North America Switchgear Market (2025-2031) | Outlook, Forecast, Companies, Size, Trends, Share, Value, Industry, Analysis, Revenue & Growth

Market ForecastBy Voltage (Low Voltage (0-1.1 KV), Medium Voltage (1.1-36 KV), High Voltage (>36 KV)), By Low Voltage (Types (MCB, MCCB, ACB, Others), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By Medium Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By High Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By Countries (U.S. and Canada) and Competitive Landscape

| Product Code: ETC001597 | Publication Date: Jul 2024 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 200 | No. of Figures: 90 | No. of Tables: 30 |

North America Switchgear Market Size & Growth Rate

According to 6Wresearch internal database and industry insights, the North America Switchgear Market was valued at USD 9.7 billion in 2024 and is projected to cross USD 19.2 billion by 2031, growing at a compound annual growth rate (CAGR) of 8.5% during the forecast period 2025-2031.

North America Switchgear Market Highlights

| Report Name | North America Switchgear Market |

| Forecast period | 2025-2031 |

| Market Size | USD 19.2 billion by 2031 |

| CAGR | 8.5% |

| Growing Sector | Power Utilities and Commercial Sector |

Topics Covered in the North America Switchgear Market Report

The North America Switchgear Market report thoroughly covers the market by voltage, by insulation type, by applications and by countries. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

North America Switchgear Market Synopsis

North America Switchgear Market is seeing consistent growth over the past few years. North America is one of the most developed regions due to growing expansion of renewable energy projects, increasing demand for reliable grid infrastructure, and modernization of aging power systems. Witing this region, countries like the U.S. and Canada are investing heavily in smart grids, industrial electrification, and urban infrastructure projects, that is driving switchgear adoption.

Evaluation of Growth Drivers in the North America Switchgear Market

Below mentioned some major drivers and their impacts on the market dynamics:

| Drivers | Primary Segments Affected | Why it matters (evidence) |

| Renewable Energy Expansion | Medium & High Voltage Switchgear | Noteworthy investments in solar, wind, and offshore energy projects in the U.S. and Canada are fuelling demand for robust switchgear systems. |

| Smart Grid Modernization | Medium Voltage Switchgear | The focus of government is emphasizing on digital grids and energy-efficient transmission lines, which is leading to higher adoption of GIS and smart switchgear. |

| Industrial Automation | Medium & High Voltage Switchgear | Due to increasing automation in manufacturing hubs such as Texas and Ontario, the requirement for reliable power distribution is rising. |

| Urbanization & EV Infrastructure | Low & Medium Voltage Switchgear | EV charging networks and commercial infrastructure projects is expanding across North America which requires advanced low-voltage switchgear systems. |

| Replacement of Aging Infrastructure | High Voltage Switchgear | Modernization of decades-old T&D infrastructure across U.S. states creates strong opportunities for advanced high-voltage GIS systems. |

North America Switchgear Market is predicted to gain momentum at a CAGR of 8.5% during the forecast period. Due to several growth factors such as rapid modernization of grid infrastructure, growing investments in renewable energy, and the expansion of electric vehicle charging networks, this industry is set to expand in the coming years. Particularly, U.S. and Canada are focusing on smart grid deployment that is creating demand for digital and gas-insulated switchgear that ensures efficient and reliable power distribution. Further, the rise of industrial automation and large-scale manufacturing hubs, particularly in the U.S., is boosting demand for medium- and high-voltage switchgear. Furthermore, the electric vehicles and charging infrastructure is on the rise in North America, which has supported the demand for low- and medium-voltage switchgear.

Evaluation of Restraints in the North America Switchgear Market

Below mentioned some major restraints and their influence on the market dynamics:

| Restraints | Primary Segments Affected | What this means (evidence) |

| High Installation Costs | Medium & High Voltage Switchgear | Advanced GIS systems are cost-intensive, limiting deployment for small-scale utilities and industries. |

| Regulatory Delays | Power Utilities | Lengthy approval processes for large-scale energy projects in the U.S. slow down switchgear adoption. |

| Cybersecurity Concerns | Smart Switchgear | Increased use of IoT and smart grids raises data security issues, hindering adoption in certain sectors. |

| Price Competition | Low Voltage Switchgear | Within North America, local and regional manufacturers often face difficulties in price wars, reducing margins. |

| Skilled Workforce Shortage | High Voltage Switchgear | There is specialized skills required for advanced GIS and HV equipment integration remain limited in certain regions. |

North America Switchgear Market Challenges

North American switchgear Market faces multiple challenges while expanding its landscape, which include the high initial costs, cybersecurity risks in digital grids, and fragmented regulatory frameworks across states and provinces. Further, while renewable energy projects are accelerating, delays in grid interconnection approvals could slow down the large-scale switchgear deployments. Another major challenge lies in the lack of uniform standards across regions, which make the adoption and integration more complex for global manufacturers.

North America Switchgear Market Trends

Some emerging trends are shown in the market which include:

- Digital & IoT-Enabled Switchgear: The adoption of smart, connected switchgear is growing with predictive maintenance features.

- EV Charging Infrastructure Growth: The deployment of EV charging stations is on the peak across U.S. and Canada driving medium-voltage switchgear demand.

- Adoption of Gas-Insulated Switchgear: The preference for GIS over AIS is increasing in urban regions due to compactness and efficiency.

- Eco-Friendly Switchgear: SF6-free technologies gaining traction as U.S. and Canadian governments strengthen environmental regulations.

- Decentralized Energy Systems: Microgrids and distributed generation systems increasing the demand for flexible switchgear solutions.

Investment Opportunities in the North America Switchgear Industry

Some lucrative opportunities are present in the North America Switchgear Industry include:

- Smart Grid Deployment: Rising demand for digital grids creates strong opportunities for IoT-enabled switchgear.

- EV Infrastructure Development: The expansion of electric vehicle charging stations is increasing across the region which offers opportunities for low- and medium-voltage switchgear suppliers.

- Renewable Energy Integration: Projects based on solar and wind across U.S. and Canada are pushing demand for high-voltage GIS systems.

- Local Manufacturing: Introducing localized production facilities in North America reduces supply chain risks and offers competitive advantage.

- Green Switchgear Solutions: Strong market potential for SF6-free and eco-friendly switchgear technologies in line with sustainability goals.

Top 5 Leading Players in the North America Switchgear Market

There are some major companies in the market which include:

1. Schneider Electric

| Company Name | Schneider Electric |

| Establishment Year | 1836 |

| Headquarter | Rueil-Malmaison, France |

| Official Website | Click here |

This company offers comprehensive low-, medium-, and high-voltage switchgear, with a strong focus on energy efficiency, digital grids, and eco-friendly solutions.

2. Siemens AG

| Company Name | Siemens AG |

| Establishment Year | 1847 |

| Headquarter | Munich, Germany |

| Official Website | Click here |

This company specializes in high-voltage GIS solutions, renewable integration technologies, and smart grid deployment across North America.

3. ABB Ltd.

| Company Name | ABB Ltd. |

| Establishment Year | 1988 |

| Headquarter | Zurich, Switzerland |

| Official Website | Click here |

This company provides digital switchgear, automation technologies, and high-voltage solutions for renewable projects and industrial applications.

4. Eaton Corporation

| Company Name | Eaton Corporation |

| Establishment Year | 1911 |

| Headquarter | Dublin, Ireland |

| Official Website | Click here |

This company is known for low- and medium-voltage switchgear, Eaton dominates the North America market in commercial, residential, and EV charging infrastructure applications.

5. General Electric (GE)

| Company Name | General Electric (GE) |

| Establishment Year | 1892 |

| Headquarter | Boston, USA |

| Official Website | Click here |

This company offers advanced GIS, HV switchgear, and smart grid solutions, with strong utility and industrial customer base across U.S. and Canada.

Government Regulations Introduced in the North America Switchgear Market

Governments are playing a critical role in shaping the landscape of North America Switchgear Market. Regulations & Polices are introduced in the market such as DOE Energy Efficiency Standards (U.S.) and CSA Standards (Canada) which emphasize the sustainable and energy-efficient technologies. The Environmental Protection Agency's (EPA) Clean Air Act limits the amount of sulphur hexafluoride (SF6) emissions from switchgear equipment. SF6 is a potent greenhouse gas, and its use in electrical equipment has been linked to climate change. Further, federal funding programs for renewable energy integration and EV infrastructure projects are driving new switchgear deployments.

Future Insights of the North America Switchgear Market

The future of the North America switchgear industry is promising, with strong growth expected from emerging trends and major growth factors which include the renewable energy expansion, EV infrastructure, and smart grid deployment. In the coming years, the adoption of eco-friendly GIS technologies and digital automation solutions is continued to rise which will reshape the market landscape. With the U.S. and Canada prioritizing grid modernization and sustainable power distribution, the switchgear market is set to witness strong and sustained growth through 2031.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

MCB to Dominate the Market -By Low Voltage

According to Anjali, Senior Research Analyst, 6Wresearch, in terms of low-voltage category, Miniature Circuit Breakers (MCBs) are expected to dominate owing to their broad use in residential and commercial applications. Within applications, the residential and commercial sectors collectively account for the largest share, as both housing and smart buildings increasingly rely on advanced low-voltage switchgear for safe and efficient electricity distribution.

GIS to Dominate the Market -By Medium Voltage

Within the medium-voltage segment, Gas-Insulated Switchgear (GIS) dominates over Air-Insulated Switchgear (AIS) due to its compact design, reliability, and suitability for space-constrained urban regions such as Los Angeles and Toronto. In terms of applications, power utilities lead the segment, as modernization of distribution systems and renewable energy integration demand reliable medium-voltage solutions. Industrial applications also contribute significantly, driven by automation and manufacturing growth across North America.

GIS to Dominate the Market -By High Voltage

In the high-voltage segment, Gas-Insulated Switchgear (GIS) is expected to lead the market given its efficiency, safety, and ability to handle large-scale renewable integration projects, followed by industrial projects that require stable high-voltage transmission. While AIS remains cost-effective in rural or less-dense areas, GIS is increasingly preferred in major cities and large-scale infrastructure projects where reliability and compactness are critical.

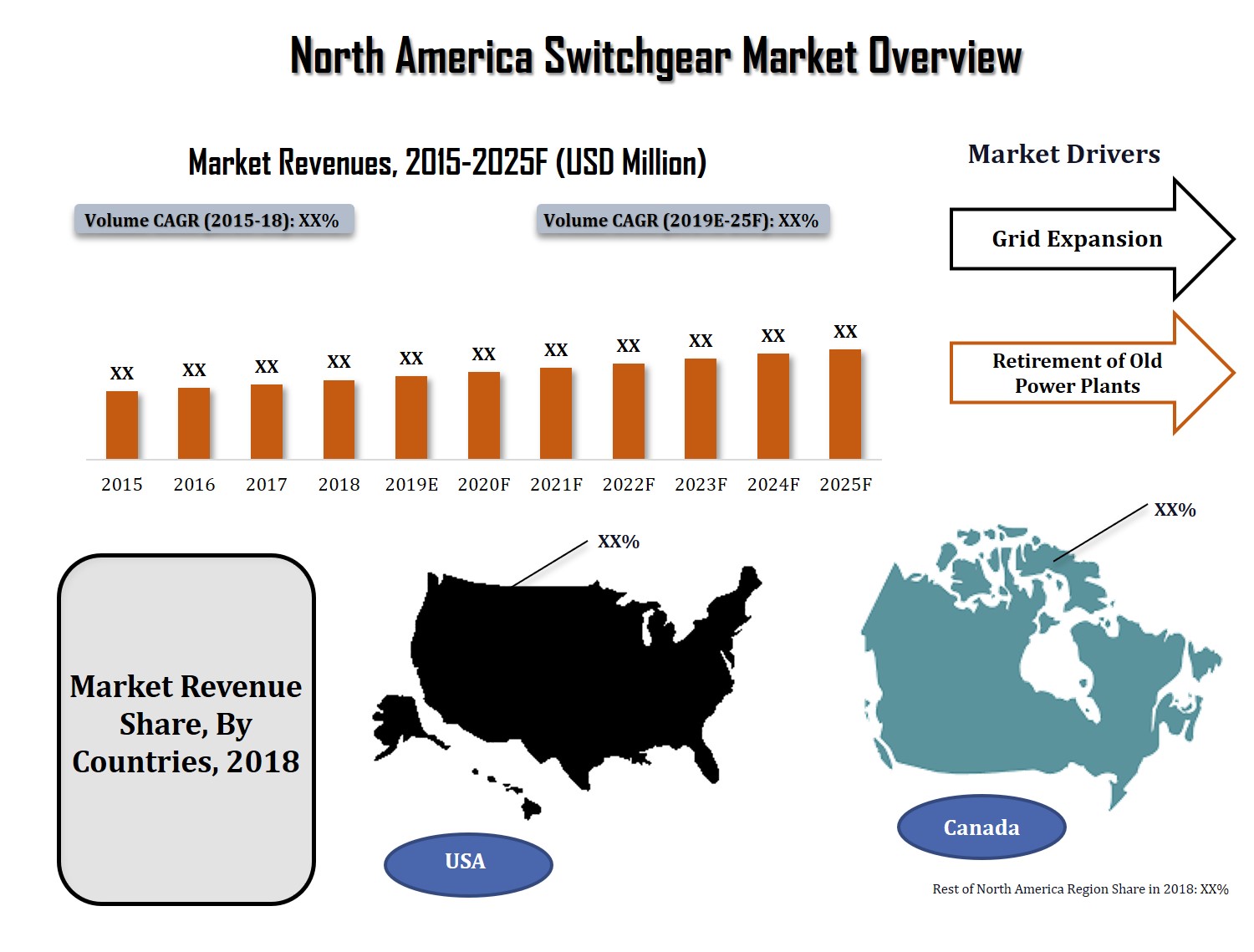

U.S. to Dominate the Market- By Countries

Among countries, U.S. is expected to hold the largest market share due to its massive investments in grid modernization, EV charging infrastructure, and renewable projects. Canada follows closely with strong developments in hydropower, wind energy, and transmission upgrades.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- North America Switchgear Market Outlook

- Market Size of North America Switchgear Market

- Forecast of North America Switchgear Market

- Historical Data and Forecast of North America Switchgear Revenues & Volume for the Period 2021 - 2031

- North America Switchgear Market Trend Evolution

- North America Switchgear Market Drivers and Challenges

- North America Switchgear Price Trends

- North America Switchgear Porter's Five Forces

- North America Switchgear Industry Life Cycle

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Voltage for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Low Voltage Switchgear for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Medium Voltage Switchgear for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By High Voltage Switchgear for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Insulation for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Medium Voltage Switchgear for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By High Voltage Switchgear Voltage Switchgear for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Low Voltage Switchgear for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Applications for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Industrial for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Power Utilities for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Power Utilities for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Power Utilities for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Power Utilities for the Period 2021 - 2031

- Historical Data and Forecast of North America Switchgear Market Revenues & Volume By Power Utilities for the Period 2021 - 2031

- North America Switchgear Market Import Export Trade Statistics

- North America Switchgear Market Opportunity Assessment By Voltage

- North America Switchgear Market Opportunity Assessment By Insulation

- North America Switchgear Market Opportunity Assessment By Applications

- North America Switchgear Market Top Companies Market Share

- North America Switchgear Market Competitive Benchmarking By Technical and Operational Parameters

- North America Switchgear Market Company Profiles

- North America Switchgear Market Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments

By Voltage

- Low Voltage Switchgear

- Medium Voltage Switchgear

- High Voltage Switchgear

By Insulation

- Medium Voltage Switchgear (Air Insulated, Gas Insulated And Others)

- High Voltage Switchgear (Air Insulated, Gas Insulated And Others)

By Types

- Low Voltage Switchgear (MCB, MCCB, C&R, ACB, COS, & Others)

- Medium Voltage Switchgear (Indoor Switchgear (ISG), Outdoor Switchgear (OSG) & Others)

By Applications

- Residential

- Commercial

- Industrial

- Power Utilities

- Others

By Countries

- US

- Canada

- Rest of North America Region

North America Switchgear Market (2025-2031); FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2 Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. North America Switchgear Market Overview |

| 3.1 North America Switchgear Market Revenues (2021-2031F) |

| 3.2 North America Switchgear Market - Industry Life Cycle, 2021 |

| 3.3 North America Switchgear Market - Porter’s Five Forces |

| 3.4 Impact Analysis of Covid-19 on North America Switchgear Market |

| 4. North America Switchgear Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. North America Switchgear Market Trends |

| 6. North America Low Voltage Switchgear Market Overview |

| 6.1 North America Low Voltage Switchgear and Panels Market Revenues (2021-2031F) |

| 6.2 North America Low Voltage Switchgear Market Overview, By Types |

| 6.2.1 North America Low Voltage Switchgear Market Revenue Share, By Types (2021 & 2031F) |

| 6.2.2 North America Low Voltage Switchgear Market Revenues, By Types (2021-2031F) |

| 6.3 North America Low Voltage Switchgear Market Overview, By Applications |

| 6.3.1 North America Low Voltage Switchgear Market Revenue Share, By Applications (2021 & 2031F) |

| 6.3.2 North America Low Voltage Switchgear Market Revenues, By Applications (2021-2031F) |

| 7. North America Medium Voltage Switchgear Market Overview |

| 7.1 North America Medium Voltage Switchgear Market Revenues (2021-2031F) |

| 7.2 North America Medium Voltage Switchgear Market Overview, By Insulation Types |

| 7.2.1 North America Medium Voltage Switchgear Market Revenue Share, By Insulation Types (2021 & 2031F) |

| 7.2.2 North America Medium Voltage Switchgear Market Revenues, By Insulation Types (2021-2031F) |

| 7.3 North America Medium Voltage Switchgear Market Overview, By Applications |

| 7.3.1 North America Medium Voltage Switchgear Market Revenue Share, By Applications (2021 & 2031F) |

| 7.3.2 North America Medium Voltage Switchgear Market Revenues, By Applications (2021-2031F) |

| 8. North America High Voltage Switchgear Market Overview |

| 8.1 North America High Voltage Switchgear Market Revenues (2021-2031F) |

| 8.2 North America High Voltage Switchgear Market Overview, By Insulation Types |

| 8.2.1 North America High Voltage Switchgear Market Revenue Share, By Insulation (2021 & 2031F) |

| 8.2.2 North America High Voltage Switchgear Market Revenues, By Insulation (2021-2031F) |

| 8.3 North America High Voltage Switchgear Market Overview, By Application Types |

| 8.3.1 North America High Voltage Switchgear Market Revenue Share, By Application Types (2021 & 2031F) |

| 8.3.2 North America High Voltage Switchgear Market Revenues, By Application Types (2021-2031F) |

| 9. North America Switchgear Market Overview, By Applications |

| 9.1 North America Switchgear Market Revenues, By Residential Application (2021-2031F) |

| 9.2 North America Switchgear Market Revenues, By Commercial Application (2021-2031F) |

| 9.3 North America Switchgear Market Revenues, By Industrial Application (2021-2031F) |

| 9.4 North America Switchgear Market Revenues, By Power Utilities Application (2021-2031F) |

| 9.5 North America Switchgear Market Revenues, By Other Application (2021-2031F) |

| 10. North America Switchgear Market Overview, By Countries |

| 10.1 United States Switchgear Market Revenues (2021-2031F) |

| 10.2 Canada Emirates Switchgear Market Revenues (2021-2031F) |

| 11. North America Switchgear Market Key Performance Indicators |

| 12. North America Switchgear Market Opportunity Assessment |

| 12.1 North America Switchgear Market Opportunity Assessment, By Voltage (2031F) |

| 12.2 North America Switchgear Market Opportunity Assessment, By Applications (2031F) |

| 13. North America Switchgear Market Competitive Landscape |

| 13.1 North America Switchgear Market Revenue Share, By Voltage, By Company (2024) |

| 13.2 North America Switchgear Market Competitive Benchmarking, By Technical Parameters |

| 13.3 North America Switchgear Market Competitive Benchmarking, By Operational Parameters |

| 14. Company Profiles |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

Market Forecast By Voltage (Low Voltage (0-1.1 KV), Medium Voltage (1.1-36 KV), High Voltage (>36 KV)), By Low Voltage (Types (MCB, MCCB, ACB, Others), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By Medium Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By High Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By Countries (U.S. and Canada) and Competitive Landscape

| Product Code: ETC001597 | Publication Date: May 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 90 | No. of Tables: 30 |

North America Switchgear Market is projected to grow over the coming years. North America Switchgear Market is a part of our various regional publications globally. 6W tracks Switchgear Market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Switchgear Market outlook report annually.

North America Switchgear Market report comprehensively covers the market by Voltage, Types application, Insulation and countries. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest (2024) Development of the North America Switchgear Market

North America Switchgear Market has witnessed remarkable growth, driven by the increasing demand for reliable and efficient power distribution systems. This surge can be attributed to several key factors, including the expansion of renewable energy projects, modernization of existing grid infrastructures, and the rising need for advanced electric network systems due to urbanization and industrial developments. Innovations in smart switchgear technology have also played a significant role, enabling enhanced monitoring, control, and automation capabilities which improve overall grid reliability and reduce downtime. Additionally, supportive government policies and investments in smart grid technology have bolstered the market, fostering an environment ripe for continued growth and development.

North America Switchgear Market Synopsis

North America Switchgear Market is anticipated to project moderate growth during the upcoming years on the back of surging infrastructure development. The growing penetration towards effective controlling and monitoring is proliferating the North America Switchgear Industry. Moreover, growing integration of renewable power generation backed by replacement of convectional power is adding to the North America Switchgear Market Growth. Rising investment by the government to develop the power infrastructure is also one of the factors contributing to the development of the market.

According to 6Wresearch, North America Switchgear Market size is projected to register growth during 2022-2028. Rising demand for safe and reliable system of power is driving the North America Switchgear Market Share. Public and private sources are also increasing their investment towards the development of solar energy which is further contributing to the development of the market. However, the market suffered a major setback owing to the outbreak of COVID-19. Various Industries have shut down the power generation owing to the nationwide lockdown.

North America Switchgear Market: Government Regulations

Government regulations play a critical role in shaping the North America switchgear market. Regulatory frameworks are designed to ensure safety, reliability, and efficiency in the distribution of electrical power. Authorities such as the North American Electric Reliability Corporation (NERC) and the Federal Energy Regulatory Commission (FERC) set stringent standards that manufacturers and utility companies must adhere to. These regulations often focus on the implementation of smart grid technologies, energy efficiency, and the integration of renewable energy sources. Compliance with these standards is essential for market participants to secure certifications and avoid penalties, thus maintaining their market position and ensuring the highest standards of operational integrity.

North America Switchgear Market: Leading Players

The North America switchgear market features several leading players who dominate the industry due to their advanced technological capabilities, extensive product portfolios, and robust distribution networks. Major companies such as ABB Ltd., Schneider Electric SE, Siemens AG, and General Electric Company are at the forefront of innovation in the switchgear sector.

Market Analysis by Countries

On the basis of countries, the US is anticipated to dominate the market during the upcoming years owing to replacement of existing electrical equipment.

Market Analysis by Voltage

Based on voltage, the low-voltage segment is expected to register growth during the upcoming years on the back of advancement of technology and investment towards residential and commercial sector.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2021.

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of Switchgear Report

- North America Switchgear Market Overview

- North America Switchgear Market Outlook

- North America Switchgear Market Forecast

- Historical Data and Forecast of North America Switchgear Market Revenues, By Voltage, By Applications and By Countries for the Period 2018-2028F

- Historical Data and Forecast of North America Low Voltage Switchgear Market Revenues, By Types for the Period 2018-2028F

- Historical Data and Forecast of North America Low Voltage Switchgear Market Revenues, By Applications for the Period 2018-2028F

- Historical Data and Forecast of North America Medium Voltage Switchgear Market Revenues, By Insulation Types for the Period 2018-2028F

- Historical Data and Forecast of North America Medium Voltage Switchgear Market Revenues, By Applications for the Period 2018-2028F

- Historical Data and Forecast of North America High Voltage Switchgear Market Revenues, By Types for the Period 2018-2028F

- Historical Data and Forecast of North America High Voltage Switchgear Market Revenues, By Applications for the Period 2018-2028F

- Historical Data and Forecast of United States Switchgear Market Revenues, for the Period 2018-2028F

- Historical Data and Forecast of Canada Switchgear Market Revenues, for the Period 2018-2028F

- Market Drivers and Restraints

- India Switchgear Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Player’s Revenue Shares

- Market Competitive Benchmarking

- India Switchgear Market Share, By Company

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

· By Voltage

o Low Voltage (0-1.1 kV)

o Medium Voltage (1.1-36 kV)

o High Voltage (>36 kV)

· By Low Voltage

o Types

- MCB

- MCCB

- ACB

- Others (Distribution Boards, Contactors, Relays, Starters, Fuses, COS, MPCB)

o Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil and Gas)

· By Medium Voltage

o Insulation Types

- AIS

- GIS

o Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil and Gas)

· By High Voltage

o Insulation Types

- AIS

- Others (GIS, Oil Insulated)

o Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil and Gas)

· By Countries

o United States

o Canada

Market Forecast By Voltage(Low Voltage (< 1kV), Medium Voltage (1 KV - 36 KV), High Voltage (> 36 KV)), By Insulation Type(Medium Voltage(AIS and Others (GIS, Etc.)), High(AIS and Others (GIS, Etc.))), By Types(Low Voltage(MCB, MCCB, ACB, and Others (C&R, COS, Etc.))), By Applications(Residential, Commercial, Industrial, Power Utilities and Others (Transportation, Etc.)), By Countries(U.S. and Canada) and Competitive Landscape

| Product Code: ETC001597 | Publication Date: Sep 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 90 | No. of Tables: 30 |

Latest 2021 Developments:

North America Switchgear Market is developing due to continuous integration of renewable energy sources with traditional power infrastructure rehabilitation and replacement. Schneider Electric introduced their new medium voltage SF6-free switchgear in 2020, which uses pure air as an insulating medium as well as vacuum interruption. Outdoor installation segment of North America switchgear market is now able to enhance the operability, reduce maintenance, and sustain the aesthetic proximity of the peripherals. Various manufacturers have produced components with automated self-assessment features, making it even easier for the end user to handle and avoid minor operational disruptions.

To enquire about latest release please click here

Previous Release:

Factors such as smart meter implementation and increasing power demand along with regulatory measures for the expansion of electricity network across grid isolated areas would accelerate the growth of the switchgear market in North America. Additionally, rising power demand and growing concern towards the enhancement of conventional power grid, would further propel the switchgear market growth in the region over the coming years

According to 6Wresearch, North America Switchgear Market size is projected to grow at a CAGR of 6.7% during 2019-25. The proclivity towards self-efficiency along with rising concern towards the integration of diverse frequency transmission links would boost the growth of the switchgear market in the region. Apart from this, government initiatives for refurbishment and replacement of existing power infrastructure and increasing demand for cost-efficient technology would also play an indispensable role in resizing the growth of the switchgear market in North America during the forecast period.

The low voltage switchgear would acquire a greater market share as it is widely applicable across the electricity sector and process industries. The supportive power distribution measures along with rising demand for smart control & monitoring units would add on to the growth of the low voltage switchgear market over the years. Additionally, a wide range of applications across small scale process industries and manufacturing and large scale residential deployment of switchgear would provide thrust to the switchgear market in North America.

In North American countries such as the United States of America and Canada, the power utility sector acquired the majority of the market revenue share, owing to a considerable amount of investment in the renewable sector of the respective countries.

The North America switchgear market report thoroughly covers the market by voltage, insulation, applications, and countries. The North America switchgear market outlook report provides an unbiased and detailed analysis of the on-going North America switchgear market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report

- North America Switchgear Market Overview

- North America Switchgear Market Outlook

- North America Switchgear Market Forecast

- Historical Data of North America Switchgear Market Revenues for the Period 2015-2018

- North America Switchgear Market Size and Market Forecast of Revenues, Until 2025

- Historical Data of United States of America and Canada Switchgear Market Revenues for the Period 2015-2018

- Market Size & Forecast of the United States of America and Canada Switchgear Market Revenues Until 2025F

- Historical Data of United States of America and Canada Switchgear Market Revenues for the Period 2015-2018, By Voltage

- Market Size & Forecast of United States of America and Canada Switchgear Market Revenues Until 2025F, By Voltage

- Historical Data of United States of America and Canada Switchgear Market Revenues for the Period 2015-2018, By Types

- Market Size & Forecast of United States of America and Canada Switchgear Market Revenues Until 2025F, By Types

- Historical Data of United States of America and Canada Switchgear Market Revenues for the Period 2015-2018, By Insulation Type

- Market Size & Forecast of United States of America and Canada Switchgear Market Revenues Until 2025F, By Insulation Type

- Historical Data of United States of America and Canada Switchgear Market Revenues for the Period 2015-2018, By Applications

- Market Size & Forecast of United States of America and Canada Switchgear Market Revenues Until 2025F, By Applications

- North America Switchgear Market Drivers

- North America Switchgear Market Restraints

- North America Switchgear Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- North America Switchgear Market Share, By Players

- North America Switchgear Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

North America Switchgear Market Report Covered:

The report provides a detailed analysis of the following market segments:

- By Voltage:

- Low Voltage (< 1kV)

- Medium Voltage (1 kV - 36 kV)

- High Voltage (> 36 kV)

- By Insulation Type:

- Medium Voltage

- AIS

- Others (GIS etc.)

- High

- AIS

- Others (GIS etc.)

- Medium Voltage

- By Types

- Low Voltage

- MCB

- MCCB

- ACB

- Others (C&R, COS etc.)

- Low Voltage

- By Applications

- Residential

- Commercial

- Industrial

- Power Utilities

- Others (Transportation etc.)

- By Countries

- United States of America

- Canada

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero