Poland Jewellery Market (2025-2031) | Trends, Value, Outlook, Analysis, Forecast, Revenue, Growth, Size, Companies, Industry & Share

Market Forecast By Product (Necklace, Ring, Earrings, Bracelet, Others), By Material (Gold, Platinum, Diamond, Others) And Competitive Landscape

| Product Code: ETC021635 | Publication Date: Jun 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

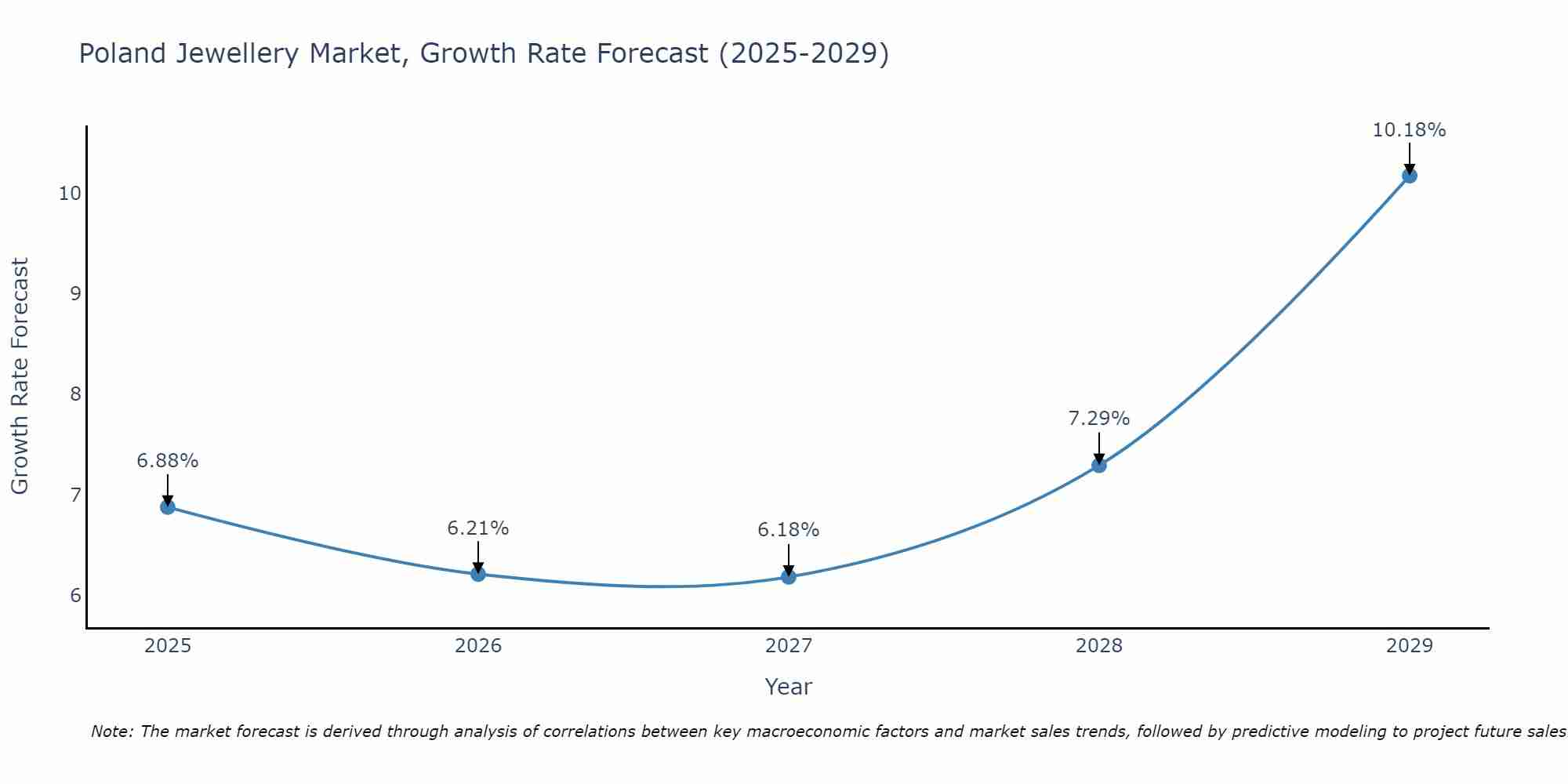

Poland Jewellery Market Size Growth Rate

The Poland Jewellery Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate starts at 6.88% in 2025 and reaches 10.18% by 2029.

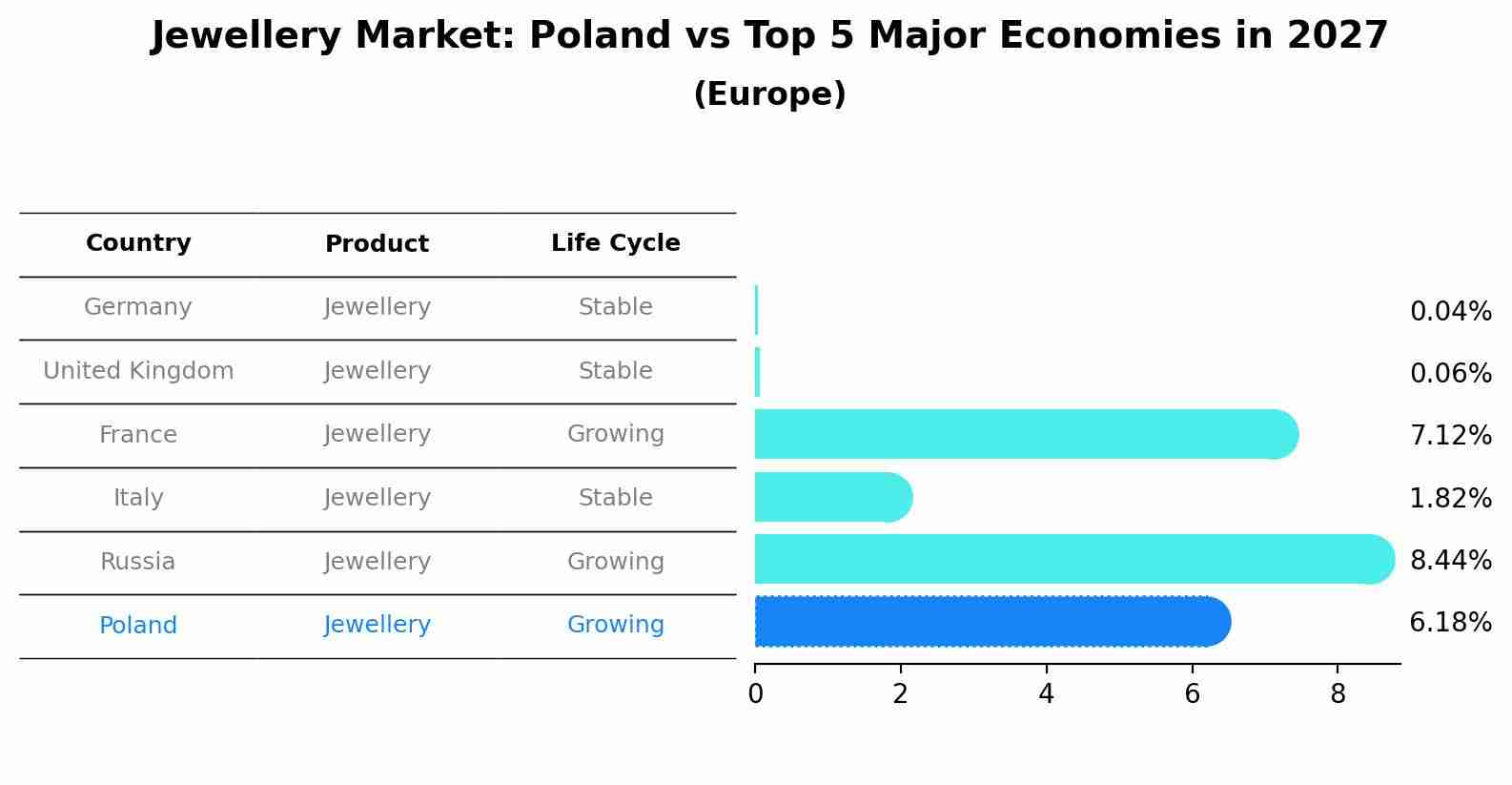

Jewellery Market: Poland vs Top 5 Major Economies in 2027 (Europe)

In the Europe region, the Jewellery market in Poland is projected to expand at a growing growth rate of 6.18% by 2027. The largest economy is Germany, followed by United Kingdom, France, Italy and Russia.

Poland Jewellery Market Highlights

| Report Name | Poland Jewellery Market |

| Forecast period | 2025-2031 |

| CAGR | 5% |

| Growing Sector | Fine Jewellery |

Topics Covered in the Poland Jewellery Market Report

Poland Jewellery Market report thoroughly covers the market By Product and By Material. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Poland Jewellery Market Synopsis

Poland jewellery market is experiencing notable growth, driven by rising disposable incomes and an expanding middle class eager to invest in luxury items. This growth is further fuelled by a burgeoning interest in unique and personalized jewellery, as consumers seek to express their individuality. Additionally, the increasing acceptance of online shopping has transformed the retail landscape, allowing brands to reach a wider audience and enhance consumer engagement. The trend towards sustainability and ethical sourcing is also gaining traction, prompting both established and emerging brands to align with these values. Overall, the market is poised for continued expansion, reflecting evolving consumer preferences and a robust economic environment.

According to 6Wresearch, the Poland Jewellery Market Size is projected to reach at a CAGR of 5% during the forecast period 2025-2031. This growth is expected to be driven by factors such as increasing consumer demand for luxury goods, a shift towards personalized and bespoke jewellery, and the expanding influence of e-commerce, which enhances accessibility for shoppers. Additionally, the rising emphasis on sustainable and ethically sourced materials is likely to resonate with a more conscious consumer base, further contributing to the market's expansion.

Despite the promising growth trajectory, the Poland jewellery industry faces several challenges, including intense competition from both local and international brands, which can pressure pricing and profit margins. Fluctuating raw material costs, particularly for precious metals and gemstones, pose risks to production and pricing stability. Additionally, the market must navigate changing consumer preferences, especially among younger demographics who prioritize sustainability and ethical sourcing, requiring brands to adapt quickly. Economic uncertainties, including inflation and potential shifts in consumer spending habits, could also impact demand. Lastly, while e-commerce presents opportunities, it also necessitates robust logistics and customer engagement strategies to succeed in an increasingly digital marketplace.

Poland Jewellery Market Trends

The Poland jewellery market growth is currently characterized by several key trends shaping its evolution. A notable shift towards sustainability and ethical sourcing is influencing consumer purchasing decisions, as buyers increasingly seek brands that prioritize eco-friendly practices and transparency. Customization and personalization are on the rise, with consumers favouring unique pieces that reflect their individual styles and stories.

Additionally, the growth of e-commerce is transforming how jewellery is marketed and sold, making it easier for consumers to access diverse offerings. Social media and influencer marketing are also playing a significant role in driving brand awareness and engagement, particularly among younger consumers. Together, these trends reflect a dynamic market adapting to the changing preferences and values of modern shoppers.

Investment Opportunities in the Poland Jewellery Market

Investment opportunities in the Poland jewellery market are promising, driven by a combination of rising consumer demand and evolving market trends. The increasing focus on sustainable and ethically sourced materials presents a unique chance for investors to support brands that align with these values, appealing to environmentally conscious consumers.

Additionally, the growth of e-commerce offers significant potential for online jewellery retailers to reach wider audiences and leverage innovative marketing strategies. The trend towards personalization and bespoke jewellery also opens avenues for investment in artisanal brands and technologies that enable customization. Furthermore, partnerships with local artisans can enhance brand authenticity and tap into Poland's rich cultural heritage, making the market ripe for investment in both traditional and contemporary jewellery ventures.

Leading Players in the Poland Jewellery Market

In the vibrant landscape of the Poland jewellery market, a blend of iconic brands and emerging artisans stand out. Established names like W.Kruk and YES have long captivated consumers with their exceptional craftsmanship and stylish designs, appealing to a wide range of tastes. Meanwhile, Apart shines in the luxury sector, offering stunning pieces that attract both local aficionados and international clientele. On the rise are innovative designers who embrace sustainability and personalization, creating unique pieces that tell a story. This dynamic mix of players not only enhances the market's allure but also drives forward the spirit of creativity and craftsmanship that defines Polish jewellery today.

Government Regulations

Government regulations in the Poland jewellery market play a vital role in ensuring consumer protection, product quality, and ethical practices. The industry is governed by strict hallmarking laws, which require that all precious metals be stamped to verify their purity, thereby safeguarding consumers from counterfeit products.

Additionally, regulations are in place to ensure that gemstones are sourced responsibly, minimizing the risk of conflict diamonds entering the market. The Polish government also adheres to European Union directives that mandate transparency in advertising and selling practices, protecting consumer rights. These regulations not only promote fair competition among brands but also foster trust and accountability, contributing to the Poland jewellery market growth.

Future Insights of the Poland Jewellery Market

Poland jewellery market indicates a trajectory of continued growth, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and ethical sourcing is expected to reshape the landscape, with brands that prioritize these values likely to capture a larger share of the market.

The rise of e-commerce will further revolutionize retail, enabling more brands to reach consumers directly and offer personalized shopping experiences. Additionally, innovations in design and production, including 3D printing and customization options, will cater to the growing demand for unique and bespoke pieces. As the market adapts to these trends, it is poised for a vibrant future that balances tradition with modern consumer expectations.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Necklaces to dominate the Jewellery Market - By Product

Necklaces are expected to dominate Poland Jewellery Market Share due to their versatility and appeal across various occasions, making them a staple in many consumers' jewellery collections. They can range from simple everyday wear to elaborate statement pieces, catering to diverse tastes.

Gold to dominate the Market-By Material

According to Vasudha, Senior Research Analyst, 6Wresearch, Gold remains the dominant material in the market, appreciated for its enduring value, cultural significance, and versatility in design. It is favoured for a wide range of jewellery, from everyday pieces to high-end items.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Poland Jewellery Market Outlook

- Market Size of Poland Jewellery Market, 2024

- Forecast of Poland Jewellery Market, 2031

- Historical Data and Forecast of Poland Jewellery Revenues & Volume for the Period 2021 - 2031

- Poland Jewellery Market Trend Evolution

- Poland Jewellery Market Drivers and Challenges

- Poland Jewellery Price Trends

- Poland Jewellery Porter's Five Forces

- Poland Jewellery Industry Life Cycle

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Product for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Necklace for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Ring for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Earrings for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Bracelet for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Material for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Gold for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Platinum for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Diamond for the Period 2021 - 2031

- Historical Data and Forecast of Poland Jewellery Market Revenues & Volume By Others for the Period 2021 - 2031

- Poland Jewellery Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Material

- Poland Jewellery Top Companies Market Share

- Poland Jewellery Competitive Benchmarking By Technical and Operational Parameters

- Poland Jewellery Company Profiles

- Poland Jewellery Key Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories

By Product

- Necklace

- Ring

- Earrings

- Bracelet

- Others

By Material

- Gold

- Platinum

- Diamond

- Others

Poland Jewellery Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Poland Jewellery Market Overview |

| 3.1 Poland Country Macro Economic Indicators |

| 3.2 Poland Jewellery Market Revenues & Volume, 2021 & 2031F |

| 3.3 Poland Jewellery Market - Industry Life Cycle |

| 3.4 Poland Jewellery Market - Porter's Five Forces |

| 3.5 Poland Jewellery Market Revenues & Volume Share, By Product, 2021 & 2031F |

| 3.6 Poland Jewellery Market Revenues & Volume Share, By Material, 2021 & 2031F |

| 4 Poland Jewellery Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Poland Jewellery Market Trends |

| 6 Poland Jewellery Market, By Types |

| 6.1 Poland Jewellery Market, By Product |

| 6.1.1 Overview and Analysis |

| 6.1.2 Poland Jewellery Market Revenues & Volume, By Product, 2021 - 2031F |

| 6.1.3 Poland Jewellery Market Revenues & Volume, By Necklace, 2021 - 2031F |

| 6.1.4 Poland Jewellery Market Revenues & Volume, By Ring, 2021 - 2031F |

| 6.1.5 Poland Jewellery Market Revenues & Volume, By Earrings, 2021 - 2031F |

| 6.1.6 Poland Jewellery Market Revenues & Volume, By Bracelet, 2021 - 2031F |

| 6.1.7 Poland Jewellery Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2 Poland Jewellery Market, By Material |

| 6.2.1 Overview and Analysis |

| 6.2.2 Poland Jewellery Market Revenues & Volume, By Gold, 2021 - 2031F |

| 6.2.3 Poland Jewellery Market Revenues & Volume, By Platinum, 2021 - 2031F |

| 6.2.4 Poland Jewellery Market Revenues & Volume, By Diamond, 2021 - 2031F |

| 6.2.5 Poland Jewellery Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Poland Jewellery Market Import-Export Trade Statistics |

| 7.1 Poland Jewellery Market Export to Major Countries |

| 7.2 Poland Jewellery Market Imports from Major Countries |

| 8 Poland Jewellery Market Key Performance Indicators |

| 9 Poland Jewellery Market - Opportunity Assessment |

| 9.1 Poland Jewellery Market Opportunity Assessment, By Product, 2021 & 2031F |

| 9.2 Poland Jewellery Market Opportunity Assessment, By Material, 2021 & 2031F |

| 10 Poland Jewellery Market - Competitive Landscape |

| 10.1 Poland Jewellery Market Revenue Share, By Companies, 2024 |

| 10.2 Poland Jewellery Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero