Poland Sulphuric Acid Market (2022-2028) | Trends, Value, Revenue, Analysis, Industry, Share, Segmentation & COVID-19 IMPACT

Market Forecast By Raw Material (Elemental sulfur, Base metal smelters, Pyrite ore, Others), By Applications (Fertilizers, Chemical manufacturing, Metal processing, Petroleum refining, Textile industry & Others) And Competitive Landscape

| Product Code: ETC074554 | Publication Date: Jan 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Poland Sulphuric Acid Market: Import Trend Analysis

In 2024, Poland sulphuric acid market saw a notable increase in imports. This trend was driven by rising demand from various industries, leading to a higher volume of imported sulphuric acid to meet domestic needs.

Poland Sulphuric Acid Market | Country-Wise Share and Competition Analysis

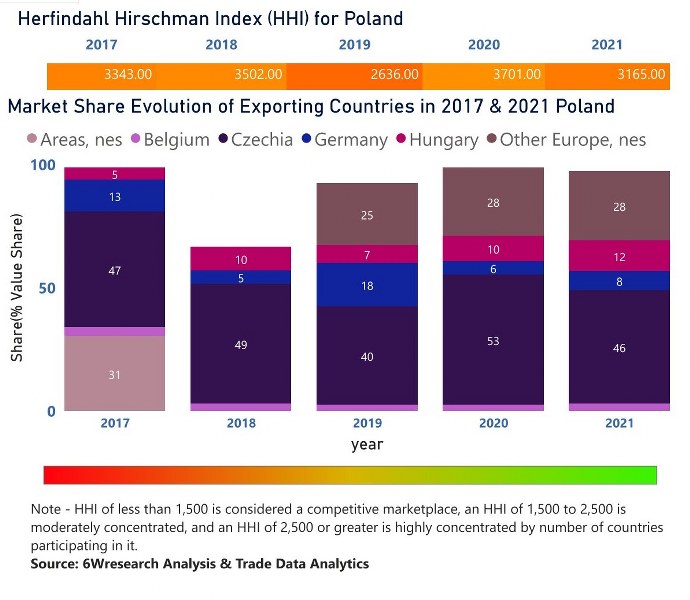

In the year 2021, Czechia was the largest exporter in terms of value, followed by Other Europe, nes. It has registered a decline of -12.52% over the previous year. While Other Europe, nes registered a growth of 2.92% as compare to the previous year. In the year 2017 Czechia was the largest exporter followed by Areas, nes. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Poland has the Herfindahl index of 3343 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 3165 which signifies high concentration in the market.

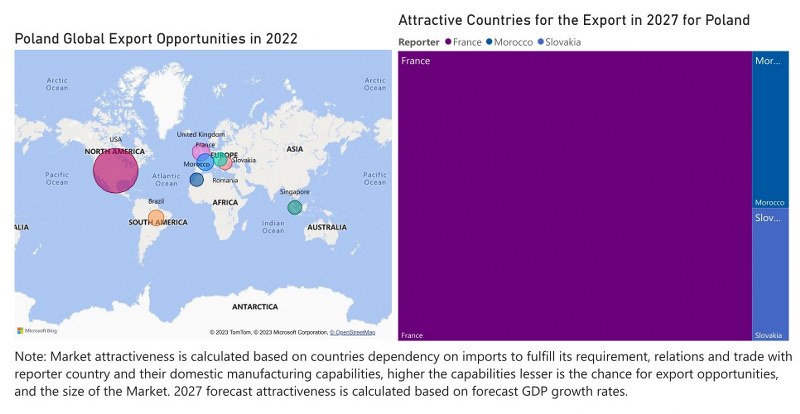

Poland Sulphuric Acid Market - Export Market Opportunities

Poland Sulphuric Acid Market Synopsis

Poland Sulphuric Acid Market is forecast to grow over the years with rising adoption of Sulphuric acid in various applications including fertilizers manufacturing and chemical products, the demand for sulphuric acid would rise in the upcoming years. However, COVID-19 negatively impacted the sale of the Sulphuric Acid Market in Poland on account of business restrictions imposed by the government. Additionally, manufacturing facilities were impacted by COVID-19 on account of labour shortages and logistical challenges posed by the lockdown. Apart from this, growing government initiatives to regulate the emissions of sulphur dioxide, sulphuric acid mist, particulate matter, and nitrogen oxides from sulphuric acid production facilities could hamper the Sulphuric Acid market growth in the upcoming years.

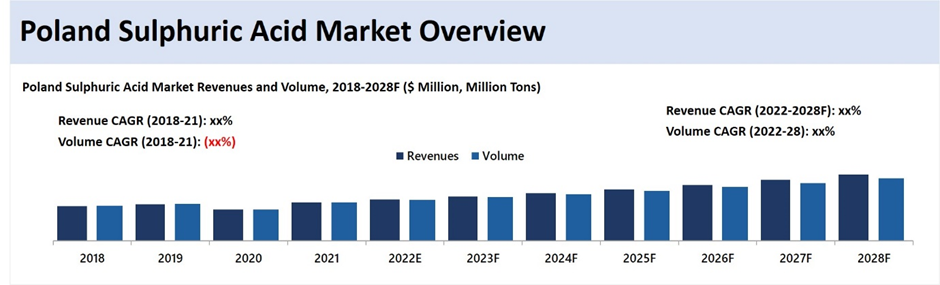

According to 6Wresearch, Poland Sulphuric Acid Market revenues is expected to grow at a CAGR of 5.5% during 2022-2028. The market is likely to experience growth in the forecast period on account of the rising chemical manufacturing sector along with Sulphuric acid’s various applications in the manufacturing of paper and paper products, coke and refined petroleum products, chemicals and chemical products. Growing demand for fertilizers, insecticides, and pesticides to increase crop yield and agricultural production level is expected to boost the demand of Sulphuric acid in Poland. Furthermore, the flourishing automobile sector would uplift the demand for lead batteries in the country and further drive the Poland Sulphuric Acid Industry. Poland Sulphuric Acid market drives most of its demand from the manufacturing of fertilizers, detergents, pigments, and various other products as well as chemical manufacturing, petroleum refining, automotive, and textile industry. On account of the growth of these sectors and industries in recent years the demand for Sulphuric acid has been increasing and a similar trend is set to follow in the forecast period years. Further, the growing demand for metal refining, pharmaceuticals and chemical manufacturing has further raised the demand for sulphuric acid in the region. Hence, the Sulphuric acid market would show a positive trend in the forecast period.

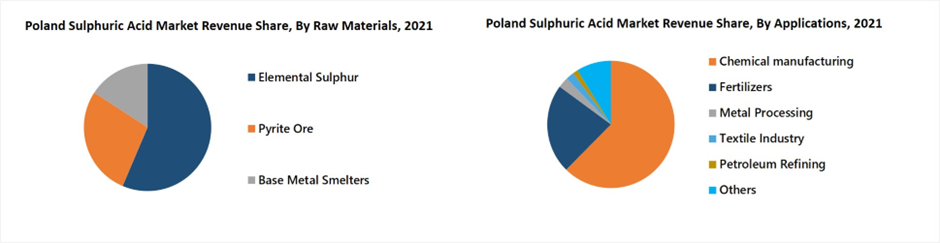

Market by Raw Materials

Elemental sulphur held the largest segment in the Poland Sulphuric Acid Market owing to the increased utilization of sulphur as a raw material in the processing product during the manufacturing process in the country. Furthermore, elemental Sulphur causes less pollution in comparison to pyrite ore or base metal smelters therefore, elemental sulphur has the most demand for sulphuric acid in Poland.

Market by Applications

The chemical manufacturing acquired the largest revenue share owing to increasing demand for Sulphuric acid in chemical manufacturing as it is widely used manufacturing of chemicals – nitric acid, hydrochloric acid, synthesis of dye, drugs, detergents, explosives, etc.

Key Highlights of the Report:

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2022

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Poland Sulphuric Acid Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Poland Sulphuric Acid Market Overview |

| 3.1 Poland Sulphuric Acid Market Revenues and Volume, 2018-2028F |

| 3.2 Poland Sulphuric Acid Market - Industry Life Cycle |

| 3.3 Poland Sulphuric Acid Market - Porter's Five Forces |

| 4. Poland Sulphuric Acid Market COVID-19 Impact Analysis |

| 5. Poland Sulphuric Acid Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. Poland Sulphuric Acid Market Trends |

| 7. Poland Sulphuric Acid Market Overview, By Raw Materials |

| 7.1 Poland Sulphuric Acid Market Revenues Share, By Raw Materials, 2021 & 2028F |

| 7.1 Poland Sulphuric Acid Market Revenues, By Raw Materials, 2018-2028F |

| 7.1.1 Poland Sulphuric Acid Market Revenues, By Elemental Sulphur, 2018-2028F |

| 7.1.2 Poland Sulphuric Acid Market Revenues, By Pyrite Ore, 2018-2028F |

| 7.1.3 Poland Sulphuric Acid Market Revenues, By Base Metal Smelters, 2018-2028F |

| 8. Poland Sulphuric Acid Market Overview, By Applications |

| 8.1 Poland Sulphuric Acid Market Revenue Share, By Applications, 2021 & 2028F |

| 8.1 Poland Sulphuric Acid Market Revenues, By Applications, 2018-2028F |

| 8.1.1 Poland Sulphuric Acid Market Revenues, By Fertilizers, 2018-2028F |

| 8.1.2 Poland Sulphuric Acid Market Revenues, By Chemical Manufacturing, 2018-2028F |

| 8.1.3 Poland Sulphuric Acid Market Revenues, By Metal Processing, 2018-2028F |

| 8.1.4 Poland Sulphuric Acid Market Revenues, By Petroleum Refining, 2018-2028F |

| 8.1.5 Poland Sulphuric Acid Market Revenues, By Textile Industry, 2018-2028F |

| 8.1.6 Poland Sulphuric Acid Market Revenues, By Others, 2018-2028F |

| 9. Poland Sulphuric Acid Market Trade Statistics |

| 9.1 Poland Sulphuric Acid Market, Export Statistics, 2021 |

| 9.2 Poland Sulphuric Acid Market, Import Statistics, 2021 |

| 10. Poland Sulphuric Acid Market Key Performance Indicators |

| 11. Poland Sulphuric Acid Market Opportunity Assessment |

| 11.1 Poland Sulphuric Acid Market Opportunity Assessment, By Raw Materials, 2028F |

| 11.2 Poland Sulphuric Acid Market Opportunity Assessment, By Applications, 2028F |

| 12. Poland Sulphuric Acid Market Competitive Landscape |

| 12.1 Poland Sulphuric Acid Market Revenue Ranking, By Companies, 2021 |

| 12.2 Poland Sulphuric Acid Market Competitive Benchmarking, By Operating Parameters |

| 13. Poland Sulphuric Acid Market Company Profiles |

| 13.1 PCC Societas Europaea |

| 13.2 Grupa Azoty S.A |

| 13.3 BASF SE |

| 13.4 LANXESS AG |

| 13.5 Brenntag Group |

| 13.6 Nouryon |

| 13.7 Univar Solutions Inc. |

| 13.8 Ineos Group |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Poland Sulphuric Acid Market Revenues, 2018-2028F ($ Million, Million Tons) |

| 2. Monthly Sales of Polish Chemistry Goods, Jan-Sep 2021 (USD Billion) |

| 3. Production of Chemical industry in Poland,2019-2021 (USD Billion) |

| 4. Poland Soil Valuation Structure, By Class |

| 5. Poland Phosphatic and Potassic Fertilizers Total Production, 2018-2021 (‘000 Tonnes) |

| 6. Poland Co2 Emissions Levels and Potential Targets (Metric tons) |

| 7. Poland Additional Investments for Decarbonization, 2021-2050 ((USD Billion)) |

| 8. Poland Sulphuric Acid Market Revenue Share, By Raw Materials, 2021 & 2028F |

| 9. Poland Sulphuric Acid Market Revenue Share, By Applications, 2021 & 2028F |

| 10. Share of Top 3 Export Partners, 2021 |

| 11. Poland Export Value of Sulphuric Acid, By Country, 2021, (USD Million) |

| 12. Poland Export Value of Sulphuric Acid, 2019-2021, (USD Million) |

| 13. Share of Top 3 Import Partners, 2021 |

| 14. Poland Import Value of Sulphuric Acid, By Country, 2021, (USD Million) |

| 15. Poland Import Value of Sulphuric Acid, 2019-2021, (USD Million) |

| 16. Value of agricultural output in Poland, 2017-21 (‘000 tonnes) |

| 17. Poland Manufacturing Sector Value Added to GDP, 2009-21 (USD Billion) |

| 18. Poland Sulphuric Acid Market Opportunity Assessment, By Raw Materials (USD Million) |

| 19. Poland Sulphuric Acid Market Opportunity Assessment, By Applications (USD Million) |

| 20. Poland Sulphuric Acid Market Revenue Ranking, By Companies, 2021 |

| List of Tables |

| 1. Poland Sulphuric Acid Market Revenues, By Raw Materials, 2021 & 2028F |

| 2. Poland Sulphuric Acid Market Revenues, By Applications, 2021 & 2028F |

| 3. Major Crops Production, 2018-21 (‘000 tonnes) |

| 4. Consumption of Sulphuric Acid in Manufacturing Sector, 2020-21 (tons) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero