Philippines Flour Market (2025-2031) | Outlook, Share, Growth, Revenue, Trends, Analysis, Size, Industry, Value, Segmentation & COVID-19 IMPACT

Market Forecast By Raw Material (Wheat, Rice, Maize, Others), By Applications (Bread & Bakery Products, Noodles & Pasta, Animal Feed, Wafers, Crackers, & Biscuits, Non-Food Application, Others), By Technology (Dry Technology, Wet Technology) And Competitive Landscape

| Product Code: ETC039970 | Publication Date: Jan 2021 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

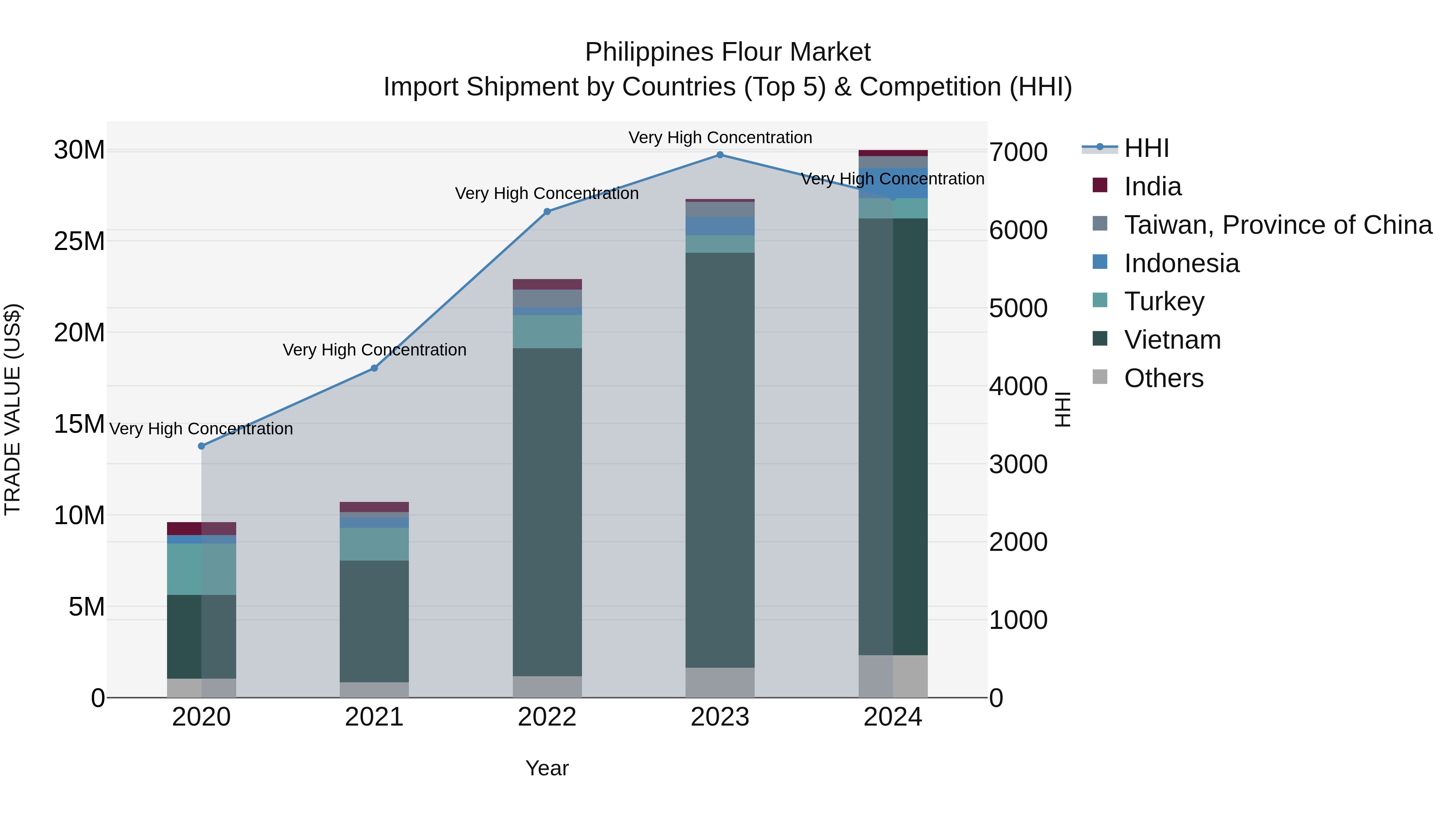

Philippines Flour Market Top 5 Importing Countries and Market Competition (HHI) Analysis

Philippines` flour import market in 2024 continues to be dominated by key exporters such as Vietnam, Indonesia, and Turkey, with emerging players like Metropolitan France and Taiwan, Province of China also making significant contributions. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market, while the impressive Compound Annual Growth Rate (CAGR) of 32.89% from 2020 to 2024 showcases strong demand. The notable growth rate of 9.77% from 2023 to 2024 suggests a promising outlook for the industry, driven by diversified sources of flour imports.

Philippines Flour Market Highlights

| Report Name | Philippines Flour Market |

| Forecast Period | 2025 - 2031 |

| CAGR | 5.3% |

| Growing Sector | Bread and bakery |

Topics Covered in the Philippines Flour Market Report

The Philippines Flour Market report thoroughly examines the market by Raw Material, by Applications, and by Technology. It offers an unbiased and detailed analysis of ongoing market trends, opportunities, high-growth areas, and market drivers, enabling stakeholders to align their strategies with evolving market dynamics.

Philippines Flour Market Synopsis

The flour market in the Philippines has shown steady growth driven by rising demand from the bakery, confectionery, and food processing industries. The increasing popularity of convenient and processed food products, coupled with the robust expansion of quick-service restaurants, has further boosted the consumption of wheat-based flour in the country. However, the market faces challenges such as fluctuating global wheat prices and import dependency, which can impact pricing and supply stability. Efforts are being made to promote local flour production and improve supply chain efficiency to ensure consistent availability and competitiveness within the market.

According to 6Wresearch, the Philippines Flour Market is expected to grow at a CAGR of 5.3% from 2025 - 2031. The growth of the Philippines flour market is driven by several key factors. The expanding bakery and confectionery industry remains a significant growth driver, as bread, pastries, and other flour-based products are staples in the Filipino diet. Additionally, the rising urbanization and changing lifestyles have increased the demand for convenient food items, further boosting flour consumption. The emergence of quick-service restaurants and food chains also directly supports the need for flour-based products, contributing to the market's expansion. Furthermore, the ongoing development of the country's food processing sector, supported by investments from both local and international businesses, continues to create opportunities for flour manufacturers, leading to the Philippines Flour Market growth.

Despite its growth, the flour market in the Philippines faces notable challenges. The nation's heavy reliance on imported wheat exposes the market to global price fluctuations, which can disrupt pricing stability and overall costs for consumers and producers alike. Import dependency also makes the supply chain vulnerable to external factors such as geopolitical tensions and logistical bottlenecks. Additionally, promoting local wheat production remains a challenge, as the country's climatic conditions and limited agricultural resources make it difficult to compete with more established wheat-producing nations.

Philippines Flour Market Trends

The Philippines flour market continues to evolve, driven by shifting consumer preferences and advancements in food technology. There is a growing demand for healthier alternatives, such as organic and whole-grain flour, as Filipino consumers become increasingly health-conscious. Additionally, the rising popularity of home baking, partly fueled by the restrictions of the COVID-19 pandemic, has created a surge in the consumption of flour-based products. Beyond individual consumption, the increasing demand for quick-service restaurants and bakery chains has further solidified flour's position as a crucial ingredient in the foodservice industry.

Investment Opportunities in the Philippines Flour Market

The Philippines flour market presents numerous investment opportunities, especially in value-added processing and product diversification. Businesses that innovate to meet the demand for specialty flours, such as gluten-free or fortified options, stand to gain a competitive edge in the market. The evolving foodservice industry also provides room for investment in flour distribution and supply chain improvements. Furthermore, public and private collaborative initiatives to improve agricultural infrastructure and reduce reliance on wheat imports could open avenues for long-term investments that strengthen the local wheat and flour production ecosystem.

Leading Players in the Philippines Flour Market

The Philippines flour market is dominated by several key players who have established strong distribution networks and product offerings. Notable companies include San Miguel Mills, Pilmico Foods Corporation, and General Milling Corporation, which have consistently leveraged their extensive experience and technical expertise to cater to consumer demand. These companies focus on maintaining high-quality standards while introducing innovative product lines to sustain their market positions. Additionally, global players such as Cargill and Interflour Group also contribute significantly, bringing in advanced technologies and international best practices to enhance the market's competitiveness.

Government Regulations in the Philippines Flour Market

The flour industry in the Philippines is subject to a comprehensive regulatory framework that ensures food quality, safety, and fair commercial practices. The Food and Drug Administration (FDA) and the Bureau of Customs play pivotal roles in overseeing the importation, labeling, and quality control of flour products. Regulations mandate strict adherence to standards regarding nutritional content and fortification, particularly the inclusion of vitamins and minerals to address public health concerns. Furthermore, import tariffs and quotas are implemented to balance domestic production and international trade, fostering a stable local market while supporting the growth of the Philippine agriculture sector.

Future Insights of the Philippines Flour Market

The Philippines flour industry is poised for continued growth in the coming years, driven by evolving consumer preferences and advancements in agriculture and food technology. Increasing health awareness is expected to fuel demand for alternative flours, such as almond, coconut, and rice flour, catering to gluten-free and health-conscious consumers. Technological innovations in farming and milling practices could further optimize production efficiency, reducing costs and improving sustainability. Additionally, expanding partnerships between the public and private sectors focused on enhancing food security and reducing reliance on imports will likely play a crucial role in shaping a resilient and adaptive flour market ecosystem in the Philippines.

Market Segmentation Analysis

The report provides a detailed analysis of the market segments, revealing the leading categories.

Wheat to Lead the Market Growth - By Raw Material

According to Ravi Bhandari, Research Head at 6Wresearch, wheat remains the dominant category in the Philippines flour market due to its widespread use in bread, bakery products, and noodles, which are staples in the Filipino diet. Its versatility and availability make it the preferred choice for both commercial and household applications, ensuring its continued leadership in the market.

Bread and bakery products to Dominate the Market Growth - By Application

The bread and bakery products segment leads the market, driven by strong consumer demand for baked goods and pastries, which are integral to the Philippine culinary landscape. The convenience, affordability, and cultural popularity of bread-based products contribute significantly to this category's growth.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines Flour Market Outlook

- Market Size of Philippines Flour Market, 2024

- Forecast of Philippines Flour Market, 2031

- Historical Data and Forecast of Philippines Flour Revenues & Volume for the Period 2021 - 2031

- Philippines Flour Market Trend Evolution

- Philippines Flour Market Drivers and Challenges

- Philippines Flour Price Trends

- Philippines Flour Porter's Five Forces

- Philippines Flour Industry Life Cycle

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Raw Material for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Wheat for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Rice for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Maize for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Applications for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Bread & Bakery Products for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Noodles & Pasta for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Animal Feed for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Wafers, Crackers, & Biscuits for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Non-Food Application for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Technology for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Dry Technology for the Period 2021 - 2031

- Historical Data and Forecast of Philippines Flour Market Revenues & Volume By Wet Technology for the Period 2021 - 2031

- Philippines Flour Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Technology

- Philippines Flour Top Companies Market Share

- Philippines Flour Competitive Benchmarking By Technical and Operational Parameters

- Philippines Flour Company Profiles

- Philippines Flour Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Raw Material

- Wheat

- Rice

- Maize

- Others

By Applications

- Bread & Bakery Products

- Noodles & Pasta

- Animal Feed

- Wafers

- Crackers, & Biscuits

- Non-Food Application

- Others

By Technology

- Dry Technology

- Wet Technology

Philippines Flour Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Philippines Flour Market Overview |

| 3.1 Philippines Flour Market Revenues & Volume, 2021 - 2031F |

| 3.2 Philippines Flour Market - Industry Life Cycle |

| 3.3 Philippines Flour Market - Porter's Five Forces |

| 3.4 Philippines Flour Market Revenues & Volume Share, By Raw Material, 2021 & 2031F |

| 3.5 Philippines Flour Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 3.6 Philippines Flour Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 4 Impact Analysis of COVID-19 on Philippines Flour Market |

| 5 Philippines Flour Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6 Philippines Flour Market Trends |

| 7 Philippines Flour Market, By Raw Material |

| 7.1 Overview and Analysis |

| 7.2 Philippines Flour Market Revenues & Volume, By Raw Material, 2021 - 2031F |

| 7.3 Philippines Flour Market Revenues & Volume, By Wheat, 2021 - 2031F |

| 7.4 Philippines Flour Market Revenues & Volume, By Rice, 2021 - 2031F |

| 7.5 Philippines Flour Market Revenues & Volume, By Maize, 2021 - 2031F |

| 7.6 Philippines Flour Market Revenues & Volume, By Others, 2021 - 2031F |

| 8 Philippines Flour Market, By Applications |

| 8.1 Overview and Analysis |

| 8.2 Philippines Flour Market Revenues & Volume, By Bread & Bakery Products, 2021 - 2031F |

| 8.3 Philippines Flour Market Revenues & Volume, By Noodles & Pasta, 2021 - 2031F |

| 8.4 Philippines Flour Market Revenues & Volume, By Animal Feed, 2021 - 2031F |

| 8.5 Philippines Flour Market Revenues & Volume, By Wafers, Crackers, & Biscuits, 2021 - 2031F |

| 8.6 Philippines Flour Market Revenues & Volume, By Non-Food Application, 2021 - 2031F |

| 8.7 Philippines Flour Market Revenues & Volume, By Others, 2021 - 2031F |

| 9 Philippines Flour Market, By Technology |

| 9.1 Overview and Analysis |

| 9.2 Philippines Flour Market Revenues & Volume, By Dry Technology, 2021 - 2031F |

| 9.3 Philippines Flour Market Revenues & Volume, By Wet Technology, 2021 - 2031F |

| 10 Philippines Flour Market Import-Export Trade Statistics |

| 10.1 Philippines Flour Market Export to Major Countries |

| 10.2 Philippines Flour Market Imports from Major Countries |

| 11 Philippines Flour Market Key Performance Indicators |

| 12 Philippines Flour Market - Opportunity Assessment |

| 12.1 Philippines Flour Market Opportunity Assessment, By Raw Material, 2021 & 2031F |

| 12.2 Philippines Flour Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 12.3 Philippines Flour Market Opportunity Assessment, By Technology, 2021 & 2031F |

| 13 Philippines Flour Market - Competitive Landscape |

| 13.1 Philippines Flour Market Revenue Share, By Companies, 2024 |

| 13.2 Philippines Flour Market Competitive Benchmarking, By Operating and Technical Parameters |

| 14 Company Profiles |

| 15 Recommendations |

| 16 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero