Saudi Arabia Bakery Products Market (2023-2029) | Revenue, Size, Share, Growth, Industry, Outlook, Forecast, Analysis, Trends, Value, Segmentation & COVID-19 IMPACT

Market Forecast By Product Types (Cakes and Pastries,Biscuits,Bread,Morning Goods&Others), By Distribution Channels (Hypermarkets/Supermarkets, Convenience Stores, Speciality Stores, Online Retailing & Others) and competitive landscape

| Product Code: ETC002449 | Publication Date: Jan 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 64 | No. of Figures: 18 | No. of Tables: 2 |

The Saudi Arabia Bakery Products Market report comprehensively covers the market by type and distribution channel. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Saudi Arabia Bakery Products Market

Saudi Arabia bakery products market witnessed decent growth in the year 2019 on the back of growth shown by the hospitality sector which showed no sign of slowing with 64,000 hotel rooms and 187 hotel projects added to the supply list in 2019 coupled with rise in demand for ready to eat food products. However, the outbreak of the Covid-19 pandemic caused disruption in supply chain as well as imports of raw materials such as wheat, which created shortage of raw material supply, furthermore the closure of confectioneries, restaurants, retail establishments and other places of business to limit the spread of COVID-19 had significant impacted bakery business. Although, due to fear of sudden imposition of lockdown trend of bulk buying of bakery products was seen in the country in 2020.

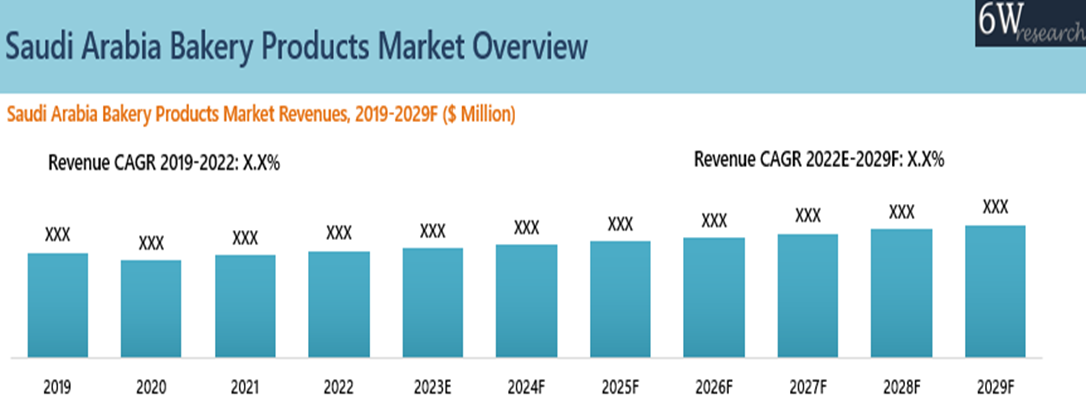

According to 6wresearch, Saudi Arabia bakery products market revenue size is projected to grow at a CAGR of 3.3% during 2023-2029. The growth associated with the bakery market during the forecast period is accredited to the developments in the kingdom on account of Saudi Vision 2030 and the efforts and initiatives by the government in projects such as Red Sea Development, Jeddah Tower, NEOM City Development and other GIGA Projects. Moreover, with expansion in hotels and opening of restaurant chains in the country to make Saudi Arabia, a leisure tourism hub in the region for foreign tourist would boost the bakery market. Therefore, hospitality sector of the country would multiply the revenues in the coming future. Also, the diversification of the economy on account of rising urban middle class population of the country would increase the demand for bakery products such as breads, cakes/pastries and biscuits across the country.

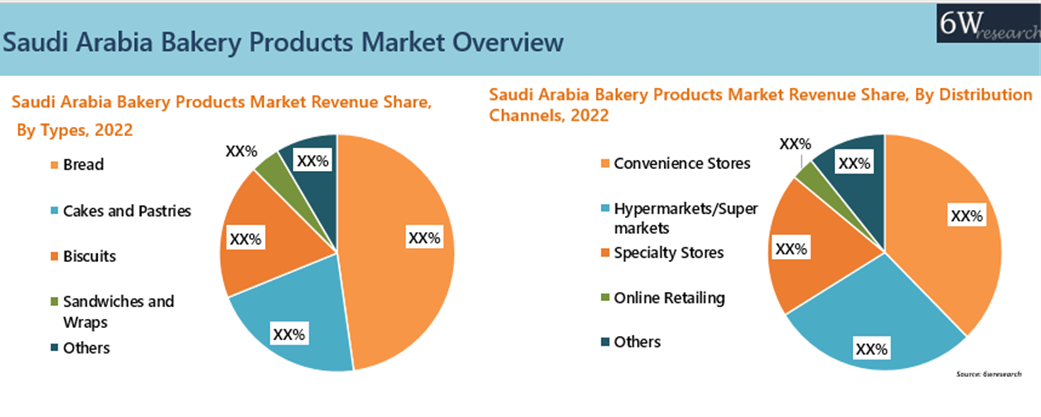

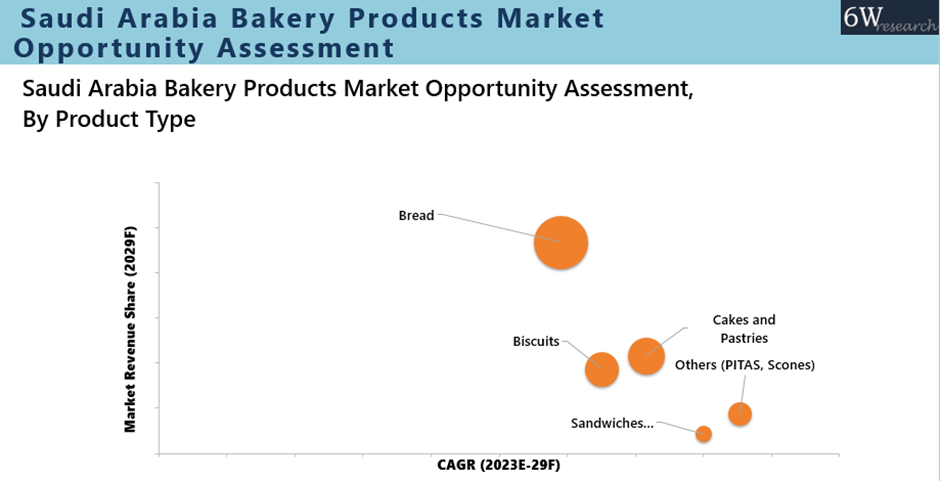

Breads account for the highest revenues in the current scenario of the market and would continue to dominate through niche product developments such as gluten free, multigrain and diabetic variants. Hypermarkets and Supermarkets captures the dominant share in the bakery sales owing to end-consumers preference for greater accessibility, product offerings and availability among the distribution channels for ready to eat products such as bakery products.

Saudi Arabia Bakery Products market report comprehensively covers the market by Product Types and Distribution Channels. Saudi Arabia Bakery Products market report provides an unbiased and detailed analysis of the Bakery Products market on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Market by Type

Bread accounts for the major share in the Saudi Arabia Bakery Products market and the trend would continue in the upcoming years with higher growth rate because of its demand and widespread use in the residential sector as it is a staple diet of majority of urban households therefore accounting major share in bakery products market in Saudi Arabia.

Market by Distribution Channel Type

Among all the distribution channels present, Around 66% of market is captured by Convenience stores and hyper/supermarkets channels as the majority retail structure is reliant on it in Saudi Arabia. Also consumers also prefer these channels due to the variety of choices it offers, availability and accessibility factor.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- Historical Data Starting from 2019 to 2029.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

Key Highlights of the Report:

- Saudi Arabia Bakery Products Market Overview

- Saudi Arabia Bakery Products Market Outlook

- Saudi Arabia Bakery Products Market Forecast

- Saudi Arabia Bakery Products Market Size

- Historical Data of Saudi Arabia Bakery Products Market Revenues, for the Period 2019-2022

- Saudi Arabia Bakery Products Market Forecast of Revenues, Until 2029

- Historical Data ofSaudi Arabia Bakery Products Market Revenues, by Product Types, for the Period 2019-2022

- Market Size & Forecast ofSaudi Arabia Bakery Products Market Revenues, by Product Types, until 2029

- Historical Data ofSaudi Arabia Bakery Products Market Revenues, by Distribution Channels, for the Period 2019-2022

- Market Size & Forecast ofSaudi Arabia Bakery Products Market Revenues, by Distribution Channels, until 2029

- Market Drivers and Restraints

- Saudi Arabia Bakery Products Market Trends

- Market Opportunity Assessment

- Saudi Arabia Bakery Products Company Ranking

- Saudi Arabia Bakery Products Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Breads

- Cakes & Pastries

- Biscuits

- Sandwiches & Wraps

By Distribution Type

- Convenience stores

- Supermarkets & Hypermarkets

- Specialty stores

- Online Retailing

Saudi Arabia Bakery Products Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope and Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Bakery Products Market Overview |

| 3.1 Saudi Arabia Bakery Products Market Revenues |

| 3.2 Saudi Arabia Bakery Products Market Industry Life Cycle |

| 3.3 Saudi Arabia Bakery Products Market – Porter’s Five Forces |

| 3.4 Saudi Arabia Bakery Products Market Revenue Share and Revenues, By Product Types |

| 3.4.1 Saudi Arabia Bakery Products Market Revenues, By Bread, 2019-2029F |

| 3.4.2 Saudi Arabia Bakery Products Market Revenues, By Cakes and Pastries, 2019-2029F |

| 3.4.3 Saudi Arabia Bakery Products Market Revenues, By Biscuits, 2019-2029F |

| 3.4.4 Saudi Arabia Bakery Products Market Revenues, By Sandwiches and Wraps, 2019-2029F |

| 3.4.5 Saudi Arabia Bakery Products Market Revenues, By Others (PITAS, Scones), 2019-2029F |

| 3.5 Saudi Arabia Bakery Products Market Revenue Share and Revenues, By Distribution Channel |

| 3.5.1 Saudi Arabia Bakery Products Market Revenues, By Hypermarket/Supermarket, 2019-2029F |

| 3.5.2 Saudi Arabia Bakery Products Market Revenues, By Convinience Stores, 2019-2029F |

| 3.5.3 Saudi Arabia Bakery Products Market Revenues, By Speciality Stores, 2019-2029F |

| 3.5.4 Saudi Arabia Bakery Products Market Revenues, By Online Retailing, 2019-2029F |

| 3.5.5 Saudi Arabia Bakery Products Market Revenues, By Others, 2019-2029F |

| 4. Saudi Arabia Bakery Products Market Covid-19 Impact Analysis |

| 5. Saudi Arabia Bakery Products Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing urbanization and changing consumer lifestyles leading to higher demand for convenient and ready-to-eat bakery products. |

| 5.2.2 Growing disposable income levels and a rising middle-class population driving consumption of premium and specialty bakery items. |

| 5.2.3 Innovation in product offerings and flavors to cater to diverse consumer preferences and trends. |

| 5.3. Market Restraints |

| 5.3.1 Fluctuating raw material prices impacting production costs and profitability of bakery product manufacturers. |

| 5.3.2 Intense competition within the market leading to price wars and margin pressures for players in the bakery products segment. |

| 5.3.3 Regulatory challenges related to food safety standards and labeling requirements affecting the market entry and expansion strategies of companies. |

| 6. Saudi Arabia Bakery Products Market Trends |

| 7. Saudi Arabia Bakery Products Market Key Performance Indicators |

| 7.1 Consumer sentiment and preferences surveys to gauge evolving demands and trends in the bakery products market. |

| 7.2 Number of new product launches and innovations in the bakery sector to assess market dynamics and competitiveness. |

| 7.3 Health and wellness certifications obtained by bakery product manufacturers to reflect the growing consumer focus on nutritious and clean-label products. |

| 8. Saudi Arabia Bakery Products Market Opportunity Assessment |

| 8.1. Saudi Arabia Bakery Products Market Opportunity Assessment, By Product Types, 2029F |

| 8.2. Saudi Arabia Bakery Products Market Opportunity Assessment, By Distribution Channels, 2029F |

| 9. Saudi Arabia Bakery Products Market Competitive Landscape |

| 9.1. Saudi Arabia Bakery Products Market Revenue Ranking, By Companies, 2022 |

| 9.2. Saudi Arabia Bakery Products Market Competitive Benchmarking, By Offerings |

| 9.3. Saudi Arabia Bakery Products Market Competitive Benchmarking, By Operating Parameters |

| 10. Company Profiles |

| 10.1 Almarai Group |

| 10.2 Al Munajem Group |

| 10.3 Al Hasa automatic bakeries(Fuschia) |

| 10.4 Herfy food services company |

| 10.5 Munch Automatic Bakeries food industry company limited |

| 10.6 Prima International Pastry Factory |

| 10.7 Kanolli Food Industries Company |

| 10.8 Nofoth for food products company |

| 10.9 Tmreya for sweets and pastries Co |

| 10.10 Saudi Bakeries Company |

| 11. Key Recommendations |

| 12. Disclaimer |

| List of Figures |

| 1. Saudi Arabia Bakery Products Market Revenues, 2019-2029F ($ Million) |

| 2. Saudi Arabia Bakery Products Market Revenue Share, By Product Types, 2022 & 2029F |

| 3. Saudi Arabia Bakery Products Market Revenue Share, By Distribution Channel, 2022 & 2029F |

| 4. Total Number of Hajj Pilgrims in Saudi Arabia, 2016-2022E |

| 5. Total Number of Umrah Pilgrims in Saudi Arabia, 2016-2022E (In Millions) |

| 6. Domestic Vs. Foreign Hajj Pilgrims, 2022E |

| 7. County wise Hajj Pilgrims, 2022E |

| 8. Saudi Arabia Wheat Price per Metric Ton, Saudi Riyal, (Nov’21-Sep’22) |

| 9. Saudi Arabia Consumer Price Index (Inflation), (2017-2021) |

| 10. Saudi Arabia Number of Upcoming Hotel Projects, 2022-2024F |

| 11. Saudi Arabia investment in food and beverages industry, (2021 & 2026F), USD Billion |

| 12. Saudi Arabia food app and delivery market value, (2021 & 2026F), USD Million |

| 13. Saudi Arabia Bakery Products Market Opportunity Assessment, By Product Type, 2029F |

| 14. Saudi Arabia Bakery Products Market Opportunity Assessment, By Distribution Channel, 2029F |

| 15. Saudi Arabia Bakery Products Market Revenue Ranking, By Companies, 2022 |

| 16. Saudi Arabia Number of Tourists Arrivals, Million, 2022 |

| 17. Saudi Arabia Percentage of Businesses in The Food And Beverages Industry, 2022 |

| 18. Saudi Arabia Number of Tourists Arrivals, Million, 2022 |

| List of Tables |

| 1.Saudi Arabia Bakery Products Market Revenues, By Product Type, 2019-2029F ($ Million) |

| 2.Saudi Arabia Bakery Products Market Revenues, By Distribution Channel, 2019-2029F ($ Million) |

| 3.Saudi Arabia Under Development Hotel Rooms, 2022 |

Market Forecast By Product Types (Cakes and Pastries, Biscuits, Bread, Morning Goods & Others), By Distribution Channels (Hypermarkets/Supermarkets, Convenience Stores, Speciality Stores, Online Retailing & Others) and competitive landscape

| Product Code: ETC002449 | Publication Date: Nov 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Saudi Arabia Bakery Product Market Synopsis

Saudi Arabia is one of the countries with a high population density. This has led to an increase in the demand for bakery products. Bakery products are in high demand due to health benefits and convenience. Bakery products are widely consumed across different age groups and social classes in Saudi Arabia. However, the country's bakery industry faces several challenges such as a low level of competitiveness, lack of expertise, and unfavorable infrastructure conditions. Additionally, the Saudi Bakery Product Market is expected to grow over the next five years owing to increasing consumer demand for bakery products across different geographies especially in developing countries such as Saudi Arabia. The growth of the market can be attributed to factors such as aging population, increasing income levels, rising food expenditure, and growing popularity of healthy eating among people in developed economies such as Saudi Arabia. The country is one of the fastest growing markets for bakery products in the world. Middle East Bakery Product Market is a part of the Global bakery product market.

According to 6Wresearch, the Saudi Arabia Bakery Product Market size is likely to witness growth during 2022-28. The market is growing due to the increasing demand for bakery products in the country. There is an increased preference for healthy food items among Saudis, which is driving the bakery product market. The Saudi Arabia Bakery Product Market is estimated to be worth US$1.4 billion by 2025. This market will grow at a CAGR of 7.8% during the forecast period. The growth of this market can be attributed to the increasing population of people in Saudi Arabia, rising disposable incomes, and the increasing demand for bakery products. One major factor restraining the growth of this market is the high tariffs imposed on imports of bakery products. However, these tariffs are expected to decline over time as a result of trade agreements that have been signed between Saudi Arabia and various countries. Furthermore, the growth of online retailing is also boosting the demand for bakery products in Saudi Arabia.

Market Analysis By Type

The Saudi Arabia bakery market is divided into two segments: packaged food and prepared food. The packaged food segment dominates the market with a share of over 60%. This is due to the high demand for pre-packaged foods such as breads, cakes, biscuits, pies, etc. In terms of prepared food category, coffee shops are the major buyers of this type of product.

Market Analysis By End User

In terms of distribution channel, the market is categorized into hypermarkets/supermarkets, convenience stores, speciality stores and online retailing & others. The supermarkets hold the highest market share. Whereas, the online platforms are also gaining popularity over the past few years.

COVID-19 Influence on the Saudi Arabia Bakery Product Market

The occurrence of Covid-19 pandemic has resulted into a slump in the market growth. Growing concerns about food security and health are likely to spur the growth of the Saudi Arabia Bakery Product Market. Other factors that are anticipated to contribute towards the growth of the Saudi Arabia Bakery Product Market include increasing urbanization and consumer spending.

Key Attractiveness of the Report

- COVID-19 Influence on the Market Dynamics.

- 10 Years of Market Data.

- Historical Numbers from 2018 to 2021.

- Base Year: 2021

- Market Forecast Data Until 2028

- Key Performance Indicators Influencing the Market.

- Key Developments and Projects.

Key Highlights of the Report

- Saudi Arabia Bakery Products Market Overview

- Saudi Arabia Bakery Products Market Outlook

- Saudi Arabia Bakery Products Market Forecast

- Saudi Arabia Bakery Products Market Size

- Historical Data of Saudi Arabia Bakery Products Market Revenues, for the Period 2018-2021

- Saudi Arabia Bakery Products Market Forecast of Revenues, Until 2028

- Historical Data of Saudi Arabia Bakery Products Market Revenues, by Product Types, for the Period 2018-2021

- Market Size & Forecast of Saudi Arabia Bakery Products Market Revenues, by Product Types, until 2026

- Historical Data of Saudi Arabia Bakery Products Market Revenues, by Distribution Channels, for the Period 2018-2021

- Market Size & Forecast of Saudi Arabia Bakery Products Market Revenues, by Distribution Channels, until 2026

- Market Drivers and Restraints

- Saudi Arabia Bakery Products Market Trends

- Market Opportunity Assessment

- Saudi Arabia Bakery Products Market Share, By Players

- Saudi Arabia Bakery Products Market Share, By Regions

- Saudi Arabia Bakery Products Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The report provides a broad study of the subsequent market segments

By Product Type

- Cakes and Pastries

- Biscuits

- Bread

- Morning Goods & Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Speciality Stores

- Online Retailing & Others

Frequently Enquired Queries Regarding the Market Study: FAQs

1). Which product type accounts for the maximum market share in the Saudi Arabia Bakery Product Market?

The biscuits accounts for the maximum market share in the Saudi Arabia Bakery Product Market.

2). Does the report include the impact of COVID-19?

Yes, the report includes the impact of COVID-19.

3). Which distribution channel is predictable to register the maximum growth rate?

The hypermarkets/supermarkets is projected to record the highest share in future.

4). What are the major trends in Saudi Arabia Bakery Product Market?

Overall, bakery product sales are growing faster in GCC countries than elsewhere in the Middle East region In addition, there is greater consumer awareness of healthy eating trends, which is attracting consumers towards healthier foods such as bakery products.

5). What are the crucial factors which are spurring the market demand?

The Saudi Arabia Bakery Product Market is anticipated to witness growth owing to increasing demand for bakery products in the country.

Market Forecast By Product Types (Cakes and Pastries, Biscuits, Bread, Morning Goods & Others), By Distribution Channels (Hypermarkets/Supermarkets, Convenience Stores, Speciality Stores, Online Retailing & Others) and competitive landscape

| Product Code: ETC002449 | Publication Date: Apr 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Saudi Arabia bakery product market is expected to witness tremendous growth due to the increasing awareness about health and wellness, shift towards whole wheat bakery products, increasing demand for whole grain and gluten-free product options, changing consumer lifestyles along with the convenience, accessibility and nutrition profile associated bakery products would attribute to the strong growth of bakery products market in the coming years.

According to 6Wresearch, Saudi Arabia Bakery Product Market size is expected to register significant growth during the forecast period 2020-2026. The growth of the bakery product market is mainly attributed due to the outburst of coronavirus, creating a fear of market closures among people resulting in the stocking of the essential food items such as bread and buns to meet the daily requirements. The Saudi Arabian government is ensuring the continuous supply of food is made available and is taking steps to overcome the demand-supply gap promoting the sales of bakery products in the country.

Based on distribution channels, hypermarkets/supermarkets segment is expected to acquire a major market share as these stores provide a wide range for fresh-baked products, whole-grain bread, and specialty bakery products. Furthermore, supermarkets and hypermarkets mode is expected to gain dominance as ordering food through online mode would increase the risk of spreading of coronavirus.

Saudi Arabia Bakery Products market report thoroughly covers the market by product types and distribution channels. Saudi Arabia Bakery Products' market outlook report provides an unbiased and detailed analysis of the on-going Saudi Arabia Bakery Products market trends, opportunities/high growth areas, and drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

- Saudi Arabia Bakery Products Market Overview

- Saudi Arabia Bakery Products Market Outlook

- Saudi Arabia Bakery Products Market Forecast

- Saudi Arabia Bakery Products Market Size

- Historical Data of Saudi Arabia Bakery Products Market Revenues, for the Period 2016-2019

- Saudi Arabia Bakery Products Market Forecast of Revenues, Until 2026

- Historical Data of Saudi Arabia Bakery Products Market Revenues, by Product Types, for the Period 2016-2019

- Market Size & Forecast of Saudi Arabia Bakery Products Market Revenues, by Product Types, until 2026

- Historical Data of Saudi Arabia Bakery Products Market Revenues, by Distribution Channels, for the Period 2016-2019

- Market Size & Forecast of Saudi Arabia Bakery Products Market Revenues, by Distribution Channels, until 2026

- Market Drivers and Restraints

- Saudi Arabia Bakery Products Market Trends

- Market Opportunity Assessment

- Saudi Arabia Bakery Products Market Share, By Players

- Saudi Arabia Bakery Products Market Share, By Regions

- Saudi Arabia Bakery Products Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

Saudi Arabia Bakery Products Market report provides a detailed analysis of the following market segments:

- By Product Types:

- Cakes and Pastries

- Biscuits

- Bread

- Morning Goods

- Others

- By Distribution Channels:

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retailing

- Others

Other Key Related Reports Include:

- Kenya Bakery Products Market Report

- Nigeria Bakery Products Market Report

- India Bakery Products Market Report

- United Arab Emirates Bakery Products Market Report

- Qatar Bakery Products Market Report

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero