Saudi Arabia Building Management System Market (2020-2026) | Size, Share, Revenue, Analysis, Forecast, Trends, industry, Growth, Outlook & COVID-19 IMPACT

Market Forecast By Types (By Solution Types(Facility Management, Security Management, Energy Management, Emergency Management, Infrastructure Management), By Service Types (Professional Services, Managed Services)), By Applications (Commercial, Residential, Industrial) and competitive and landscape

| Product Code: ETC001851 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 28 | No. of Tables: 9 |

Latest 2023 Development of the Saudi Arabia Building Management System Market

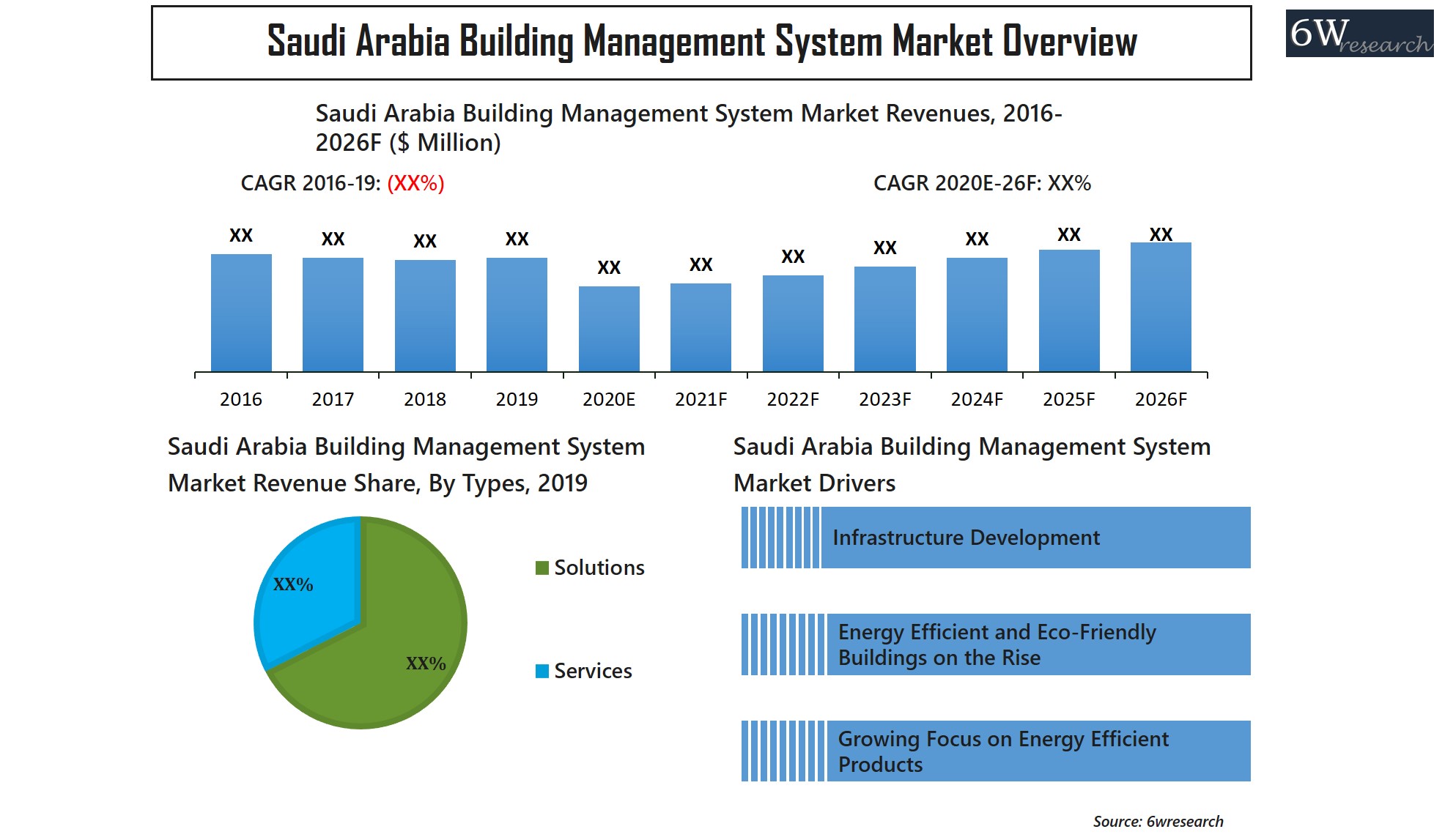

Saudi Arabia Building Management System Market is witnessing robust growth on the back of increasing demand for Energy Efficiency due to the rising cost of energy and concerns about the environment. Moreover, the government is investing heavily in infrastructure projects which generally include the development of smart city initiatives. Also, with the advancement of technology, building management systems are becoming more sophisticated and capable of integrating with lighting and HVAC systems. The construction industry is growing which is also propelling the demand for building management systems.

The wide adoption of the Internet of Things is also driving the growth of Saudi Arabia building management systems market size as these systems can be connected to a wide range of devices and sensors to monitor and control several aspects of a building. Moreover, smart building solutions are gaining popularity in Saudi Arabia backed by their ability to optimize building performance and enhance occupant comfort and safety. The growing construction industry in Saudi Arabia is driving the demand for building management systems, as building owners are looking to optimize the performance of their properties. Overall, the Saudi Arabia building management system market is booming and is anticipated to grow as the country invests in modern infrastructure.

Saudi Arabia Building Management System Market Synopsis

The Building Management System Market in Saudi Arabia would grow at a significant rate over the coming years on account of the growing trend of smart buildings across the country. Despite a slowdown in the overall economy in the past due to the rising oil prices, the building management system market in Saudi Arabia is anticipated to grow substantially over the forecast period on the back of diversifying the economy of the country from the oil sector to the non-oil sector that has been boosted by the favourable government policies such as Saudi Vision 2030. GCC Railway project, Neom project, and Red Sea project are some of the upcoming infrastructural projects in the country that would drive the building management system market over the forecast period. However, the spread of the coronavirus would lead to an overall economic slowdown which would further result in falling oil prices, affecting the investments made in the construction projects in the country, thereby leading to the sluggish growth in the building management system market in Saudi Arabia in 2020.

According to 6Wresearch, the Saudi Arabia Building Management System Market size is projected to grow at a CAGR of 7.2% during 2020-2026. Significant growth in the construction of smart cities such as Neom City, and Riyadh Tower which is underpinned by the government’s ambitious infrastructural development plan would drive the building management system market in Saudi Arabia over the coming years. Moreover, the rising awareness about energy conservation would increase the adoption of LEED-accredited buildings across the country as these systems ensure sustainable use of energy, thereby augmenting the demand for the building management system market in Saudi Arabia.

Market Analysis by Application

Based on applications, the commercial sector is the leading market revenue-generating application in the building management system market in Saudi Arabia overall market revenues in 2019 owing to the rising number of smart cities in the country. Moreover, the rising adoption of LEED-accredited buildings with a vision to promote sustainable development would impel the growth of the building management system market in the commercial sector over the forecast period.

Market Analysis by Solution Types

Based on the solution types, facility management systems that comprise HVAC control and lighting control have garnered the maximum market revenue shares in the overall market revenues in 2019 and are expected to maintain the same over the coming years. Saudi Arabia is characterized by its extreme climatic conditions; hence HVAC systems are in continuous usage all year round throughout the country. Also, with the growing awareness about energy conservation, the demand for HVAC control and lighting control would continue to maintain its dominance over the coming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2020.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Building Management System Market Overview

- Saudi Arabia Building Management System Market Outlook

- Market Size and Forecast of Saudi Arabia Building Management System Market Revenues, Until 2026

- Historical Data and Forecast of Saudi Arabia Building Management System Market Revenues for the period, 2016-2026

- Market Size and Forecast of Saudi Arabia Building Management System Market Revenues, By Types, Until 2026

- Historical Data and Forecast of Saudi Arabia Building Management System Market Revenues for the period, By Types, 2016-2026

- Market Size and Forecast of Saudi Arabia Building Management System Market Revenues, By Solutions, Until 2026

- Historical Data and Forecast of Saudi Arabia Building Management System Market Revenues for the period, By Solutions, 2016-2026

- Market Size and Forecast of Saudi Arabia Building Management System Market Revenues, By Solution Types, Until 2026

- Historical Data and Forecast of Saudi Arabia Building Management System Market Revenues for the period, By Solution Types, 2016-2026

- Market Size and Forecast of Saudi Arabia Building Management System Market Revenues, By Services, Until 2026

- Historical Data and Forecast of Saudi Arabia Building Management System Market Revenues for the period, By Services, 2016-2026

- Market Size and Forecast of Saudi Arabia Building Management System Market Revenues, By Service Types, Until 2026

- Historical Data and Forecast of Saudi Arabia Building Management System Market Revenues for the period, By Service Types, 2016-2026

- Market Size and Forecast of Saudi Arabia Building Management System Market Revenues, By Applications, Until 2026

- Historical Data and Forecast of Saudi Arabia Building Management System Market Revenues for the period, By Applications, 2016-2026

- Market Drivers and Restraints

- Saudi Arabia Building Management System Market Trends

- Saudi Arabia Building Management System Industry Life Cycle

- Porter’s Five Force Analysis

- Saudi Arabia Building Management System Market Opportunity Assessment

- Saudi Arabia Building Management System Market Revenue Share, By Company

- Saudi Arabia Building Management System Market Revenue Share, By Regions

- Saudi Arabia Building Management System Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Types:

- By Solution Types:

- Facility Management

- Security Management

- Energy Management

- Emergency Management

- Infrastructure Management

- By Service Types:

- Professional Services

- Managed Services

By Applications:

- Commercial Sector

- Residential Sector

- Industrial Sector

Saudi Arabia Building Management System Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Saudi Arabia Building Management System Market Overview |

| 3.1. Saudi Arabia Country Indicators |

| 3.2. Saudi Arabia Building Management System Market Revenues, 2016-2026F |

| 3.3. Saudi Arabia Building Management System Market Revenue Share, By Types, 2019 & 2026F |

| 3.4. Saudi Arabia Building Management System Market Revenue Share, By Solutions, 2019 & 2026F |

| 3.5. Saudi Arabia Building Management System Market Revenue Share, By Services, 2019 & 2026F |

| 3.6. Saudi Arabia Building Management System Market Revenue Share, By Applications, 2019 & 2026F |

| 3.7. Saudi Arabia Building Management System Market - Industry Life Cycle |

| 3.8. Saudi Arabia Building Management System Market - Porter’s Five Forces |

| 4. Saudi Arabia Building Management System Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing focus on energy efficiency and sustainability in buildings |

| 4.2.2 Technological advancements in building automation systems |

| 4.2.3 Government initiatives and regulations promoting smart buildings |

| 4.2.4 Growing urbanization and infrastructure development in Saudi Arabia |

| 4.3. Market Restraints |

| 4.3.1 High initial investment costs for implementing building management systems |

| 4.3.2 Lack of skilled professionals for system installation and maintenance |

| 4.3.3 Concerns regarding data security and privacy in smart buildings |

| 4.3.4 Resistance to change and lack of awareness about the benefits of building management systems |

| 5. Saudi Arabia Building Management System Market Trends |

| 6. Saudi Arabia Building Management System Market Overview, By Solutions |

| 6.1 Saudi Arabia Building Management System Market Revenues, By Solutions, 2016-2026F |

| 6.1.1 Saudi Arabia Facility Management System Market Revenues, 2016-2026F |

| 6.1.1.1 Saudi Arabia Facility Management System Market Revenue Share, By Types, 2019 & 2026F |

| 6.1.1.2 Saudi Arabia Facility Management System Market Revenues, By Types, 2016-2026F |

| 6.1.2 Saudi Arabia Security Management System Market Revenues, 2016-2026F |

| 6.1.2.1 Saudi Arabia Security Management System Market Revenue Share, By Types, 2019 & 2026F |

| 6.1.2.2 Saudi Arabia Security Management System Market Revenues, By Types, 2016-2026F |

| 6.1.3 Saudi Arabia Energy Management System Market Revenues, 2016-2026F |

| 6.1.4 Saudi Arabia Emergency Management System Market Revenues, 2016-2026F |

| 6.1.5 Saudi Arabia Infrastructure Management System Market Revenues, 2016-2026F |

| 7. Saudi Arabia Building Management System Market Overview, By Services |

| 7.1 Saudi Arabia Building Management System Market Revenues, By Services, 2016-2026F |

| 7.1.1 Saudi Arabia Building Management System Market Revenues, By Professional services, 2016-2026F |

| 7.1.2 Saudi Arabia Building Management System Market Revenues, By Managed Services, 2016-2026F |

| 8. Saudi Arabia Building Management System Market Overview, By Applications |

| 8.1 Saudi Arabia Building Management System Market Revenues, By Applications, 2016-2026F |

| 8.1.1 Saudi Arabia Building Management System Market Revenues, By Residential, 2016-2026F |

| 8.1.2 Saudi Arabia Building Management System Market Revenues, By Commercial, 2016-2026F |

| 8.1.3 Saudi Arabia Building Management System Market Revenues, By Industrial, 2016-2026F |

| 9. Saudi Arabia Building Management System Market - Key Performance Indicators |

| 10. Saudi Arabia Building Management System Market - Opportunity Assessment |

| 10.1. Saudi Arabia Building Management System Market Opportunity Assessment, By Solution Types, 2026F |

| 10.2. Saudi Arabia Building Management System Market Opportunity Assessment, By Service Types, 2026F |

| 10.3. Saudi Arabia Building Management System Market Opportunity Assessment, By Applications, 2026F |

| 11. Saudi Arabia Building Management System Market Competitive Landscape |

| 11.1. Saudi Arabia Building Management System Market Revenue Share, By Companies, 2019 |

| 11.2. Saudi Arabia Building Management System Market Competitive Benchmarking, By Operating & Technical Parameters |

| 12. Company Profiles |

| 12.1 Siemens AG |

| 12.2 General Electric |

| 12.3 Honeywell International Inc. |

| 12.4 Schneider Electric SE |

| 12.5 Johnson Controls International PLC |

| 12.6 Robert Bosch GmbH |

| 12.7 Legrand Group |

| 12.8 Delta Controls Inc. |

| 12.9 ABB Ltd. |

| 12.10 LG Electronics, Inc. |

| 13. Key Recommendations |

| 14. Disclaimer |

| List of Figures |

| Figure 1. Saudi Arabia Building Management System Market Revenues, 2016-2026F ($ Million) |

| Figure 2. Saudi Arabia Building Management System Market Revenue Share, By Types, 2019 & 2026F |

| Figure 3. Saudi Arabia Building Management System Market Revenues, By Solutions, 2016-2026F ($ Million) |

| Figure 4. Saudi Arabia Building Management System Market Revenue Share, By Solution Types, 2019 & 2026F |

| Figure 5. Saudi Arabia Facility Management System Market Revenue Share, By Types, 2019 & 2026F |

| Figure 6. Saudi Arabia Security Management System Market Revenue Share, By Types, 2019 & 2026F |

| Figure 7. Saudi Arabia Building Management System Market Revenues, By Services, 2016-2026F ($ Million) |

| Figure 8. Saudi Arabia Building Management System Market Revenue Share, By Service Types, 2019 & 2026F |

| Figure 9. Saudi Arabia Building Management System Market Revenue Share, By Applications, 2019 & 2026F |

| Figure 10. Riyadh Residential Supply, 2015-2021F (Thousand Units) |

| Figure 11. Jeddah Residential Supply, 2015-2021F (Thousand Units) |

| Figure 12. Dammam Residential Supply, 2015-2021F (Thousand Units) |

| Figure 13. Makkah Residential Supply, 2015-2021F (Thousand Units) |

| Figure 14. Riyadh Retail Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 15. Jeddah Retail Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 16. Dammam Retail Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 17. Makkah Retail Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 18. Riyadh Office Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 19. Jeddah Office Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 20. Dammam Office Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 21. Makkah Office Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 22. Riyadh Hotel Supply, 2015-2021F (‘00 Keys ) |

| Figure 23. Jeddah Hotel Supply, 2015-2021F (‘00 Keys ) |

| Figure 24. Dammam Hotel Supply, 2015-2021F (‘00 Keys ) |

| Figure 25. Makkah Hotel Supply, 2015-2021F (‘00 Keys ) |

| Figure 26. Saudi Arabia Building Management System Market Opportunity Assessment, By Solution Types (2026F) |

| Figure 27. Saudi Arabia Building Management System Market Opportunity Assessment, By Applications (2026F) |

| Figure 28. Saudi Arabia Building Management System Market Revenue Share, By Company (2018) |

| List of Tables |

| Table 1. Saudi Arabia Building Management System Market Revenues, By Solution Types, 2016-2026F ($ Million) |

| Table 2. Saudi Arabia Facility Management System Market Revenues, By Types, 2016-2026F ($ Million) |

| Table 3. Saudi Arabia Security Management System Market Revenues, By Types, 2016-2026F ($ Million) |

| Table 4. Saudi Arabia Building Management System Market Revenues, By Service Types, 2016-2026F ($ Million) |

| Table 5. Saudi Arabia Building Management System Market Revenues, By Applications, 2016-2026F ($ Million) |

| Table 6. List of Major Infrastructure Projects in Saudi Arabia |

| Table 7. List of Upcoming Skyscrapers in Saudi Arabia |

| Table 8. Saudi Arabia Upcoming Transportation Projects |

| Table 9. Saudi Arabia Upcoming Projects |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero