Saudi Arabia POS Terminal Market (2020-26) | Industry, Forecast, Growth, Size, Share, COVID-19 IMPACT, Outlook, Trends, Companies, Revenue, Value & Analysis

Market Forecast By POS Terminal Types (Portable, Countertop, Mobile POS, PIN Pad & Multimedia), By End Users (Hospitality, Healthcare, Retail, Government & Transportation and Others),By Regions (Western, Central, Eastern, Southern)and Competitive Landscape.

| Product Code: ETC060905 | Publication Date: Jul 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 79 | No. of Figures: 32 | No. of Tables: 4 |

Saudi Arabia Point-of-Sale Terminal Market report comprehensively covers Saudi Arabia point-of-sale terminal market by technology, by types, by applications and by regions. Saudi Arabia point-of-sale terminal market outlook report provides an unbiased and detailed analysis of the point-of-sale terminal market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia POS Terminal Market Synopsis

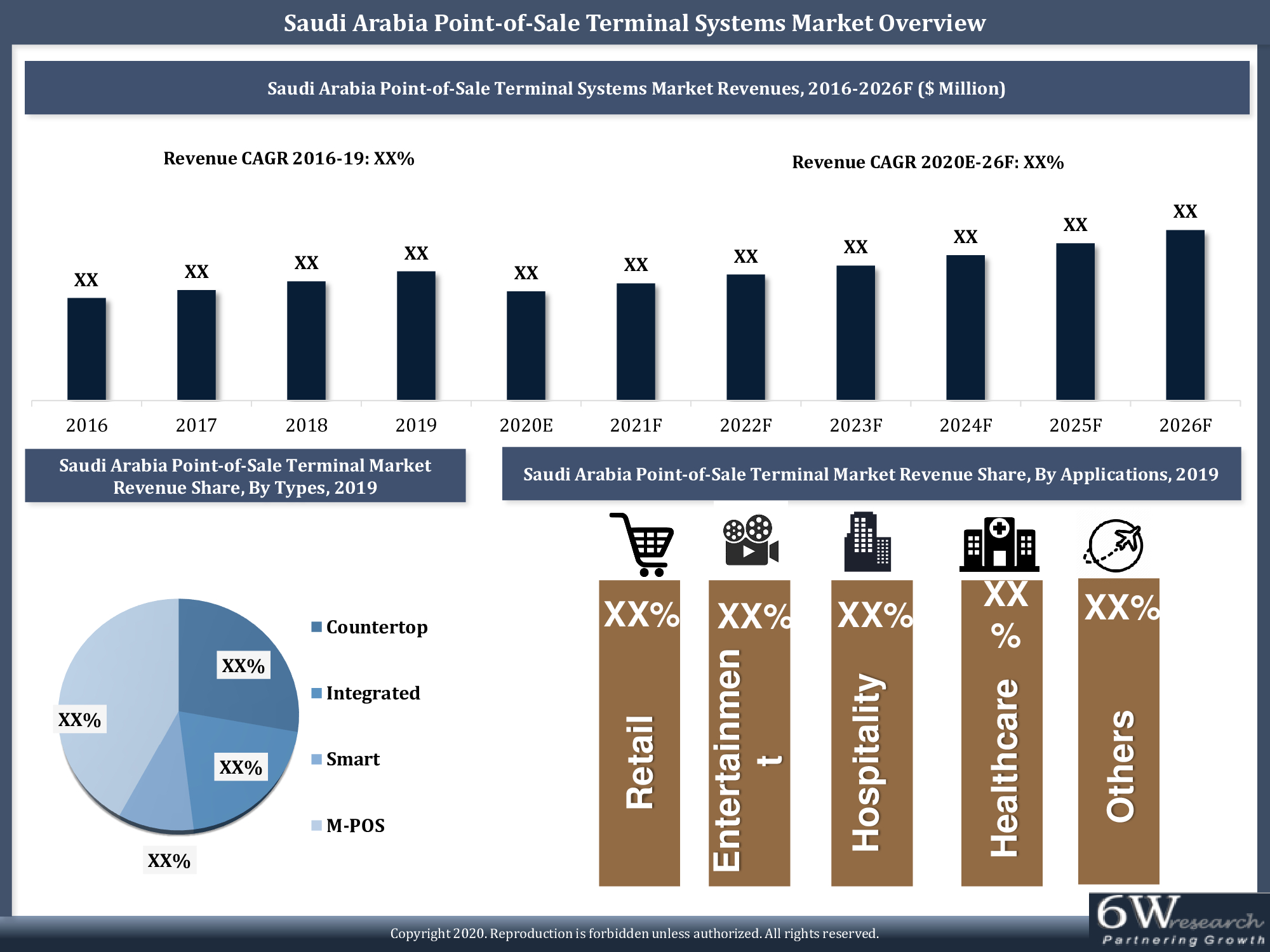

Saudi Arabia POS Terminal Market is expected to register considerable growth principally due to the increasing adoption of card transactions and technological advancement in the country. Increase in the number of pilgrims and tourists is also acting as a growth driver of the POS terminal market in Saudi Arabia. Based on the data provided by Saudi Arabian Monetary Authority (SAMA), the number of POS transactions have shown growth rate of approximately 30% from year 2019 to Q2 2020. Additionally, several players are perusing partnerships and acquisitions to gain market share and enhance their customer base in Saudi Arabia. For instance, Geidea, one of the providers of payment systems has partnered with Linga in January 2020. The partnership will strengthen the payment terminal platform in the country and enhance customer base. Further government initiatives such as Saudi Financial Sector Development Program which aims at promoting cashless transactions would also spur the demand for Saudi Arabia POS terminal market over the coming years.

The outburst of coronavirus has adversely impacted the country’s POS Terminal Market in 2020 as the government imposed nationwide lockdown has led to the closure of all economical foundational work in the country and has led to a massive disruption in the overall market competitive landscape.

According to 6Wresearch, Saudi Arabia POS Terminal Market size is projected to grow at CAGR of 7.7% during 2020-2026. Saudi Arabia POS Terminal market is estimated to register sound revenues in the upcoming six years backed by the rising logistics industry in the country. Increased eCommerce platforms have boosted the logistic industry coupled with a rise in the need for vehicles on rent in order to transport goods to the warehouse which is expected to accelerate the POS Terminal deployment in the country in the forthcoming years. Moreover, increased urbanization is estimated to generate high sales revenue in the market owing to the increased vehicle on rent during traveling for a few days. Is expected to proliferate the demand for the POS Terminal and would leave a positive impact on the market and is estimated to secure optimistic growth of Saudi Arabia POS Terminal market in the upcoming six years.

Market Analysis by Type

Among all types, M-POS captured the largest market revenue share in 2019 and is expected to maintain its position during the forecast period due to the portability and versatility it offers to businesses along with lower installation cost. Integrated POS terminals are expected to flourish in the near future as they offer information about efficient inventory management and provides real-time access to insightful customer information making business operations easier. In terms of technology and type, the portable and mobile POS terminals are registering significant growth in Saudi Arabia market in 2019 respectively. Additionally, retail sector is dominating the market, with the hospitality and healthcare applications expected to witness healthy growth in the market due to increased spending on healthcare and traveling services by tourists in the country

Market Analysis by Applications

On the basis of applications, the retail sector has gained a major chunk of the overall market revenues in 2019 and is projected to grow at the highest rate among all the applications owing to an increased usage of credit and debit card for shopping. Moreover, increasing penetration of POS terminals in malls and complexes would augment the growth of the market in the future.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Point-of-Sale Terminal Market Overview

- Saudi Arabia Point-of-Sale Terminal Market Outlook

- Saudi Arabia Point-of-Sale Terminal Market Size and Forecast for the period, 2016-2026F

- Historical Data of Saudi Arabia Point-of-Sale Terminal Market Revenues for the period, 2016-2019

- Market size and Forecast of Saudi Arabia Point-of-Sale Terminal Market Revenues until 2026F

- Historical Data of Saudi Arabia Point-of-Sale Terminal Market Revenues for the period, By Technology, 2016-2019

- Market size and Forecast of Saudi Arabia Point-of-Sale Terminal Market Revenues, By Technology until 2026F

- Historical Data of Saudi Arabia Point-of-Sale Terminal Market Revenues for the period, By Types, 2016-2019

- Market size and Forecast of Saudi Arabia Point-of-Sale Terminal Market Revenues, By Types until 2026F

- Historical Data of Saudi Arabia Point-of-Sale Terminal Market Revenues for the period, By Applications, 2016-2019

- Market size and Forecast of Saudi Arabia Point-of-Sale Terminal Market Revenues, By Applications until 2026F

- Historical Data of Saudi Arabia Point-of-Sale Terminal Market Revenues for the period, By Regions, 2016-2019

- Market size and Forecast of Saudi Arabia Point-of-Sale Terminal Market Revenues, By Regions until 2026F

- Market Drivers and Restraints

- Saudi Arabia Point-of-Sale Terminal Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Saudi Arabia Point-of-Sale Terminal Market Opportunity Assessment

- Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Company

- Saudi Arabia Point-of-Sale Terminal Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By POS Terminal Types

- Portable

- Countertop

- Mobile POS

- PIN Pad & Multimedia

By End Users

- Hospitality

- Healthcare

- Retail

- Government & Transportation and

- Others

By Regions

- Western

- Central

- Eastern

- Southern

Saudi Arabia POS Terminal Market: FAQs

| Table of Contents |

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Saudi Arabia Point-of-Sale Terminal Market Overview |

| 3.1 Saudi Arabia Point-of-Sale Terminal Market Revenues, 2016-2026F |

| 3.2 Saudi Arabia Point-of-Sale Terminal Market - Industry Life Cycle, 2019 |

| 3.3 Saudi Arabia Point-of-Sale Terminal Market - Porter’s Five Forces |

| 3.4 Saudi Arabia Point-of-Sale Terminal Market Revenue, By Technology, 2019 & 2026F |

| 3.5 Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Types, 2019 & 2026F |

| 3.6 Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Applications, 2019 & 2026F |

| 3.7 Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Regions, 2019 & 2026F |

| 4. Saudi Arabia Point-of-Sale Terminal Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Government initiatives promoting digital payments |

| 4.2.2 Growth in the retail sector and increasing adoption of POS terminals |

| 4.2.3 Increasing demand for contactless payment solutions |

| 4.3. Market Restraints |

| 4.3.1 Security concerns related to digital payments |

| 4.3.2 Initial high setup costs for POS terminals |

| 4.3.3 Limited internet penetration in some regions affecting POS terminal connectivity |

| 5. Saudi Arabia Point-of-Sale Terminal Market Evolution |

| 6. Saudi Arabia Point-of-Sale Terminal Market Overview, By Technology |

| 6.1 Saudi Arabia Fixed Point-of-Sale Terminal Market Revenues, 2016-2026F |

| 6.2 Saudi Arabia Portable Point-of-Sale Terminal Market Revenues, 2016-2026F |

| 7. Saudi Arabia Point-of-Sale Terminal Market Overview, By Types |

| 7.1 Saudi Arabia Countertop Point-of-Sale Terminal Market Revenues, 2016-2026F |

| 7.2 Saudi Arabia Integrated Point-of-Sale Terminal Market Revenues, 016-2026F |

| 7.3 Saudi Arabia Smart Point-of-Sale Terminal Market Revenues, 2016-2026F |

| 7.4 Saudi Arabia M-Point-of-Sale Terminal Market Revenues, 2016-2026F |

| 8. Saudi Arabia Point-of-Sale Terminal Market Overview, By Applications |

| 8.1 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Retail, 2016-2026F |

| 8.2 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Entertainment, 2016-2026F |

| 8.3 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Hospitality, 2016-2026F |

| 8.4 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Healthcare, 2016-2026F |

| 8.5 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Others, 2016-2026F |

| 9. Saudi Arabia Point-of-Sale Terminal Market Overview, By Regions |

| 9.1 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Central, 2016-2026F |

| 9.2 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Western, 2016-2026F |

| 9.3 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Eastern, 2016-2026F |

| 9.4 Saudi Arabia Point-of-Sale Terminal Market Revenues, By Southern, 2016-2026F |

| 10. Saudi Arabia Point-of-Sale Terminal Market Key Performance Indicators |

| 10.1 Average transaction value processed through POS terminals |

| 10.2 Number of new merchant sign-ups for POS terminal services |

| 10.3 Percentage increase in mobile wallet transactions in correlation with POS terminal adoption |

| 10.4 Customer satisfaction ratings for POS terminal user experience |

| 10.5 Percentage increase in POS terminal transactions during peak shopping seasons |

| 11. Saudi Arabia Point-of-Sale Terminal Market Opportunity Assessment |

| 11.1 Saudi Arabia Point-of-Sale Terminal Market Opportunity Assessment, By Technology, 2026F |

| 11.2 Saudi Arabia Point-of-Sale Terminal Market Opportunity Assessment, By Types, 2026F |

| 11.3 Saudi Arabia Point-of-Sale Terminal Market Opportunity Assessment, By Applications, 2026F |

| 12. Saudi Arabia Point-of-Sale Terminal Market Competitive Landscape |

| 12.1 Saudi Arabia Point-of-Sale Terminal Market Competitive Benchmarking, By Operating Parameters |

| 12.2 Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Companies, 2019 |

| 13. Company Profiles |

| 13.1 Cisco Systems, Inc. |

| 13.2 HP Inc. |

| 13.3 Ingenico Group |

| 13.4 NEC Saudi Arabia Ltd. |

| 13.5 Oracle Corporation |

| 13.6 Panasonic Marketing Middle East & Africa FZE |

| 13.7 PAX Global Technology Limited |

| 13.8 Samsung Electronics Co. Ltd. |

| 13.9 Toshiba Gulf FZE |

| 13.10 VeriFone Systems, Inc. |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| Figure 1. Saudi Arabia Point-of-Sale Terminal Market Revenues, 2016-2026F ($ Million) |

| Figure 2. Saudi Arabia Point-of-Sale Terminal Market - Industry Life Cycle, 2020 |

| Figure 3. Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Technology, 2019 & 2026F |

| Figure 4. Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Types, 2019 & 2026F |

| Figure 5. Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Applications, 2019 & 2026F |

| Figure 6. Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Regions, 2019 & 2026F |

| Figure 7. Rise In Number of POS Transactions, 2011-2020 (Million) |

| Figure 8. Saudi Arabia NFC Technology Transactions Share, By Device, 2019 |

| Figure 9. Saudi Arabia Fixed Point-of-Sale Terminal Market Revenues, 2016–2026F ($ Million) |

| Figure 10. Saudi Arabia Portable Point-of-Sale Terminal Market Revenues, 2016–2026F ($ Million) |

| Figure 11. Saudi Arabia Countertop Point-of-Sale Terminal Market Revenues, 2016–2026F ($ Million) |

| Figure 12. Saudi Arabia Integrated Point-of-Sale Terminal Market Revenues, 2016–2026F ($ Million) |

| Figure 13. Saudi Arabia Smart Point-of-Sale Terminal Market Revenues, 2016–2026F ($ Million) |

| Figure 14. Saudi Arabia M-Point-of-Sale Terminal Market Revenues, 2016–2026F ($ Million) |

| Figure 15. Saudi Arabia Point-of-Sale Terminal Market Revenues, By Retail, 2016-2026F ($ Million) |

| Figure 16. Saudi Arabia Point-of-Sale Terminal Market Revenues, By Entertainment, 2016-2026F ($ Million) |

| Figure 17. Saudi Arabia Point-of-Sale Terminal Market Revenues, By Hospitality, 2016-2026F ($ Million) |

| Figure 18. Saudi Arabia Point-of-Sale Terminal Market Revenues, By Healthcare, 2016-2026F ($ Million) |

| Figure 19. Saudi Arabia Point-of-Sale Terminal Market Revenues, By Others, 2016-2026F ($ Million) |

| Figure 20. Riyadh Retail Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 21. Jeddah Retail Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 22. Dammam Retail Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 23. Makkah Retail Supply, 2015-2021F (‘000 sq. m GLA ) |

| Figure 24. Riyadh Hotel Supply, 2015-2021F (‘00 Keys ) |

| Figure 25. Jeddah Hotel Supply, 2015-2021F (‘00 Keys ) |

| Figure 26. Dammam Hotel Supply, 2015-2021F (‘00 Keys ) |

| Figure 27. Makkah Hotel Supply, 2015-2021F (‘00 Keys ) |

| Figure 28. POS Transaction To Cash Withdrawal Ratio In Saudi Arabia, Jan 2020-July 2020 |

| Figure 29. Saudi Arabia Point-of-Sale Terminal Market Opportunity Assessment, By Technology, 2026F |

| Figure 30. Saudi Arabia Point-of-Sale Terminal Market Opportunity Assessment, By Types, 2026F |

| Figure 31. Saudi Arabia Point-of-Sale Terminal Market Opportunity Assessment, By Applications, 2026F |

| Figure 32. Saudi Arabia Point-of-Sale Terminal Market Revenue Share, By Companies, 2019 |

| List of Tables |

| Table 1. Saudi Arabia NFC Technology Transactions Volume, By Device, 2019 |

| Table 2. Saudi Arabia Point-of-Sale Terminal Market Revenues, By Regions, 2016-2026F ($ Million) |

| Table 3. Saudi Arabia Upcoming Transportation Projects |

| Table 4. Saudi Arabia Upcoming Tourism, Recreation and Entertainment Projects |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero