Saudi Arabia Industrial Valves Market (2018-2024) | Size, Share, Outlook, Growth, Revenue, Analysis, Forecast, Trends & industry

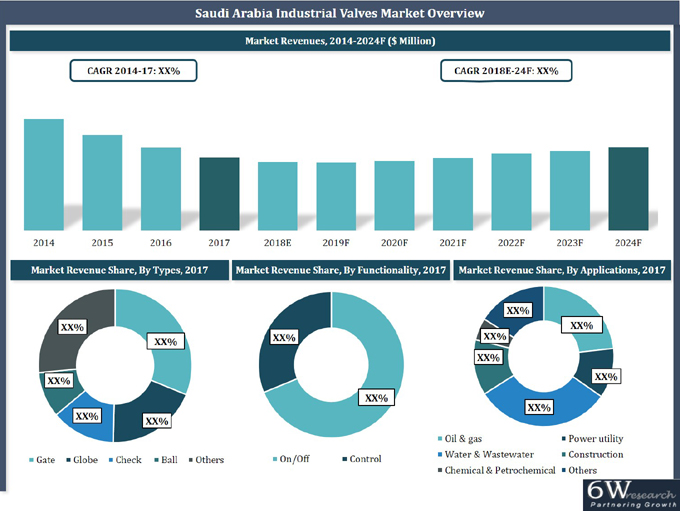

Market Forecast By Types (Gate, Globe, Check, Ball and Others), By Functionality (On/Off and Control), By Applications (Oil & Gas, Water & Wastewater, Chemical & Petrochemical, Power & Utility, Construction, and Others), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC000527 | Publication Date: Sep 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 110 | No. of Figures: 71 | No. of Tables: 10 |

Latest Development (2022) in Saudi Arabia Industrial Valves Market

Saudi Arabia Industrial Valves Market is expected to gain momentum during the forecast years on account of increasing advancement of infrastructure and technically advanced buildings. The increasing development of smart cities along with increasing advancement in developing cities is driving the growth of the market. Moreover, increasing demand from the power industry is also one of the key factors adding to the development of the market. Increasing demand for holding the capacity of oil owing to growing oil refineries is driving the Saudi Arabia Industrial Valves Market revenue.

Saudi Arabia Industrial Valves Market Synopsis

Saudi Arabia industrial valves market report is a part of the Middle East Industrial Valves Market report comprehensively covers the industrial valves market by types, applications, and regions. The Saudi Arabia industrial valves market outlook report provides an unbiased and detailed analysis of the Saudi Arabia industrial valves market trends, opportunities/high growth areas, and market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

During 2014-17, Saudi Arabia economy witnessed a setback owing to a decline in oil prices, consequently, leading to delays in construction projects across the country. The industrial valves market in Saudi Arabia registered a weak demand amidst the crisis which resulted in a decline in the market. However, the market is further expected to bounce back over the coming years owing to the recovery of oil prices, economic stability, and growth of the non-oil sector. Additionally, growing construction projects would further proliferate the market demand.

According to 6Wresearch, Saudi Arabia industrial valves market size is projected to grow at a CAGR of 3.3% during 2018-2024. The government of Saudi Arabia has introduced several development plans such as Saudi Vision 2030 and the National Transformation Plan 2020, with the objective of accelerating growth and diversification of the economy. Such initiatives would help the non-oil sectors to grow and promote the development of commercial buildings, offices, healthcare centers, and hotels in the future. Hence, the market for industrial valves in the country is expected to grow substantially during the forecast period.

Saudi Arabia Industrial Valves Market all the industrial valve manufacturers used the pressure of the valve of the liquids, gases, and slurries that to control the flow of the pressure. Used in a wide variety and known as regulators. Saudi Arabia Industrial Valves market invested in multiple sectors such as hospitality, energy, mega infrastructure, and healthcare are expected to boost sales of industrial valves in upcoming years. The Saudi Arabia industrial valves market is expected to bounce back in upcoming years in a way such as oil prices, growth of the non-oil sector, and economic stability. The government of Saudi Arabia has introduced several development plans in different sectors such as the Saudi Vision, and the National Transformation Plan with the objective of increasing the growth of diversification of the economy. Promote development in the commercial sectors such as buildings, healthcare centers, offices, and hotels.

Saudi Arabia Industrial valves market registered different types attributed to the decrease in the oil prices and it will deteriorate the economy. There is a substantial investment in the Industrial valves market and it will flow in multiple sectors such as energy, hospitality, and mega infrastructure is going to boost the industrial valves market. The market going to increase in the upcoming years in many sectors such as oil prices, growth of the non-oil sector, and economic stability. According to research in Saudi Arabia, industrial valves are projected to grow more in the future.

The Saudi Arabia industrial valves market is expected to register potential market growth in the coming years owing to the growth and development of the oil industry coupled with economic stability in the country which would instigate healthy growth in the non-oil sectors as well in the country. However, the market has seen a slight slump in the past few years owing to the deterioration of the oil prices and slowdown in the oil industry but backed by the Saudi Vision 2030 and National Transformation Plan 2020 by the Saudi government to promote the construction of residential and corporate buildings, the non-oil sectors are anticipated to witness significant growth which would add on to the potential growth of the Saudi Arabia industrial valves market in the coming years.

Saudi Arabia Industrial Valves market is projected to witness exponential growth in the upcoming six years on the back of the rising oil and gas sector. Increased demand for fuel oil coupled with rising export activities emphasis on a massive supply of petrol tends to require valves in order to regulate the flow pattern of liquid. Further, rising industries are leading to the release of tremendous waste in water which stimulates the government to start a wastewater treatment process that has led to support for the deployment of industrial valves to control excess running water and is expected to boost Saudi Arabia industrial valves market in the coming years.

Saudi Arabia industrial valves market is projected to find its true potential underpinned by the rising growth of food & beverages in the country. The rising growth of the young population along with rising disposable income and tends to spend high food and on bakery items such as cookies, canned fruits, and pastries these all are processed food where industrial ball valves play a crucial role in the circulation of steam-water only and are estimated to boost the demand for industrial valves and are estimated to bolster the growth of the Saudi Arabia industrial valves market in the coming timeframe.

Market Analysis by Application

Water and wastewater applications registered the highest Saudi Arabia industrial valves market share as compared to other applications, to regulate the water flow round the clock. Being a basic component while designing infrastructure, industrial valves are used on a large scale for regulating various functions in water and wastewater applications.

Key players in The Market

- Some of the key players in Saudi Arabia Industrial Valves Market are:

- Saudi Pipes Systems Co

- Shoaibi Group

- Yusuf Bin Ahmed Kanoo Group

Key Highlights of the Report:

- Saudi Arabia Industrial Valves Market Overview

- Saudi Arabia Industrial Valves Market Outlook

- Saudi Arabia Industrial Valves Market Forecast

- Historical Market Revenue Trends for Saudi Arabia Industrial Valves Market, 2014-2017

- Saudi Arabia Industrial Valves Market Size & Saudi Arabia Industrial Valves Market Forecast of Revenues, until 2024

- Historical Market Volume Trends for Saudi Arabia Industrial Valves Market, 2014-2017

- Market Size & Volume Forecast of Saudi Arabia Industrial Valves Market, until 2024

- Historical Market Volume and Revenue Trends for Saudi Arabia Industrial Valves Market, By On-Off Valves, 2014-2017

- Market Size & Volume and Revenue Forecast of Saudi Arabia Industrial Valves Market, By On-Off Valves, until 2024

- Historical Market Volume and Revenue Trends for Saudi Arabia Industrial Valves Market, By Control Valves, 2014-2017

- The market of Saudi Arabia Industrial Valves Market, By Control Valves, until 2024

- Saudi Arabia Industrial Valves Market Revenue, Size & Volume Forecast, By Types, until 2024

- Saudi Arabia Industrial Valves Market Revenue Forecast, By Applications, until 2024

- Market Drivers and Restraints

- Saudi Arabia Industrial Valves Market Trends and Opportunities

- Industry Life Cycle & Value Chain Analysis

- Saudi Arabia Industrial Valves Market Share, By Players

- Saudi Arabia Industrial Valves Market Overview on Competitive Landscape

- Competitive Benchmarking & Company Profiles

- Key Strategic Pointers

Markets Covered

The Saudi Arabia industrial valves market report provides a detailed analysis of the following market segments:

By Types:

- Gate

- Globe

- Check

- Ball

- Others

By Functionality:

- On/Off

- Control

By Applications:

- Oil & Gas

- Water & Wastewater

- Chemical & Petrochemical

- Power & Utility

- Construction

- Others

By Regions:

- Eastern

- Western

- Central

- Southern

Saudi Arabia Industrial Valves Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Global Industrial Valves Market Overview |

| 3.1 Global Industrial Valves Market Revenues (2014-2024F) |

| 3.2 Global Industrial Valves Market Revenue Share, By Regions (2017 & 2024F) |

| 4. Saudi Arabia Industrial Valves Market Overview |

| 4.1 Saudi Arabia Industrial Valves Market Revenues (2014-2024F) |

| 4.2 Saudi Arabia Industrial Valves Market, Industry Life Cycle |

| 4.3 Saudi Arabia Industrial Valves Market, Opportunity Matrix |

| 4.4 Saudi Arabia Industrial Valves Market, Porters Five Forces |

| 4.5 Saudi Arabia Industrial Valves Market Revenue Share, By Applications (2017 & 2024F) |

| 4.6 Saudi Arabia Industrial Valves Market Revenue Share, By Types (2017 & 2024F) |

| 4.7 Saudi Arabia Industrial Valves Market Revenue Share, By Regions (2017 & 2024F) |

| 5. Saudi Arabia Industrial Valves Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing industrialization in Saudi Arabia leading to higher demand for industrial valves |

| 5.2.2 Implementation of stringent regulations for industrial safety and environmental protection |

| 5.2.3 Growth in sectors such as oil gas, water & wastewater management, and power generation driving the demand for industrial valves |

| 5.3 Market Restraints |

| 5.3.1 Fluctuations in raw material prices impacting the production cost of industrial valves |

| 5.3.2 Intense competition among market players leading to pricing pressures |

| 5.3.3 Economic uncertainties affecting investment decisions in industrial projects |

| 6. Saudi Arabia Industrial Valves Market Trends |

| 7. Saudi Arabia Industrial Valves Market Overview, By Types (On/Off) |

| 7.1 Saudi Arabia Industrial Valves Market Revenues, By Ball Valves (2014-2024F) |

| 7.2 Saudi Arabia Industrial Valves Market Revenues, By Gate Valves (2014-2024F) |

| 7.3 Saudi Arabia Industrial Valves Market Revenues, By Check Valves (2014-2024F) |

| 7.4 Saudi Arabia Industrial Valves Market Revenues, By Globe Valves (2014-2024F) |

| 7.5 Saudi Arabia Industrial Valves Market Revenues, By Other Valves (2014-2024F) |

| 8. Saudi Arabia Industrial Valves Market Overview, By Types (Control) |

| 8.1 Saudi Arabia Industrial Valves Market Revenues, By Ball Valves (2014-2024F) |

| 8.2 Saudi Arabia Industrial Valves Market Revenues, By Gate Valves (2014-2024F) |

| 8.3 Saudi Arabia Industrial Valves Market Revenues, By Check Valves (2014-2024F) |

| 8.4 Saudi Arabia Industrial Valves Market Revenues, By Globe Valves (2014-2024F) |

| 8.5 Saudi Arabia Industrial Valves Market Revenues, By Other Valves (2014-2024F) |

| 9. Saudi Arabia Industrial Valves Market Overview, By Applications |

| 9.1 Saudi Arabia Industrial Valves Market Revenues, By Oil & Gas Application (2014-2024F) |

| 9.2 Saudi Arabia Industrial Valves Market Revenues, By PCF Application (2014-2024F) |

| 9.3 Saudi Arabia Industrial Valves Market Revenues, By Power Application (2014-2024F) |

| 9.4 Saudi Arabia Industrial Valves Market Revenues, By Construction Application (2014-2024F) |

| 9.5 Saudi Arabia Industrial Valves Market Revenues, By Water & Wastewater Application (2014-2024F) |

| 9.6 Saudi Arabia Industrial Valves Market Revenues, By Other Applications (2014-2024F) |

| 10. Saudi Arabia Industrial Valves Market Overview, By Functionality |

| 10.1 Saudi Arabia Industrial Valves Market Revenue Share, By On-Off Type (2014-2024F) |

| 10.2 Saudi Arabia Industrial Valves Market Revenue Share, By Control Type (2014-2024F) |

| 11. Saudi Arabia Industrial Valves Market Overview, By Competitive Benchmarking |

| 11.1 Saudi Arabia Industrial Valves Player's Market Volume Share (2017) |

| 11.2 Competitive Benchmarking, By Technology |

| 12. Company Profiles |

| 12.1 Pan Gulf Valves Manufacturing Co. Ltd. |

| 12.2 AVK International |

| 12.3 Cameron Al-Rushaid Limited |

| 12.4 KSB Pumps Ltd. |

| 12.5 Flowserve Abahsain Co. Ltd |

| 12.6 YBA Kanoo |

| 12.7 SAUDI PIPE SYSTEMS |

| 12.8 Shoaibi Group |

| 12.9 Forum Energy Technologies |

| 12.10 Emerson Process Management Arabia LTD |

| 12.11 Dresser Al-Rushaid Valve & Instrument Co. Ltd (DRAVICO) |

| 13. Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Saudi Arabia Industrial valves Market Revenues, 2014-2024F ($ Million) |

| 2. Global Industrial Valves Market Revenue Share, By Regions, 2017 |

| 3. Saudi Arabia Industrial Valves Market Revenues, 2014-2024F ($ Million) |

| 4. Saudi Arabia Industrial Valves Market Overview - Industry Life Cycle |

| 5. Saudi Arabia Industrial Valves Market Opportunity Matrix, By Applications, 2024F |

| 6. Saudi Arabia Industrial Valves Market Revenue Share, By Applications, 2017 & 2024F |

| 7. Saudi Arabia Industrial Valves Market Revenue Share, By Types, 2017 & 2024F |

| 8. Saudi Arabia Industrial Valves Market Revenue Share, By Regions, 2017 & 2024F |

| 9. Saudi Vision 2030 - Key Targets |

| 10. Saudi Vision 2030 Goals for Non-Oil Sector |

| 11. Saudi Arabia Non-Oil Revenues, 2012-2018E ($ Billion) |

| 12. Upcoming Construction Projects in Saudi Arabia |

| 13. Upcoming Economic Cities in Saudi Arabia |

| 14. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2017 ($ Million) |

| 15. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion) |

| 16. Saudi Industrial Ball Valves Market Share, 2017 & 2024F |

| 17. Saudi Industrial Ball Valves Market Revenues, 2014-2024F ($ Million) |

| 18. Saudi Industrial Gate Valves Market Share, 2017 & 2024F |

| 19. Saudi Industrial Gate Valves Market Revenues, 2014-2024F ($ Million) |

| 20. Saudi Industrial Check Valves Market Share, 2017 & 2024F |

| 21. Saudi Industrial Check Valves Market Revenues, 2014-2024F ($ Million) |

| 22. Saudi Industrial Globe Valves Market Share, 2017 & 2024F |

| 23. Saudi Industrial Globe Valves Market Revenues, 2014-2024F ($ Million) |

| 24. Saudi Industrial Other Valves Market Share, 2017 & 2024F |

| 25. Saudi Industrial Other Valves Market Revenues, 2014-2024F ($ Million) |

| 26. Saudi Industrial Ball Valves Market Share, 2017 & 2024F |

| 27. Saudi Industrial Ball Valves Market Revenues, 2014-2024F ($ Million) |

| 28. Saudi Industrial Gate Valves Market Share, 2017 & 2024F |

| 29. Saudi Industrial Gate Valves Market Revenues, 2014-2024F ($ Million) |

| 30. Saudi Industrial Check Valves Market Share, 2017 & 2024F |

| 31. Saudi Industrial Check Valves Market Revenues, 2014-2024F ($ Million) |

| 32. Saudi Industrial Globe Valves Market Share, 2017 & 2024F |

| 33. Saudi Industrial Globe Valves Market Revenues, 2014-2024F ($ Million) |

| 34. Saudi Industrial Other Valves Market Share, 2017 & 2024F |

| 35. Saudi Industrial Other Valves Market Revenues, 2014-2024F ($ Million) |

| 36. Saudi Arabia Oil & Gas Industrial Valves Market Share, 2017 & 2024F |

| 37. Saudi Industrial Oil & Gas Valves Market Revenues, 2014-2024F ($ Million) |

| 38. Saudi Arabia PCF Industrial Valves Market Share, 2017 & 2024F |

| 39. Saudi PCF Industrial Valves Market Revenues, 2014-2024F ($ Million) |

| 40. Production of Refined Products in Saudi Arabia, 2014-2016 (Million Barrels) |

| 41. Saudi Arabia Power Industrial Valves Market Share, 2017 & 2024F |

| 42. Saudi Industrial Power Valves Market Revenues, 2014-2024F ($ Million) |

| 43. Upcoming Power Plant Projects in Saudi Arabia |

| 44. Saudi Arabia Construction Valves Market Share, 2017 & 2024F |

| 45. Saudi Industrial Construction Valves Market Revenues, 2014-2024F ($ Million) |

| 46. Saudi Arabia Construction Contracts Awards, 2016-2017 ($ Million) |

| 47. Saudi Arabia Building Construction Projects Value by Status, 2017 |

| 48. Saudi Arabia Value of Awarded Contracts, 2013-2018E ($ Billion) |

| 49. Saudi Arabia Water & Wastewater Valves Market Share, 2017 & 2024F |

| 50. Saudi Industrial Water & Wastewater Valves Market Revenues, 2014-2024F ($ Million) |

| 51. Saudi Arabia Other Valves Market Share, 2017 & 2024F |

| 52. Saudi Industrial Other Valves Market Revenues, 2014-2024F ($ Million) |

| 53. Total Number of Manufacturing Facilities in Saudi Arabia, Q1-Q3 2017 |

| 54. Riyadh Office Supply, 2014-2019F ('000 Sq. m.) |

| 55. Jeddah Office Supply, 2014-2019F ('000 Sq. m.) |

| 56. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.) |

| 57. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.) |

| 58. Riyadh Hotel Supply, 2014-2019F (No. of Rooms) |

| 59. Jeddah Hotel Supply, 2014-2019F (No. of Rooms) |

| 60. Major Upcoming Healthcare Projects in Saudi Arabia |

| 61. Upcoming Healthcare Projects in Saudi Arabia |

| 62. Saudi Arabia On/Off Valves Market Share, 2017 & 2024F |

| 63. Saudi Industrial On/Off Valves Market Revenues, 2014-2024F ($ Million) |

| 64. Saudi Arabia Control Valves Market Share, 2017 & 2024F |

| 65. Saudi Industrial Control Valves Market Revenues, 2014-2024F ($ Million) |

| 66. Saudi Arabia Industrial Valves Market Revenue Share, By Company (2017) |

| 67. Number of Under Construction Manufacturing Factories as on Q1, 2017 |

| 68. Riyadh Industrial Cities Composition, 2014 & 2018 |

| 69. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2023F ($ Billion) |

| 70. Value of Projects at Pre-Execution Stage By Industry, 2017 ($ Million) |

| 71. Saudi Arabia Government Budget Spending Outlook, 2018E ($ Billion) |

| List of Tables |

| 1. Major Upcoming Infrastructure Projects |

| 2. Saudi Arabia Upcoming Oil & Gas Projects |

| 3. Saudi Arabia Upcoming Petrochemical Projects |

| 4. List of Major Infrastructure Projects in Saudi Arabia |

| 5. Under Construction Manufacturing Units in Saudi Arabia, Q4 2017 and Q1 2018 |

| 6. Upcoming Manufacturing Plants in Saudi Arabia |

| 7. Upcoming Hotels Projects in Saudi Arabia |

| 8. Upcoming Residential Projects in Saudi Arabia |

| 9. Upcoming Petrochemicals Facilities in Saudi Arabia |

| 10. Saudi Arabia Budget Expenses By Sectors, 2017 and 2018 ($ Billion) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero