Saudi Arabia Busway Market (2020-2026) | COVID-19 IMPACT, Analysis, Industry, Share, Size, Forecast, Outlook, Growth, Value, Trends, Revenue & Companies

Market Forecast By Insulation (Air, Sandwich), By Conductor (Copper, Aluminum), Power Range (Lighting Power Range (Upto 0.5 kV), Low Power Range (0.6 kV-1 kV), Medium Power Range (3.6 kV-17 kV), High Power Range (Above 17 kV)) and competitive landscape

| Product Code: ETC002043 | Publication Date: Apr 2020 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Saudi Arabia Busway Market report thoroughly covers the market by kVA rating and applications. Saudi Arabia Busway market outlook report provides an unbiased and detailed analysis of the on-going Saudi Arabia Busway market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Busway Market Synopsis

Saudi Arabia Busway Market is expected to witness potential growth in the upcoming six years on the back of rising industrial expansion like the mining and petroleum industry. Increased demand for sufficient energy during the industrial operation by installing an energy supply system where the busway is the best solution and attributed as irreplaceable due to having multiple salient features like flexibility, reliability, and proven fire resistance is expected to accelerate busway deployment in the country. Moreover, mining and petroleum are the fastest growing sector as a result, it would benefit Saudi Arabia busway market growth exponentially in the forthcoming years. Further, ongoing commercial projects in the country like Jeddah chamber of commerce and industry in Jeddah which consisting of offices and hotels infrastructure is estimated to generate high sales revenues owing to a rise in the need for the energy distribution system to ensure uninterruptable work in the offices and is estimated to spur the substantial growth of Saudi Arabia busway market in the coming years.

The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in the overall market growth.

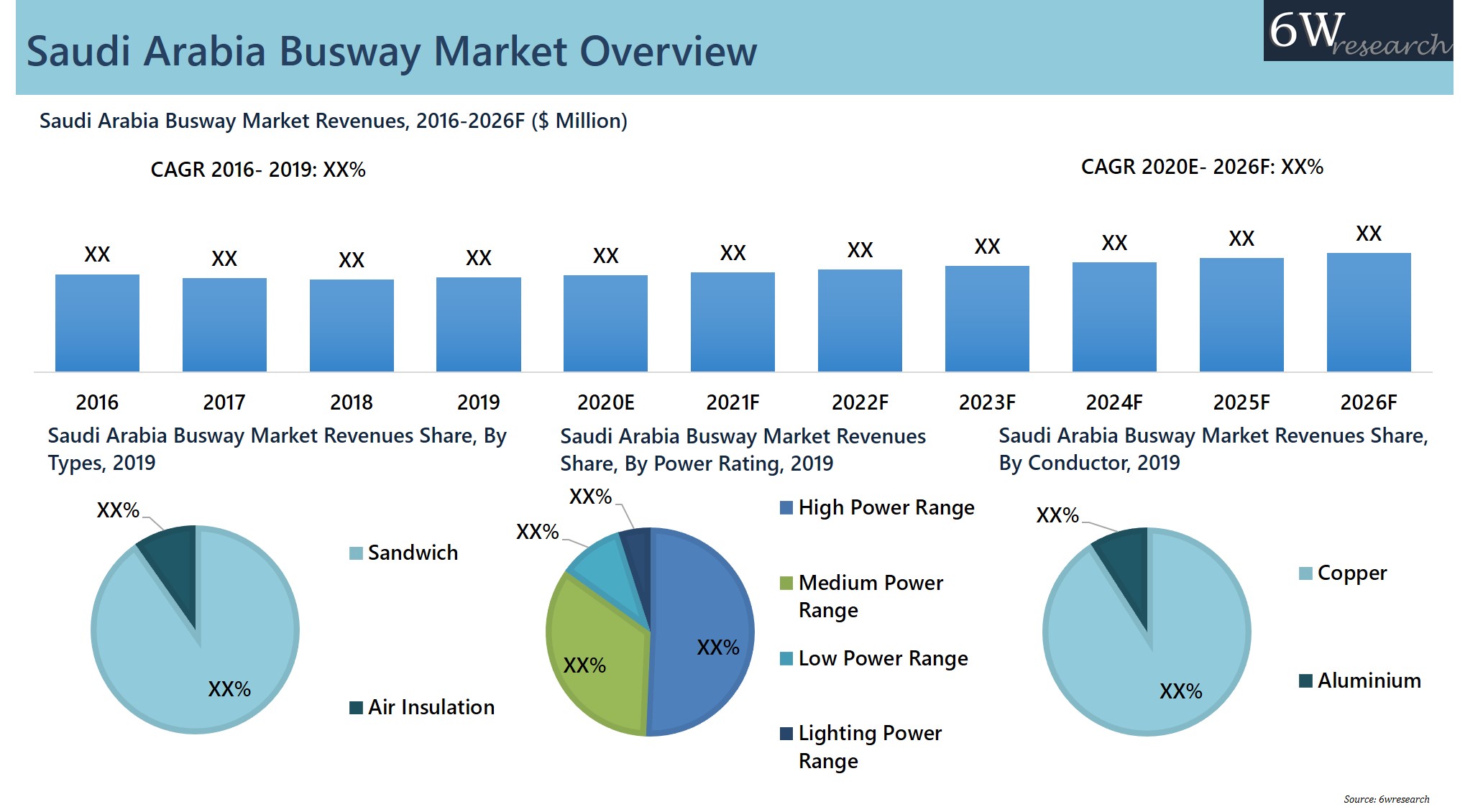

According to 6Wresearch, Saudi Arabia Busway Market size is projected to grow at CAGR of 3.5% during 2020-2026. Over the next six years, mega infrastructural development coupled with surging investment by government and private companies, rising tourism and hospitality sector are anticipated to drive the growth of the busway market in Saudi Arabia due to the rise in the construction sector to boost the accommodation of the tourist and providing better hospitality services. Moreover, an increase in the number of malls, airports, and high-rise buildings in the country is expected to surge the market for busway during the forecast period.

Market Analysis by Insulation

On the basis of insulation, Sandwich bus ducts dominated the Saudi Arabia busway market revenues in 2019 due to their vast usage in the residential and industrial sectors. Furthermore, the sandwich busway segment would grow in the coming years due to a non-ventilated and compact design suitable for manufacturing industries and commercial spaces. The busway market in the region registered a decline during the first half of 2020 on account of the global economic slowdown caused by COVID-19, however, the aforementioned market is expected to recover post-2020.

Market Analysis by Power Range

On the basis of power range, the high-power range bus duct system dominated the market revenue share in 2019 on account of growing industrialization in Saudi Arabia. Moreover, low and medium power range are anticipated to grow in the forecast period, owing to increasing transportation infrastructure and commercial sector in the Kingdom of Saudi Arabia

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2020.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical data of Saudi Arabia busway market revenues for the period 2016-2019

- Saudi Arabia busway market size and market forecast of revenues, until 2026F

- Historical data of Saudi Arabia busway market revenues, by insulation, for the period 2016-2019

- Saudi Arabia busway market size and market forecast of revenues, by insulation, until 2026F

- Historical data of Saudi Arabia busway market revenues, by the conductor, for the period 2016-2019

- Saudi Arabia busway market size and market forecast of revenues, by the conductor, until 2026F

- Historical data of Saudi Arabia busway market revenues, by power range, for the period 2016-2019

- Saudi Arabia busway market size and market forecast of revenues, by power range, until 2026F

- Market Drivers and Restraints.

- Market Trends and Developments.

- Player Market Share and Competitive Landscape.

- Company Profiles.

- Strategic Recommendations.

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Insulation

- Air

- Sandwich

- By Conductor

- Copper

- Aluminum

- Power Range

- Lighting Power Range (Up to 0.5 kV)

- Low Power Range (0.6 kV-1 kV)

- Medium Power Range (3.6 kV-17 kV)

- High Power Range (Above 17 kV)

Other Key Reports Available:

- Canada Busway Market Report

- Brazil Busway Market Report

- Argentina Busway Market Report

- USA Busway Market Report

- Japan Busway Market Report

- Australia Busway Market Report

- Bangladesh Busway Market Report

- Germany Busway Market Report

- Russia Busway Market Report

- UK Busway Market Report

- France Busway Market Report

- Saudi Arabia Busway Market Report

Saudi Arabia Busway Market: FAQs

| 1. Executive Summary |

| 2.Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Saudi Arabia Busway Market Overview |

| 3.1. Saudi Arabia Country Indicators |

| 3.3. Saudi Arabia Busway Market Revenues, 2016 - 2026F |

| 3.3. Saudi Arabia Busway Market - Industry Life Cycle |

| 3.4. Saudi Arabia Busway Market - Porter’s Five Forces Model |

| 3.5. Saudi Arabia Busway Market Revenue Share, By Insulation, 2019 & 2026F |

| 3.6. Saudi Arabia Busway Market Revenue Share, By Power range, 2019 & 2026F |

| 3.7. Saudi Arabia Busway Market Revenue Share, By Conductor, 2019 & 2026F |

| 4. Saudi Arabia Busway Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing urbanization and infrastructure development in Saudi Arabia |

| 4.2.2 Government initiatives to enhance public transportation systems |

| 4.2.3 Growing awareness about the benefits of busways in reducing traffic congestion and emissions |

| 4.3. Market Restraints |

| 4.3.1 High initial investment costs for busway infrastructure |

| 4.3.2 Lack of integration with existing transportation systems |

| 4.3.3 Limited availability of skilled workforce for busway maintenance and operations |

| 5. Saudi Arabia Busway Market Trends |

| 6. Saudi Arabia Busway Market Revenues, By Insulation |

| 6.1. Saudi Arabia Air Insulation Busway Market Revenues, 2016-2026F |

| 6.2 . Saudi Arabia Sandwich Insulation Busway Market Revenues, 2016-2026F |

| 7. Saudi Arabia Busway Market Revenue Share, By Power range |

| 7.1. Saudi Arabia Lighting Power Range Busway Market Revenues, 2016-2026F |

| 7.2. Saudi Arabia Low Power Range Busway Market Revenues, 2016-2026F |

| 7.3. Saudi Arabia Medium Power Range Busway Market Revenues, 2016-2026F |

| 7.4. Saudi Arabia High Power Range Busway Market Revenues, 2016-2026F |

| 8. Saudi Arabia Busway Market Revenue Share, By Conductor |

| 8.1. Saudi Arabia Copper Conductor Busway Market Revenues, 2016-2026F |

| 8.2. Saudi Arabia Aluminium Conductor Busway Market Revenues, 2016-2026F |

| 9. Saudi Arabia Busway Market - Key Performance Indicators |

| 9.1 Average daily ridership on busways |

| 9.2 Percentage of busway infrastructure expansion projects completed on time |

| 9.3 Average wait time for passengers at busway stations |

| 10. Opportunity Assessment |

| 10.1. Saudi Arabia Busway Market Opportunity Assessment, By Insulation (2026F) |

| 10.2. Saudi Arabia Busway Market Opportunity Assessment, By Power Range (2026F) |

| 10.3. Saudi Arabia Busway Market Opportunity Assessment, By Conductor (2026F) |

| 11. Competitive Landscape |

| 11.1. Saudi Arabia Busway Market Revenue Share, By Company, 2019 |

| 12. Company Profiles |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures: |

| Figure 1. Saudi Arabia Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 2. Saudi Arabia Busway Market Revenue Share, By Insulation, 2019 & 2026F |

| Figure 3. Saudi Arabia Air Insulation Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 4. Saudi Arabia Sandwich Insulation Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 5. Saudi Arabia Busway Market Revenue Share, By Power Range, 2019 & 2026F |

| Figure 6. Saudi Arabia Lighting Power Range (Up to 0.5 kV) Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 7. Saudi Arabia Low Power Range (0.6 kV-1 kV) Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 8. Saudi Arabia Medium Power Range (3.6 kV-17 kV) Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 9. Saudi Arabia High Power Range (Above 17 kV) Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 10. Saudi Arabia Busway Market Revenue Share, By Conductor, 2019 & 2026F |

| Figure 11. Saudi Arabia Copper Conductor Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 12. Saudi Arabia Aluminum Conductor Busway Market Revenues, 2016-2026F ($ Million) |

| Figure 13. Saudi Arabia Busway Market Opportunity Assessment, By Insulation (2026F) |

| Figure 14. Saudi Arabia Busway Market Opportunity Assessment, By Power Range (2026F) |

| Figure 15. Saudi Arabia Busway Market Opportunity Assessment, By Conductor (2026F) |

| Figure 16. Saudi Arabia Busway Market Revenue Share, By Company, (2019) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero