Nigeria Data Center Market Outlook (2021-2027) | companies, Size, Growth, Share, Revenue, Forecast, Analysis, industry, Outlook & COVID-19 IMPACT

Market Forecast By Types (Colocation Data Center, Cloud Data Center, Managed Services Data Center, Enterprise Data Center), By Verticals (Telecom & IT, BFSI, Government, Healthcare, Education & Others), By Regions (Southwest, Central, Southeast, Northwest, Northeast)And Competitive Landscape

| Product Code: ETC150344 | Publication Date: Mar 2023 | Product Type: Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 89 | No. of Figures: 21 | No. of Tables: 7 |

The Nigeria Data Center Market report thoroughly covers the market by types, verticals, and regions. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of the Nigeria Data Center Market

Nigeria Data Center Market has been growing steadily in recent years and the market is being driven by increasing demand for digital services and the need for reliable data storage and processing infrastructure. The investment in new data centre facilities is further contributing to the development of this market. Moreover, cloud services are becoming increasingly popular in Nigeria. In addition, the Data centre providers in Nigeria are gradually partnering with local and international technology companies to offer a wider range of services to customers. The data centre industry in Nigeria is experiencing tremendous growth on the back of increasing demand for data storage. With the rise of the digital economy and the growth of internet usage in Nigeria, there is a growing need for data storage and processing.

Moreover, the government is investing heavily in the development of the country's digital infrastructure, including data centres which have further created a favourable environment for data centre operators. The emergence of technology trends such as cloud computing, artificial intelligence, and the Internet of Things (IoT) is driving demand for data centre services in Nigeria. Thereby, the demand for data centre services is likely to grow further in the upcoming years.

Nigeria Data Center Market Synopsis

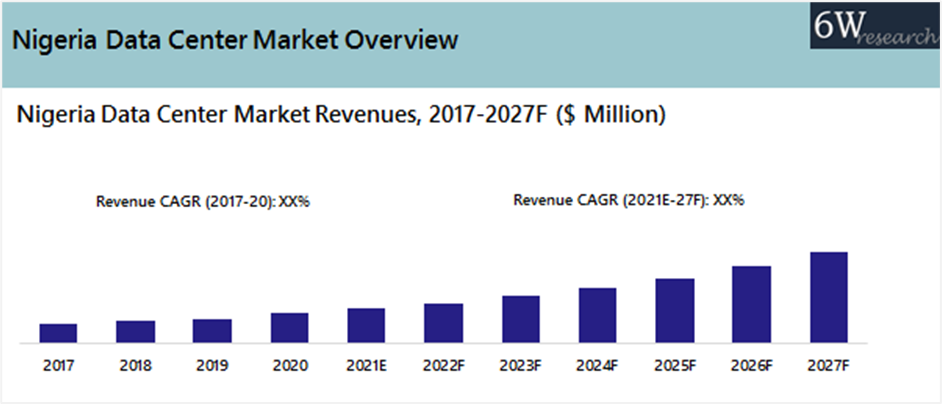

Nigeria data centre market witnessed decent growth in 2017-2019 owing to several government initiatives such as Nigeria vision 2020 and Nigeria ICT Roadmap 2017–2020 which aimed at improving ICT infrastructure in the country along with promoting e-governance, e-commerce, digital banking, and others which significantly contributed towards the market of a data centre.

Social distancing norms implemented in the region due to the Covid-19 pandemic in 2020 acted as a catalyst in the growth of telehealthcare, remote working, e-learning and other digital platforms, which resulted in increased data traffic. According to the data from the Nigerian Communications Commission, the number of internet subscribers rose by 2.5 million in April and with a similar number in May, overall internet subscriber figures went up by ~5 million. The role of data centres got widened by the surge in data traffic, data storage and processing requirements.

According to 6Wresearch, the Nigeria Data Center Market size is projected to grow at a CAGR of 17.9% during 2021-2027. Nigeria data centre market is likely to experience rapid growth in the forecast period on account of multiple initiatives launched by the government such as the National Digital Economy Policy and Strategy (2020-2030), Cloud Computing Policy (2019), National Broadband Plan (2020-2025), Smart city initiative combined with the upcoming rollout of 5G technology and growing tech ecosystem in the country. Nigeria’s tech start-ups received $701.5 million in funding in 2020, one of the highest in Africa, of which fintech start-ups accounted for 44% of the start-up investments. The number of fintech start-ups in Nigeria also grew from 74 in 2017 to 144 in 2021. Government initiatives coupled with a growing tech ecosystem would create opportunities for the data centre market in the coming years.

Market by Type Analysis

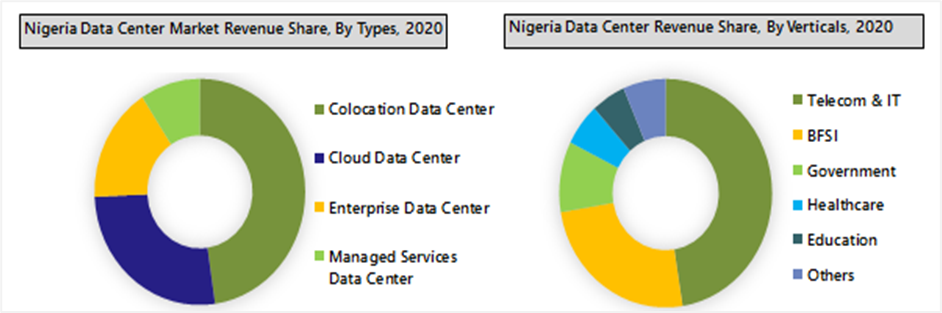

In terms of types, the segments colocation and cloud data centre cumulatively have captured 74% of the market revenues in 2020, with colocation data centers leading the market. Colocation data centers dominated the Nigeria data centre market revenues for the year 2020 and the same trend is expected to continue in the future on account of increasing awareness among business executives about the security of their IT infrastructure, due to frequent power cuts in Nigeria causing financial losses and operational disruptions. This is driving the companies toward colocations services as it provides redundant power supply, better security, and scalability at a lower price.

Market by Application Analysis

In Nigeria Data Center Market, the telecom & IT verticals have led the overall market revenues accounting for more than 45% of the market revenues in 2020. Telecom & IT applications captured a key share of the market pie, led by growing internet penetration, adoption of modern technologies and digitization initiatives are taken by the government.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Nigeria Data Center Market Overview

- Nigeria Data Center Market Outlook

- Nigeria Data Center Market Forecast

- Historical Data and Forecast of Nigeria Data Center Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of Revenues, By Types, Verticals, and Regions for the Period 2017-2027F

- Market Drivers and Restraints

- Nigeria Data Center Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

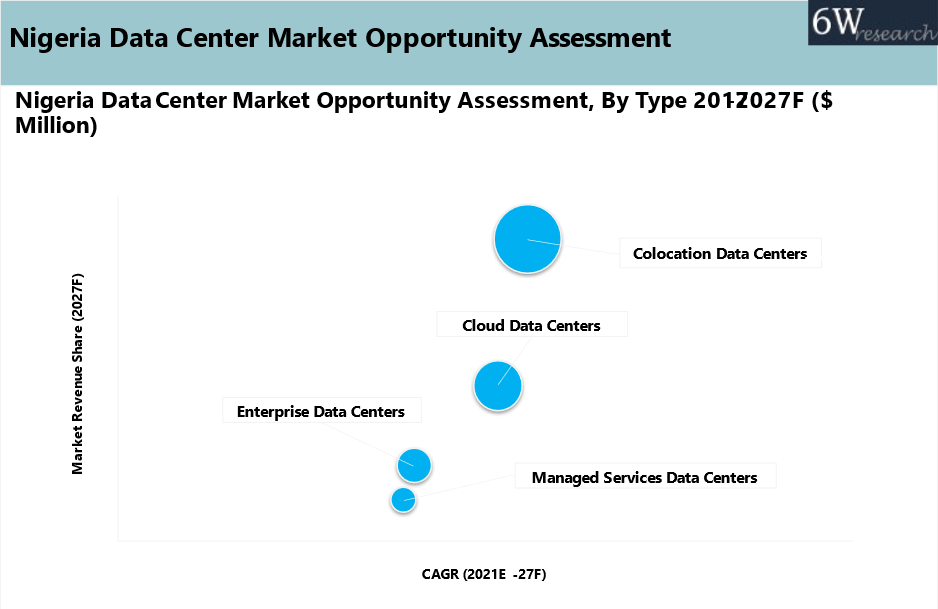

- Market Opportunity Assessment

- Nigeria Data Center Market Revenue Ranking, By Company

- Nigeria Data Center Market – Impact of Local Policies

- Nigeria Data Center Market – Analysis of Data Center Requirement of Tenants in Colocation Scenarios

- Nigeria Data Center Market – Analysis of User Engagement

- Nigeria Data Center Market – Existing Gap Analysis, Capacity Vs Requirement

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types:

- Colocation Data Center

- Cloud Data Center

- Managed Services Data Center

- Enterprise Data Center

By Verticals:

- Telecom & IT

- BFSI

- Government

- Healthcare

- Education

- Others

By Regions:

- Southwest

- Central

- Southeast

- Northwest

- Northeast

Nigeria Data Center Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Nigeria Data Center Market Overview |

| 3.1. Nigeria Data Center Market Revenues, 2017-2027F |

| 3.2. Nigeria Data Center Market Industry Life Cycle |

| 3.3. Nigeria Data Center Market Ecosystem |

| 3.4. Nigeria Data Center Market- Porter’s Five Forces |

| 3.5. Nigeria Data Center Market Revenue Share, By Types, 2020 & 2027F |

| 3.6. Nigeria Data Center Market Revenue Share, By Verticals, 2020 & 2027F |

| 3.7. Nigeria Data Center Market Revenue Share, By Regions, 2020 & 2027F |

| 4. Covid-19 Impact Analysis on Nigeria Data Center Market |

| 5. Nigeria Data Center Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Nigeria Data Center Market Trends |

| 7. Nigeria Data Center Market Overview, By Types |

| 7.1. Nigeria Data Center Market Revenues, By Enterprise Data Centers Types, 2017-2027F |

| 7.2. Nigeria Data Center Market Revenues, By Managed Services Data Centers Types, 2017-2027F |

| 7.3. Nigeria Data Center Market Revenues, By Colocation Data Centers Types, 2017-2027F |

| 7.4. Nigeria Data Center Market Revenues, By Cloud Data Centers Types, 2017-2027F |

| 8. Nigeria Data Center Market Overview, By Verticals |

| 8.1. Nigeria Data Center Market Revenues, By BFSI, 2017-2027F |

| 8.2. Nigeria Data Center Market Revenues, By Telecom & IT, 2017-2027F |

| 8.3. Nigeria Data Center Market Revenues, By Government, 2017-2027F |

| 8.4. Nigeria Data Center Market Revenues, By Healthcare, 2017-2027F |

| 8.5. Nigeria Data Center Market Revenues, By Education, 2017-2027F |

| 8.6. Nigeria Data Center Market Revenues, By Others, 2017-2027F |

| 9. Nigeria Data Center Market Overview, By Regions |

| 9.1. Nigeria Data Center Market Revenues, By North-Eastern Region, 2017-2027F |

| 9.2. Nigeria Data Center Market Revenues, By North-Western Region, 2017-2027F |

| 9.3. Nigeria Data Center Market Revenues, By Central Region, 2017-2027F |

| 9.4. Nigeria Data Center Market Revenues, By South-Western Region, 2017-2027F |

| 9.6. Nigeria Data Center Market Revenues, By South-Eastern Region, 2017-2027F |

| 10. Nigeria Data Center Market - Key Performance Indicators |

| 11. Nigeria Data Center Market - Impact of Local Policies (such as NPDR etc.) on the Data Center Industry |

| 12. Nigeria Data Center Market - Analysis on DC Requirements of Tenants in the Colocation Scenarios |

| 13. Analysis on How to Engage End Users for Typical Colo Service Providers, Such as Mainone, Rackcentre, or Why They Are More Successful? |

| 14. Existing Gap Analysis regarding DC Capacity Vs. Requirements in Nigeria Data Center Market |

| 15. Nigeria Data Center Market – Opportunity Assessment |

| 15.1. Nigeria Data Center Market Opportunity Assessment, By Types, 2027F |

| 15.2. Nigeria Data Center Market Opportunity Assessment, By Verticals, 2027F |

| 15.3. Nigeria Data Center Market Opportunity Assessment, By Regions, 2027F |

| 16. Nigeria Data Center Market Competitive Landscape |

| 16.1. Nigeria Data Center Market Revenue Ranking, By Companies, 2020 |

| 16.3. Nigeria Data Center Market Competitive Benchmarking, By Operating Parameters |

| 17. Company Profiles |

| 17.1. Rack Centre Ltd. |

| 17.2. Liquid Intelligent Technologies |

| 17.3. ipNX Nigeria Ltd. |

| 17.4. Medallion Communications Inc. |

| 17.5. MainOne |

| 17.6. Excelsimo Networks Ltd. |

| 17.7. MTN Group |

| 17.8. Galaxy Backbone Plc |

| 17.9. 21st Century Technologies Ltd. |

| 17.10. Dreamlabs Nigeria Ltd. |

| 18. Key Strategic Recommendations |

| 19. Disclaimer |

| List of Figures |

| Figure 1. Nigeria Data Center Market Revenues, 2017-2027F ($ Million) |

| Figure 2. Nigeria Data Center Market Revenue Share, By Types, 2020 & 2027F |

| Figure 3. Nigeria Data Center Market Revenue Share, By Verticals, 2020 & 2027F |

| Figure 4. Nigeria Data Center Market Revenue Share, By Regions, 2020 & 2027F |

| Figure 5. Nigeria Spending on ICT Sector in $ Billion, 2020 & 2023F |

| Figure 6. Nigeria ICT Sector GDP Contribution, 2016-Q2’2021 |

| Figure 7. Individual Using the Internet (% of Population), 2017-2023F |

| Figure 8. Nigeria Mobile Internet Performance, June 2020- June 2021 |

| Figure 9. Nigeria Fixed Broadband Internet Performance, June 2020- June 2021 |

| Figure 10. Nigeria Percentage Contribution of Telecom to GDP, Q1‘2018 – Q2’2021 |

| Figure 11. Nigeria Number of Active Telephony Subscribers in Million, 2017-2020 |

| Figure 12. Nigeria Number Fintech Start-Ups, 2017-2021 |

| Figure 13. Nigeria Volume of Electronic Funds Transfer in Millions, 2016-2020 |

| Figure 14. Lagos Quarterly Supply and Take Up IT Power in MW, Q1’2019-Q2’2021 |

| Figure 15. Lagos Supply of Different Types of IT Space in MW, Q1’2019-Q2’2021 |

| Figure 16. Nigeria Data Center Market Opportunity Assessment, By Types, 2027F |

| Figure 17. Nigeria Data Center Market Opportunity Assessment, By Verticals, 2027F |

| Figure 18. Nigeria Data Center Market Opportunity Assessment, By Regions, 2027F |

| Figure 19. Nigeria Data Center Market Revenue Share, By Companies, 2020 |

| Figure 20. Top 100 Tech Start-ups in the Nigerian Ecosystem, By Location |

| Figure 21. Top 100 Tech Start-ups in the Nigerian Ecosystem, By Technology |

| List of Tables |

| Table 1. Nigerian Government’s Key Focus Areas Under National Digital Economy Policy and Strategy, 2020-2030 |

| Table 2. Nigeria Data Center Market Revenues, By Types, 2017-2027F ($ Million) |

| Table 3. Nigeria Data Center Market Revenues, By Verticals, 2017-2027F ($ Million) |

| Table 4. Nigeria Data Center Market Revenues, By Regions, 2017-2027F ($ Million) |

| Table 5. Key Tenants Requirement in the Colocation Scenarios |

| Table 6. Facility Description of Rack Centre & MainOne |

| Table 7. Major Data Centers in Lagos with their Built Capacity and Under Construction Capacity in MW, 2021 |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero