Saudi Arabia Air Duct Market (2021-2027) | Size, Analysis, Forecast, Trends, Revenue, Growth, Outlook & COVID-19 IMPACT

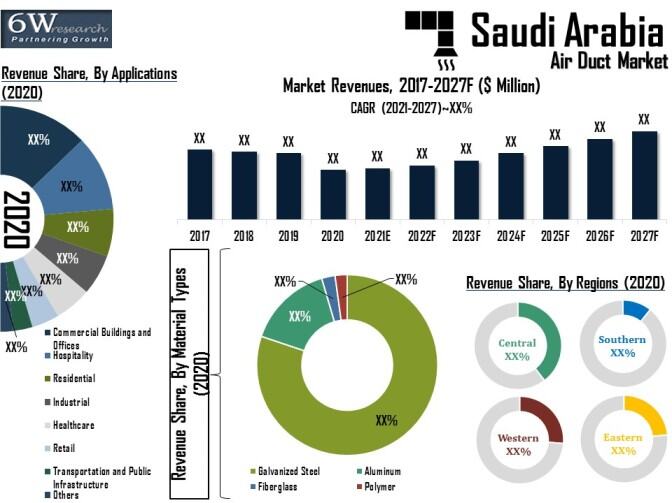

Market Forecast By Material Types (Galvanized steel, Aluminium, Fiberglass, Polymer), By Shape Types (Round, Half Round, Triangular, Square/ Rectangular, Other (Oval)), By Applications (Residential, Commercial Buildings and OfficesTransportation and Public Infrastructure, Retail, Hospitality, Healthcare, Industrial, Others (Education and BFSI)), By Regions (Central, Western, Southern, Eastern) and competitive landscape

| Product Code: ETC054280 | Publication Date: Mar 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 87 | No. of Figures: 21 | No. of Tables: 12 |

Latest 2023 Development of the Saudi Arabia Air Duct Market

Saudi Arabia Air Duct Market is projected to register steady growth on account of increasing construction activities, rising demand for HVAC systems in residential and commercial buildings, and government initiatives to develop the construction sector. Apart from this, the market has undergone several latest developments which include the expansion of manufacturing facilities to meet the growing demand for air ducts in the region. Also, the government has launched several initiatives to promote green building practices in the country. In addition, manufacturers of air ducts in Saudi Arabia are utilizing advanced materials to produce high-quality and durable air ducts.

Partnership and collaborations of local manufacturers with international companies in order to gain access to advanced technologies and expand their product portfolios is another major development in this industry. Moreover, the construction industry in Saudi Arabia is rapidly growing, which is leading to an increase in demand for air ducts. The government of Saudi Arabia is taking various initiatives which are fueling the growth of the Saudi Arabia air duct industry. The government is investing heavily in infrastructure projects such as the construction of hospitals, educational institutions, and other public facilities to support market growth.

Saudi Arabia Air Duct Market Synopsis

Saudi Arabia Air Duct Market is expected to be driven by significant investments towards developing the country’s non-oil sectors over the coming years, which is anticipated to propel the development of retail, transportation, entertainment & leisure, and hospitality sectors. Furthermore, investments to augment the residential sector would drive the demand for air ducts in the country. Growing medical and religious tourism in Saudi Arabia would significantly propel the demand for air ducts in the hospitality sector. However, the ban of international pilgrims from Hajj as well as a temporary suspension of tourism and construction activities in 2020 to prevent the spread of coronavirus resulted in a decline in the market revenues during the year 2020.

However, due to COVID-19, a nationwide lockdown was imposed, which interrupted production and hindered the demand for air ducts. Also, a downfall in the hospitality sector along with low construction activities of hotels, restaurants, and guest houses has led to a decline in the demand for air ducts in the country. Although, the air duct market is projected to grow at a healthy rate in the coming period as the economy resumes normalcy.

According to 6Wresearch, the Saudi Arabia Air Duct Market size is projected to grow at a CAGR of 9.4% during 2021-2027. Efforts to reduce the dependence of the country on the oil sector are expected to bolster the country’s spending on infrastructure development during the forecast period. The ambitious Saudi Vision 2030 plans to improve the economy through a series of measures including infrastructural development, thereby driving the air duct market, especially in residential and commercial sectors, which extensively use centralized cooling. Moreover, high energy efficiency requirements, increasing concerns about the cost of electricity, and sustainability in the country would further drive the demand for sustainable building designs which in turn, would augment the demand for air ducts since they minimize leakages and reduce energy losses.

Market Analysis By Material Types

Among all material types, Galvanized, Aluminium and Fiberglass Steel acquired a cumulative market share of more than 90% of the total market revenues in 2020. Galvanized Steel acquired the highest revenue share in the overall air duct market in Saudi Arabia in recent years and is expected to maintain its dominant position over the coming years as well, on account of its durability and affordability. Growing demand for cold storage in the food and beverage industry in Saudi Arabia would also drive the demand for galvanized steel air ducts during the forecast period, in order to maintain the relatively safe indoor air quality in the cold storage units in the country. Aluminium air ducts are relatively light and easy to install, which makes them suitable for residential and certain commercial applications in Saudi Arabia where centralized air conditioning is used. Thus, with upcoming developments in the residential and the commercial sector, the aluminium air ducts market revenues are projected to witness substantial growth during the forecast period

Market Analysis By Applications

In Saudi Arabia Air Duct Market, Residential, Commercial Buildings and Offices, Transportation and Public Infrastructure, Retail, and Hospitality sectors have led the overall market revenues accounting for more than 60% of the market revenues in 2020. Rising industrial and logistics development, construction of energy-efficient and eco-friendly buildings coupled with growing infrastructural development in Saudi Arabia are the key factors driving the growth and development of commercial buildings and offices and the residential sector in the country. Additionally, under Vision 2030 aimed at reducing the country’s dependence on oil, the non-oil sectors including hospitality, commercial and residential sectors, are anticipated to be another factor driving the growth of the air duct market in the country in near future.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical Data of Saudi Arabia Air Duct Market Revenues for the Period 2017-2020

- Market Size and Forecast of Saudi Arabia Air Duct Market Revenues until 2027F

- Historical Data of Saudi Arabia Air Duct Market Revenues for the Period 2017-2020, By Material Types

- Market Size and Forecast of Saudi Arabia Air Duct Market Revenues until 2027F, By Material Types

- Historical Data of Saudi Arabia Air Duct Market Revenues for the Period 2017-2020, By Shape Types

- Market Size and Forecast of Saudi Arabia Air Duct Market Revenues until 2027F, By Shape Types

- Historical Data of Saudi Arabia Air Duct Market Revenues for the Period 2017-2020, By Applications

- Market Size and Forecast of Saudi Arabia Air Duct Market Revenues until 2027F, By Material Applications

- Historical Data of Saudi Arabia Air Duct Market Revenues for the Period 2017-2020, By Regions

- Market Size and Forecast of Saudi Arabia Air Duct Market Revenues until 2027F, By Regions

- Market Drivers and Restraints

- Recent Market Trends

- Players Market Share

- Company Profiles

- Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Material Types

- Galvanized steel

- Aluminium

- Fiberglass

- Polymer

By Shape Types

- Round

- Half Round

- Triangular

- Square/ Rectangular

- Other (Oval)

By Applications

- Residential

- Commercial Buildings

- OfficesTransportation

- Public Infrastructure

- Retail Hospitality

- Healthcare Industrial

- Others (Education, BFSI)

By Regions

- Central

- Western

- Southern

- Eastern

Saudi Arabia Air Duct Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Air Duct Market Overview |

| 3.1 Saudi Arabia Air Duct Market Revenues (2017-2027F) |

| 3.2 Saudi Arabia Air Duct Market Industry Life Cycle |

| 3.3 Saudi Arabia Air Duct Market Porter’s Five Forces Model |

| 3.4 Saudi Arabia Air Duct Market Ecosystem |

| 3.5 Saudi Arabia Air Duct Market Revenue Share, By Material Type (2020 & 2027F) |

| 3.6 Saudi Arabia Air Duct Market Revenue Share, By Shape Type (2020 & 2027F) |

| 3.7 Saudi Arabia Air Duct Market Revenue Share, By Applications (2020 & 2027F) |

| 3.8 Saudi Arabia Air Duct Market Revenue Share, By Regions (2020 & 2027F) |

| 4. Saudi Arabia Air Duct Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing construction activities and infrastructure development in Saudi Arabia. |

| 4.2.2 Growing awareness about energy efficiency and sustainability driving demand for energy-efficient air duct systems. |

| 4.2.3 Rising demand for HVAC systems in residential, commercial, and industrial sectors. |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating raw material prices impacting manufacturing costs. |

| 4.3.2 Stringent regulations and standards related to air quality and energy efficiency. |

| 4.3.3 Competition from alternative ventilation systems like radiant cooling and underfloor air distribution. |

| 5. Saudi Arabia Air Duct Market Trends & Evolution |

| 6. Saudi Arabia Market Overview, By Material Type |

| 6.1 Saudi Arabia Galvanized Steel Air Duct Market Revenues (2017-2027F) |

| 6.2 Saudi Arabia Aluminum Air Duct Market Revenues (2017-2027F) |

| 6.3 Saudi Arabia Fiberglass Air Duct Market Revenues (2017-2027F) |

| 6.4 Saudi Arabia Polymers Air Duct Market Revenues (2017-2027F) |

| 7. Saudi Arabia Market Overview, By Shape Type |

| 7.1 Saudi Arabia Round Air Duct Market Revenues (2017-2027F) |

| 7.2 Saudi Arabia Half Round Air Duct Market Revenues (2017-2027F) |

| 7.3 Saudi Arabia Square/Rectangular Air Duct Market Revenues (2017-2027F) |

| 7.4 Saudi Arabia Triangular Air Duct Market Revenues (2017-2027F) |

| 7.5 Saudi Arabia Other Air Duct Market Revenues (2017-2027F) |

| 8. Saudi Arabia Market Overview, By Applications |

| 8.1 Saudi Arabia Air Duct Market Revenues, By Residential (2017-2027F) |

| 8.2 Saudi Arabia Air Duct Market Revenues, By Commercial Buildings and Offices (2017-2027F) |

| 8.3 Saudi Arabia Air Duct Market Revenues, By Transportation and Public Infrastructure (2017-2027F) |

| 8.4 Saudi Arabia Air Duct Market Revenues, By Retail (2017-2027F) |

| 8.5 Saudi Arabia Air Duct Market Revenues, By Hospitality (2017-2027F) |

| 8.6 Saudi Arabia Air Duct Market Revenues, By Healthcare (2017-2027F) |

| 8.7 Saudi Arabia Air Duct Market Revenues, By Industrial (2017-2027F) |

| 8.8 Saudi Arabia Air Duct Market Revenues, By Others (2017-2027F) |

| 9. Saudi Arabia Market Overview, By Regions |

| 9.1 Saudi Arabia Air Duct Market Revenues, By Central Region (2017-2027F) |

| 9.2 Saudi Arabia Air Duct Market Revenues, By Southern Region (2017-2027F) |

| 9.3 Saudi Arabia Air Duct Market Revenues, By Eastern Region (2017-2027F) |

| 9.4 Saudi Arabia Air Duct Market Revenues, By Western Region (2017-2027F) |

| 10. Saudi Arabia Air Duct Market - Key Performance Indicators |

| 11. Saudi Arabia Air Duct Market Opportunity Assessment |

| 11.1 Saudi Arabia Air Duct Market Opportunity Assessment, By Material Type (2027F) |

| 11.2 Saudi Arabia Air Duct Market Opportunity Assessment, By Shape Type (2027F) |

| 11.3 Saudi Arabia Air Duct Market Opportunity Assessment, By Applications (2027F) |

| 11.4 Saudi Arabia Air Duct Market Opportunity Assessment, By Regions (2027F) |

| 12. Saudi Arabia Air Duct Market Competitive Landscape |

| 12.1 Saudi Arabia Air Duct Market Competitive Benchmarking, By Operating Parameters |

| 12.2 Saudi Arabia Air Duct Market Revenue Share, By Company (2020) |

| 12.3 Saudi Arabia Air Duct Primary Raw Material Share, By Source (2020) |

| 13. Company Profiles |

| 13.1 Sharqawi Co. |

| 13.2 Safid Co. Ltd. |

| 13.3 Arabian Thermal Aire Industries Company Limited |

| 13.4 Empower Air Technologies |

| 13.5 Saudi Akhwan Ducting Factory Co Ltd |

| 13.6 Zamil Air Conditioners Holding Co. Ltd |

| 13.7 Gulf Heavy Industries CO. |

| 13.8 Carrier Global Corporation |

| 13.9 Carrier Global Corporation |

| 13.10 Technical Duct Factory |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Saudi Arabia Air Duct Market Revenues, 2017 - 2027F ($ Million) |

| 2. Saudi Arabia Air Duct Market - Industry Life Cycle |

| 3. Saudi Arabia Air Duct Market Revenue Share, By Material Type, 2020 & 2027F |

| 4. Saudi Arabia Air Duct Market Revenue Share, By Shape Type, 2020 & 2027F |

| 5. Saudi Arabia Air Duct Market Revenue Share, By Applications, 2020 & 2027F |

| 6. Saudi Arabia Air Duct Market Revenue Share, By Regions, 2020 & 2027F |

| 7. Mostadam Rating Systems |

| 8. Crude Oil (Petroleum) Monthly Price - Saudi Riyal per Barrel, Nov 2019-Nov 2020 |

| 9. Saudi Arabia Office Supply Space, Q2 2020-2022F (Sq.mt. GLA) |

| 10. Saudi Arabia Residential Supply Stock, Q2 2020-2022F (Million Units) |

| 11. Saudi Arabia Retail Supply Stock, Q2 2020-2022F (sq. mt. GLA) |

| 12. Upcoming Power Plant Projects in Saudi Arabia |

| 13. Saudi Arabia Air Duct Market Opportunity Assessment, By Material Types, 2027F |

| 14. Saudi Arabia Air Duct Market Opportunity Assessment, By Shape Type, 2027F |

| 15. Saudi Arabia Air Duct Market Opportunity Assessment, By Applications, 2027F |

| 16. Saudi Arabia Air Duct Market Opportunity Assessment, By Regions, 2027F |

| 17. Saudi Arabia Air Duct Market Revenue Share, By Company (2020) |

| 18. Saudi Arabia Galvanized Steel Air Duct Market, Sources for Primary Raw Material (Steel), 2020 |

| 19. Saudi Arabia Aluminum Air Duct Market, Sources for Primary Raw Material (Aluminum), 2020 |

| 20. Saudi Arabia Fiberglass Air Duct Market, Sources for Primary Raw Material (Fiberglass), 2020 |

| 21. Saudi Arabia Polymer Air Duct Market, Sources for Primary Raw Material (Polymer), 2020 |

| List of Tables |

| 1. Short-term and Primary chosen segments for Equipment and Machinery Cluster in Saudi Arabia |

| 2. Saudi Arabia Air Duct Market Revenues, By Material Type, 2017 - 2027F ($ Million) |

| 3. Saudi Arabia Air Duct Market Revenues, By Shape Type, 2017 - 2027F ($ Million) |

| 4. Saudi Arabia Air Duct Market Revenues, By Applications, 2017 - 2027F ($ Million) |

| 5. Saudi Arabia Air Duct Market Revenues, By Regions, 2017 - 2027F ($ Million) |

| 6. Saudi Arabia Upcoming Transportation Projects |

| 7. Saudi Arabia Upcoming Mega Projects |

| 8. Saudi Arabia Upcoming Skyscraper Projects 9. Saudi Arabia Upcoming Medical Complex Projects |

| 10. Saudi Arabia Economic Cities |

| 11. Saudi Arabia Upcoming Industrial Projects |

| 12. Saudi Arabia Major Upcoming Infrastructure Projects |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero