Philippines Adhesive Tapes Market (2025-2031) | Revenue, Size, Trends, Analysis, Companies, Outlook, Value, Forecast, Share, Growth & Industry

Market Forecast By Resin Types (Acrylic, Epoxy, Rubber-based, Silicone, Polyurethane, Others), By Technology Types (Water-based, Solvent-based, Hot-melt, Reactive, Others), By Baking Material (Polypropylene (PP), Polyvinyl Chloride (PVC), Paper, Others), By End-users (Automotive, Health Care, Appliances, Others) And Competitive Landscape

| Product Code: ETC003940 | Publication Date: Sep 2020 | Updated Date: Dec 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

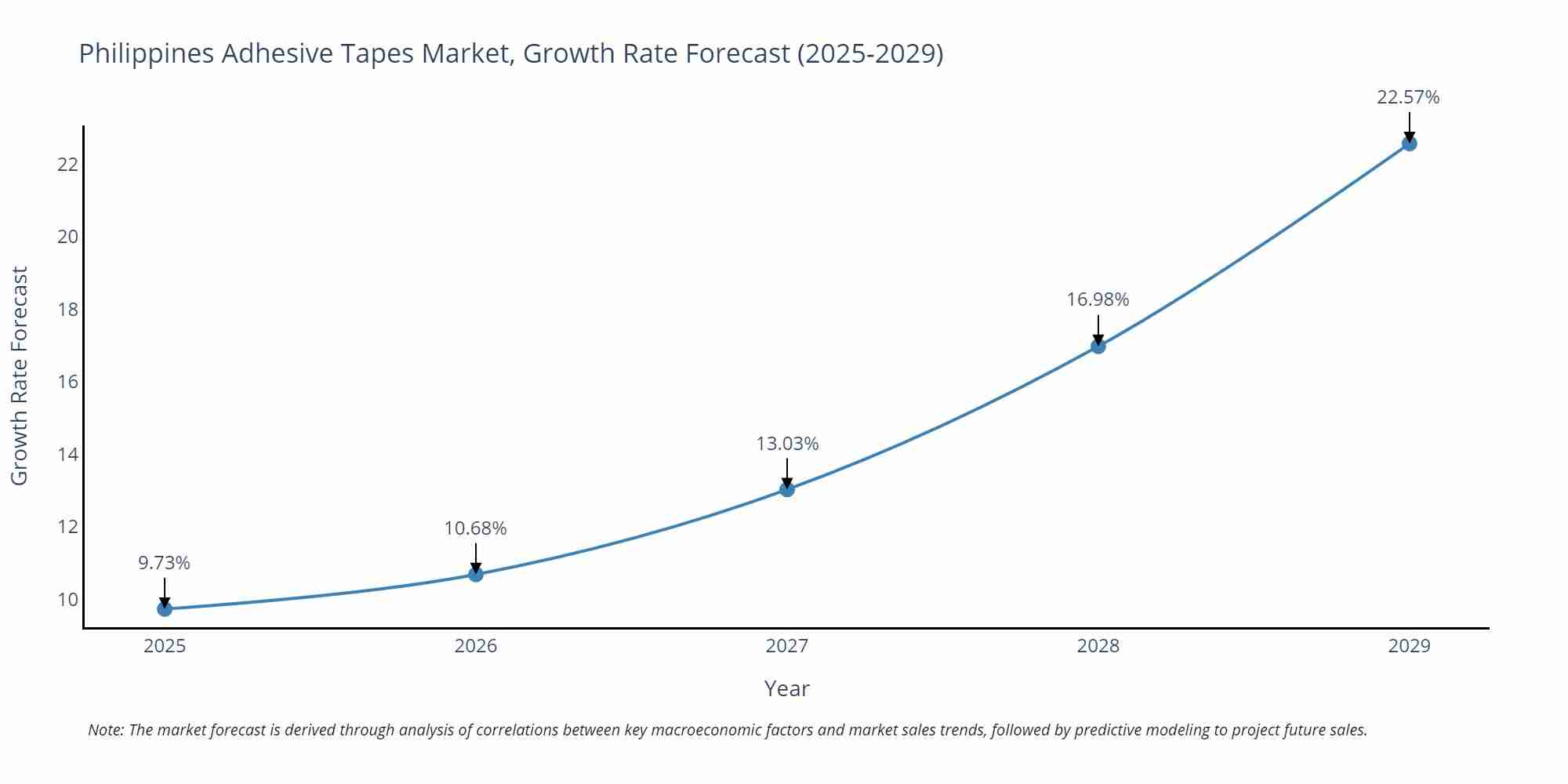

Philippines Adhesive Tapes Market Size Growth Rate

The Philippines Adhesive Tapes Market is likely to experience consistent growth rate gains over the period 2025 to 2029. The growth rate starts at 9.73% in 2025 and reaches 22.57% by 2029.

Adhesive Tapes Market: Philippines vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Adhesive Tapes market in Philippines is anticipated to reach a growth rate of 13.03%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Philippines Adhesive Tapes Market Highlights

| Report Name | Philippines Adhesive Tapes Market |

| Forecast period | 2025-2031 |

| CAGR | 6.1% |

| Growing Sector | Automotive |

Topics Covered in the Philippines Adhesive Tapes Market Report

Philippines Adhesive Tapes Market report thoroughly covers the market By Resin Types, By Technology Types, By Baking Material, and By End-users. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Philippines Adhesive Tapes Market Synopsis

Philippines Adhesive Tapes Market is witnessing growth, driven by the expanding manufacturing and packaging sectors. The increasing demand for these tapes stems from their versatility and efficacy in various applications ranging from securing packaging to insulation and wiring in electronics.

According to 6Wresearch, the Philippines Adhesive Tapes Market size is anticipated to grow at a CAGR of 6.1% during the forecast period of 2025-2031. The robust growth of the construction sector and the government's infrastructure development plans under the "Build, Build, Build" program are significant contributors to the Philippines Adhesive Tapes Market Growth. The market is also benefiting from the rise in e-commerce, which necessitates durable and efficient packaging solutions for shipping and handling. Regionally, the market size is scaling, indicative of the increasing consumer and industrial reliance on these adhesive solutions. However, the market faces challenges in terms of competition from alternative fastening materials and the need for innovation to meet stringent environmental regulations. The volatile raw material prices can also impact market dynamics, posing a potential challenge for manufacturers seeking to maintain profitability without compromising quality. However, the evolution in product design and the introduction of eco-friendly adhesive solutions are setting the stage for market differentiation and expansion. Market trends indicate a gradual shift towards sustainable materials, with an increasing number of companies investing in research and development to produce greener and more efficient adhesive tapes. As the demand grows, the Philippines adhesive tapes market is poised to become a key player in the Asia-Pacific region's industrial landscape.

Government policies and schemes introduced in the Philippines Adhesive Tapes Market

The government has implemented various policies aimed at bolstering the manufacturing sector, including the adhesive tapes market. Tax incentives for raw material importation, financial aid programs for small and medium-sized enterprises (SMEs), and infrastructure development are enhancing production capabilities.

Key players in the Philippines Adhesive Tapes Market

Key players in the Philippines adhesive tapes market are capitalizing on these government initiatives to innovate and expand their product range. Companies like 3M Philippines, Teraoka Seisakusho, and Nitto Denko Corporation are leveraging advanced technologies to improve adhesive properties and develop eco-friendly alternatives.

Future insights of the Philippines Adhesive Tapes Market

The future of the Philippines adhesive tapes industry appears promising, with potential growth driven by the increasing demand from industries such as electronics, automotive, and construction. The market is likely to witness an upsurge in sustainable and value-added products, with an emphasis on research and development to meet the evolving needs of both local and international markets.

Market by Resin Types

According to Sachin, Senior Research Analyst, 6Wresearch, the acrylic-based adhesives are particularly gaining traction and currently leading the Philippines Adhesive Tapes Market Share owing to their durability and excellent long-term aging properties. Consequently, they are increasingly favored in various applications, such as in the automotive and electronics industries which are significant growth sectors in the Philippines.

Market by End-Users

By End-Users, the automotive sector is witnessing significant growth in the Philippine adhesive tapes market. This is mainly attributed to the increasing demand for vehicles and the government's support for the automotive industry, which includes incentives for both manufacturers and consumers.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines Adhesive Tapes Market Overview

- Philippines Adhesive Tapes Market Outlook

- Market Size of Philippines Adhesive Tapes Market, 2031

- Forecast of Philippines Adhesive Tapes Market, 2031

- Historical Data and Forecast of Philippines Adhesive Tapes Revenues & Volume for the Period 2021-2031

- Philippines Adhesive Tapes Market Trend Evolution

- Philippines Adhesive Tapes Market Drivers and Challenges

- Philippines Adhesive Tapes Price Trends

- Philippines Adhesive Tapes Porter's Five Forces

- Philippines Adhesive Tapes Industry Life Cycle

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Resin Types for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Acrylic for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Epoxy for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Rubber-based for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Silicone for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Polyurethane for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Technology Types for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Water-based for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Solvent-based for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Hot-melt for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Reactive for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Baking Material for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Polypropylene (PP) for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Polyvinyl Chloride (PVC) for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Paper for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By End-users for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Automotive for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Health Care for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Appliances for the Period 2021-2031

- Historical Data and Forecast of Philippines Adhesive Tapes Market Revenues & Volume By Others for the Period 2021-2031

- Philippines Adhesive Tapes Import Export Trade Statistics

- Market Opportunity Assessment By Resin Types

- Market Opportunity Assessment By Technology Types

- Market Opportunity Assessment By Baking Material

- Market Opportunity Assessment By End-users

- Philippines Adhesive Tapes Top Companies Market Share

- Philippines Adhesive Tapes Competitive Benchmarking By Technical and Operational Parameters

- Philippines Adhesive Tapes Company Profiles

- Philippines Adhesive Tapes Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Resin Types

- Acrylic

- Epoxy

- Rubber-Based

- Silicone

- Polyurethane

- Others

By Technology Types

- Water-Based

- Solvent-Based

- Hot-Melt

- Reactive

- Others

By Baking Material

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Paper

- Others

By End-Users

- Automotive

- Health Care

- Appliances

- Others

Philippines Adhesive Tapes Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Philippines Adhesive Tapes Market Overview |

| 3.1. Philippines Country Macro Economic Indicators |

| 3.2. Philippines Adhesive Tapes Market Revenues & Volume, 2021 & 2031F |

| 3.3. Philippines Adhesive Tapes Market - Industry Life Cycle |

| 3.4. Philippines Adhesive Tapes Market - Porter's Five Forces |

| 3.5. Philippines Adhesive Tapes Market Revenues & Volume Share, By Resin Types, 2021 & 2031F |

| 3.6. Philippines Adhesive Tapes Market Revenues & Volume Share, By Technology Types, 2021 & 2031F |

| 3.7. Philippines Adhesive Tapes Market Revenues & Volume Share, By Baking Material, 2021 & 2031F |

| 3.8. Philippines Adhesive Tapes Market Revenues & Volume Share, By End-users, 2021 & 2031F |

| 4. Philippines Adhesive Tapes Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Philippines Adhesive Tapes Market Trends |

| 6. Philippines Adhesive Tapes Market, By Types |

| 6.1. Philippines Adhesive Tapes Market, By Resin Types |

| 6.1.1 Overview and Analysis |

| 6.1.2. Philippines Adhesive Tapes Market Revenues & Volume, By Resin Types, 2021-2031F |

| 6.1.3. Philippines Adhesive Tapes Market Revenues & Volume, By Acrylic, 2021-2031F |

| 6.1.4. Philippines Adhesive Tapes Market Revenues & Volume, By Epoxy, 2021-2031F |

| 6.1.5. Philippines Adhesive Tapes Market Revenues & Volume, By Rubber-based, 2021-2031F |

| 6.1.6. Philippines Adhesive Tapes Market Revenues & Volume, By Silicone, 2021-2031F |

| 6.1.7. Philippines Adhesive Tapes Market Revenues & Volume, By Polyurethane, 2021-2031F |

| 6.1.8. Philippines Adhesive Tapes Market Revenues & Volume, By Others, 2021-2031F |

| 6.2. Philippines Adhesive Tapes Market, By Technology Types |

| 6.2.1. Overview and Analysis |

| 6.2.2. Philippines Adhesive Tapes Market Revenues & Volume, By Water-based, 2021-2031F |

| 6.2.3. Philippines Adhesive Tapes Market Revenues & Volume, By Solvent-based, 2021-2031F |

| 6.2.4. Philippines Adhesive Tapes Market Revenues & Volume, By Hot-melt, 2021-2031F |

| 6.2.5. Philippines Adhesive Tapes Market Revenues & Volume, By Reactive, 2021-2031F |

| 6.2.6. Philippines Adhesive Tapes Market Revenues & Volume, By Others, 2021-2031F |

| 6.3. Philippines Adhesive Tapes Market, By Baking Material |

| 6.3.1. Overview and Analysis |

| 6.3.2. Philippines Adhesive Tapes Market Revenues & Volume, By Polypropylene (PP), 2021-2031F |

| 6.3.3 Philippines Adhesive Tapes Market Revenues & Volume, By Polyvinyl Chloride (PVC), 2021-2031F |

| 6.3.4. Philippines Adhesive Tapes Market Revenues & Volume, By Paper, 2021-2031F |

| 6.3.5. Philippines Adhesive Tapes Market Revenues & Volume, By Others, 2021-2031F |

| 6.4. Philippines Adhesive Tapes Market, By End-users |

| 6.4.1. Overview and Analysis |

| 6.4.2. Philippines Adhesive Tapes Market Revenues & Volume, By Automotive, 2021-2031F |

| 6.4.3. Philippines Adhesive Tapes Market Revenues & Volume, By Health Care, 2021-2031F |

| 6.4.4. Philippines Adhesive Tapes Market Revenues & Volume, By Appliances, 2021-2031F |

| 6.4.5. Philippines Adhesive Tapes Market Revenues & Volume, By Others, 2021-2031F |

| 7. Philippines Adhesive Tapes Market Import-Export Trade Statistics |

| 7.1. Philippines Adhesive Tapes Market Export to Major Countries |

| 7.2. Philippines Adhesive Tapes Market Imports from Major Countries |

| 8. Philippines Adhesive Tapes Market Key Performance Indicators |

| 9. Philippines Adhesive Tapes Market - Opportunity Assessment |

| 9.1. Philippines Adhesive Tapes Market Opportunity Assessment, By Resin Types, 2021 & 2031F |

| 9.2. Philippines Adhesive Tapes Market Opportunity Assessment, By Technology Types, 2021 & 2031F |

| 9.3. Philippines Adhesive Tapes Market Opportunity Assessment, By Baking Material, 2021 & 2031F |

| 9.4. Philippines Adhesive Tapes Market Opportunity Assessment, By End-users, 2021 & 2031F |

| 10. Philippines Adhesive Tapes Market - Competitive Landscape |

| 10.1. Philippines Adhesive Tapes Market Revenue Share, By Companies, 2024 |

| 10.2. Philippines Adhesive Tapes Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11. Company Profiles |

| 12. Recommendations |

| 13. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero