Saudi Arabia Construction Equipment Market (2023-2029) | Size, Share, Growth, Trends, Forecast, Revenue, industry, Outlook & COVID-19 IMPACT

Market ForecastBy Types (Mobile Crane, Tracked Dozer, Earthmoving Equipment, Material Handling Equipment, Dump Truck, Aerial Equipment, Concrete Mixer Trucks, Road Construction Equipment), By Size (Below 15 Ton, 16 – 50 Ton, 51 – 80 Ton, Above 80 Ton), By End Use (Oil & Gas, Construction, Mining, Others (Municipality, Road Construction etc.)), By Regions (Central Region, Western Region, Eastern Region, Southern Region)and Competitive Landscape

| Product Code: ETC060909 | Publication Date: Sep 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 93 | No. of Figures: 29 | No. of Tables: 18 |

Saudi Arabia Construction Equipment Market Synopsis

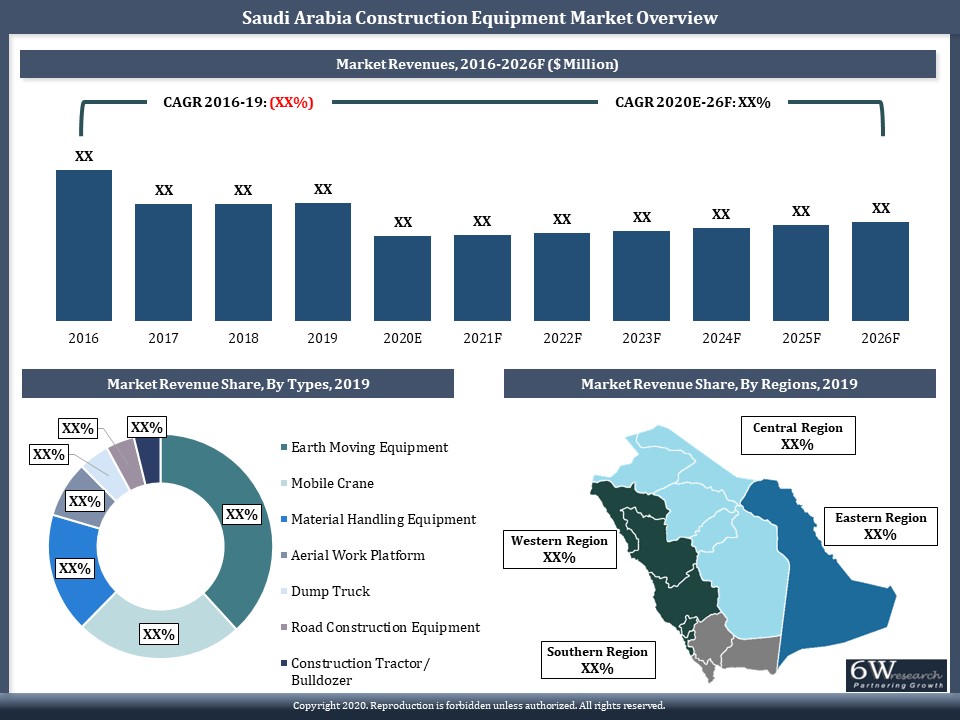

Saudi Arabia construction equipment market was growing modestly before 2020 on account of government expenditure on infrastructure development activities. However, the market witnessed stagnation in 2020 due to COVID pandemic and in 2021 several projects were impacted due to inadequate funding which resulted in the suspension of many large-scale construction projects, thereby affecting the demand for construction equipment negatively in that year. However, there has been rise in government infrastructure spending underpinned by initiatives such as Sustainable Development Vision 2030 coupled with rising FDI, and private sector investment. This has led to sudden increase in the demand for construction equipment in the country.

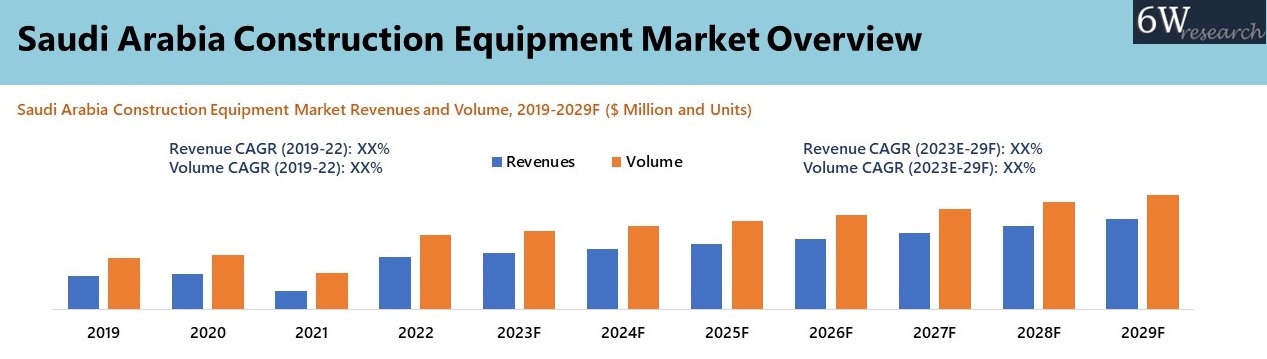

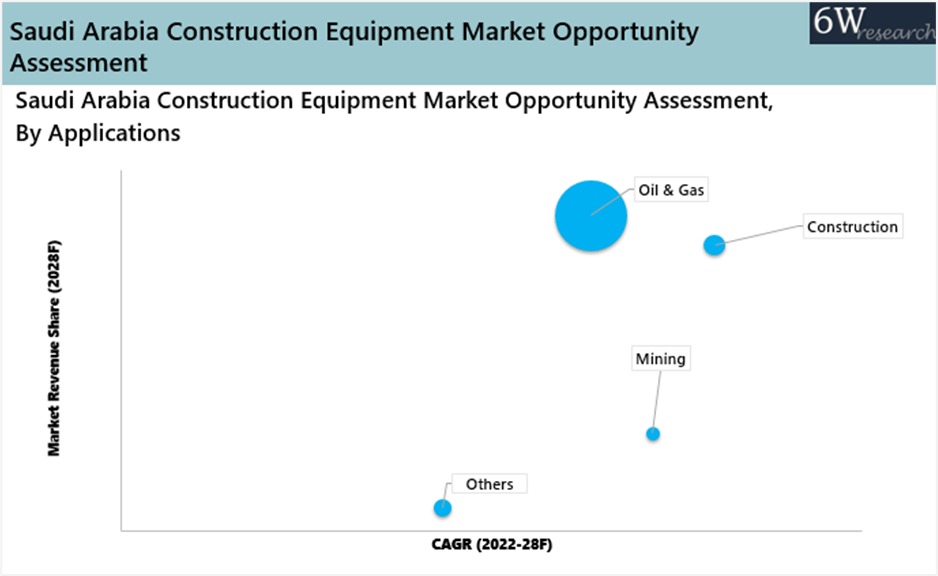

According to 6Wresearch, Saudi Arabia Construction Equipment market revenues is projected to grow at a CAGR of 6.4% during 2023-2029. This growth is being fueled by growing population, rapid urbanization and rise in tourist arrival as the kingdom seeks to diversify its economy and create more avenues of income other than sale of oil and gas. Mining has also seen rise in investment as Saudi Arabia holds valuable mineral resources, including bauxite, phosphate, gold, copper, and zinc. However, oil and gas would continue to be one of the largest generators of demand for construction equipment as the kingdom holds a significant oil and gas reserve and oil and gas are deemed to be major source to meet the rising demand of energy globally.

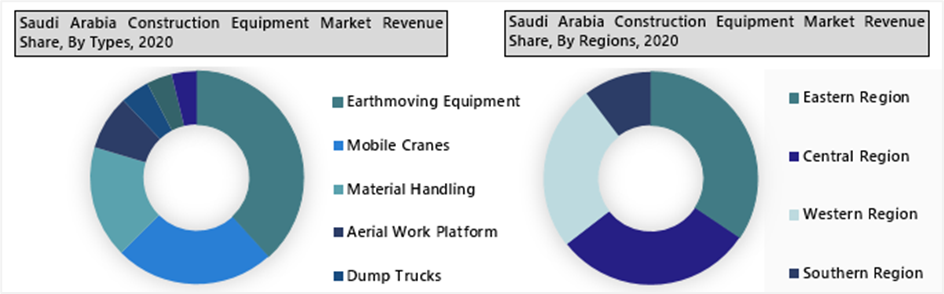

Market by Types

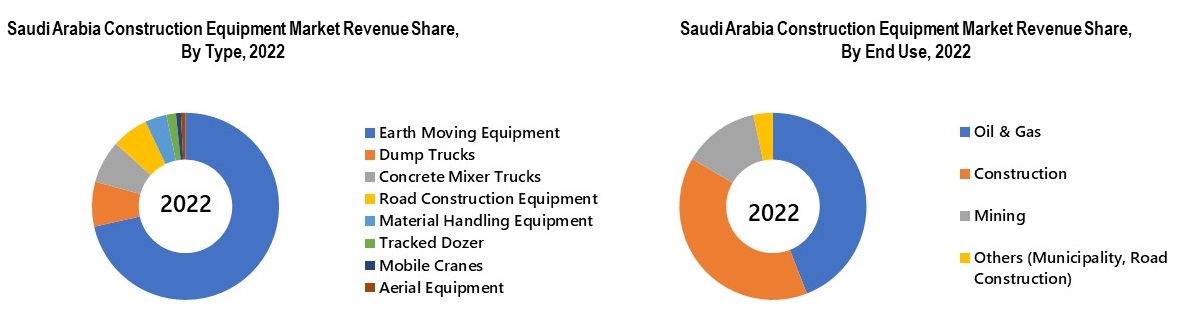

Earth moving equipment is expected to dominate the Saudi Arabia Construction Equipment Industry due to their widespread use in construction and adaptability across various sectors, ensuring consistent demand. Dump trucks are also in demand as they are used extensively for transportation at construction sites.

Market by Size

Construction equipment in the 16-50 ton range, such as excavators, wheel loaders, and bulldozers, is highly sought after for their versatility, capacity, stability, and advanced technology, making them ideal for medium to large-scale projects.

Market by End Use

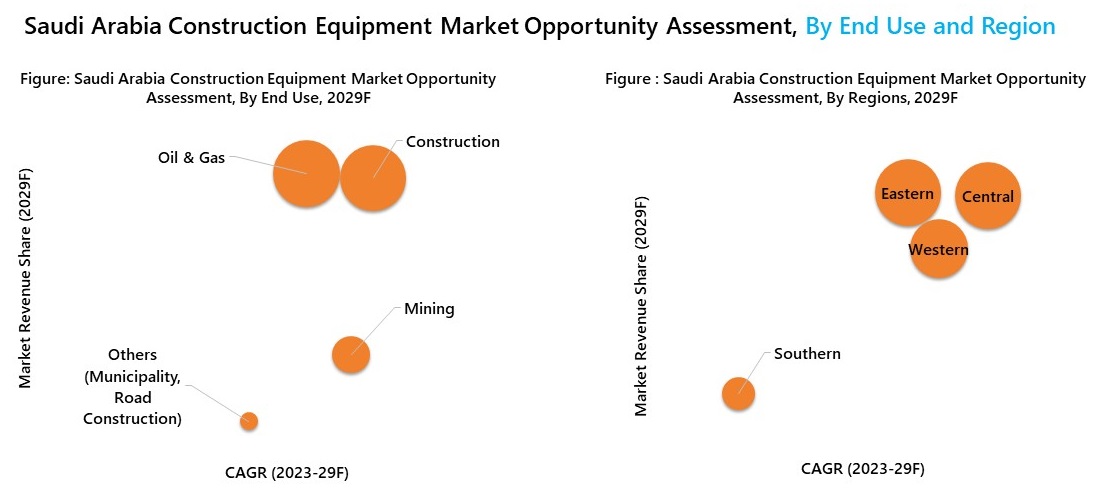

Oil & Gas sector along with construction sector would occupy the most of the market as multi-fold rise in investment into infrastructure projects by the Saudi government and Oil and gas contributing major income to the kingdom.

Market by Regions

Eastern region has the most of the Saudi Oil fields, therefore it generates major demand for construction equipment which are used for multiple purposes. The west region is witnessing major construction projects such as Neom, Red sea project, etc in which a numerous equipment are being deployed.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Construction Equipment Market Overview

- Saudi Arabia Construction Equipment Market Outlook

- Saudi Arabia Construction Equipment Market Forecast

- Historical Data and Forecast of Saudi Arabia Construction Equipment Market Revenues for the Period 2019-2029F

- Historical Data and Forecast of Saudi Arabia Construction Equipment Market Revenues, By Types for the Period 2019-2029F

- Historical Data and Forecast of Saudi Arabia Construction Equipment Market Revenues, By Applications for the Period 2019-2029F

- Historical Data and Forecast of Saudi Arabia Construction Equipment Market Revenues, By Regions for the Period 2019-2029F

- Market Drivers and Restraints

- Market Trends

- Industry Life Cycle

- Saudi Arabia Construction Equipment Market – Porter’s Five Forces

- Market Opportunity Assessment

- Company Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

- Mapping of Key Chinese Players by Models

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Types

- Mobile Crane

- Tracked Dozer

- Earthmoving Equipment

- Material Handling Equipment

- Dump Truck

- Aerial Equipment

- Concrete Mixer Trucks

- Road Construction Equipment

By Size

- Below 15 Ton

- 16 – 50 Ton

- 51 – 80 Ton

- Above 80 Ton

By End Use

- Oil & Gas

- Construction

- Mining

- Others (Municipality, Road Construction etc)

By Regions

- Central Region

- Western Region

- Eastern Region

- Southern Region

Saudi Arabia Construction Equipment Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Construction Equipment Market Overview |

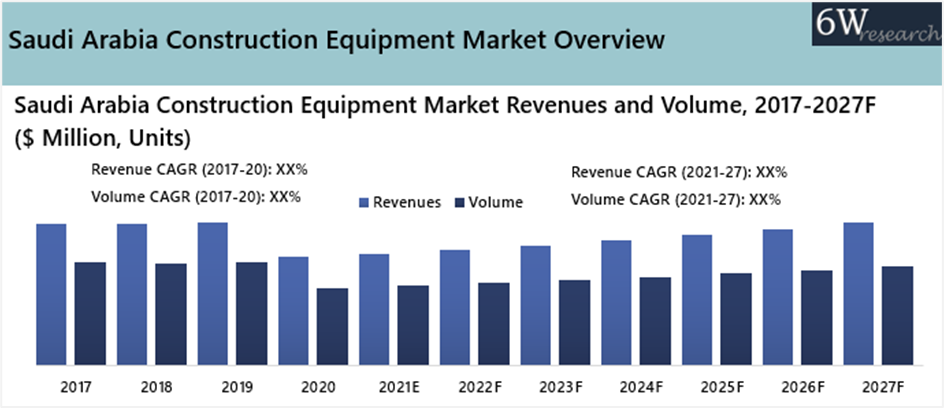

| 3.1 Saudi Arabia Construction Equipment Market Revenues and Volume, 2019-2029F |

| 3.2 Saudi Arabia Construction Equipment Market - Industry Life Cycle |

| 3.3 Saudi Arabia Construction Equipment Market - Porter’s Five Forces |

| 4. Saudi Arabia Construction Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Government investments in infrastructure projects |

| 4.2.2 Growth in the real estate sector |

| 4.2.3 Increasing urbanization and industrialization in Saudi Arabia |

| 4.3 Market Restraints |

| 4.3.1 Fluctuations in oil prices affecting government spending |

| 4.3.2 Regulatory challenges and bureaucracy in the construction industry |

| 4.3.3 Competition from rental equipment services |

| 5. Saudi Arabia Construction Equipment Market Trends |

| 6. Saudi Arabia Construction Equipment Market Overview, By Types |

| 6.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, 2022 & 2029F |

| 6.1.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, By Mobile Cranes, 2022 & 2029F |

| 6.1.2 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, By Tracked Dozer, 2022 & 2029F |

| 6.1.3 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, By Earth Moving Equipment, 2022 & 2029F |

| 6.1.4 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, By Material Handling Equipment, 2022 & 2029F |

| 6.1.5 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, By Dump Trucks, 2022 & 2029F |

| 6.1.6 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, By Aerial Equipment, 2022 & 2029F |

| 6.1.7 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, By Road Construction Equipment, 2022 & 2029F |

| 6.1.8 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Type, By Concrete Mixer Trucks, 2022 & 2029F |

| 6.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, 2019 - 2029F |

| 6.2.1 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, By Mobile Cranes, 2019 - 2029F |

| 6.2.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, By Tracked Dozer, 2019 - 2029F |

| 6.2.3 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, By Earth Moving Equipment, 2019 - 2029F |

| 6.2.4 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, By Material Handling Equipment, 2019 - 2029F |

| 6.2.5 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, By Dump Trucks, 2019 - 2029F |

| 6.2.6 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, By Aerial Equipment, 2019 - 2029F |

| 6.2.7 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, By Road Construction Equipment, 2019 - 2029F |

| 6.2.8 Saudi Arabia Construction Equipment Market Revenues and Volume, By Type, By Concrete Mixer Trucks, 2019 - 2029F |

| 7. Saudi Arabia Construction Equipment Market Overview, By Earth Moving Equipment |

| 7.1 Saudi Arabia Construction Equipment Market Revenue and Volume Share, By Earth Moving Equipment, 2022 & 2029 |

| 7.1.1 Saudi Arabia Construction Equipment Market Revenue and Volume Share, By Earth Moving Equipment, By Excavators, 2022 & 2029 |

| 7.1.2 Saudi Arabia Construction Equipment Market Revenue and Volume Share, By Earth Moving Equipment, By Loaders, 2022 & 2029 |

| 7.1.3 Saudi Arabia Construction Equipment Market Revenue and Volume Share, By Earth Moving Equipment, By Motor Graders, 2022 & 2029 |

| 7.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Earth Moving Equipment, 2019-2029 |

| 7.2.1 Saudi Arabia Construction Equipment Market Revenues and Volume, By Earth Moving Equipment, By Excavators, 2019-2029 |

| 7.3.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Earth Moving Equipment, By Loaders, 2019-2029 |

| 7.2.3 Saudi Arabia Construction Equipment Market Revenues and Volume, By Earth Moving Equipment, By Motor Graders, 2019-2029 |

| 7.3 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Loaders, 2022 & 2029 |

| 7.3.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Loaders, By Backhoe Loader, 2022 & 2029 |

| 7.3.2 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Loaders, By Wheel Loader, 2022 & 2029 |

| 7.3.3 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Loaders, By Skid Steer Loader, 2022 & 2029 |

| 7.3.4 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Loaders, By Compact Track Loader, 2022 & 2029 |

| 7.4 Saudi Arabia Construction Equipment Market Revenues and Volume, By Loaders, 2019-2029 |

| 7.4.1 Saudi Arabia Construction Equipment Market Revenues and Volume, By Loaders, By Backhoe Loader, 2019-2029 |

| 7.4.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Loaders, By Wheel Loader, 2019-2029 |

| 7.4.3 Saudi Arabia Construction Equipment Market Revenues and Volume, By Loaders, By Skid Steer Loader, 2019-2029 |

| 7.4.4 Saudi Arabia Construction Equipment Market Revenues and Volume, By Loaders, By Compact Track Loader, 2019-2029 |

| 7.5 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Excavators, 2022 & 2029 |

| 7.5.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Excavators, By Track Excavator, 2022 & 2029 |

| 7.5.2 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Excavators, By Wheel Excavator, 2022 & 2029 |

| 7.5.3 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Excavators, By Mini Excavator, 2022 & 2029 |

| 7.6 Saudi Arabia Construction Equipment Market Revenues and Volume, By Excavators, 2019-2029 |

| 7.6.1 Saudi Arabia Construction Equipment Market Revenues and Volume, By Excavators, By Track Excavator, 2019-2029 |

| 7.6.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Excavators, By Wheel Excavator, 2019-2029 |

| 7.6.3 Saudi Arabia Construction Equipment Market Revenues and Volume, By Excavators, By Mini Excavator, 2019-2029 |

| 8. Saudi Arabia Construction Equipment Market Overview, By Material Handling Equipment |

| 8.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Material Handling Equipment, 2022 & 2029F |

| 8.1.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Material Handling Equipment, By Forklifts, 2022 & 2029F |

| 8.1.2 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Material Handling Equipment, Telescopic Handler, 2022 & 2029F |

| 8.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Material Handling Equipment, 2019-2029 |

| 8.2.1 Saudi Arabia Construction Equipment Market Revenues and Volume, By Material Handling Equipment, By Forklifts, 2019-2029 |

| 8.2.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Material Handling Equipment, By Telescopic Handler, 2019-2029 |

| 9. Saudi Arabia Construction Equipment Market Overview, By Aerial Equipment |

| 9.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Aerial Equipment, 2022 & 2029F |

| 9.1.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Aerial Equipment, By Articulated Boom Lift, 2022 & 2029F |

| 9.1.2 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Aerial Equipment, By Telescopic Boom Lift, 2022 & 2029F |

| 9.1.3 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Aerial Equipment, By Scissor Lift, 2022 & 2029F |

| 9.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Aerial Equipment, 2019-2029 |

| 9.2.1 Saudi Arabia Construction Equipment Market Revenues and Volume, By Aerial Equipment, By Articulated Boom Lift, 2019-2029 |

| 9.2.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Aerial Equipment, By Telescopic Boom Lift, 2019-2029 |

| 9.2.3 Saudi Arabia Construction Equipment Market Revenues and Volume, By Aerial Equipment, By Scissor Lift, 2019-2029 |

| 10. Saudi Arabia Construction Equipment Market Overview, By Road Construction Equipment |

| 10.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Road Construction Equipment, 2022 & 2029F |

| 10.1.1 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Road Construction Equipment, By Pavers, 2022 & 2029F |

| 10.1.2 Saudi Arabia Construction Equipment Market Revenue Share and Volume Share, By Road Construction Equipment, By Road Rollers, 2022 & 2029F |

| 10.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Road Construction Equipment, 2019-2029 |

| 10.2.1 Saudi Arabia Construction Equipment Market Revenues and Volume, By Road Construction Equipment, By Pavers, 2019-2029 |

| 10.2.2 Saudi Arabia Construction Equipment Market Revenues and Volume, By Road Construction Equipment, By Road Rollers, 2019-2029 |

| 11. Saudi Arabia Construction Equipment Market Overview, By Size |

| 11.1 Saudi Arabia Construction Equipment Market Revenue Share, By Size, 2022 & 2029F |

| 11.1.1 Saudi Arabia Construction Equipment Market Revenue Share, By Size, By Below 15 Ton, 2022 & 2029F |

| 11.1.2 Saudi Arabia Construction Equipment Market Revenue Share, By Size, By 16- 50 Ton, 2022 & 2029F |

| 11.1.3 Saudi Arabia Construction Equipment Market Revenue Share, By Size, By 51-80 Ton, 2022 & 2029F |

| 11.1.4 Saudi Arabia Construction Equipment Market Revenue Share, By Size, By Above 80 Ton, 2022 & 2029F |

| 11.2 Saudi Arabia Construction Equipment Market Revenues, By Size, 2019-2029 |

| 11.2.1 Saudi Arabia Construction Equipment Market Revenues, By Size, By Below 15 Ton, 2019-2029 |

| 11.2.2 Saudi Arabia Construction Equipment Market Revenues, By Size, By 16- 50 Ton, 2019-2029 |

| 11.2.3 Saudi Arabia Construction Equipment Market Revenues, By Size, By 51-80 Ton, 2019-2029 |

| 11.2.4 Saudi Arabia Construction Equipment Market Revenues, By Size, By Above 80 Ton, 2019-2029 |

| 12. Saudi Arabia Construction Equipment Market Overview, By End Use |

| 12.1 Saudi Arabia Construction Equipment Market Revenue Share, By End Use, 2022 & 2029F |

| 12.1.1 Saudi Arabia Construction Equipment Market Revenue Share, By End Use, By Construction, 2022 & 2029F |

| 12.1.2 Saudi Arabia Construction Equipment Market Revenue Share, By End Use, By Oil & Gas, 2022 & 2029F |

| 12.1.3 Saudi Arabia Construction Equipment Market Revenue Share, By End Use, By Mining, 2022 & 2029F |

| 12.1.4 Saudi Arabia Construction Equipment Market Revenue Share, By End Use, By Others, 2022 & 2029F |

| 12.2 Saudi Arabia Construction Equipment Market Revenues, By End Use, 2019-2029 |

| 12.2.1 Saudi Arabia Construction Equipment Market Revenues, By End Use, By Construction, 2019-2029 |

| 12.2.2 Saudi Arabia Construction Equipment Market Revenues, By End Use, By Oil & Gas, 2019-2029 |

| 12.2.3 Saudi Arabia Construction Equipment Market Revenues, By End Use, By Mining, 2019-2029 |

| 12.2.4 Saudi Arabia Construction Equipment Market Revenues, By End Use, By Others, 2019-2029 |

| 13. Saudi Arabia Construction Equipment Market Overview, By Region |

| 13.1 Saudi Arabia Construction Equipment Market Revenue Share, By Region, 2022 & 2029F |

| 13.1.1 Saudi Arabia Construction Equipment Market Revenue Share, By Region, By Eastern, 2022 & 2029F |

| 13.1.2 Saudi Arabia Construction Equipment Market Revenue Share, By Region, By Western, 2022 & 2029F |

| 13.1.3 Saudi Arabia Construction Equipment Market Revenue Share, By Region, By Central, 2022 & 2029F |

| 13.1.4 Saudi Arabia Construction Equipment Market Revenue Share, By Region, By Southern, 2022 & 2029F |

| 13.2 Saudi Arabia Construction Equipment Market Revenues, By Region, 2019-2029 |

| 13.2.1 Saudi Arabia Construction Equipment Market Revenues, By Region, By Eastern, 2019-2029 |

| 13.2.2 Saudi Arabia Construction Equipment Market Revenues, By Region, By Western, 2019-2029 |

| 13.2.3 Saudi Arabia Construction Equipment Market Revenues, By Region, By Central, 2019-2029 |

| 13.2.4 Saudi Arabia Construction Equipment Market Revenues, By Region, By Southern, 2019-2029 |

| 14. Saudi Arabia Construction Equipment Market Key Performance Indicators |

| 15. Saudi Arabia Construction Equipment Market Opportunity Assessment |

| 15.1 Saudi Arabia Construction Equipment Market Opportunity Assessment, By Type, 2029F |

| 15.2 Saudi Arabia Construction Equipment Market Opportunity Assessment, By End Use and Region, 2029F |

| 16. Saudi Arabia Construction Equipment Market – Deployment By Key Projects |

| 17. Saudi Arabia Construction Equipment Market – Key Chinese Brands |

| 18. Saudi Arabia Construction Equipment Market Competitive Landscape |

| 18.1 Saudi Arabia Construction Equipment Market Revenue Share, By Companies, 2022 |

| 18.2 Saudi Arabia Construction Equipment Market Competitive Benchmarking, By Technical Parameters |

| 18.3 Saudi Arabia Construction Equipment Market Competitive Benchmarking, By Operating Parameters |

| 19. Company Profiles |

| 19.1 Caterpillar Inc. |

| 19.2 Komatsu Ltd. |

| 19.3 Hitachi Construction Machinery Co., Ltd. |

| 19.4 HD Hyundai Infracore Co., Ltd. |

| 19.5 Zoomlion International Trading Company |

| 19.6 Volvo Construction Equipment |

| 19.7 Sany Heavy Industry Co., Ltd. |

| 19.8 Xuzhou Construction Machinery Group Co., Ltd. |

| 20. Key Strategic Recommendations |

| 21. Disclaimer |

Market Forecast By Types (Mobile Crane, Bulldozer and Construction Tractor, Earthmoving Equipment (Loader, Excavator, Motor Grader), Material Handling Equipment (Telescopic Handler, Forklift), Dump Truck, Aerial Work Platform (Articulated Boom lift, Telescopic Boom lift, Scissor Lift), Road Construction Equipment (Paver, Road Roller)), By Applications (Construction, Oil & Gas, Mining and Others including Municipality and Road Construction), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC060909 | Publication Date: Mar 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 120 | No. of Figures: 41 | No. of Tables: 22 |

Latest 2023 Development of the Saudi Arabia Construction Equipment Market

Saudi Arabia Construction Equipment Market has been witnessing significant developments in recent years. For instance, the introduction of several projects such as the NEOM City project aims to create a new smart city in the country. The project requires a significant amount of construction equipment, and this has led to an increase in demand for construction equipment in Saud Arabia. Additionally, the Jeddah Tower Project aims to create the world's tallest buildings which require a large amount of construction equipment. The government has been investing heavily in infrastructure projects, including roads, airports, and seaports which drives demand for construction equipment in the country.

The construction equipment market in Saudi Arabia is expected to grow in the coming years, driven by government investments in infrastructure development, increasing urbanization, the rising tourism industry, and economic diversification as the government has been working to diversify its economy away from its reliance on oil. Additionally, technological advancements such as telematics, IoT, and automation are making construction equipment more efficient and productive, which is expected to drive demand for new equipment in the industry.

Saudi Arabia Construction Equipment Market Synopsis

Saudi Arabia Construction Equipment Market report is a part of the Middle East Construction Equipment Market report thoroughly covers the market by types, applications, and regions. Saudi Arabia Construction Equipment Market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

The construction equipment market in Saudi Arabia declined over the past few years on account of reduced government expenditure due to low crude oil prices, which resulted in the cancellation of many large-scale construction projects, thereby affecting the demand for construction equipment negatively. However, the rising government infrastructure spending underpinned by initiatives such as Saudi Vision 2030 and National Transformation Program coupled with rising FDI, and private sector investment would drive the construction equipment market in the Kingdom. The spread of the COVID-19 pandemic has resulted in a slowdown of the overall economy leading to a temporary halt in many construction projects across the region, thereby impacting the construction equipment market in Saudi Arabia, which is expected to regain momentum in the year 2021.

According to 6Wresearch, the Saudi Arabia Construction Equipment Market size is projected to grow at a CAGR of 4.2% in terms of revenues during 2021-2027. Growing economic growth coupled with increasing investment in the development of the construction sector is accelerating Saudi Arabia Construction Equipment Market Growth. The rising shift toward smart cities along with the partnership of private firms with government authorities is driving the development of the industry.

Market by Types Analysis

On the basis of types, the mobile crane segment is expected to grow at a substantial rate over the coming years on account of widespread utility for moving containers, especially in the oil & gas industry. Earthmoving equipment has garnered the major market revenue share in Saudi Arabia’s construction equipment market owing to its prevalent usage in sectors such as mining, transportation, and commercial, where they are extensively used for excavating, lifting heavy weights, and laying railway tracks.

Market by Applications Analysis

On the basis of applications, the construction application segment is expected to demonstrate significant growth over the coming years owing to a large number of upcoming infrastructure projects in the region such as NEOM city, the Red Sea project, and Diriya Gate project. Additionally, the rising hotel chains and entertainment areas on account of Saudi vision to boost the tourism sector have further escalated the demand for construction equipment in the country. Based on regions, the central region of Saudi Arabia is anticipated to register the fastest growth in the forecast period on the back of many upcoming infrastructure development projects in the region.

COVID-19 Impact on Saudi Arabia Construction Equipment Market

The construction equipment market in Saudi Arabia has bethe en declining over the last few years on account of the halting and cancellation of various projects in the wake of several factors such as the oil crisis. Further, with the outbreak of the COVID-19 pandemic in 2020, the construction sector witnessed another massive hit due to supply chain disruptions, delays, and lack of manforce, thus, negatively impacting the construction equipment market in the country in 2020.

Key Players in the Market

- Some of the key players in Saudi Arabia Construction Market are:

- Komatsu Ltd.

- Volvo Construction Equipment Corporation.

- Caterpillar Incorporation.

- Hitachi Construction Machinery Co. Ltd.

- Manitowoc Company Inc.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

Key Highlights of the Report

- Saudi Arabia Construction Equipment Market Overview

- Saudi Arabia Construction Equipment Market Outlook

- Saudi Arabia Construction Equipment Market Forecast

- Saudi Arabia Construction Equipment Market Share

- Saudi Arabia Construction Equipment Market Growth

- Historical Data and Forecast of Saudi Arabia Construction Equipment Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of Saudi Arabia Construction Equipment Market Revenues, By Types for the Period 2017-2027F

- Historical Data and Forecast of Saudi Arabia Construction Equipment Market Revenues, By Applications for the Period 2017-2027F

- Historical Data and Forecast of Saudi Arabia Construction Equipment Market Revenues, By Regions for the Period 2017-2027F

- Market Drivers, Restraints

- Saudi Arabia Construction Equipment Market Trends

- Industry Life Cycle

- Saudi Arabia Construction Equipment Market – Porter’s Five Forces

- Saudi Arabia PESTEL Analysis

- Market Opportunity Assessment

- Company Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

-

By Types

- Mobile Crane

- Bulldozer and Construction Tractor

- Earthmoving Equipment

- Loader

- Excavator

- Motor Grader

- Material Handling Equipment

- Telescopic Handler

- Forklift

- Dump Truck

- Aerial Work Platform

- Articulated Boom lift

- Telescopic Boom lift

- Scissor Lift

- Road Construction Equipment

- Paver

- Road Roller

By Applications

- Oil & Gas

- Construction

- Mining

- Others (Municipality, Road Construction, etc.)

By Regions

- Eastern Region

- Western Region

- Central Region

- Southern Region

Market Forecast By Type (Mobile Crane, Construction Tractor and Bulldozer and Earthmoving Equipment (Loaders, Excavators and Motor Grader (Aerial Work Equipment (Articulated Boom Lifts, Telescopic Boom Lifts, and Scissor Lifts), Material Handling Equipment (Telescopic Handlers and Forklifts), Dump Trucks (Road Construction Equipment (Pavers and Road Rollers)), By Applications (Construction, Oil & Gas, Mining and Others including Municipality and Road Construction), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC060909 | Publication Date: Jul 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 116 | No. of Figures: 45 | No. of Tables: 21 |

The Saudi Arabia Construction Equipment Market covers the market by types, applications, and regions. The report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Saudi Arabia Construction Equipment Market Synopsis

Saudi Arabia Construction Equipment Market has declined on account of low crude oil prices over the past few years. Fall in the prices of crude oil has led to several large-scale construction projects being halted or cancelled as a result of reduced government expenditure, thereby affecting the demand for construction equipment negatively. However, growth in the construction sector on account of increased infrastructure spending owing to Saudi Vision 2030 and National Transformation Program 2020 would drive the construction equipment market in the region over the coming years. The market has seen a substantial decline owing to the massive outbreak of COVID-19 as construction was halted to combat the spreads of the virus.

According to 6Wresearch, Saudi Arabia Construction Equipment Market size is projected to grow at CAGR of 2.6% during 2020-2026. Government plans to reduce the country’s dependence on oil-sector revenues and focus on developing and strengthening non-oil economy has led to widespread commercial and infrastructure development in the country, which include expansion of metros and airports, along with the construction of new hotels and shopping malls, which would boost the demand for construction equipment during the forecast period.

Market Analysis by Application

On the basis of Application, the construction sector has captured a decent market share in the overall market revenues in 2019 and is expected to demonstrate significant growth over the coming years owing to a large number of upcoming infrastructure projects in the region. Additionally, mobile cranes and earthmoving equipment would dominate the market revenue share due to their extensive use at construction sites for excavation and lifting heavyweights.

Market Analysis by Types

On the basis of types, the mobile crane segment has witnessed a substantial market share in the overall market revenues in 2019 and is expected to grow at a substantial rate over the coming years on account of widespread utility for moving the containers, especially in the oil & gas industry. Earth moving equipment has garnered the major market revenue share in Saudi Arabia’s construction equipment market owing to its prevalent usage in digging the earth in all the sectors such as mining, transportation and commercial, where they are extensively used for excavating, lifting heavy weights and laying railway tracks.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Saudi Arabia Construction Equipment Market Overview

- Saudi Arabia Construction Equipment Market Outlook

- Saudi Arabia Construction Equipment Market Forecast

- Historical Data of Saudi Arabia Construction Equipment Market Revenues and Volume for the Period 2016-2019

- Saudi Arabia Construction Equipment Market Size and Saudi Arabia Construction Equipment Market Forecast of Revenues and Volume, Until 2026

- Historical Data of Saudi Arabia Construction Equipment Market Revenues and Volume, by Equipment Type, for the Period 2016-2019

- Saudi Arabia Construction Equipment Market Size and Saudi Arabia Construction Equipment Market Forecast of Revenues and Volume, by Equipment Type, Until 2026F

- Historical Data of Saudi Arabia Construction Equipment Market Revenues and Volume, by Applications, for the Period 2016-2019

- Saudi Arabia Construction Equipment Market Size and Saudi Arabia Construction Equipment Market Forecast of Revenues and Volume, Applications, Until 2026F

- Historical Data of Saudi Arabia Construction Equipment Market Revenues and Volume, by Regions, for the Period 2016-2019

- Saudi Arabia Construction Equipment Market Size and Saudi Arabia Construction Equipment Market Forecast of Revenues and Volume, by Regions, Until 2026F

- Saudi Arabia Construction Equipment Market Drivers

- Saudi Arabia Construction Equipment Market Restraints

- Saudi Arabia Construction Equipment Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Saudi Arabia Construction Equipment Market Share, By Players

- Saudi Arabia Construction Equipment Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following Market segments:

- By Type

- Mobile Crane

- Construction Tractor and Bulldozer

- Earthmoving Equipment

- Loaders

- Excavators

- Motor Grader

- Aerial Work Equipment

- Articulated Boom Lifts

- Telescopic Boom Lifts

- Scissor Lifts

- Material Handling Equipment

- Telescopic Handlers

- Forklifts

- Dump Trucks

- Road Construction Equipment

- Pavers

- Road Rollers

- By Applications

- Construction

- Oil & Gas

- Mining

- Others (Municipality, Road Construction)

- By Regions

- Eastern

- Western

- Central

- Southern

Frequently Asked Questions About the Market Study:

- Does the report consider COVID-19 impact?

The report not only has considered COVID-19 impact but also current Market dynamics, trends and KPIs into consideration. - How much growth is expected in the Saudi Arabia Construction Equipment Market over the coming years?

The Saudi Arabia Construction Equipment Market revenue is anticipated to record a CAGR of 2.6% during 2020-2026. - Which segment has captured key share of the Market?

Earth moving Equipment has dominated the overall Market revenues in the year 2020. - Which segment is exhibited to gain traction over the forecast period?

Construction sector is expected to record key growth throughout the forecast period 2020-2026. - Who are key the key players of the Market?

The key players of the Market include- Caterpillar Inc., Komatsu Middle East FZE [KME], Hitachi Construction Machinery Middle East Corporation FZE, Hyundai Construction Equipment Co., Ltd, Volvo Construction Equipment, Bamford Excavators Limited, Doosan Infracore Co., Ltd., Xuzhou Construction Machinery Group Co., Ltd., Tadano Ltd., Dynapac MEA FZE - Is customization available in the Market study?

Yes, we can do customization as per your requirements. Please feel free to write to us sales@6wresearch.com for any customized or any other requirements - We also want to have Market reports for other countries/regions.

6Wresearch has the database of more than 60 countries globally, which can make us your first choice of all your research needs.

Other Key Reports Available:

- Kuwait Air Compressor Market Report

- Qatar Air Compressor Market Report

- India Air Compressor Market Report

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero