Saudi Arabia Coffee Market (2021-2027) | Size, Share, Trends, Growth, Revenue, Analysis, Forecast, Value, Outlook, Company & COVID-19 IMPACT

Market Forecast By Bean Types (Arabica, Robusta & Others), By Coffee Types (Ground Coffee, Instant Coffee, Whole-Bean, Coffee Pod And Capsules), By Distribution Channel (Hypermarkets/ Supermarkets, Online Channels, Cafes, And Food Services & Others), By Applications (Hot Coffee, Cold Coffee),By Regions (Central Region, Southern Region, Eastern Region, Western Region) And Competitive Landscape

| Product Code: ETC054354 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 91 | No. of Figures: 38 | No. of Tables: 3 |

Saudi Arabia Coffee Market Size & Growth Rate

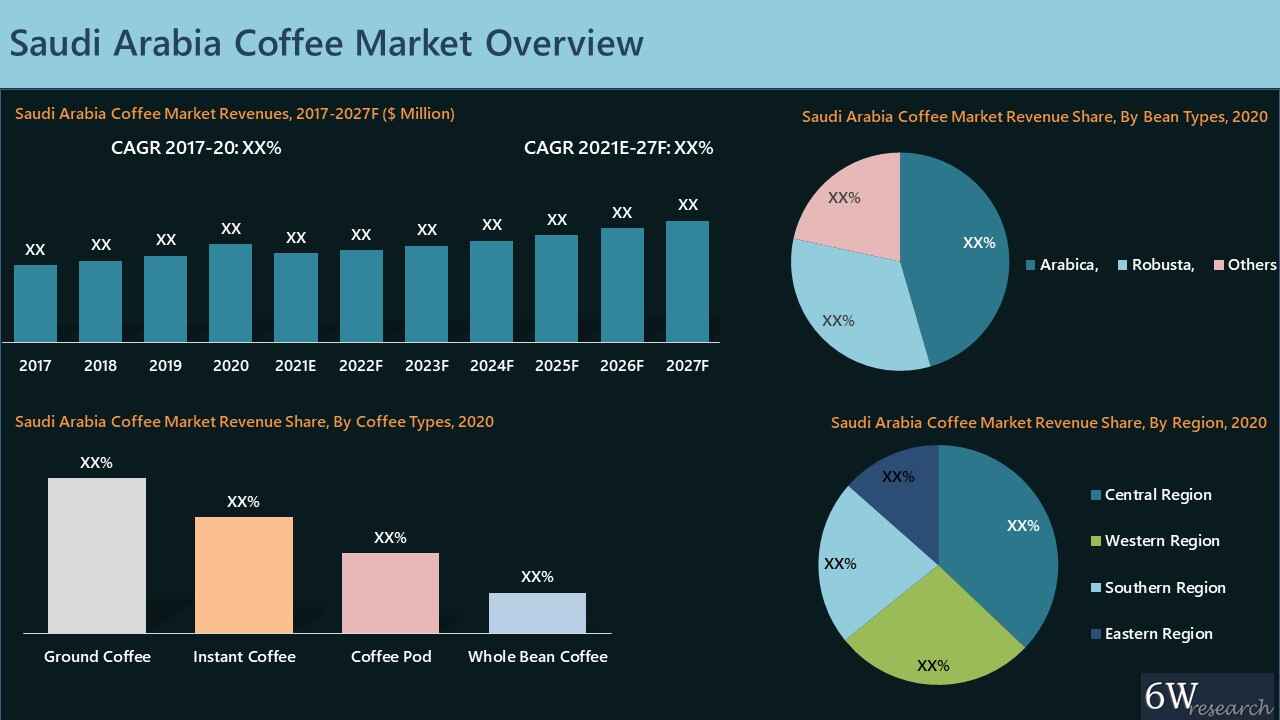

The Saudi Arabia Coffee Market is projected to grow at a CAGR of 6.2% during 2021–2027. Growth is driven by evolving consumer preferences, a fast-paced lifestyle, rising working-class and youth populations, and increased adoption of Western coffee culture.

Saudi Arabia Coffee Market Synopsis

Saudi Arabia Coffee Market grew at a considerable rate in recent years on the back of changing consumer preferences, a fast-paced lifestyle, and a growing working-class population. Additionally, the coffee market across the country is majorly import-driven. African, Asian, and Latin American nations are the major exporters of coffee across the Kingdom of Saudi Arabia. The market witnessed substantial growth during the past years on account of the growing young population, rising adoption of western culture combined with an increasing number of foreign tourists. Additionally, Arabica garnered the maximum revenue share for the year 2020 and would maintain its dominance in the forthcoming years, owing to high demand from the F&B industry due to the low caffeine content and high lipid content & acidic in nature. However, Robusta would witness considerable growth in the upcoming years, on account of the high demand for black coffee among health-conscious people.

Furthermore, the spread of COVID-19 led to an unreasonable hike in the coffee market, owing to the ‘stringent nation-wide lockdown policy’ adopted by the Saudi government, which resulted in, unnecessary piling of packed food items which also including instant coffee packs and pouches by the inhabitants of the country during 2020.

According to 6Wresearch, Saudi Arabia Coffee Market size is projected to grow at a CAGR of 6.2% during 2021-2027. Based on regions, the central region is accounted for the maximum share in terms of revenues on account of the residential & working-class population is relatively high, coupled with the presence of business workplaces and working spots around Riyadh city. However, the western region would witness substantial growth in the upcoming years of Saudi Arabia coffee market, on account of the rise in the number of tourists footprints owing to the presence of famous Hajj places in Mecca & Medina, which in turn, would increase the demand for coffee from cafes, coffee houses, food outlets and restaurants & hotels.

Coffee Market Size in Saudi Arabia

Coffee in Saudi Arabia is getting more and more popular with each passing day, and it is driving the Coffee Market in the country. The Coffee Market Size in Saudi Arabia is estimated to grow at a XXX in the near future. The market is an inseparable part of the Middle East Coffee Market. The sector is accomplishing growth owing to the fast-paced lifestyle, transforming consumer preferences, and a rising working-class population. In addition, the coffee sector across the nation is mainly import-driven. The sector is witnessing rapid growth in the country and it is progressing in an effortless manner.

The sector in the country has become one of the most essential sectors as it has been attaining growth in the most efficient manner. The changing lifestyle of people is one of the key factors stimulating the sector growth in the country.

Market Analysis By Bean Types

Further, based on bean types, Arabica occupied the majority of revenue share in 2020 with a CAGR of 7.4% 2020, and the same trend is expected during the forthcoming years, owing to end-consumer taste combined with health benefits for such bean types as Arabica is much sweeter and has more lipid contents than its other counterparts i.e. Robusta, Liberica, and Excelsa. Additionally, the higher acid content in Arabica beans makes them perfect for improving the taste of wines and chocolates. Hence, Arabica is highly demanded in the F&B industry of Saudi Arabia.

Market Analysis By Coffee Types

Further, based on coffee types, ground coffee accounted for the highest revenue share in the Saudi Arabia coffee market in 2020 owing to its high demand in cafes, coffee shops, restaurants and food outlets due to its taste, essence and high antioxidants. However, instant coffee would witness substantial growth in the forthcoming years on account of ease of making and time-saving.

Market Analysis By Application

By distribution channel, hypermarket/supermarket and online stores bagged the highest revenue share, capturing around 60% of the total market revenues in 2020, on account of limitless buying options available, in comparison to its counterpart i.e., online platform combined with a lack of trust while making payments via digital platforms. However, the online channel is projected to witness significant growth opportunities in the forthcoming years, owing to contactless buying/delivery and cashless transaction options.

Key Attractiveness of The Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Coffee Market Overview

- Saudi Arabia Coffee Market Outlook

- Saudi Arabia Coffee Market Forecast

- Historical Data and Forecast of Saudi Arabia Coffee Market Revenues By Bean Types, Coffee Types, Distribution Channel, Applications and Regions for the Period 2017-2027F

- Market Drivers & Restraints

- Saudi Arabia Coffee Market Trends & Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Saudi Arabia Coffee Market Shares, By Company

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Beans Type

- Arabica

- Robusta

- Others

By Coffee Types

- Ground Coffee

- Instant Coffee

- Whole-Bean

- Coffee Pod & Capsules

By Distribution Channel

- Hypermarket/Supermarket

- Online Channels

- Caf and Food Services

- Others

By Applications

- Hot Coffee

- Cold Coffee

By Regions

- Central Region

- Southern Region

- Eastern Region

- Western Region

Saudi Arabia Coffee Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology - Sources of Information |

| 2.5 Robust Forecasting Model |

| 2.6 Assumptions |

| 3. Saudi Arabia Coffee Market Overview |

| 3.1 Saudi Arabia Coffee Market Revenues |

| 3.2 Saudi Arabia Coffee Market Industry Life Cycle |

| 3.3 Saudi Arabia Coffee Market Porter’s Five Forces |

| 4. Saudi Arabia Coffee Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing urbanization and modernization leading to a growing coffee culture |

| 4.2.2 Changing consumer preferences towards specialty and gourmet coffee |

| 4.2.3 Rise in disposable income and middle-class population increasing coffee consumption |

| 4.3 Market Restraints |

| 4.3.1 High import costs and fluctuations in coffee prices affecting market stability |

| 4.3.2 Limited coffee production within Saudi Arabia leading to dependency on imports |

| 4.3.3 Cultural factors and conservative attitudes towards coffee consumption in some regions |

| 5. Saudi Arabia Coffee Market Trends |

| 6. Saudi Arabia Coffee Market Overview, By Bean Types |

| 6.1 Saudi Arabia Coffee Market Revenue Share, By Bean Types, 2020 & 2027F |

| 6.2 Saudi Arabia Coffee Market Revenues, By Bean Types, 2017-2027F |

| 6.2.1 Saudi Arabia Coffee Market Revenues, By Arabica Bean Types, 2017-2027F |

| 6.2.2 Saudi Arabia Coffee Market Revenues, By Robusta Bean Types, 2017-2027F |

| 6.2.3 Saudi Arabia Coffee Market Revenues, By Others Bean Types, 2017-2027F |

| 7. Saudi Arabia Coffee Market Overview, By Coffee Types |

| 7.1 Saudi Arabia Coffee Market Revenue Share, By Coffee Types, 2020 & 2027F |

| 7.2 Saudi Arabia Coffee Market Revenues, By Coffee Types, 2017-2027F |

| 7.2.1 Saudi Arabia Ground Coffee Market Revenues, 2017-2027F |

| 7.2.2 Saudi Arabia Instant Coffee Market Revenues, 2017-2027F |

| 7.2.3 Saudi Arabia Whole-Bean Coffee Market Revenues, 2017-2027F |

| 7.2.4 Saudi Arabia Coffee Pods & Capsules Market Revenues, 2017-2027F |

| 8. Saudi Arabia Coffee Market Overview, By Distribution Channel |

| 8.1 Saudi Arabia Coffee Market Revenue Share, By Distribution Channel, 2020 & 2027F |

| 8.2 Saudi Arabia Coffee Market Revenues, By Distribution Channel, 2017-2027F |

| 8.2.1 Saudi Arabia Coffee Market Revenues, By Hypermarkets/Supermarkets, 2017-2027F |

| 8.2.2 Saudi Arabia Coffee Market Revenues, By Online Platform, 2017-2027F |

| 8.2.3 Saudi Arabia Coffee Market Revenues, By Cafes & Food Services, 2017-2027F |

| 8.2.4 Saudi Arabia Coffee Market Revenues, By Others, 2017-2027F |

| 9. Saudi Arabia Coffee Market Overview, By Applications |

| 9.1 Saudi Arabia Coffee Market Revenue Share, By Applications, 2020 & 2027F |

| 9.2 Saudi Arabia Coffee Market Revenues, By Applications, 2017-2027F |

| 9.2.1 Saudi Arabia Coffee Market Revenues, By Hot Coffee, 2017-2027F |

| 9.2.2 Saudi Arabia Coffee Market Revenues, By Cold Coffee, 2017-2027F |

| 10. Saudi Arabia Coffee Market Overview, By Regions |

| 10.1 Saudi Arabia Coffee Market Revenue Share, By Regions, 2020 & 2027F |

| 10.2 Saudi Arabia Coffee Market Revenues, By Regions, 2017-2027F |

| 10.2.1 Saudi Arabia Coffee Market Revenues, By Central Region, 2017-2027F |

| 10.2.2 Saudi Arabia Coffee Market Revenues, By Western Region, 2017-2027F |

| 10.2.3 Saudi Arabia Coffee Market Revenues, By Southern Region, 2017-2027F |

| 10.2.4 Saudi Arabia Coffee Market Revenues, By Eastern Region, 2017-2027F |

| 11. Saudi Arabia Coffee Market Key Performance Indicators |

| 12. Saudi Arabia Coffee Market Opportunity Assessment |

| 12.1 Saudi Arabia Coffee Market Opportunity Assessment, By Bean Types, 2027F |

| 12.2 Saudi Arabia Coffee Market Opportunity Assessment, By Coffee Types, 2027F |

| 12.3 Saudi Arabia Coffee Market Opportunity Assessment, By Applications, 2027F |

| 12.4 Saudi Arabia Coffee Market Opportunity Assessment, By Distribution Channel, 2027F |

| 12.5 Saudi Arabia Coffee Market Opportunity Assessment, By Regions, 2027F |

| 13. Saudi Arabia Coffee Market Competitive Landscape |

| 13.1 Saudi Arabia Coffee Market Revenue Share, By Companies, 2020 |

| 13.2 Saudi Arabia Coffee Market Competitive Benchmarking |

| 13.2.1 Saudi Arabia Coffee Market Competitive Benchmarking, By Operating Parameters |

| 13.2.2 Saudi Arabia Coffee Market Competitive Benchmarking, By Technical Parameters |

| 14. Company Profiles |

| 14.1 Nestle S.A. |

| 14.2 Zino Davidoff Group |

| 14.3 Food Empire Holdings Ltd. |

| 14.4 Baja Food Industries Co. |

| 14.5 Saudi Goody Products Marketing Company |

| 14.6 Hintz Foodstuff Production GmbH |

| 14.7 The J.M. Sucker Company |

| 14.8 Power Root (M) Sdn. Bhd. |

| 14.9 Societe Est. Michel Najjar Sal |

| 14.10 Luigi Lavazza Spa |

| 14.11 Yousef Al Rajhi Group |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Tables |

| Table 1: Saudi Arabia Coffee Market Revenues, By Bean Types, 2017-2027F ($ Million) |

| Table 2: Saudi Arabia Ongoing Hospitality Projects |

| Table 3: Saudi Arabia Total Number of Foreign Employees, By Region, 2019 |

| List of Figures |

| Figure 1: Saudi Arabia Coffee Market Revenues, 2017-2027F ($ Million) |

| Figure 2: Percentage of Positive Aspect Related to Coffee Consumption, 2020 |

| Figure 3: Projected revenues for “restaurants, bars and canteens”, 2019- 2023, billion SR |

| Figure 4: Distribution of Restaurants and Shops Across Saudi Arabia, 2018 |

| Figure 5: Saudi Arabia Coffee Market Revenue Share, By Bean Types, 2020 & 2027F |

| Figure 6: Saudi Arabia Coffee Market Revenue Share, By Coffee Types, 2020 & 2027F |

| Figure 7: Saudi Arabia Ground Coffee Market Revenues, 2017-2027F ($ Million) |

| Figure 8: Saudi Arabia Instant Coffee Market Revenues, 2017-2027F ($ Million) |

| Figure 9: Saudi Arabia Whole Bean Coffee Market Revenues, 2017-2027F ($ Million) |

| Figure 10: Saudi Arabia Coffee Pods & Capsules Market Revenues, 2017-2027F ($ Million) |

| Figure 11: Saudi Arabia Coffee Market Revenue Share, By Distribution Channel, 2020 & 2027F |

| Figure 12: Saudi Arabia Coffee Market Revenues, By Hypermarkets/Supermarkets, 2017-2027F ($ Million) |

| Figure 13: Saudi Arabia Coffee Market Revenues, By Online Platform, 2017-2027F ($ Million) |

| Figure 14: Saudi Arabia Coffee Market Revenues, By Cafes & Food Services, 2017-2027F ($ Million) |

| Figure 15: Saudi Arabia Coffee Market Revenues, By Others, 2017-2027F ($ Million) |

| Figure 16: Saudi Arabia Coffee Market Revenue Share, By Applications, 2020 & 2027F |

| Figure 17: Saudi Arabia Coffee Market Revenues, By Hot Coffee, 2017-2027F ($ Million) |

| Figure 18: Saudi Arabia Coffee Market Revenues, By Cold Coffee, 2017-2027F ($ Million) |

| Figure 19: Saudi Arabia Coffee Market Revenue Share, By Regions, 2020 & 2027F |

| Figure 20: Saudi Arabia Coffee Market Revenues, By Central Region, 2017-2027F ($ Million) |

| Figure 21: Saudi Arabia Coffee Market Revenues, By Western Region, 2017-2027F ($ Million) |

| Figure 22: Saudi Arabia Coffee Market Revenues, By Southern Region, 2017-2027F ($ Million) |

| Figure 23: Saudi Arabia Coffee Market Revenues, By Eastern Region, 2017-2027F ($ Million) |

| Figure 24: Top 5 Cuisines Categories Across Riyadh, 2020 |

| Figure 25: Top 5 Cuisines Categories Across Jeddah, 2020 |

| Figure 26: Saudi Arabia Existing and Upcoming Quality Hotel Supply (2020-2022) |

| Figure 27: Saudi Arabia Upcoming First Class & Luxury Hotel Projects, (2020-23) |

| Figure 28: Saudi Arabia Population Distribution, By Gender, 2019 |

| Figure 29: Saudi Arabia Distribution of Male Population, By Age Group, 2019 |

| Figure 30: Saudi Arabia Distribution of Female Population, By Age Group, 2019 |

| Figure 31: Saudi Arabia Distribution of Population, By Age Group, By Gender, 2019 (Million) |

| Figure 32: Saudi Arabia Coffee Market Opportunity Assessment, By Bean Types, 2027F |

| Figure 33: Saudi Arabia Coffee Market Opportunity Assessment, By Coffee Types, 2027F |

| Figure 34: Saudi Arabia Coffee Market Opportunity Assessment, By Distribution Channel, 2027F |

| Figure 35: Saudi Arabia Coffee Market Opportunity Assessment, By Applications, 2027F |

| Figure 36: Saudi Arabia Coffee Market Opportunity Assessment, By Regions, 2027F |

| Figure 37: Saudi Arabia Coffee Market Revenue Share and Revenue Ranking, By Companies, 2020 |

| Figure 38: Number of Internet Users for E-Commerce in Saudi Arabia, 2019-2024(Million Users) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero