Saudi Arabia Paints Market (2025-2031) | Companies, Industry, Size, Revenue, Outlook, Analysis, Growth, Trends, Forecast, Share & Value

| Product Code: ETC017579 | Publication Date: Jul 2023 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

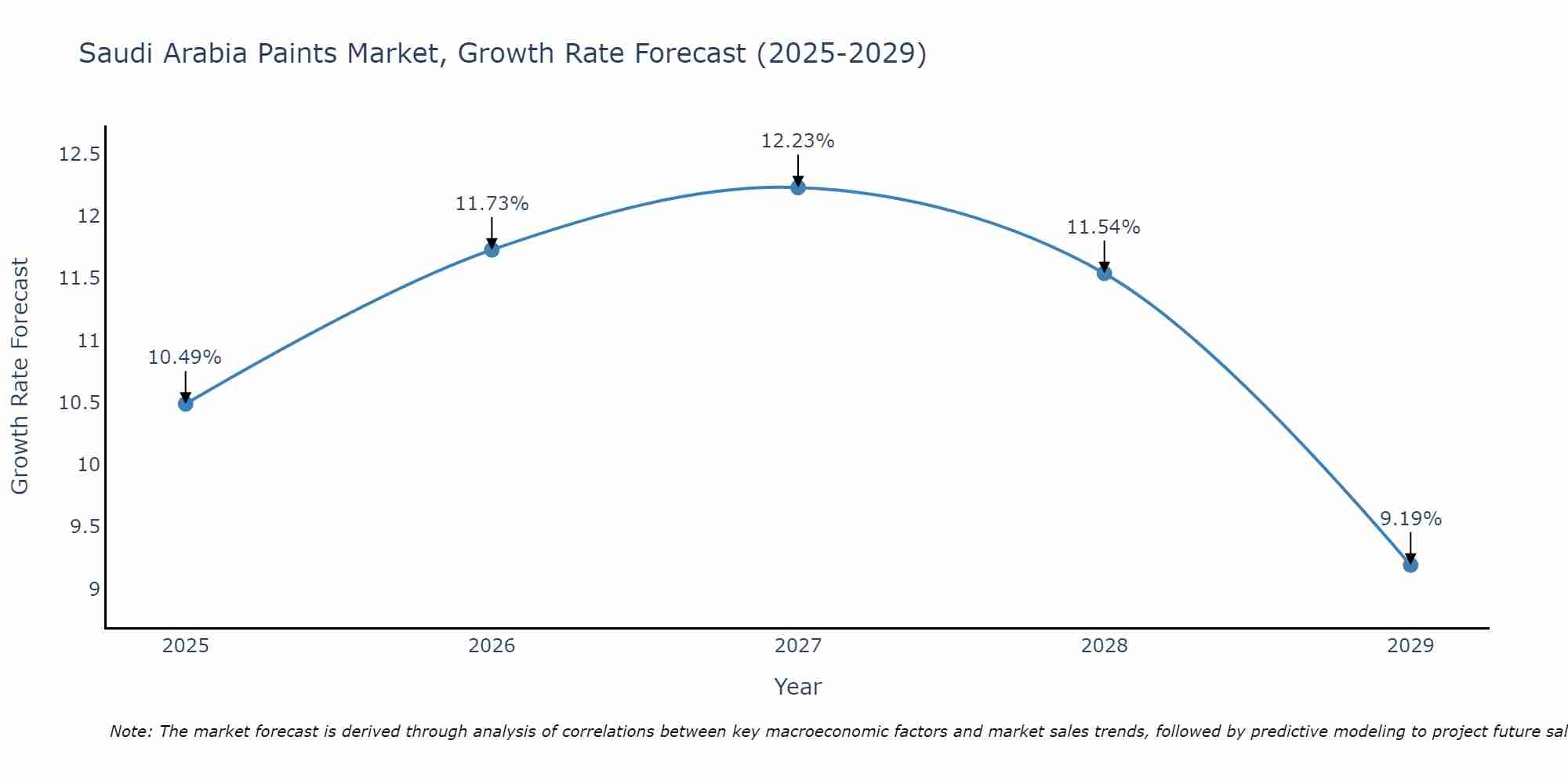

Saudi Arabia Paints Market Size Growth Rate

The Saudi Arabia Paints Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 10.49% in 2025, climbs to a high of 12.23% in 2027, and moderates to 9.19% by 2029.

Saudi Arabia Paints Market Synopsis

The Saudi Arabia paints market is estimated to witness a CAGR of 5.5% during the forecast period (2025-2031). The increasing demand for eco-friendly paint products, rising construction activities and growing population are some of the major factors driving the growth of the paints market in Saudi Arabia. Increasing government spending on infrastructure development projects will further boost the growth of this market.

Market Drivers

The increasing number of construction activities, especially residential buildings, has increased significantly over recent years due to rapid urbanization and industrialization across different cities in Saudi Arabia as well as due to large investments made by both public and private sector entities towards real estate development initiatives. This has led to an increase in demand for different types of paint products such as interior wall paint, exterior wall coatings/paints etc., which is fueling the growth of this market. With a population increasing at a high rate each year, there is an increased need for new housing units within existing dwellings or adding additional rooms which is creating more opportunities for paint companies operating within this region. This factor coupled with strong GDP per capita growth has resulted into improved living standards among consumers resulting into higher expenditure capacity towards purchase decorative paints that provide better aesthetic look and feel along with superior protection from external elements such as weathering effects etc., thus propelling overall demand from end user segments such as residential & commercial building constructions.

Challenges of the Market

As compared to other countries in GCC region like UAE or Qatar where cost involved setting up manufacturing facilities are low due to availability inexpensive labor force & land costs; however same cannot be said about Saudi Arabia wherein cost associated with setting up factories may go quite high owing presence several costly regulations imposed by local governments upon manufacturers operating within country??s boundary lines hence making it difficult many international players enter kingdom??s painting industry without proper financial planning beforehand . Moreover these companies have deal strict environmental norms make sure their operations do not cause any harm environment around them leading additional expenses incurred order comply set rules regulations frame authorities.

Covid 19 Impact on the Market

The outbreak of Coronavirus (COVID-19) pandemic has had an adverse effect on the Saudi Arabia paint industry due to disruption in production activities and fall in consumption levels. This can be attributed to closure or restriction imposed on movement around major cities which have hampered work activities across all industrial segments including construction sector leading to decrease in number of orders placed by customers for various coating solutions like waterproofing coatings etc., thus impacting overall demand potential for paint products within this region over short term assessment period.

key players of the Market

Key players operating in Saudi Arabia Paints Market include AkzoNobel Paint Company Sdn Bhd ,Asian Paints Ltd ,BASF SE ,Berger Paints India Limited ,National Industrialization Co.(Tasnee),Orica Ltd.,PPG Industries Inc.,RPM International Inc.,Sherwin Williams Co.,SICO Paint Group LLC among others.

Key Highlights of the Report:

- Saudi Arabia Paints Market Outlook

- Market Size of Saudi Arabia Paints Market, 2024

- Forecast of Saudi Arabia Paints Market, 2031

- Historical Data and Forecast of Saudi Arabia Paints Revenues & Volume for the Period 2021-2031

- Saudi Arabia Paints Market Trend Evolution

- Saudi Arabia Paints Market Drivers and Challenges

- Saudi Arabia Paints Price Trends

- Saudi Arabia Paints Porter's Five Forces

- Saudi Arabia Paints Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Resin for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Acrylic for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Alkyd for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Epoxy for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Polyurethane for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Polyester for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Technology for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Waterborne for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Solventborne for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Powder for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Architectural for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Paints Market Revenues & Volume By Industrial for the Period 2021-2031

- Saudi Arabia Paints Import Export Trade Statistics

- Market Opportunity Assessment By Resin

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By Application

- Saudi Arabia Paints Top Companies Market Share

- Saudi Arabia Paints Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Paints Company Profiles

- Saudi Arabia Paints Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Saudi Arabia Paints Market Overview |

3.1 Saudi Arabia Country Macro Economic Indicators |

3.2 Saudi Arabia Paints Market Revenues & Volume, 2021 & 2031F |

3.3 Saudi Arabia Paints Market - Industry Life Cycle |

3.4 Saudi Arabia Paints Market - Porter's Five Forces |

3.5 Saudi Arabia Paints Market Revenues & Volume Share, By Resin, 2021 & 2031F |

3.6 Saudi Arabia Paints Market Revenues & Volume Share, By Technology, 2021 & 2031F |

3.7 Saudi Arabia Paints Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 Saudi Arabia Paints Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Saudi Arabia Paints Market Trends |

6 Saudi Arabia Paints Market, By Types |

6.1 Saudi Arabia Paints Market, By Resin |

6.1.1 Overview and Analysis |

6.1.2 Saudi Arabia Paints Market Revenues & Volume, By Resin, 2021-2031F |

6.1.3 Saudi Arabia Paints Market Revenues & Volume, By Acrylic, 2021-2031F |

6.1.4 Saudi Arabia Paints Market Revenues & Volume, By Alkyd, 2021-2031F |

6.1.5 Saudi Arabia Paints Market Revenues & Volume, By Epoxy, 2021-2031F |

6.1.6 Saudi Arabia Paints Market Revenues & Volume, By Polyurethane, 2021-2031F |

6.1.7 Saudi Arabia Paints Market Revenues & Volume, By Polyester, 2021-2031F |

6.2 Saudi Arabia Paints Market, By Technology |

6.2.1 Overview and Analysis |

6.2.2 Saudi Arabia Paints Market Revenues & Volume, By Waterborne, 2021-2031F |

6.2.3 Saudi Arabia Paints Market Revenues & Volume, By Solventborne, 2021-2031F |

6.2.4 Saudi Arabia Paints Market Revenues & Volume, By Powder, 2021-2031F |

6.3 Saudi Arabia Paints Market, By Application |

6.3.1 Overview and Analysis |

6.3.2 Saudi Arabia Paints Market Revenues & Volume, By Architectural, 2021-2031F |

6.3.3 Saudi Arabia Paints Market Revenues & Volume, By Industrial, 2021-2031F |

7 Saudi Arabia Paints Market Import-Export Trade Statistics |

7.1 Saudi Arabia Paints Market Export to Major Countries |

7.2 Saudi Arabia Paints Market Imports from Major Countries |

8 Saudi Arabia Paints Market Key Performance Indicators |

9 Saudi Arabia Paints Market - Opportunity Assessment |

9.1 Saudi Arabia Paints Market Opportunity Assessment, By Resin, 2021 & 2031F |

9.2 Saudi Arabia Paints Market Opportunity Assessment, By Technology, 2021 & 2031F |

9.3 Saudi Arabia Paints Market Opportunity Assessment, By Application, 2021 & 2031F |

10 Saudi Arabia Paints Market - Competitive Landscape |

10.1 Saudi Arabia Paints Market Revenue Share, By Companies, 2024 |

10.2 Saudi Arabia Paints Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero