Philippines Online Gaming Market (2025-2031) | Industry, Outlook, Size, Share, Revenue, Analysis, Forecast, Trends

Market Forecast By Gaming Platform (PC Gaming, Console Gaming, Mobile Gaming), By Revenue Model (Free-to-play with in-app purchases, Premium (paid download), Subscription-based, Advertising-supported free games), By Age Groups (Kids & Teens (Below 18), Young Adults (18-24 years), Adults (25+ years), and Competitive Landscape

| Product Code: ETC053830 | Publication Date: Feb 2023 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 20 | No. of Tables: 4 |

Topics Covered in Philippines Online Gaming Market Report

The Philippines Online Gaming Market Report thoroughly covers the market By gaming platform, revenue model and age groups. Philippines Online Gaming Market Outlook report provides an unbiased and detailed analysis of the ongoing Philippines Online Gaming Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Philippines Online Gaming Market Synopsis

The Philippines Online Gaming Market has expanded in line with the country’s fast-growing digital economy and rising internet penetration. The digital economy rose from 2021 to 2025 fueled by e-commerce, online media, and digital payments. Broadband access improved through Digital Infrastructure Project, while internet users increased from 2023 to 2025. Higher disposable incomes, a growing middle class, and a youthful demographic nearly half of smartphone users aged 18-24 in 2024 have reinforced strong gaming adoption.

According to 6Wresearch, the Philippines Online Gaming Market is set to grow at a CAGR of 12.3% during 2025-2031, supported by ICT sector growth (2024-2027), rising AI investments in 2024, and a increase in data centre capacity. Government initiatives, including the NCSP (2023-2028), National Broadband Plan, and National Fiber Backbone, will enhance security, speed, and reliability critical for multiplayer and streaming. By 2030, the digital economy is projected to reach more, while urbanization will climb from 2025 to 2050, further concentrating young, tech-savvy consumers with higher discretionary spend.

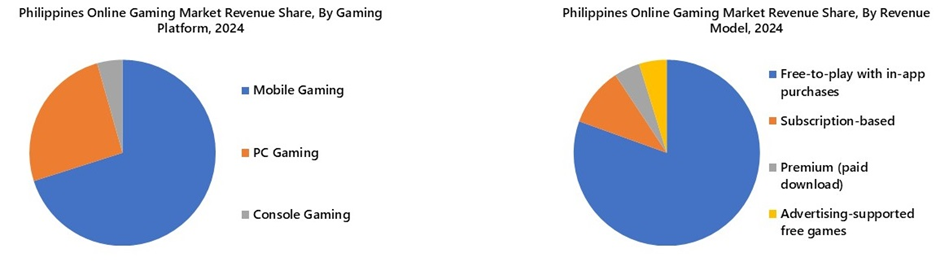

Mobile gaming accounted for the largest revenue share in 2024, driven by the country’s mobile-first internet use, affordable smartphones, and widespread mobile wallet adoption. Free-to-play models with in-app purchases dominate, making mobile the leading revenue contributor across age groups.

Market Segmentation By Gaming Platform

By 2031, mobile gaming is set to dominate the Philippine online gaming market, growing at the fastest pace as 5G rollout enhances gameplay, cloud gaming removes hardware barriers, and telcos drive adoption through affordable data bundles with gaming perks. Rising smartphone affordability, greater female gamer participation, and integration with social commerce platforms will further cement mobile’s leadership across both casual and competitive segments.

Market Segmentation By Revenue Model

By 2031, the Free-to-Play with in-app purchases segment will be the fastest-growing in the Philippines online gaming market, driven by the mobile-first ecosystem and rising adoption of digital wallets like GCash and Maya. Gamers preference for free access coupled with engagement via microtransactions skins, battle passes, and in-game currencies will make this model the market’s primary growth engine over the next decade.

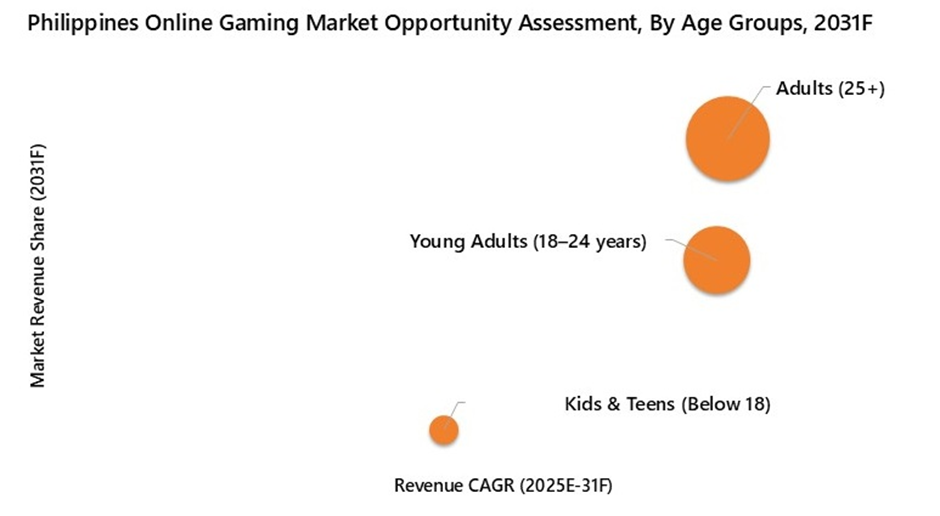

Market Segmentation By Age Groups

The 25+ age group is projected to drive the highest revenue growth in the Philippines online gaming market during 2025-2031, combining higher disposable incomes with a stronger willingness to spend on premium content, in-game purchases, and subscriptions. This segment aligns with working professionals who increasingly view gaming as a primary leisure activity. With some of the population classified as working professionals in 2025, rising to by 2031, their contribution to market revenues will accelerate significantly.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines Online Gaming Market Overview

- Philippines Online Gaming Market Outlook

- Philippines Online Gaming Market Forecast

- Historical Data and Forecast of Philippines Online Gaming Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Philippines Online Gaming Market Revenues, By Gaming Platform, for the Period 2021-2031F

- Historical Data and Forecast of Philippines Online Gaming Market Revenues, By Revenue Model, for the Period 2021-2031F

- Historical Data and Forecast of Philippines Online Gaming Market Revenues, By Age Groups, for the Period 2021-2031F

- Industry Life Cycle

- Porter’s Five Force Analysis

- Philippines Online Gaming Market Drivers and Restraints

- Market Trends & Evolution

- Market Opportunity Assessment

- Philippines Online Gaming Market Revenue Ranking, By Top 3 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Gaming Platform

- PC Gaming

- Console Gaming

- Mobile Gaming

By Revenue Model

- Free-to-play with in-app purchases

- Premium (paid download)

- Subscription-based

- Advertising-supported free games

By Age Groups

- Kids & Teens (Below 18)

- Young Adults (18-24 years)

- Adults (25+ years)

Philippines Online Gaming Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Philippines Online Gaming Market Overview |

| 3.1. Philippines Online Gaming Market Revenues (2021-2031F) |

| 3.2. Philippines Online Gaming Market Industry Life Cycle |

| 3.3. Philippines Online Gaming Market Porter’s Five Forces |

| 4. Philippines Online Gaming Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Philippines Online Gaming Market Trends |

| 6. Philippines Online Gaming Market Overview, By Gaming Platform |

| 6.1. Philippines Online Gaming Market Revenue Share, By Gaming Platform (2024 & 2031F) |

| 6.1.1. Philippines Online Gaming Market Revenues, By PC Gaming (2021-2031F) |

| 6.1.2. Philippines Online Gaming Market Revenues, By Console Gaming (2021-2031F) |

| 6.1.3. Philippines Online Gaming Market Revenues, By Mobile Gaming (2021-2031F) |

| 7. Philippines Online Gaming Market Overview, By Revenue Model |

| 7.1. Philippines Online Gaming Market Revenue Share, By Revenue Model (2024 & 2031F) |

| 7.1.1. Philippines Online Gaming Market Revenues, By Free-to-play with in-app purchases (2021-2031F) |

| 7.1.2. Philippines Online Gaming Market Revenues, By Premium (paid download) (2021-2031F) |

| 7.1.3. Philippines Online Gaming Market Revenues, By Subscription-based (2021-2031F) |

| 7.1.4. Philippines Online Gaming Market Revenues, By Advertising-supported free games (2021-2031F) |

| 8. Philippines Online Gaming Market Overview, By Age Groups |

| 8.1. Philippines Online Gaming Market Revenue Share, By Age Groups (2024 & 2031F) |

| 8.1.1. Philippines Online Gaming Market Revenues, By Kids & Teens (Below 18) (2021-2031F) |

| 8.1.2. Philippines Online Gaming Market Revenues, By Young Adults (18–24 years) (2021-2031F) |

| 8.1.2. Philippines Online Gaming Market Revenues, By Adults (25+ years) (2021-2031F) |

| 9. Philippines Online Gaming Market - Key Performance Indicators |

| 10. Philippines Online Gaming Market Opportunity Assessment |

| 10.1 Philippines Online Gaming Market Opportunity Assessment, By Gaming Platform (2031F) |

| 10.2 Philippines Online Gaming Market Opportunity Assessment, By Revenue Model (2031F) |

| 10.3 Philippines Online Gaming Market Opportunity Assessment, By Age Groups (2031F) |

| 11. Philippines Online Gaming Market Competitive Landscape |

| 11.1 Philippines Online Gaming Market Revenue Ranking, By Top 3 Companies |

| 11.2 Philippines Online Gaming Market Competitive Benchmarking, By Technical Parameters |

| 11.3 Philippines Online Gaming Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Sony Group Corporation |

| 12.2 Microsoft Corporation |

| 12.3 Nintendo Co., Ltd. |

| 12.4 Tencent Holdings Ltd |

| 12.5 Electronic Arts Inc |

| 12.6 Gameloft SE |

| 12.7 Google LLC( Alphabet Inc) |

| 12.8 Ubisoft Entertainment |

| 12.9 Take-Two Interactive |

| 12.10 Nexon Company |

| 12.11 Garena |

| 12.12 Shanghai Moonton Technology Co. Ltd. |

| 13. Key Strategic Recommendation |

| 14. Disclaimer |

| List of figures |

| 1. Philippines Online Gaming Market Revenues, 2021-2031F ($ Million) |

| 2. Philippines Number of Individuals Using Internet in Million (Jan 2021-Jan 2025) |

| 3. Philippines Daily Time Spent Using The Internet, Feb 2025 |

| 4. Philippines Share of Web Traffic by Devices, Feb 2025 |

| 5. Philippines Share of Smartphone Users, 2024, (%) |

| 6. Philippines Urbanization Rate Projections (2025-2050F) |

| 7. Philippines Total Population Broke Down by Age Group |

| 8. Philippines suspected digital fraud attempt rate by industry, 2023 |

| 9. Suspected digital fraud rate Philippines vs World |

| 10. Philippines Online Gaming Market Revenue Share, By Gaming Platform, 2024 & 2031F |

| 11. Philippines Online Gaming Market Revenue Share, By Revenue Model, 2024 & 2031F |

| 12. Philippines Online Gaming Market Revenue Share, By Age Groups, 2024 & 2031F |

| 13. Philippines Digital Economy Value, 2022-30F, (In $ billion) |

| 14. Philippines Digital Transactions By Volume, 2022-24, (%) |

| 15. Philippines ICT Market Size, 2024-27F, ($ billion) |

| List of table |

| 1. Philippines Online Gaming Market Revenues, By Gaming Platform, 2021-2031F, ($ Million) |

| 2. Philippines Online Gaming Market Revenues, By Revenue Model, 2021-2031F, ($ Million) |

| 3. Philippines Online Gaming Market Revenues, By Age Groups, 2021-2031F, ($ Million) |

| 4. Philippines ICT Development Policies, 2025 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero