Pakistan Instant Noodles Market (2023-2029) | Growth, Industry, Size, Share, Trends, Outlook, Analysis, Revenue, Value, Segmentation & COVID-19 IMPACT

Market Forecast By Category (Non-Veg, Veg),By Packaging (Packet, Cup), By Sales Channel (Convenience Stores, Supermarket/Hypermarket, Online), And Competitive Landscape

| Product Code: ETC048497 | Publication Date: Mar 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 62 | No. of Figures: 15 | No. of Tables: 4 |

Pakistan Instant Noodles Market Synopsis

Pakistan Instant Noodles Market grew significantly during the past years on account of the growing young population and rise in food processing clusters. Moreover, the market registered positive growth as the restrictions imposed due to COVID-19 led to an increase in the consumption of instant noodles, and snacks and hence, the food industry witnessed a significant rise in demand. Moreover, the food processing industry of Pakistan is the second largest industry and accounts for around 2500+ food processing units, thereby contributing to the market for instant noodles. Additionally, the food products and beverages sector include over 1800 processing units and a majority of food processing units are located within Punjab across five divisions of Lahore, Multan, DG Khan, Faisalabad, and Gujranwala. Thus, the rise in the food processing industry plays a significant role in the production and distribution of instant noodles, thereby contributing to the growth of the market.

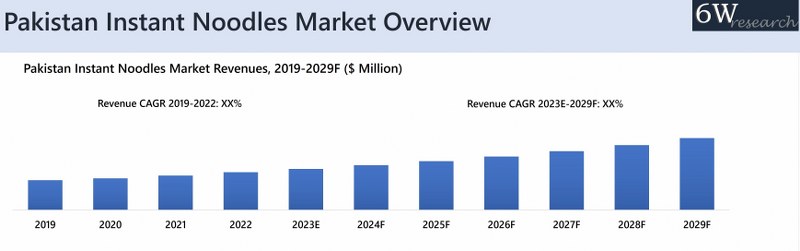

According to 6Wresearch, the Pakistan Instant Noodles Market size is projected to grow at a CAGR of 9.7% during 2023–2029F. The market is expected to witness growth in the coming years owing to an increase in the busy lifestyles of people and instant noodles being a quick meal. Moreover, instant noodles have also become a staple diet in many Asian countries and the culture of noodles is spreading to other Asian countries as well. Also, the rise in online shoppers along with the booming e-commerce sector would contribute to the instant noodles market in Pakistan in the upcoming years. According to reports, the snacks category of Pakistan accounted for $31 billion in revenue with a growth rate of 5.4% between 2021 and 2026. Additionally, the rise in Pakistan’s population is projected to continue growing, reaching 403 million by 2050, which could contribute to the instant noodles market.

According to 6Wresearch, the Pakistan Instant Noodles Market size is projected to grow at a CAGR of 9.7% during 2023–2029F. The market is expected to witness growth in the coming years owing to an increase in the busy lifestyles of people and instant noodles being a quick meal. Moreover, instant noodles have also become a staple diet in many Asian countries and the culture of noodles is spreading to other Asian countries as well. Also, the rise in online shoppers along with the booming e-commerce sector would contribute to the instant noodles market in Pakistan in the upcoming years. According to reports, the snacks category of Pakistan accounted for $31 billion in revenue with a growth rate of 5.4% between 2021 and 2026. Additionally, the rise in Pakistan’s population is projected to continue growing, reaching 403 million by 2050, which could contribute to the instant noodles market.

![Pakistan Instant Noodles Market Revenue Share]() Market by Category

Market by Category

In 2022, Non-veg category acquired major revenue share in Pakistan Instant Noodles Industry on account of preference of non-veg dishes such as chicken or beef noodles, which are commonly served as a fast-food item in cities and towns across the country. The segment will continue to dominate this market in the years to come.

Market by Packaging

Packets acquired major revenue share in 2022 in Pakistan Instant Noodles Market owing to its wide availability in Pakistan and these are sold in most grocery stores, supermarkets, and convenience stores. Moreover, convenience, accessibility, affordability, and taste of packet instant noodles make them a popular food item in Pakistan, particularly among those who are looking for a quick and easy meal option.

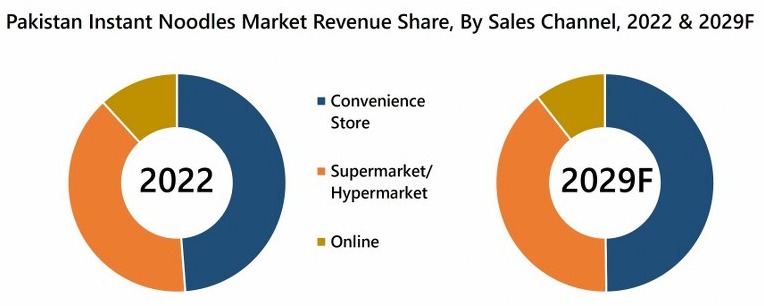

Market by Sales Channel

In 2022, Convenience stores accounted for major revenue share as convenience stores often stock a wide range of instant noodle brands and flavours, catering to a variety of tastes and preferences. This makes it easier for customers to find the instant noodle brand and flavour that they prefer. Moreover, Convenience stores often provide a convenient and accessible location for customers to purchase instant noodles. They are often open 24 hours a day, seven days a week, making it easier for customers to purchase instant noodles at any time of day or night.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Pakistan Instant Noodles Market Overview

- Pakistan Instant Noodles Market Outlook

- Pakistan Instant Noodles Market Forecast

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues, for the Period 2019-2029F

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues, By Category, for the Period 2019-2029F

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues, By Packaging, for the Period 2019-2029F

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues, By Sales Channel, for the Period 2019-2029F

- Market Opportunity Assessment By Category

- Market Opportunity Assessment By Packaging

- Market Opportunity Assessment By Sales Channel

- Market Drivers and Restraints

- Market Trends

- Competitive Benchmarking

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Category

- Non-Veg

- Veg

By Packaging

- Packet

- Cup

By Sales Channel

- Convenience Stores

- Supermarket/Hypermarket

- Online

Pakistan Instant Noodles Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Pakistan Instant Noodles Market Overview |

| 3.1 Pakistan Instant Noodles Market Revenues, 2019-2029F |

| 3.2 Pakistan Instant Noodles Market - Industry Life Cycle |

| 3.3 Pakistan Instant Noodles Market - Porter's Five Forces |

| 4. Pakistan Instant Noodles Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Pakistan Instant Noodles Market Trends |

| 6. Pakistan Instant Noodles Market, By Category |

| 6.1 Pakistan Instant Noodles Market Revenue Share and Revenues, By Category |

| 6.1.1 Pakistan Instant Noodles Market Revenues, By Veg, 2019-2029F |

| 6.1.2 Pakistan Instant Noodles Market Revenues, By Non-Veg, 2019-2029F |

| 7. Pakistan Instant Noodles Market Overview, By Packaging |

| 7.1 Pakistan Instant Noodles Market Revenue Share and Revenues, By Packaging, 2019-2029F |

| 7.1.1 Pakistan Instant Noodles Market Revenues, By Cups, 2019-2029F |

| 7.1.2 Pakistan Instant Noodles Market Revenues, By Packets, 2019-2029F |

| 8. Pakistan Instant Noodles Market Overview, By Sales Channels |

| 8.1 Pakistan Instant Noodles Market Revenue Share and Revenues, By Sales Channels, 2019-2029F |

| 8.1.1 Pakistan Instant Noodles Market Revenues, By Convenience Stores, 2019-2029F |

| 8.1.2 Pakistan Instant Noodles Market Revenues, By Supermarket/Hypermarket, 2019-2029F |

| 8.1.3 Pakistan Instant Noodles Market Revenues, By Online, 2019-2029F |

| 9. Pakistan Instant Noodles Market Trade Statistics |

| 9.1 Pakistan Instant Noodles Market Import Trade Statistics |

| 9.2 Pakistan Instant Noodles Market Export Trade Statistics 9.2 Pakistan Instant Noodles Market Export Trade Statistics |

| 10. Pakistan Instant Noodles Market Key Performance Indicators |

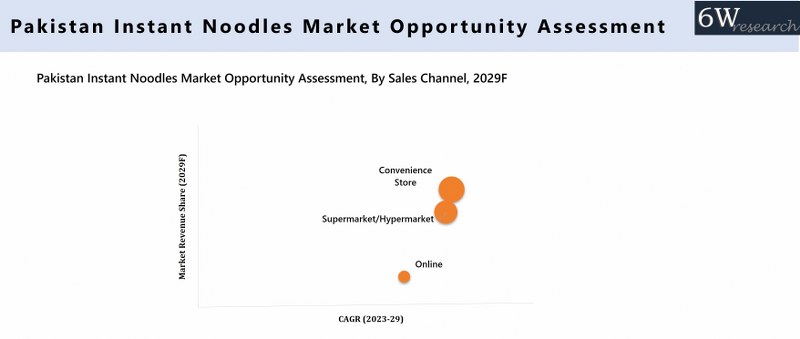

| 11. Pakistan Instant Noodles Market Opportunity Assessment |

| 11.1 Pakistan Instant Noodles Market, Opportunity Assessment, By Category, 2029F |

| 11.2 Pakistan Instant Noodles Market, Opportunity Assessment, By Packaging, 2029F |

| 11.3 Pakistan Instant Noodles Market, Opportunity Assessment, By Sales Channel, 2029F |

| 12. Pakistan Instant Noodles Market Competitive Landscape |

| 12.1 Pakistan Instant Noodles Market Revenue Ranking, By Companies, 2022 |

| 12.2 Pakistan Instant Noodles Market Competitive Benchmarking, By Technical Parameters |

| 12.2 Pakistan Instant Noodles Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Unilever |

| 13.2 Samyang Foods Co. Ltd. |

| 13.3 PT.ABC President |

| 13.4 Nissin Food Holdings Co. Ltd. |

| 13.5 Lotte Kolson |

| 13.6 PT Indofood Sukses Makmur Tbk |

| 13.7 Shan foods Pvt. Ltd. |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Pakistan Instant Noodles Market Revenues, 2019-2029F ($ Million) |

| 2. Cluster of Food Processing Units in Punjab, 2021 |

| 3. Pakistan Instant Noodles Market Revenue Share, By Category, 2022 & 2029F |

| 4. Pakistan Instant Noodles Market Revenue Share, By Packaging, 2022 & 2029F |

| 5. Pakistan Instant Noodles Market Revenue Share, By Sales Channel, 2022 & 2029F |

| 6. Share of Top 3 Import Partners, 2022 |

| 7. Pakistan Instant Noodles Import Data, By Country, 2022 (in $ Thousand) |

| 8. Share of Top 3 Export Partners, 2022 |

| 9. Pakistan Instant Noodles Export Data, By Country, 2022 (in $ Thousand) |

| 10. Location Wise Distribution of Supermarkets and Retail Stores in Pakistan, 2021 |

| 11. Pakistan Instant Noodles Servings, 2017-2021 (Million Servings) |

| 12. Pakistan Population Demographic, 2017-2021 (Million) |

| 13. Pakistan Population Age Demographic, 2021 |

| 14. Pakistan Instant Noodles Market Revenue Ranking, By Companies, 2022 |

| 15. Supermarket and Retail Shops Customers’ Presence, 2022 |

| List of Tables |

| 1. Clusters of Industries – Food Products and Beverages By Province, 2021 |

| 2. Pakistan Instant Noodles Market Revenues, By Category, 2019-2029F ($ Million) |

| 3. Pakistan Instant Noodles Market Revenues, By Packaging, 2019-2029F ($ Million) |

| 4. Pakistan Instant Noodles Market Revenues, By Sales Channel, 2019-2029F ($ Million) |

Market Forecast By Type (Fried, Non-Fried), By Packaging (Cups, Packets), By Sales Channel (Supermarket/Hypermarket, Convenience Stores, Online Stores, Others) And Competitive Landscape

| Product Code: ETC048497 | Publication Date: Mar 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Pakistan Instant Noodles Market Synopsis

Pakistan Instant Noodles Market is anticipated to grow over the years on account of increasing population, the busy lifestyle of people in urban areas and increasing participation of women in the workforce has led to a burgeoning demand for convenient food options such as instant noodles. In addition, dietary habits of individuals are evolving continuously, especially among young consumers who are drawn to convenient and quick-to-prepare food options. Moreover, the increasing disposable income and the expansion of distribution channels are further contributing in the overall growth of instant noodles market in Pakistan. Manufacturers are continuously introducing new and unique flavors of instant noodles, which attracts new consumers and keep existing customers interested. However, the intense competition from unorganized players who offer noodles at lower prices, volatile raw material prices, and the stringent government regulations are impeding the market expansion.

According to 6Wresearch, the Pakistan Instant Noodles Market size is anticipated to grow at a higher growth rate during the 2023-2029. Pakistan is one of the world’s most populous countries with a young and dynamic population. This factor combined with a growing economy, presents a huge opportunity for businesses operating in the Pakistan Instant Noodles Industry. However, there is intense competition from traditional home-cooked meals which are healthier and more nutritious options. Despite these challenges, there are several growth opportunities for businesses operating in the instant noodles market in Pakistan. The country’s young population is increasingly westernised in their tastes and preferences along with increasing incomes and enhanced standard of living. Thereby, propelling the growth of this market. In addition, the increasing awareness about health and wellness among consumers presents significant growth opportunity for manufacturers to introduce healthier variants of noodles in the market. Moreover, rapidly increasing urbanization rate in Pakistan is resulting in more people living in cities and having less time to cook traditional meals. This is leading to greater demand for convenient food products. Also, the government of Pakistan has also enacted several policies that affects the Pakistan instant noodles market size. The competitive landscape of instant noodles market in Pakistan is fairly consolidated with the leading players accounting for a significant share of the overall market.

COVID-19 impact on Pakistan Instant Noodles Market

The COVID-19 pandemic had significantly impacted the Pakistan instant noodles industry as the implementation of lockdowns and social distancing measures has led to decreased consumers spending. On the contrary, individuals are spending more time at home and looking for convenient meal options, which has led to an increase in demand for instant noodles. Additionally, supply chain disruptions and logistical challenges caused by the pandemic have led to production and distribution delays, which has affected the availability of instant noodles in some areas.

Market Analysis by Packaging

Based on packaging, the packets are the most popular form of packaging due to their convenience and affordability. However, the demand for cup packaging is growing due to the easy availability of high-priced premium products.

Market Analysis by Sales Channel

Based on sales channel, the online sales channel is expected to gain momentum in the years to come by the growing penetration of e-commerce platforms and increasing urbanization.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Pakistan Instant Noodles Market Outlook

- Market Size of Pakistan Instant Noodles Market, 2022

- Forecast of Pakistan Instant Noodles Market, 2029

- Historical Data and Forecast of Pakistan Instant Noodles Revenues & Volume for the Period 2019 - 2029

- Pakistan Instant Noodles Market Trend Evolution

- Pakistan Instant Noodles Market Drivers and Challenges

- Pakistan Instant Noodles Price Trends

- Pakistan Instant Noodles Porter's Five Forces

- Pakistan Instant Noodles Industry Life Cycle

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Type for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Fried for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Non-Fried for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Packaging for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Cups for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Packets for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Sales Channel for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Supermarket/Hypermarket for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Convenience Stores for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Online Stores for the Period 2019 - 2029

- Historical Data and Forecast of Pakistan Instant Noodles Market Revenues & Volume By Others for the Period 2019 - 2029

- Pakistan Instant Noodles Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Packaging

- Market Opportunity Assessment By Sales Channel

- Pakistan Instant Noodles Top Companies Market Share

- Pakistan Instant Noodles Competitive Benchmarking By Technical and Operational Parameters

- Pakistan Instant Noodles Company Profiles

- Pakistan Instant Noodles Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Fried

- Non-Fried

By Packaging

- Cups

- Packets

By Sales Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online Stores

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero