted in restrictions on international trade and transportation logistics which led to delays in the availability of AC units. The pandemic resulted in an economic downturn, which has led to a decrease in demand for air conditioners as individuals and businesses delayed non-essential purchases. Also, restrictions on businesses and social gatherings had an impact on commercial spaces, which experienced reduced occupancy for AC installations and maintenance.

Key Players in the Nigeria Air Conditioner (AC) Market

The Nigeria Air Conditioner (AC) Market has various leading players, including both international and domestic manufacturers and suppliers.

- Daikin

- Samsung

- LG Electronics

- Haier Thermocool

- Panasonic

- Midea

- Gree

Market Analysis by Types

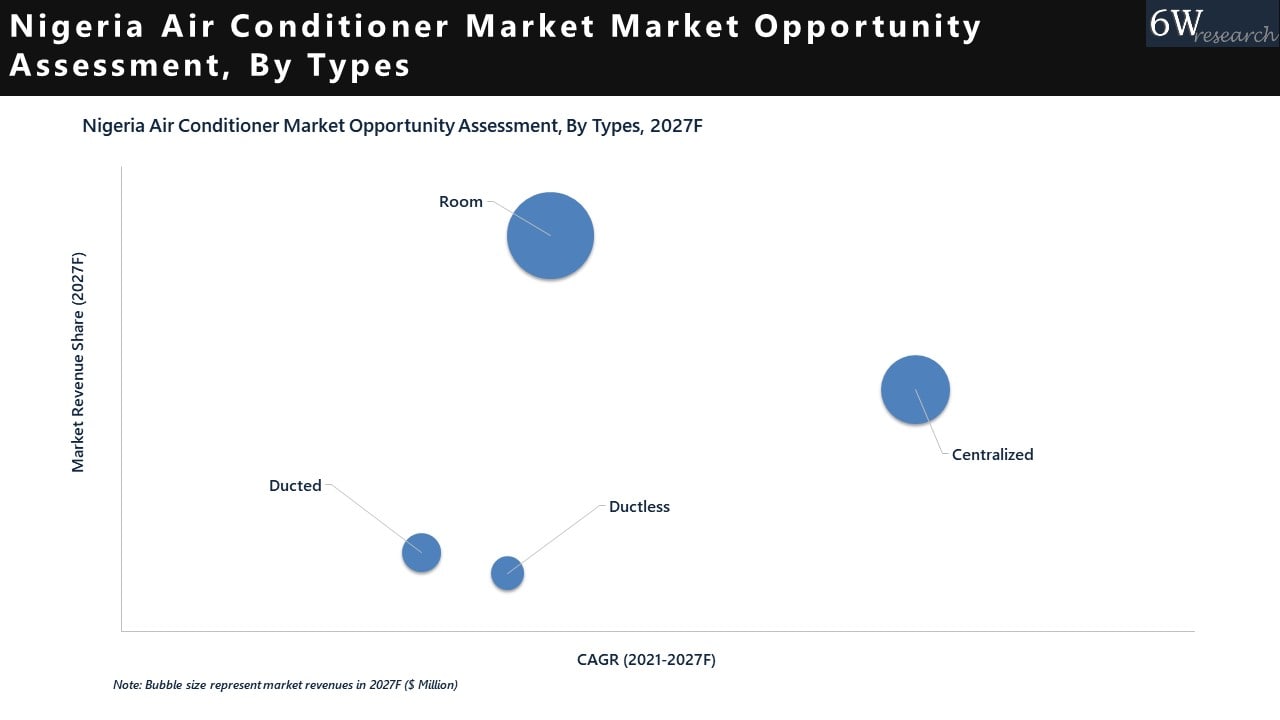

In terms of market by type, Room Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years. However, Centralized Air Conditioner is expected to have the fastest growth rate among all types.

Market Analysis by Applications

In terms of application, Residential dominates the Nigeria Air Conditioner (AC) Market share and is expected to remain in a dominant position in the coming years. However, Commercial & Retail is expected to have the fastest growth rate among all applications.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Nigeria Air Conditioner Market Outlook

- Market Size of Nigeria Air Conditioner Market, 2020

- Forecast of Nigeria Air Conditioner Market, 2027

- Historical Data and Forecast of Nigeria Air Conditioner Revenues & Volume for the Period 2017 - 2027

- Nigeria Air Conditioner Market Trend Evolution

- Nigeria Air Conditioner Market Drivers and Challenges

- Nigeria Air Conditioner Price Trends

- Nigeria Air Conditioner Porter's Five Forces

- Nigeria Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Type for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Healthcare for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of Nigeria Air Conditioner Market Revenues & Volume By Others for the Period 2017 - 2027

- Nigeria Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Nigeria Air Conditioner Top Companies Market Share

- Nigeria Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Nigeria Air Conditioner Company Profiles

- Nigeria Air Conditioner Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

By Types:

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application:

- Residential

- Commercial & Retail

- Healthcare

- Hospitality

- Transportation & Infrastructure

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero