Nigeria Tire Market (2019-2025) | Trends, Growth, Outlook, Share, Analysis, Companies, Value, Revenue, Forecast, Industry & Size

Market Forecast By Types (Radial Tires and Bias Tires), By End Users (OEM and Replacement), By Vehicle Types (Trucks and Bus, Light Trucks, Two-Wheelers and Passenger Cars), and Competitive Landscape

| Product Code: ETC001387 | Publication Date: Apr 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 60 | No. of Figures: 24 | |

Nigeria Tire Market Size Growth Rate

The Nigeria Tire Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 1.30% in 2025, climbs to a high of 1.69% in 2027, and moderates to 1.30% by 2029.

Nigeria tire market witnessed moderate growth in recent years on account of sluggish economic growth and political instability in the country. However, rising automotive manufacturing and assembly in the country would drive Nigeria Tire Market Growth during the forecast period.

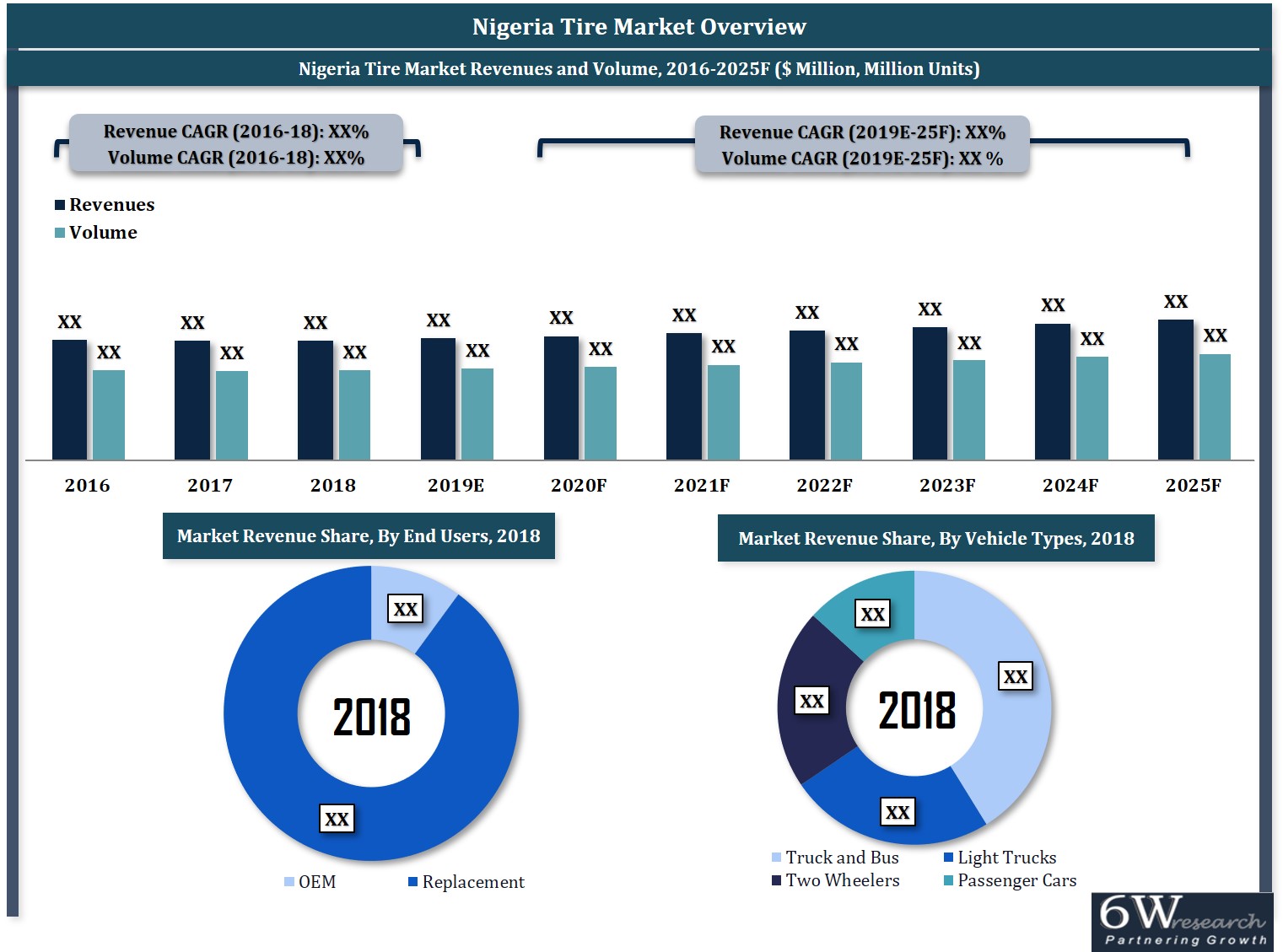

According to 6Wresearch, Nigeria Tire Market size is projected to grow at a CAGR of 2.4% during 2019-2025. The majority of the motor vehicles entering the Nigerian automotive market are used vehicles from Europe and the U.S.A. and thus, the Nigerian tire market is driven by the demand for replacement tires. Two-wheeler tires captured the majority of the volume share in the Nigeria tire market due to the high popularity of the two-wheeler in the country and the shorter life of two-wheeler tires when compared to tires in other segments. However, truck and buses tire segments had the highest revenue share in overall Nigeria Tire Market Revenue owing to higher prices and prominent use of commercial and public transport by the Nigerian citizens.

Based on types, radial tires dominated the Nigeria Tire Market due to certain advantages such as higher fuel efficiency and longer life offered by them. Some of the key players in the Nigerian tire market are Goodyear, Pirelli, Continental, Bridgestone, Michelin, and Chinese players.

The Nigeria tire market report comprehensively covers the market by types, vehicle types, and end-users. The Nigeria tire market outlook report provides an unbiased and detailed analysis of the ongoing Nigeria tire market trends, opportunities/high growth areas, and market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

Nigeria Tire market experienced moderate growth in the economic and political Nigeria. The rising of the manufacturing and assembly of the country tire market takes place. Nigeria tire market is more in demand because they do replacement of the tires, two-wheeler tires are the high popularity in the country. Nigeria's. The rising of the manufacturing and assembly of the country tire market takes place.

Favorable policies in order to safeguard the automotive sector are driving the Nigeria Tire Market Share. However, the market suffered a decline owing to the influx of inexpensive Chinese tires. The registration of new vehicles also suffered a decline during the past years.

Key Highlights of the Report:

- Nigeria Tire Market Overview

- Nigeria Tire Market Outlook

- Nigeria Tire Market Forecast

- Historical Data of Nigeria Tire Market Revenues & Volume for the Period 2016-2018

- Nigeria Tire Market Size and Nigeria Tire Market Forecast of Revenues & Volume until 2025F

- Historical Data of Nigeria Tire Market Revenues & Volume for the Period 2016-2018, By Vehicle Types.

- Market Size & Forecast of Nigeria Tire Market Revenues & Volume until 2025F, By Vehicle Types

- Historical Data of Nigeria Tire Market Revenues & Volume for the Period 2016-2018, By End Users

- Market Size & Forecast of Nigeria Tire Market Revenues & Volume until 2025F, By End Users

- Historical Data of Nigeria Tire Market Revenues & Volume for the Period 2013-2018, By Types

- Market Size & Forecast of Nigeria Tire Market Revenues & Volume until 2025F, By Types

- Nigeria Tire Market Drivers and Restraints

- Nigeria Tire Market Trends and Industry Life Cycle

- Nigeria Tire Market Porter’s Five Force Analysis

- Nigeria Tire Market Opportunity Assessment

- Nigeria Tire Market Share, By Regions

- Nigeria Tire Market Share, By Companies

- Nigeria Tire Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Nigeria tire market report provides a detailed analysis of the following market segments:

By Vehicle Types

- Truck and Bus Tires

- Light Truck Tires

- Passenger Car Tires

- Two-Wheeler Tires

By End Users

- OEM (Original Equipment Manufacturer)

- Replacement

By Types

- Radial Tires

- Bias Tires

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Nigeria Tire Market Overview |

| 3.1. Nigeria Country Indicators |

| 3.2. Nigeria Tire Market Revenues & Volume, 2016-2025F |

| 3.3. Nigeria Tire Market - Industry Life Cycle, 2018 |

| 3.4. Nigeria Tire Market – Porter’s Five Force Model |

| 4. Nigeria Tire Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Growing automotive industry in Nigeria leading to increased vehicle sales and demand for tires. |

| 4.2.2 Expansion of transportation and logistics sector in Nigeria driving demand for commercial vehicle tires. |

| 4.2.3 Increasing disposable income and urbanization leading to higher vehicle ownership rates and tire replacement demand. |

| 4.3. Market Restraints |

| 4.3.1 Volatility in raw material prices impacting tire production costs. |

| 4.3.2 Competition from cheaper imported tires affecting domestic tire manufacturers. |

| 4.3.3 Infrastructure challenges in Nigeria leading to increased wear and tear on tires and frequent replacements. |

| 5. Nigeria Tire Market Overview, By End User |

| 5.1. Nigeria Tire Market Revenues and Volume Share, By End User, 2018 & 2025F |

| 5.2. Nigeria Tire Market Revenue and Volume, By End User, 2016-2025F |

| 5.2.1 Nigeria Tire Market Revenue and Volume, By OEM, 2016-2025F |

| 5.2.2 Nigeria Tire Market Revenue and Volume, By Replacement, 2016-2025F |

| 6. Nigeria Tire Market Overview, By Vehicle Types |

| 6.1. Nigeria Tire Market Revenue and Volume Share, By Vehicle Types, 2018 & 2025F |

| 6.2. Nigeria Passenger Car Tire Market Revenues and Volume, 2016-2025F |

| 6.3. Nigeria Truck and Bus Tire Market Revenues and Volume, 2016-2025F |

| 6.3.1. Nigeria Truck and Bus Tire Market Revenue and Volume Share, By Types, 2018 & 2025F |

| 6.3.1.1. Nigeria Truck and Bus Tire Market Revenues and Volume, By Types, 2016-2025F |

| 6.3.1.1.1 Nigeria Truck and Bus Radial Tire Market Revenue and Volume, 2016-2025F |

| 6.3.1.1.2 Nigeria Truck and Bus Bias Tire Market Revenue and Volume, 2016-2025F |

| 6.4. Nigeria Light Truck Tire Market Revenues and Volume, 2016-2025F |

| 6.4.1. Nigeria Light Truck Tire Market Revenue and Volume Share, By Types, 2018 & 2025F |

| 6.4.1.1. Nigeria Light Truck Tire Market Revenues and Volume, By Types, 2016-2025F |

| 6.3.1.1.1 Nigeria Light Truck Radial Tire Market Revenue and Volume, 2016-2025F |

| 6.3.1.1.2 Nigeria Light Truck Bias Tire Market Revenue and Volume, 2016-2025F |

| 6.5. Nigeria Two-Wheeler Tire Market Revenues and Volume, 2016-2025F |

| 7. Nigeria Tire Market Key Performance Indicators |

| 7.1 Malaysia Government Spending Outlook |

| 7.2 Malaysia Automotive Sector Outlook |

| 8. Nigeria Tire Market Opportunity Assessment |

| 8.1. Nigeria Tire Market Opportunity Assessment, By Vehicle Types, 2025F |

| 8.2. Nigeria Tire Market Opportunity Assessment, By End User, 2025F |

| 9. Nigeria Tire Market-Competitive Landscape |

| 9.1. Nigeria Tire Market Competitive Benchmarking, By Vehicle Types |

| 9.2. Nigeria Tire Market Revenue Share, By Companies, 2018 |

| 10. Company Profiles |

| 10.1. Bridgestone Middle East & Africa FZE |

| 10.2. Triangle Tyre Co. Ltd. |

| 10.3. MRF Limited |

| 10.4. The Goodyear Tire & Rubber Company |

| 10.5. Continental AG |

| 10.6. The Yokohama Rubber Co., Ltd. |

| 10.7. General Company Establishment Michelin |

| 10.8. Maxxis International – Middle East and Africa |

| 10.9. Pirelli & C. S.p.A. |

| 11. Key Strategic Recommendations |

| 12. Disclaimer |

| List of Figures |

| Figure 1. Nigeria Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 2. Nigeria Tire Market Revenue Share, By End Users, 2018 & 2025F |

| Figure 3. Nigeria Tire Market Volume Share, By End Users, 2018 & 2025F |

| Figure 4. Nigeria Tire Market Revenues and Volume, By OEM, 2016-2025F ($ Million, Million Units) |

| Figure 5. Nigeria Tire Market Revenues and Volume, By Replacement, 2016-2025F ($ Million, Million Units) |

| Figure 6. Nigeria Tire Market Revenue Share, By Vehicle Types, 2018 & 2025F |

| Figure 7. Nigeria Tire Market Volume Share, By Vehicle Types, 2018 & 2025F |

| Figure 8. Nigeria Passenger Car Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 9. Nigeria Truck and Bus Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 10. Nigeria Truck and Bus Tire Market Revenue Share, By Types, 2018 & 2025F |

| Figure 11. Nigeria Truck and Bus Tire Market Volume Share, By Types, 2018 & 2025F |

| Figure 12. Nigeria Radial Truck Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 13. Nigeria Bias Truck Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 14. Nigeria Light Truck Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 15. Nigeria Light Truck Tire Market Revenue Share, By Types, 2018 & 2025F |

| Figure 16. Nigeria Light Truck Tire Market Volume Share, By Types, 2018 & 2025F |

| Figure 17. Nigeria Radial Light Truck Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 18. Nigeria Bias Light Truck Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 19. Nigeria Two-Wheeler Tire Market Revenues and Volume, 2016-2025F ($ Million, Million Units) |

| Figure 20. Nigeria Actual Government Spending Vs Actual Government Revenues, 2015-2024F (Naira Trillion) |

| Figure 21. Nigeria Tire Market Opportunity Matrix, By Vehicle Type, 2025F |

| Figure 22. Nigeria Tire Market Opportunity Matrix, By End User, 2025F |

| Figure 23. Kenya Tire Market Revenue Share, By Company, 2018 |

| Figure 24. Tire Market – Ansoff Matrix |

| List of Tables |

| Table 1. Nigeria Vehicle Sales Data, 2016-18 (Units) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero