Saudi Arabia Circuit Breaker Market (2025-2031) | Revenue, Size, Share, Growth, Industry, Outlook, Forecast, Analysis, Trends, Value & Segmentation

Market Forecast By Insulation Type (Vacuum Circuit Breaker, Air Circuit Breaker, Gas Circuit Breaker, Oil Circuit Breaker), By Voltage (Medium Voltage, High Voltage), By Installation (Indoor, Outdoor), By End User (T&D Utilities, Power Generation, Renewables, Railways) And Competitive Landscape

| Product Code: ETC431435 | Publication Date: Jul 2024 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 4 | |

Saudi Arabia Circuit Breaker Market Highlights

| Report Name | Saudi Arabia Circuit Breaker Market |

| Forecast period | 2025-2031 |

| CAGR | 5.7% |

| Growing Sector | Power Generation |

Topics Covered in the Saudi Arabia Circuit Breaker Market Report

The Saudi Arabia Circuit Breaker Market report thoroughly covers the market by Insulation Type, Voltage, Installation, and End User. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers that would assist stakeholders in devising and aligning their market strategies according to the current and future market dynamics.

Saudi Arabia Circuit Breaker Market Synopsis

The Saudi Arabia Circuit Breaker Market is predicted to witness substantial growth in the forecast period. The market is driven by factors such as increasing investments in power generation and transmission infrastructure, rapid industrialization and urbanization, and government initiatives towards renewable energy sources.

According to 6Wresearch, the Saudi Arabia Circuit Breaker Market is projected to grow at a CAGR of 5.7% during the forecast period. One major driver is the increasing investments in power generation and transmission infrastructure, as the country aims to meet its growing energy demand. Additionally, efforts towards renewable energy sources such as solar and wind power are expected to boost the market for circuit breakers in Saudi Arabia. Technological advancements in circuit breaker construction, such as the use of vacuum insulation, are also propelling market growth by providing more efficient and compact solutions. Moreover, rapid industrialization and urbanization in the country are creating a higher demand for reliable and safe electricity supply, further fueling the market growth.

Despite the positive growth prospects, there are certain challenges that may hinder the growth of the Saudi Arabia Circuit Breaker Market. A significant challenge is the volatility in raw material prices, which can impact the overall cost of production and subsequently affect market profitability. Moreover, fluctuations in oil prices, which is a major source of revenue for the country's economy, can also have an indirect impact on the circuit breaker market. Additionally, stringent regulations regarding environmental safety and emissions control pose a challenge to manufacturers who need to comply with these standards while maintaining cost-effectiveness.

Saudi Arabia Circuit Breaker Market: Key Players

Key players in the market include Siemens AG, ABB Ltd., Schneider Electric SE, and General Electric Company. These companies are focusing on strategies like collaborations, mergers & acquisitions, and technological advancements to strengthen their footprints in the market. Currently, Siemens AG holds the dominant share in the market.

Saudi Arabia Circuit Breaker Market: Governmental Regulations

The Saudi Arabia government has implemented various regulations to ensure safety and efficiency in the country's electrical infrastructure. These regulations include mandatory compliance with international standards for electrical equipment, as well as initiatives promoting energy efficiency and sustainability. Additionally, the government has launched several renewable energy projects and set targets for increasing the share of renewable energy sources in the country's overall energy mix. Such initiatives are expected to further drive the demand for circuit breakers in Saudi Arabia.

Future Insights of the Market

The Saudi Arabia Circuit Breaker Market is expected to witness significant growth in the coming years, driven by continuous investments in power infrastructure and increasing demand for renewable energy sources. Technological advancements such as vacuum insulation and smart circuit breakers are also anticipated to drive market growth. Additionally, the ongoing industrialization and urbanisation in the country will continue to create a high demand for reliable and safe electricity supply, further fueling the market. Moreover, with initiatives towards energy efficiency and safety standards in place, the use of advanced circuit breakers is only expected to increase in the future.

Market Segmentation by Insulation Type

According to Dhaval, Research Manager, 6Wresearch, Vacuum Circuit Breaker holds a significant market share due to its extensive use in power distribution networks.

Market Segmentation by Voltage

Medium Voltage Circuit Breakers are expected to hold the majority share due to the rapidly expanding power distribution network in Saudi Arabia.

Market Segmentation by Installation

Outdoor Installation holds the dominant share in the Saudi Arabia Circuit Breaker Market. This can be attributed to the extensive use of these circuit breakers in substations and power plants.

Market Segmentation by End User

The Power Generation sector holds the dominant share in the market, driven by the continuous expansion of power generation capacities in Saudi Arabia.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Circuit Breaker Market Outlook

- Market Size of Saudi Arabia Circuit Breaker Market, 2024

- Forecast of Saudi Arabia Circuit Breaker Market, 2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Revenues & Volume for the Period 2021-2031

- Saudi Arabia Circuit Breaker Market Trend Evolution

- Saudi Arabia Circuit Breaker Market Drivers and Challenges

- Saudi Arabia Circuit Breaker Price Trends

- Saudi Arabia Circuit Breaker Porter's Five Forces

- Saudi Arabia Circuit Breaker Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Insulation Type for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Vacuum Circuit Breaker for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Air Circuit Breaker for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Gas Circuit Breaker for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Oil Circuit Breaker for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Voltage for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Medium Voltage for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By High Voltage for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Installation for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Indoor for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Outdoor for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By End User for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By T&D Utilities for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Power Generation for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Renewables for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Railways for the Period 2021-2031

- Saudi Arabia Circuit Breaker Import Export Trade Statistics

- Market Opportunity Assessment By Insulation Type

- Market Opportunity Assessment By Voltage

- Market Opportunity Assessment By Installation

- Market Opportunity Assessment By End User

- Saudi Arabia Circuit Breaker Top Companies Market Share

- Saudi Arabia Circuit Breaker Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Circuit Breaker Company Profiles

- Saudi Arabia Circuit Breaker Key Strategic Recommendations

Market Segmentation

The market research offers a comprehensive analysis of the following market segments:

By Insulation Type

- Vacuum Circuit Breaker

- Air Circuit Breaker

- Gas Circuit Breaker

- Oil Circuit Breaker

By Voltage

- Medium Voltage

- High Voltage

By Installation

- Indoor

- Outdoor

By End User

- T&D Utilities

- Power Generation

- Renewables

- Railways

Saudi Arabia Circuit Breaker Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Saudi Arabia Circuit Breaker Market Overview |

| 3.1 Saudi Arabia Country Macro Economic Indicators |

| 3.2 Saudi Arabia Circuit Breaker Market Revenues & Volume, 2021 & 2031F |

| 3.3 Saudi Arabia Circuit Breaker Market - Industry Life Cycle |

| 3.4 Saudi Arabia Circuit Breaker Market - Porter's Five Forces |

| 3.5 Saudi Arabia Circuit Breaker Market Revenues & Volume Share, By Insulation Type, 2021 & 2031F |

| 3.6 Saudi Arabia Circuit Breaker Market Revenues & Volume Share, By Voltage, 2021 & 2031F |

| 3.7 Saudi Arabia Circuit Breaker Market Revenues & Volume Share, By Installation, 2021 & 2031F |

| 3.8 Saudi Arabia Circuit Breaker Market Revenues & Volume Share, By End User, 2021 & 2031F |

| 4 Saudi Arabia Circuit Breaker Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing investments in infrastructure projects in Saudi Arabia. |

| 4.2.2 Growing demand for electricity in various sectors such as residential, commercial, and industrial. |

| 4.2.3 Stringent government regulations and initiatives focusing on electrical safety and energy efficiency. |

| 4.3 Market Restraints |

| 4.3.1 Volatility in raw material prices impacting manufacturing costs. |

| 4.3.2 Competition from alternative technologies like smart grids and renewable energy sources. |

| 4.3.3 Economic uncertainties affecting overall investment in the construction sector. |

| 5 Saudi Arabia Circuit Breaker Market Trends |

| 6 Saudi Arabia Circuit Breaker Market, By Types |

| 6.1 Saudi Arabia Circuit Breaker Market, By Insulation Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Insulation Type, 2021-2031F |

| 6.1.3 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Vacuum Circuit Breaker, 2021-2031F |

| 6.1.4 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Air Circuit Breaker, 2021-2031F |

| 6.1.5 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Gas Circuit Breaker, 2021-2031F |

| 6.1.6 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Oil Circuit Breaker, 2021-2031F |

| 6.2 Saudi Arabia Circuit Breaker Market, By Voltage |

| 6.2.1 Overview and Analysis |

| 6.2.2 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Medium Voltage, 2021-2031F |

| 6.2.3 Saudi Arabia Circuit Breaker Market Revenues & Volume, By High Voltage, 2021-2031F |

| 6.3 Saudi Arabia Circuit Breaker Market, By Installation |

| 6.3.1 Overview and Analysis |

| 6.3.2 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Indoor, 2021-2031F |

| 6.3.3 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Outdoor, 2021-2031F |

| 6.4 Saudi Arabia Circuit Breaker Market, By End User |

| 6.4.1 Overview and Analysis |

| 6.4.2 Saudi Arabia Circuit Breaker Market Revenues & Volume, By T&D Utilities, 2021-2031F |

| 6.4.3 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Power Generation, 2021-2031F |

| 6.4.4 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Renewables, 2021-2031F |

| 6.4.5 Saudi Arabia Circuit Breaker Market Revenues & Volume, By Railways, 2021-2031F |

| 7 Saudi Arabia Circuit Breaker Market Import-Export Trade Statistics |

| 7.1 Saudi Arabia Circuit Breaker Market Export to Major Countries |

| 7.2 Saudi Arabia Circuit Breaker Market Imports from Major Countries |

| 8 Saudi Arabia Circuit Breaker Market Key Performance Indicators |

| 8.1 Number of new infrastructure projects announced or initiated in Saudi Arabia. |

| 8.2 Growth rate of electricity consumption in key sectors. |

| 8.3 Adoption rate of energy-efficient circuit breaker technologies in the market. |

| 8.4 Average downtime due to circuit breaker failures in critical industries. |

| 8.5 Number of reported electrical safety incidents related to circuit breakers in Saudi Arabia. |

| 9 Saudi Arabia Circuit Breaker Market - Opportunity Assessment |

| 9.1 Saudi Arabia Circuit Breaker Market Opportunity Assessment, By Insulation Type, 2021 & 2031F |

| 9.2 Saudi Arabia Circuit Breaker Market Opportunity Assessment, By Voltage, 2021 & 2031F |

| 9.3 Saudi Arabia Circuit Breaker Market Opportunity Assessment, By Installation, 2021 & 2031F |

| 9.4 Saudi Arabia Circuit Breaker Market Opportunity Assessment, By End User, 2021 & 2031F |

| 10 Saudi Arabia Circuit Breaker Market - Competitive Landscape |

| 10.1 Saudi Arabia Circuit Breaker Market Revenue Share, By Companies, 2024 |

| 10.2 Saudi Arabia Circuit Breaker Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Insulation Type (Vacuum Circuit Breaker, Air Circuit Breaker, Gas Circuit Breaker, Oil Circuit Breaker), By Voltage (Medium Voltage, High Voltage), By Installation (Indoor, Outdoor), By End User (T&D Utilities, Power Generation, Renewables, Railways) And Competitive Landscape

| Product Code: ETC431435 | Publication Date: Nov 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

Saudi Arabia Circuit Breaker Market| Country-Wise Share and Competition Analysis

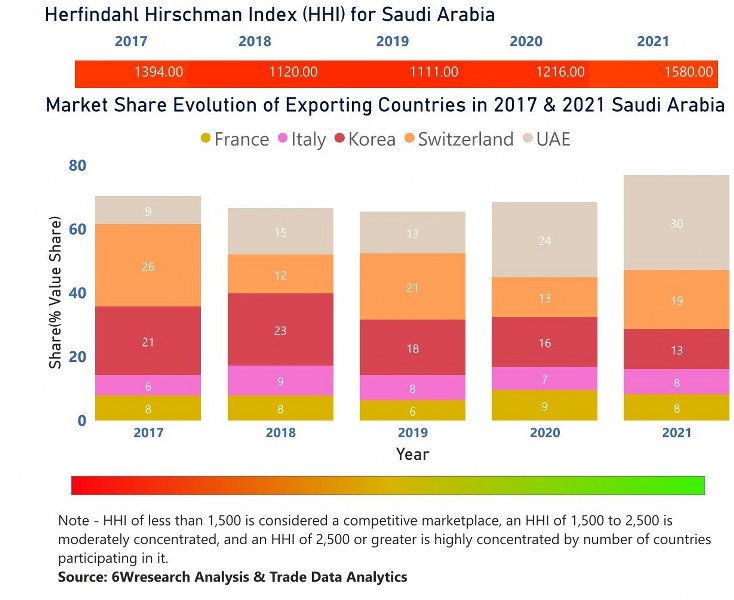

In the year 2021, UAE was the largest exporter in terms of value, followed by Switzerland. It has registered a growth of 79.85% over the previous year. While Switzerland registered a growth of 110.88% as compare to the previous year. In the year 2017 Switzerland was the largest exporter followed by Korea. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Saudi Arabia has the Herfindahl index of 1394 in 2017 which signifies high competitiveness also in 2021 it registered a Herfindahl index of 1580 which signifies moderately concentrated in the market.

Saudi Arabia Circuit Breaker Market - Export Market Opportunities

Saudi Arabia Circuit Breaker Market Synopsis

Saudi Arabia Circuit Breaker Market is expected to grow during the forecast period. This growth can be attributed to the increasing demand for circuit breakers in the Kingdom due to stringent regulations and growing infrastructure investments.

According to 6Wresearch, the Saudi Arabia Circuit Breaker Market size is expected to grow during 2022-2028. A circuit breaker is a device used to interrupt electric power in a circuit. They are typically found in electrical systems and can be operated by a switch or motor, to interrupt the flow of electricity when it becomes overloaded. When too much current flows through a wire, it can create an electric spark that can set off other wires and start a fire. Circuit breakers help prevent accidents like this from happening.

A circuit breaker is a switch used on an electrical circuit to interrupt the flow of electricity should the circuit become overloaded. Circuit breakers can also be used to protect equipment from overloading. Most modern electricity circuits are protected by a number of circuit breakers.

Drivers for the Saudi Arabia Circuit Breaker Market

The main drivers of this market are infrastructure investments (such as power generation), expansions by large businesses (such as telecoms operators), and new regulations that are issued by authorities (such as those related to taxation).

The market is driven by the increasing number of infrastructure projects in the country, which are expected to boost demand for circuit breakers. In addition, increasing demand for power and renewable energy across various sectors is also contributing to the growth of the circuit breaker market in Saudi Arabia.

The market is witnessing a growing demand for circuit breakers owing to the increasing urbanization in the country. Additionally, the government initiatives such as promoting renewable energy and upgrading infrastructure are also fuelling the growth of the Saudi Arabia circuit breaker market.

This is due to the increasing demand for energy security and safety as well as increased investment in infrastructure projects in the country. The rising population and increasing industrialization and rising oil prices and increasing investment in the country's power sector are also key drivers of the market.

The growth of the Saudi Arabia Circuit Breaker Market share is primarily driven by the increasing demand for energy security and safety, as well as increased investment in infrastructure projects in the country.

Challenges for Saudi Arabia Circuit Breaker Market

Constraints such as insufficient manufacturing capacities and low electrification rates could limit the market's growth potential. Moreover, concerns over cyber security could dampen consumer sentiment and hamper investment in new infrastructure projects.

Additionally, some restraints that could affect this market such as improper installation of circuit breakers and lack of awareness regarding their use. Regulatory constraints could also hamper the Saudi Arabia Circuit Breaker Market growth in certain regions of the country.

The limited resources are also a challenge. Saudi Arabia has few manufacturing plants that can produce circuit breakers, so importation is often necessary. This limits the country's ability to compete with other countries in the market.

Market Analysis based on Voltage

Saudi Arabia is home to several power stations with medium voltage and high voltage lines. Medium voltage lines range from 50 kilovolts to 3,000 kilovolts while high voltage lines can go as high as 30,000 kilovolts.

Each power station has a dedicated circuit breaker that can be used to safely shut down the line in the event of an emergency. These circuit breakers are usually located near the entrance of the power plant so that employees can easily reach them in case of an emergency.

Market Analysis based on Insulation Type

Based on Insulation Type, Air circuit breakers are expected to witness the fastest growth rate in the Saudi Arabia circuit breaker market revenue, owing to increasing awareness about their safety features as well as their enhanced performance. Gas circuit breakers are also anticipated to witness a moderate growth rate due to growing awareness about their benefits such as greater accuracy and faster response time. Oil circuit breakers are expected to register a lower growth rate in the near future, owing to concerns over possible environmental hazards posed by their operation.

Although vacuum circuit breakers are effective at protecting against dangerous levels of pressure, they can sometimes malfunction due to various incidents. There are several challenges that need to be addressed when it comes to using vacuum circuit breakers, including the fact that they can be affected by gases. Additionally, vacuum circuit breakers are not always reliable when it comes to preventing large power outages.

Impact of COVID-19 on the Saudi Arabia Circuit Breaker Market

The pandemic affected the Middle East Circuit Breaker Market significantly. This is due to multiple demand and supply problems. The market witnessed a huge decline for the end users as new projects were halted or cancelled. This resulted in a massive decline in sales in the Saudi Arabia Circuit Breaker Market. And it was further escalated by the increasing price of the product and the economic slowdown in the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2021.

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Circuit Breaker Market Outlook

- Market Size of Saudi Arabia Circuit Breaker Market, 2021

- Forecast of Saudi Arabia Circuit Breaker Market, 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Revenues & Volume for the Period 2018 - 2028

- Saudi Arabia Circuit Breaker Market Trend Evolution

- Saudi Arabia Circuit Breaker Market Drivers and Challenges

- Saudi Arabia Circuit Breaker Price Trends

- Saudi Arabia Circuit Breaker Porter's Five Forces

- Saudi Arabia Circuit Breaker Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Insulation Type for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Vacuum Circuit Breaker for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Air Circuit Breaker for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Gas Circuit Breaker for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By OilÃ? Circuit Breaker for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Voltage for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Medium Voltage for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By High Voltage for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Installation for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Indoor for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Outdoor for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By End User for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By T&D Utilities for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Power Generation for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Renewables for the Period 2018 - 2028

- Historical Data and Forecast of Saudi Arabia Circuit Breaker Market Revenues & Volume By Railways for the Period 2018 - 2028

- Saudi Arabia Circuit Breaker Import Export Trade Statistics

- Market Opportunity Assessment By Insulation Type

- Market Opportunity Assessment By Voltage

- Market Opportunity Assessment By Installation

- Market Opportunity Assessment By End User

- Saudi Arabia Circuit Breaker Top Companies Market Share

- Saudi Arabia Circuit Breaker Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Circuit Breaker Company Profiles

- Saudi Arabia Circuit Breaker Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Insulation Type

- Vacuum Circuit Breaker

- Air Circuit Breaker

- Gas Circuit Breaker

- Oil & Circuit Breaker

By Voltage

- Medium Voltage

- High Voltage

By Installation

- Indoor

- Outdoor

By End User

- T&D Utilities

- Power Generation

- Renewables

- Railways

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero